Fed Decision Making/H1 2025 Fiscal Tensions and Yield Curve Steepening

2yr U.S. Treasury yields can fall gradually by end 2025 to 3.25%, as a more neutral Fed Funds era is discounted. 10yr yields ability to decline on a soft landing is more difficult, given high net supply facing the market. We also remain concerned that the U.S. will see some temporary fiscal stress in H1 2025 under either president. Strategically we still see 4.00% 10yr U.S. Treasury yields by end 2025 and a +75bps yield curve.

Figure 1: U.S. Fed Funds and 2 and 10yr Government Bond Yield Forecasts (%)

Source Datastream/Continuum Economics

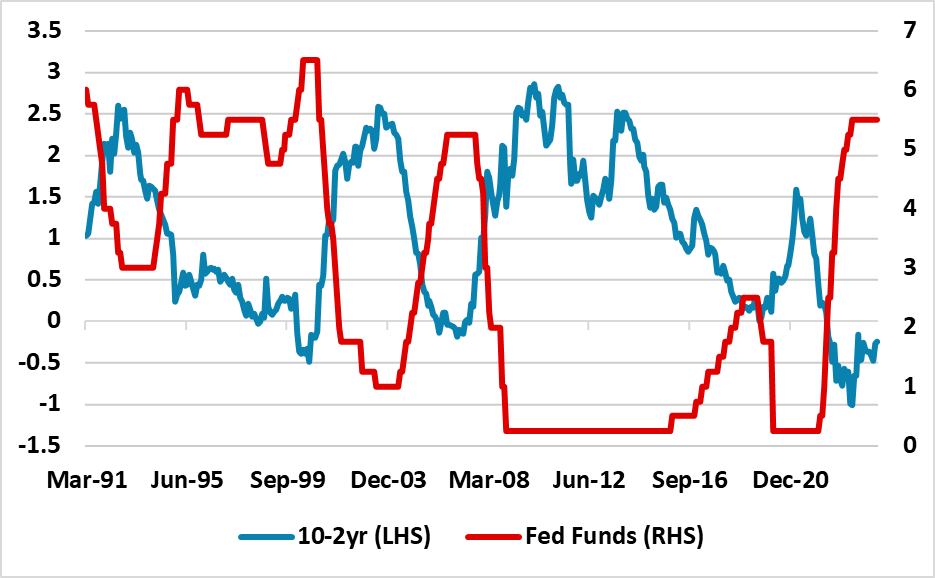

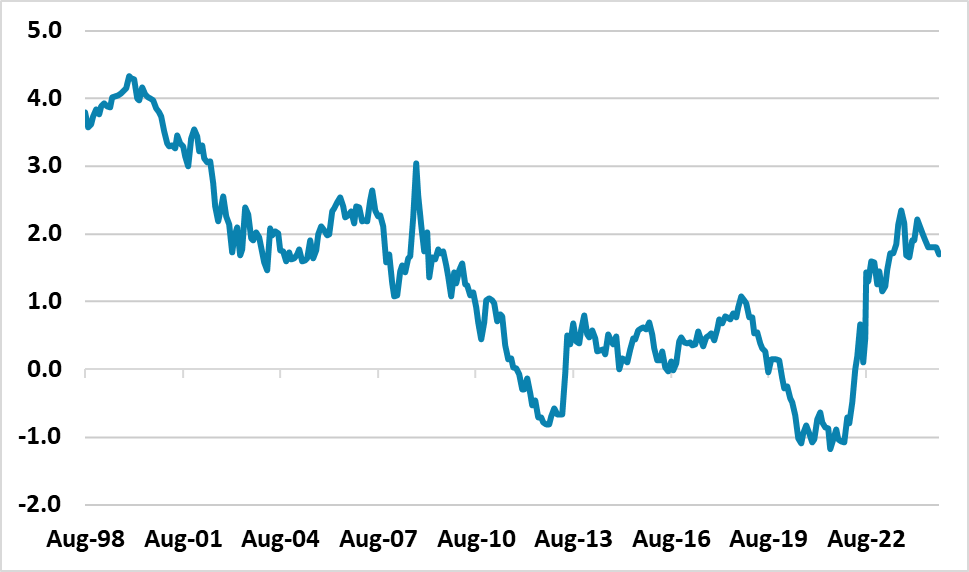

The U.S. yield curve has become less inverted over the last couple of weeks (Figure 1) as 2 yr yields have moved to discount a 3.25-3.50% Fed Funds rate and most of this expected to arrive in the next 12 months. Nevertheless, 10yr yields have also come down as well, with a sense that the U.S. real sector was entering a slowdown and faces more volatile economic data. U.S.Treasuries are once again provide a hedge for portfolio managers, both given starting nominal yields and also as real yields have seen a dramatic rise compared to the post GFC period (Figure 2). Much now depends on the real sector and inflation trajectory but also Fed decision making and forward guidance.

Recent data has left us comfortable with the soft landing outlined in the September Outlook (here), where growth slows to just above 1% with controlled inflation and then Fed easing helps to get growth back on track in H2 2025 onwards. We will have to see August data before September 18, but current data is consistent with 25bps rather than 50bps. 50bps would also raise concerns that the Fed had overtightened. We see a 25bps start in September and the SEP likely outlining a lower path in 2024 and 2025 than the June FOMC. A SEP median of two cuts in 2024 (including a 25bps in September) and 100-125bps in 2025 would implicit endorse most of the thinking in money markets. Money markets would be a bit more aggressive than the Fed communications on the view that the Fed views changes as the easing cycle develops. However, the case for discounting a sub 3% Fed Funds is tricky at the start of a gradual easing cycle, given the Fed new views on the neutral rate around 2.8%. If the U.S. faced a hard economic landing or sustained inflation undershoot, then more aggressive rate cuts could be discounted. Otherwise the start of Fed easing could only see a small dip in 2yr as the discount to the Fed Funds rate is now larger. As Fed easing arrives and the era of 3% policy rates becomes clear, then 2yr yields can still fall to 3.25% by end 2025.

Figure 2: 10yr Real U.S. Treasury Yield Using Breakeven Inflation (%)

Source Datastream/Continuum Economics

While the front end will still drive towards lower yields, we remain more skeptical of 10yr yields falling in a similar fashion consistently. A spike down to 3.60-3.70% is feasible on over optimism, but this is difficult to sustain in the face of the high net supply facing the market and the prospect for overseas investors that the USD will decline with Fed easing. We also remain concerned that the U.S. will see some temporary fiscal stress in H1 2025 under either president. If Donald Trump were elected he would be keen to make lapsing 2017 tax cuts permanent to cement his key achievement. If Kamala Harris is elected, then a likely Republican senate would cause a fight over the debt ceiling but likely eventually reach a deal (here). Either way rating agencies would be concerned over the lack of progress in reducing the large budget deficit and we see the risk of one of the agencies downgrading the U.S. This could mean a 30bps rise in 10yr yields under fiscal stress, though we would not call this a fiscal crisis. This would likely see 2 and 10yr yields moving in opposite direction and powering a move to a positive shaped 10-2yr yield curve. Strategically we still see 4.00% 10yr U.S. Treasury yields by end 2025 and a +75bps yield curve.