Volatile Treasuries But Economic and Foreign Holdings Key

Long-dated U.S. Treasury yields were being pushed up by deleveraging among leveraged players, before the 90 days pause on reciprocal tariffs easing deleveraging. Multi quarter the key question for yields is whether real sector data sees a soft or hard landing. We see a slowdown to sub trend growth, which likely means cautious Fed easing in 2025 as they wait to see monthly inflation numbers slowdown after a Q2 surge. This can produce a choppy sideways movement in Treasuries. A recession would produce a move for 10yr yields down to 3.25%. Meanwhile, so far foreign holders have not started aggressively offloading U.S. Treasuries, but China holdings should be watched carefully as USD reserve diversification could pick up. Long term foreign accounts could become less willing to increase Treasury holdings, which would place upward pressure on 10yr yields and produce a steeper yield curve.

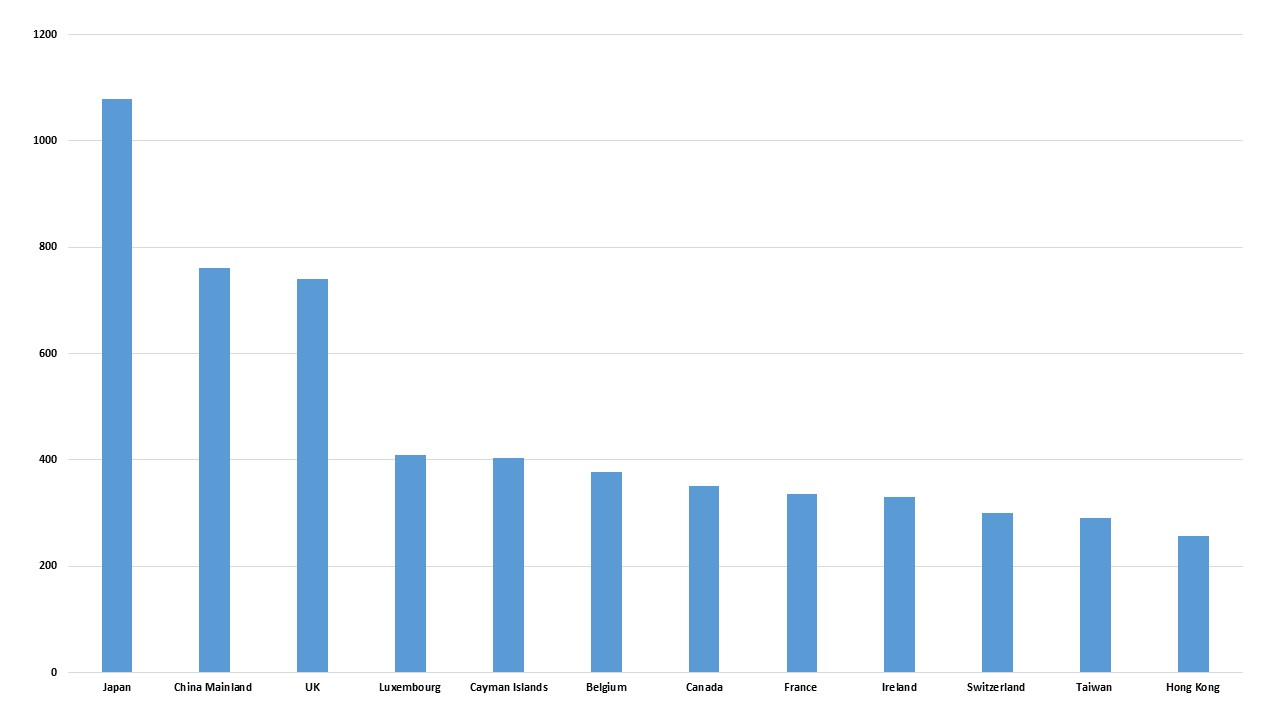

Figure 1: Foreign Private and Public Holdings of U.S. Treasuries (USD Blns)

Source: U.S. Treasury

The U.S. Treasury market has seen yields jump in the early part of this week, despite equity market weakness and expectations at the time in the money market of the Fed cutting by 100bps this year. U.S. Treasuries had been hit by speculative outright liquidation of long positions. Secondly, unwinding of long cash/short future basis trades and long Treasuries/short swaps trades has hurt liquidity and increased cash bond market inventories for market makers. This all has echoes of U.S. Treasury market liquidity problems in March 2020 that caused an initial selloff after the COVID outbreak. If the deleveraging pressure return, it is possible that the Fed could do some market smoothing operations for temporary purchases of long-dated Treasuries like the BOE did in September/October 2022. However, this would not really be QE and the Fed would likely aim to sell these holdings in the coming months once the U.S. Treasury market became less volatile. We see economics, policy and foreign holdings being the key multi quarter.

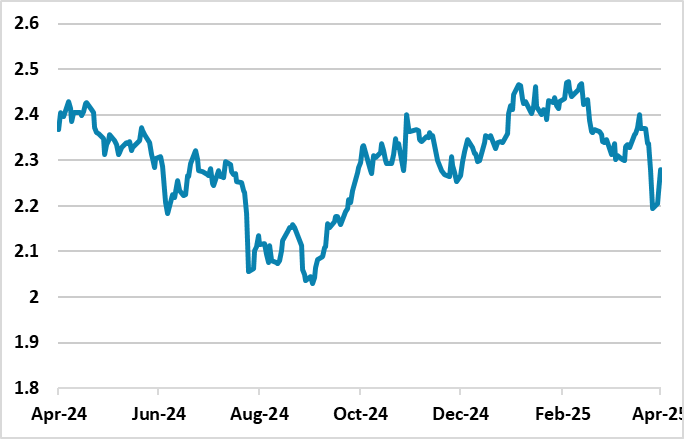

Though the market is expecting a jump in monthly CPI figure in Q2, they do not see this lasting. 10yr breakeven inflation has actually fallen since the reciprocal tariff announcement on April 2 (Figure 2). Indeed, money market expectations show that the Fed is expected to continue easing in 2026 to a 3.25-3.50% Fed Funds rate on the initial take that 2 round inflation will not be seen and that the Fed will want to help growth. 2025 GDP growth will be hit in the U.S. to slow below trend, though a recession is not our current base line view. Additionally, the price hikes will hang over and restrain 2026 growth – it takes years to build new factories for major import substitution and in certain imports it is not feasible. Meanwhile, the prospect remains that GOP hawks will restrain the 10yr budget bill and ensure it is not stimulative but rather neutral to negative for the economy. This political standoff with the House Republicans also means that the increase in the budget deficit will be modest into 2025 on our central view of sub trend growth momentum.

Figure 2: 10yr U.S. Breakeven Inflation Rate (%)

Source: Bloomberg

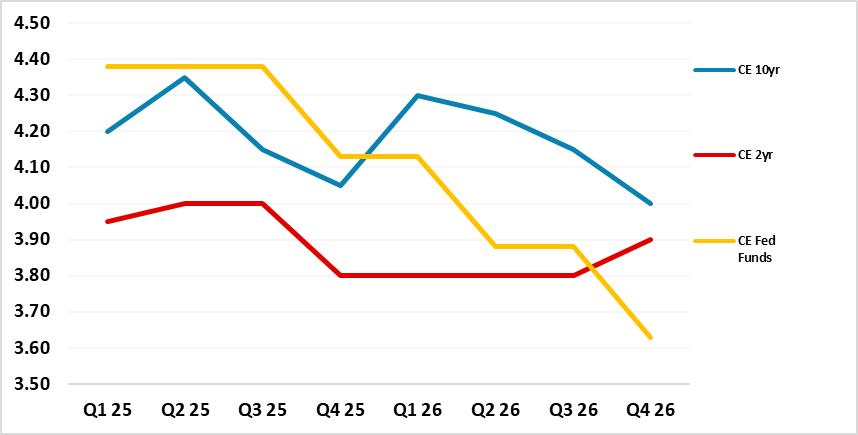

We look for less easing than the money markets, but fears of a recession should keep 2yr yields at a discount to the Fed Funds rate (Figure 3) in the next 12 months. If a recession occurs then the Fed would shift priority to the economy and look through the temporary boost to inflation. This could see the Fed Funds rate cut quickly to 3% or below and a sub 3% 2yr yield. 2yr yields need to reflect this moderate probability scenario as well as our baseline view on the Fed.

Figure 3: Fed Funds, 2 and 10yr U.S. Treasury Yields Forecasts (%)

Source: Continuum Economics

10yr yields, can also be helped by the fear of a recession, which will cap the rise in yields once leverage position adjustment eases (Figure 1). In our March DM Rates Outlook we highlighted that 10yr U.S. Treasury yields could fall to 3.25% if a recession occurs and this will see end investor buying in the 4.50-5.00% area. However, on our Fed view a more cautious pace of Fed easing than discounted at the front end for 2025 means that the Fed is unlikely to really help the long-end of the curve. Additionally, supply should not be underestimated. The budget deficit will likely be 6.5-7.0% of GDP in 2026 with the House of Representatives plans. Though the Fed has effectively stopped U.S. Treasury QT, and the Treasury will reduce funding at the long-end of the curve, we still expect some supply pressures into 2026. Trump may also try to deflect blame for lower growth to the Fed and step up pressure on the Fed to cut more, which is mixed for the long-end. This means a choppy environment for 10yr Treasuries (Figure 3) and yield curve steepening.

Finally, the attitude of foreign holders of U.S. Treasuries is a new factor for the long-end yield outlook. TICS data for January shows that private and official holdings of Treasuries and T bills are USD8.5trn, with foreign official holdings at USD3.8trn. Figure 1 shows that Japan and China are the largest holders, but some extra China holdings are likely in the UK/Cayman Island/Luxembourg figures. China total FX reserves are USD3240bln and the TICS implied 20% looks too low. China has been increasing gold holdings and diversify from the USD since the Ukraine war related seizer of Russia FX reserves. If the current huge U.S./China tariffs are not resolved then a trade war could become a hard break between the U.S. and China forced by the Trump administration (here). In this scenario, China could decide to accelerate reserve diversification away from the USD. Mainland China also holds USD237bln of ABS and USD360bln of U.S. equities according to 2024 U.S. Treasury figures.

Other EM countries could also start a reserve diversification program away from U.S. Treasuries, though DM private sector and official holders will likely not change current holdings much given a 2% plus real yield is better than most other major government bond markets and given the USD role as global reserve currency. For now we have not changed U.S. Treasury forecasts on the basis of foreign selling, but it is a risk factor for higher yields. The crucial question though is whether real sector data sees a soft or hard landing.