EZ and UK Government Bonds: Decoupling From the U.S.?

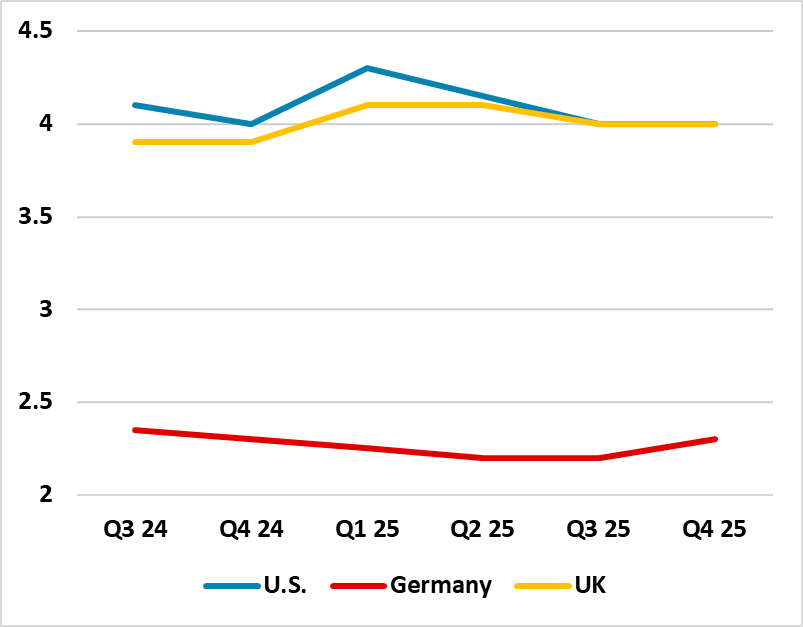

Different economic and inflation dynamics, plus no constraint from trade weighted exchange rates, means that the ECB and BOE can cut irrespective of the Fed in the coming quarters. This can see 2yr yields decline, though less so in Germany where a 2.5% ECB depo rate is already discounted. 10yr yields in Germany and UK do face yield competition from the U.S., which means little decoupling versus the U.S. The key theme for all three government bond markets will be the swing back to a positive 10-2yr yield curve.

One of the key questions for asset allocation is whether the EZ and UK government bond markets can decouple from the U.S. Treasury market, not just for bond positioning but also how the rate structure impacts equity valuations.

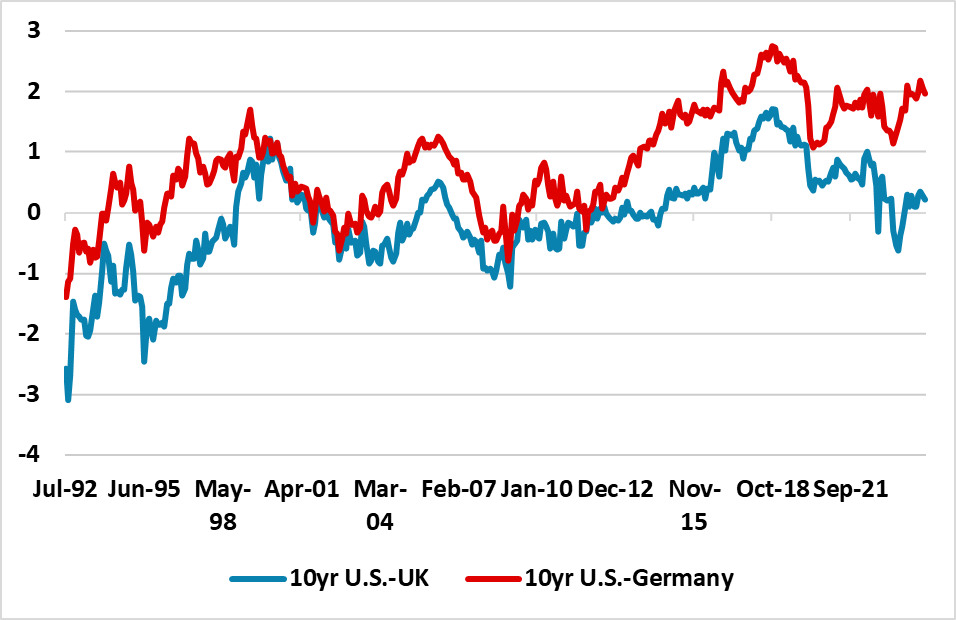

Figure 1: Germany 2yr-ECB Depo and UK 2yr-BOE Policy Rate (%)

Source Datastream/Continuum Economics

With the ECB having already started cutting and the BOE expected in the coming months (we still see 25bps on August 1), one question being asked by clients is whether the EZ and UK government bond markets can decouple from the U.S. Treasury market?

Our own view is for the Fed to actually start cutting in September, both as disinflationary pressures are still coming through and as the U.S. economy slows. The lagged effect of previous tightening, plus the rundown of pandemic savings, is producing an environment for the Fed to start cutting. What happens if Fed rate cuts get delayed?

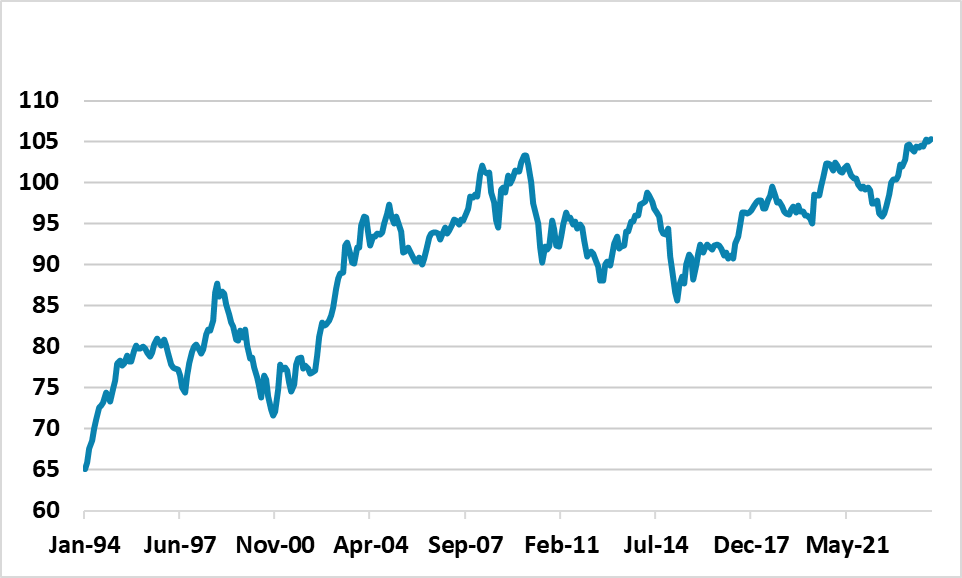

At the short-end of the curve, we see scope for the ECB and BOE to keep on cutting policy rates, if the domestic environment allows. The exchange rate is not a constraint, with the EUR trade weighted exchange rate near an all-time highs due to weak Japanese Yen and Scandi currencies (Figure 2), while GBP TWI is well off the 2016 lows (here). Disinflation appears more advanced in the EZ than the U.S., both as labour market tightness is less and as EZ economy is sluggish in contrast to the U.S. We see September and December cuts from the ECB (here). The problem for German 2yr yields is that a lot of easing is discounted down to a 2.5% ECB depo rate and the 2yr-ECB depo rate is at a historically wide discount (Figure 1). 2yr German yields can fall but slowly in the next 12-18 months and we feel less than the U.S. where a terminal policy rate of 3.75% is discounted.

Figure 2: Euro Broad Trade Weighted Exchange Rate (Jan 2010=100)

Source Datastream/Continuum Economics

For the UK, a 3.75% policy rate is discounted in 2 years times, which reflects concerns about still high UK wage and services inflation. However, the UK labour market is slackening quicker than the U.S. or EZ, with employment actually falling and the unemployment rate up 0.6% from the lows already. Lagged restrictive policy will also squeeze margins and temper services inflation. Thus we see an August cut being followed by cuts in November and December and 100bps of further easing in 2025. UK money and debt markets can swing to discounting more easing sooner than currently discounted and we forecast 3.65% and 3.20% 2yr UK yields by end 2024 and end 2025. What about 10yr German and UK?

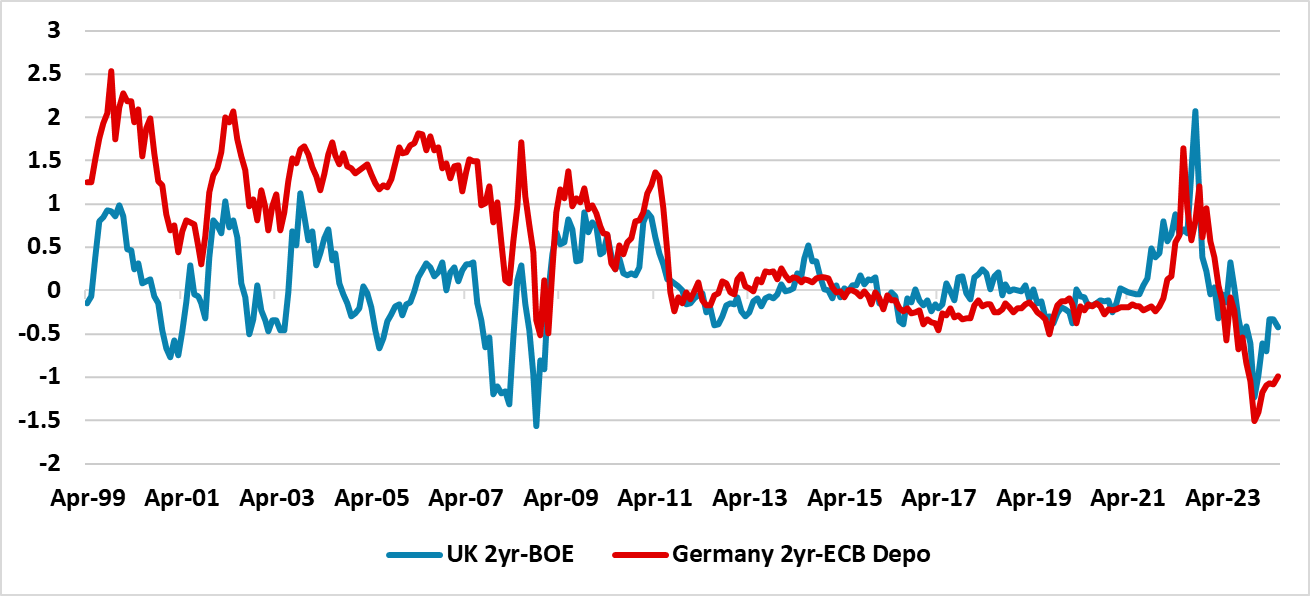

Figure 3: 10yr U.S. Treasuries versus Germany and UK (%)

Source Continuum Economics

We have highlighted that we expect fiscal stress in the U.S. in H1 2025 under either possible president (here), but not in the EZ and UK. The new labour government is actually committed to fiscal tightening, while the EZ is undertaking fiscal consolidation – this will be slow in France, but the political paralysis in France likely mean no major deterioration in the next 12 months (here). However, U.S. Treasury yields are already at a large premium to German 10yr yields and a modest premium to UK yields (Figure 3). U.S. real yields are also already significantly higher than Germany and moderately compared to the UK (using an average 0.9% discount of UK CPI to RPI used in UK index linked bonds). Thus our forecast is for yield competition from the U.S. to stop 10yr yields falling much in Germany and the UK (Figure 4).

Figure 4: CE U.S./Germany and UK 10yr Yield Forecasts (%)

Source Continuum Economics