Equities Outlook: Rate Cuts To Help in 2024

U.S. equities face a volatile Q1 2024, both because the Fed are unlikely to ease in Q1 and because a slowing economy hurts corporate earnings forecasts. With the market overvalued, a modest correction could be seen, though this would be sharper with a recession. Gains should resume with Fed rate cuts/sluggish U.S. growth and we see 4900 for the S&P500 by end 2024. Continued Fed rate cuts into 2025 can ultimately drive the S&P500 onwards to 5200 by end 2025. However, H1 2025 could be volatile on U.S. fiscal concerns with a further debt ceiling drama and the risk of multiple rating agencies downgrades which could cause temporary U.S. equity market jitters. This can be a headwind in 2025.

Equities Outlook: Rate Cuts To Help in 2024

· For other DM equity markets, EZ and UK are undervalued in contrast to the U.S., but are in or close to recessions and economic recovery will likely be weak and disappointing. Though the ECB and BOE will likely ease in Q2 with the Fed, we only see EZ equities see small to modest outperformance versus the U.S. in 2024 and 2025 – due to a sluggish EZ recovery. Circa 5% pa outperformance can be seen by the UK, both helped by greater 2024 BOE rate cuts than the ECB and Labour winning the next election and promising to improve relations with the EU.

· China’s equity market is clearly undervalued and could see a phase of outperformance in 2024, if the bad news gets less intense. However, China will likely step up military exercises around Taiwan in the spring/summer, which will keep global investors wary. GDP growth will also disappoint with the structural headwinds for residential property and exports and nominal GDP will be a mere 5% in 2024 and 2025. We would see any China outperformance as being a tactical rather than strategic asset allocation opportunity. Our preference remains for India and Brazil on a multi-year basis due to high nominal GDP and rate cuts respectively. We can see around 5-7.5% outperformance per annum in 2024 and 2025 versus the U.S. equity market.

· Risks to our views: Larger than expected lagged effects from DM monetary tightening could cause downside surprises on U.S./EZ growth and hurt the global economy and earnings outlook. Equities would see a volatile 2024, with downside and then a rebound (on more aggressive policy easing) but less overall net positive returns than our baseline view.

Figure 1: S&P500 12mth Fwd P/E Ratio and 10yr Real Government Bond Yield (inverted)

Source: Continuum Economics projections until end-2025 using 10yr U.S. breakeven inflation and Treasury yield forecasts. Baseline see 3.70% 10yr yields end 2024, end 2025 3.90%.

U.S. Equities: Economic Resilience Versus Valuations

U.S. equities have been getting relief from the sense that Fed tightening has finished and 2024 will see rate cuts (here re Dec FOMC) that ease some of the interest rate shock seen since 2022. The scale of Fed easing and associated impact on 10yr yields and follow-through to equities is a key question for 2024. The Fed will probably not be rushed into Q1 easing given the 2022 inflation miss and the desire to get close to the core PCE inflation target. This can frustrate the equity market, as the U.S. yield curve is too inverted against the macro and policy backdrop and 10yr yields will likely not fall much further in H1 2024. Additionally, the U.S. equity market 12mth forward P/E ratio is moderately expensive, while 10yr real U.S. government bond yields would argue for a somewhat lower P/E ratio (Figure 1). It could be argued that the 12mth forward P/E ratio should be closer to 15 without the tech effect on U.S. equities. Some of the magnificent seven mega tech stocks also look overdone after this year’s AI driven rally. Finally, in H1 2024 the U.S. equity market will be faced with a slowdown to below a 1% GDP pace and the risk is for downward adjustment of earnings expectations. All of these forces can act as headwinds to the S&P500 and will likely produce a setback to 4400. A swing to recession in the alternative scenario could see 3700-4000 on the S&P500 depending on the pace of offsetting rate cuts from the Fed.

H2 2024 should be better for the U.S. equity market with a soft landing of core PCE inflation moving closer to 2% and slow but not recessionary GDP. Fed rate cuts can then spark renewed optimism in the equity market and we forecast 4900 for the S&P500 by end 2024. Continued Fed rate cuts into 2025 can ultimately drive the S&P500 further to 5200 by end 2025. However, H1 2025 could be volatile on U.S. fiscal concerns with a further debt ceiling drama and the risk of multiple rating agencies downgrading and this could cause temporary U.S. equity market jitters. This can mean some derating of price/earnings multiples in 2025.

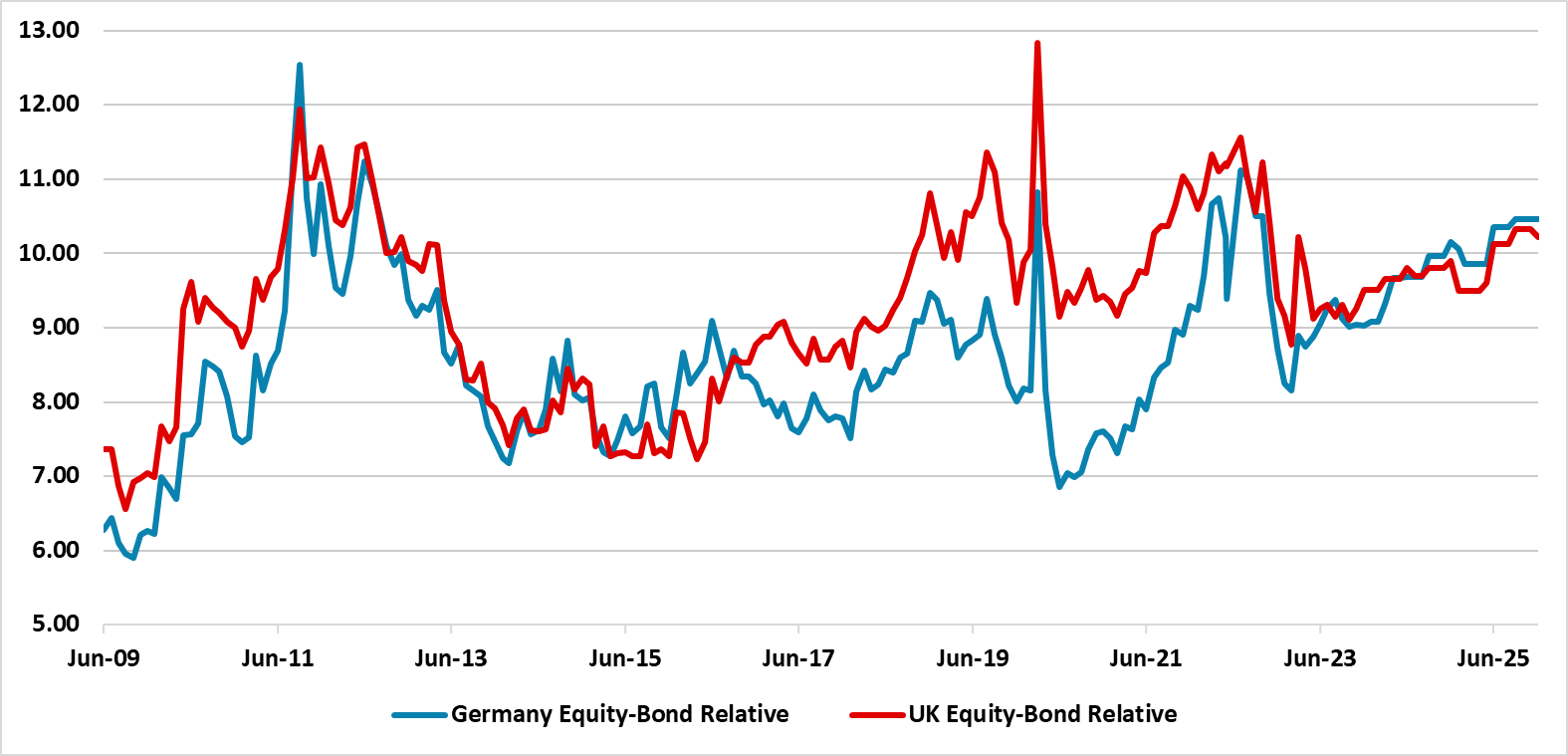

Figure 2: Germany/UK 12mth Earnings Yield minus 10yr Real Government Bond Yield (using 10yr breakeven inflation)

Source: Datastream, Continuum Economics Continuum Economics projections until end-2025 using 10yr breakeven inflation and Bund/Gilt yield forecasts. Baseline see 1.90% 10yr yields end 2024, end 2025 2.10% and 10yr gilts 3.70% and 3.80%.

The EZ equity market has a slower growth backdrop than the U.S. and we forecast a very weak recovery out of the H2 2023 recession. Corporate earnings estimates for 2024 and 2025 will likely be cut, as the lagged feedthrough of tightening bites further. However, EZ equities are modestly undervalued both in P/E ratio terms and against 10yr real government bond yields (Figure 2). We forecast that the ECB will swing into easing from Q2 2024, which will likely help sentiment – though we do not really see 10yr Bund yields coming down (here). A volatile Q1 should give way to gains of around 7% in H2 2024, though we are likely to see only small outperformance versus the U.S. by end 2024 – due to the sluggish EZ recovery. EZ equities in 2025 can be driven to further modest gains of around 7%, provided that Donald Trump is not elected President. A re-elected Trump would lead to real threats of the U.S. withdrawing from NATO, which would be a headwind for EZ equities.

UK equities also face a slower than expected recovery from the H2 2023 recession, as fiscal policy tightening has accompanied interest rate hikes. We remain below expectations for 2024 and 2025 GDP growth. However, UK equities are clearly undervalued in P/E ratio terms and versus government bonds (Figure 2). The BOE is also likely to be more aggressive than the ECB from Q2 2024 and we see 100bps of cuts in 2024 and 2025. This should drive modest UK outperformance with 10% gains in 2024 and 2025. The UK election will likely be in October 2024 and won by Labour. This will be equity positive as Labour promises to work more closely with the EU, but maintain the current budget deficit trajectory.

Finally, Japan equities can rise in line with U.S. equities in 2024 and 2025, after 2023 outperformance. Nominal GDP will likely slow, as growth reverts to 1.0% and CPI slows. This will undermine the narrative that nominal corporate earnings have entered a new era. The BOJ will lift the policy rate slowly and allow 10yr yields to rise to around 1.60%, but this should not be too adverse a headwind given the wide earnings yield-bond yield gap.

Emerging Markets

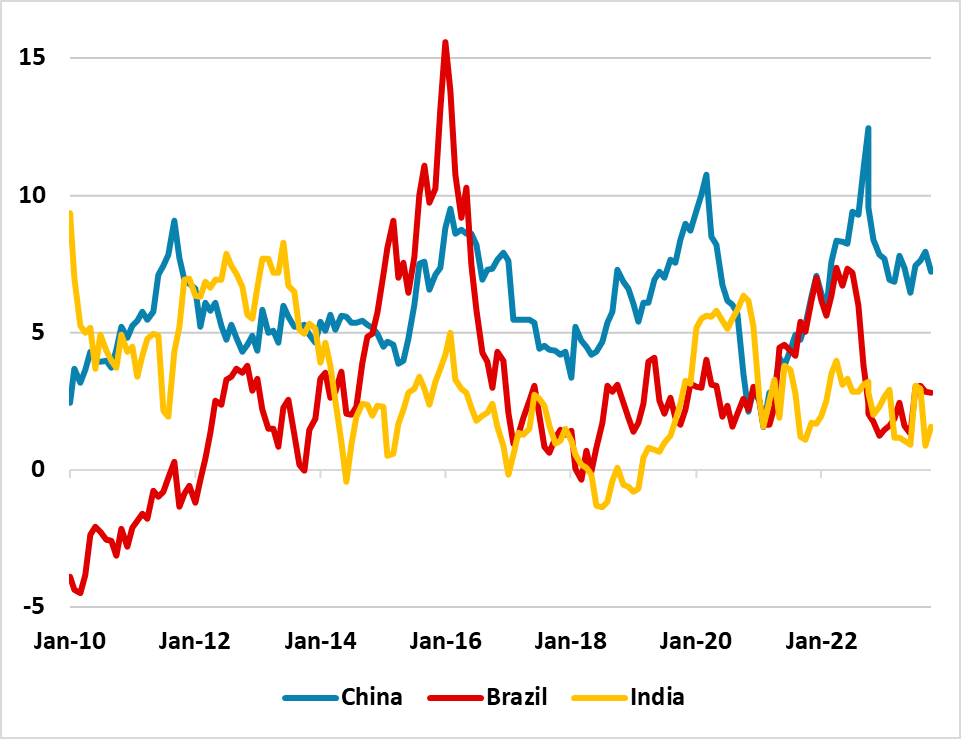

China’s equity market is clearly undervalued on a forward P/E ratio basis and against government bonds (Figure 3). A phase of outperformance is likely at some stage in 2024, if the bad news gets less bad. However, we would see this as a tactical opportunity rather than the start of a multi-year phase of China equity outperformance. Firstly, the Taiwan presidential election in January will likely see the DPP winning. This will see China increasing military exercises and posturing spring/summer 2024 (here) and will reawaken pessimism among foreign investors. Secondly, the economic picture will remain mixed, with residential property subtracting from GDP and export growth being hurt by the structural shift in global supply chains. Private business also does not have the optimism seen during the 1990-2019 period. We forecast growth of 4.2% in 2024 and nominal GDP at a mere 5% (here). Finally, China authorities future policy easing will likely remain measured rather than aggressive, as China remains concerned about overstimulating and boosting debt/GDP ratios too far. China can probably outperform the U.S. by up to 5%, but we would see this as a tactical asset allocation play.

Figure 3: China Earning-Bond Yield Relative Cheap Compared to Other Big EM’s (%)

Source: Continuum Economics. CAPE Earnings Yield-10yr Real government bond yield

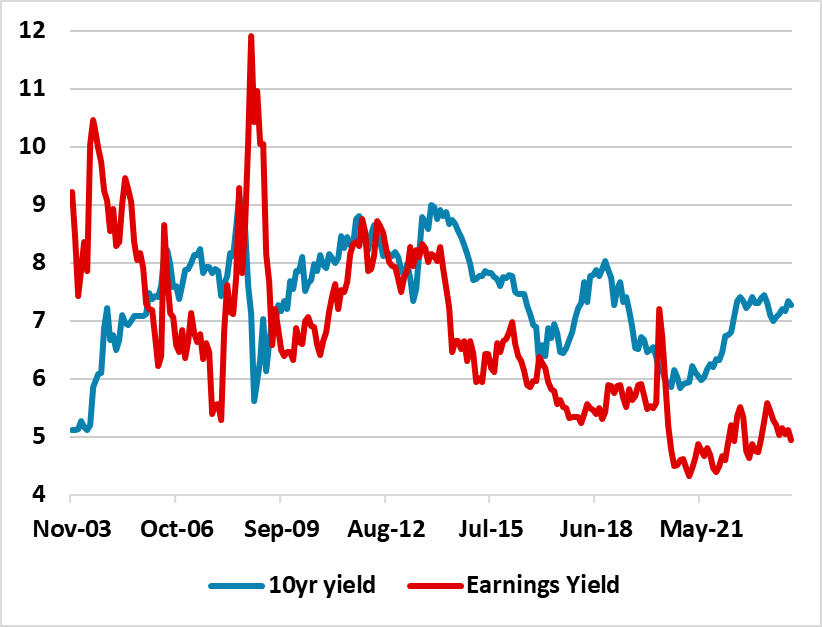

Figure 4: India 12mth Fwd Earnings Yield and 10yr Government Bond Yield (%)

Source: Datastream/Continuum Economics

India remains the darling of EM countries helped by structural momentum for corporate earnings (due to 10-12% nominal GDP growth). The political environment also remains favorable, with PM Modi likely to be reelected in 2024 and pursue extra structural reforms in the coming years. India also benefits from global investors pessimism towards China, as EM equity funds are directed towards India. This accounts for the overvaluation of India equity market against the 10yr average for the 12mth forward P/E ratio and the earnings yield discount to bond yields (Figure 4). While this cult of the Indian equities can last, the overvaluation is modestly high now and this likely means only around 10-12.5% gains in 2024 and 2025 to reduce the scale of overvaluation.

Brazil remains our other favorite equity market for 2024. The Brazilian central bank is set to cut rates by 250bps in 2024 and a further 125bps in 2025, as inflation moves closer to target. Historically this has prompted a rerating of the 12mth forward P/E ratio and we see this occurring through the next 2 years. Additionally, we remain comfortable that Brazil is trying to avoid fiscal deterioration and the political situation remains stable until the 2026 election. We can see 10-12.5% gains in 2024 and 2025.