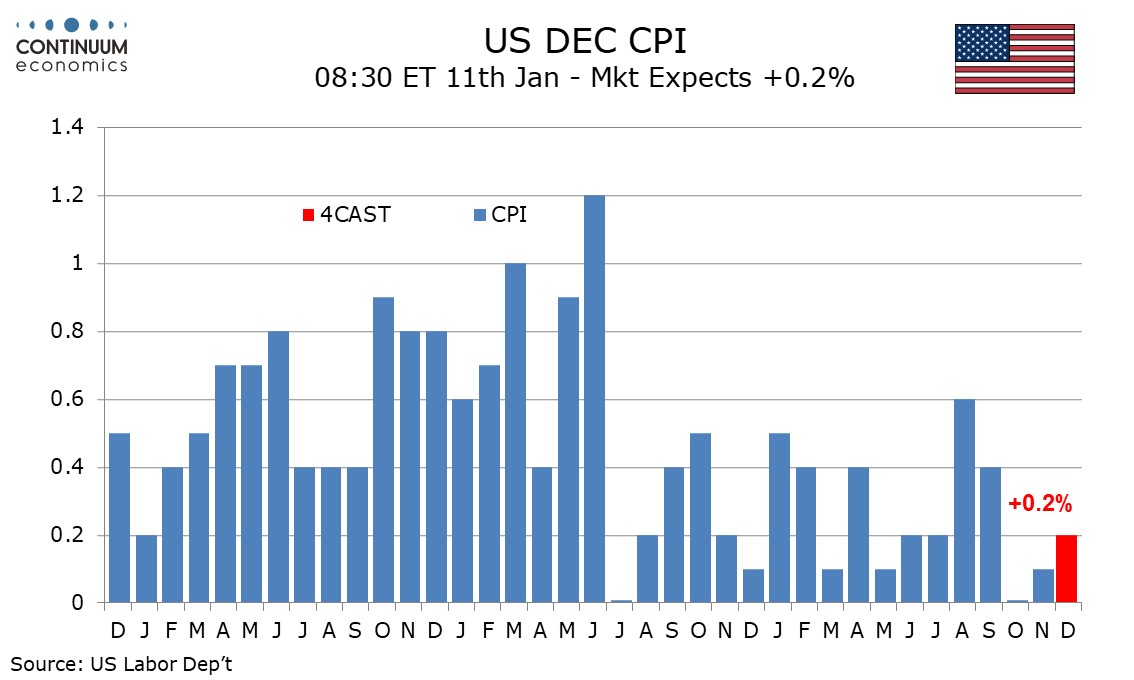

Preview: Due January 11 - U.S. December CPI - Marginally above 0.2% before rounding

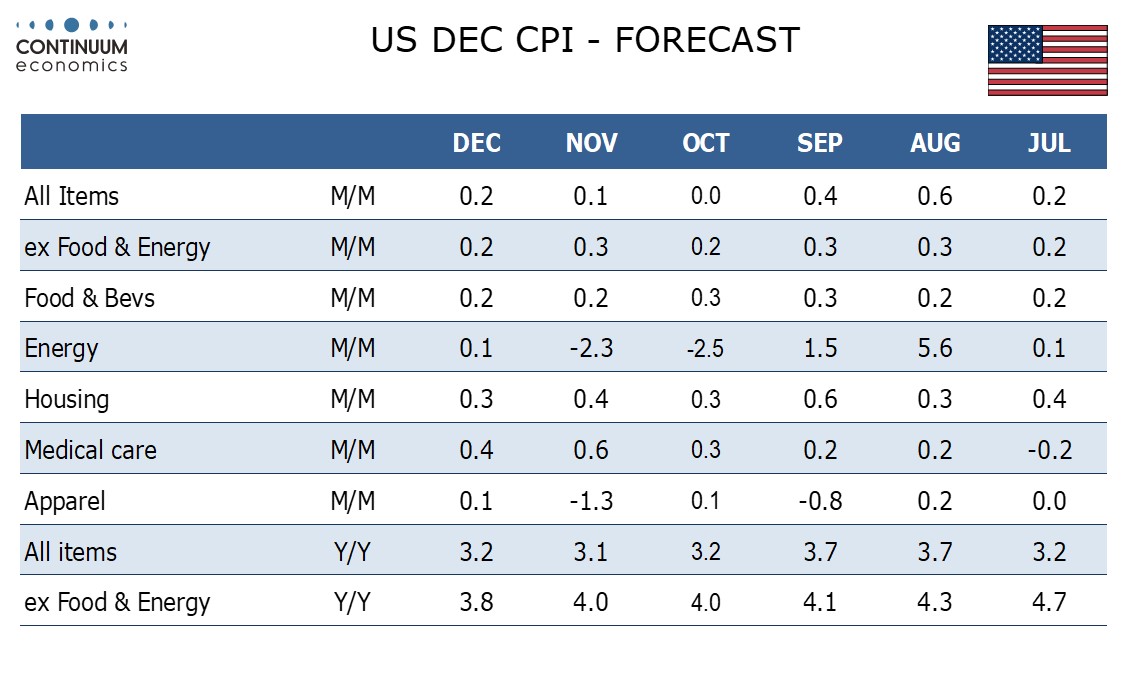

We expect December CPI to increase by 0.2% overall and ex food and energy, with risk being for higher rather than lower, with our forecasts before rounding being 0.22% overall and 0.24% ex food and energy.

Our forecast for the core rate would be a slowing from 0.3% (0.285% before rounding) in November, though similar to October’s outcome of 0.227%.

We expect some slowing from November accelerations in owners’ equivalent rent and medical care though these components should remain stronger than most in December. Services elsewhere are likely to remain subdued and commodities ex food and energy slightly negative. November saw an unusual rise in used autos which is unlikely to be repeated but steep declines in commodities ex food, energy and used autos, which will probably be less steep in December.

Energy looks set to see little change after two straight significant declines while we expect a modest 0.2% increase in food. Yr/yr growth would then edge up to 3.2% from 3.1% overall but slip to 3.8% from 4.0% ex food and energy. The latter would be the slowest since May 2021.