U.S. Outlook: How Much Damage Will a Trade War Do?

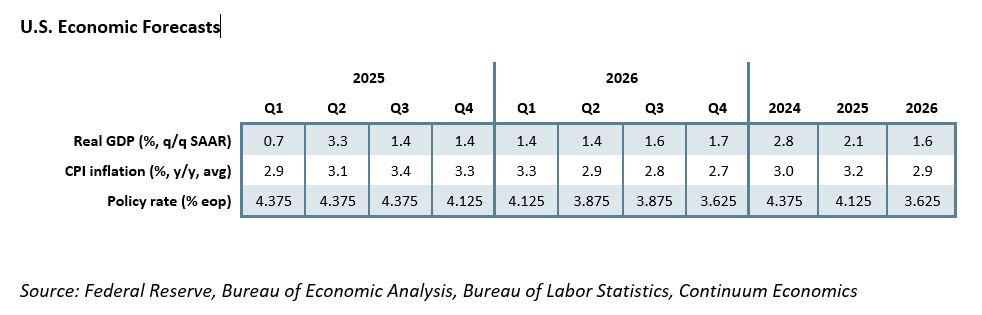

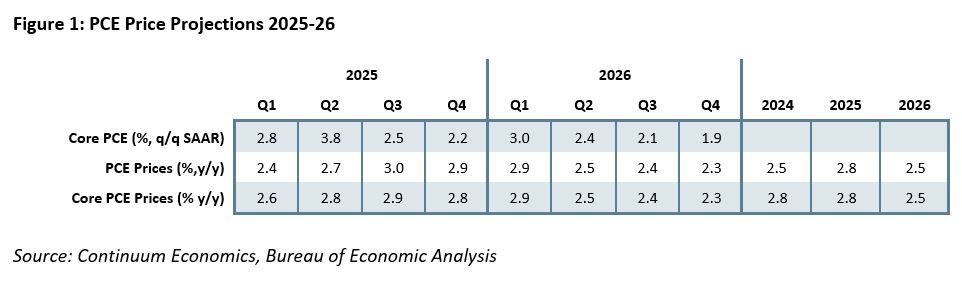

• The U.S. economy, consumer spending in particular, ended 2024 looking healthy, but with inflation still above its 2.0% target if well off its highs. The Trump administration’s more aggressive than expected trade war has made a return to the inflation target more difficult and raised downside risks to growth, but the economy still has some underlying resilience and fears that it is about to enter recession in the near term look overdone. We expect the underlying pace of growth to move below 2.0% in the second half of 2025, and to remain there through 2026. We do not expect a recession, though that is not to be ruled out if Trump escalates the trade war further. Tariffs are likely to raise inflation in Q2, with yr/yr growth in core PCE prices set to remain above 2.5% yr/yr until the tariffs drop out in Q2 2026. We expect core PCE prices to end 2026 at 2.3% yr/yr.

• The FOMC has scope to ease should the economy be threatened with recession, and with there being little scope for fiscal policy stimulus would probably do so. However, under our view that the boost to inflation from tariffs will be similar to the hit to growth, the case for aggressive action from the Fed is weak, as it would risk the one-time boost to prices from tariffs becoming entrenched. We expect only one 25bps easing in 2025, in Q4, and two 25bps moves in 2026, in Q2 and Q4. This would leave the Fed Funds target at 3.5-3.75% at the end of 2026, above the current 3.0% FOMC estimate of where neutral is, but in a less globalized world the neutral rate has probably increased.

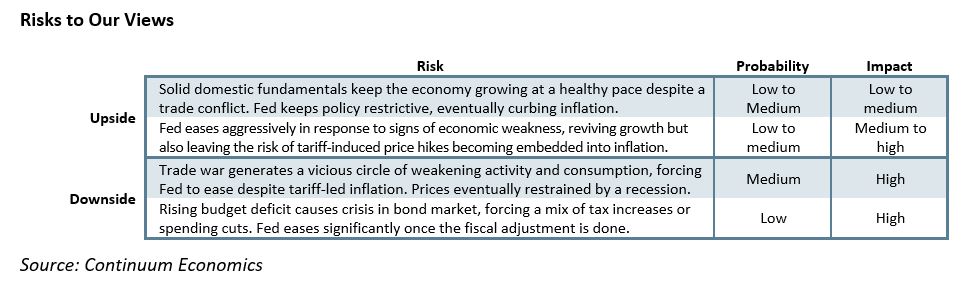

• Forecast changes: In December we expected 2025 would see the Trump administration focusing on immigration and tax cuts, turning to tariffs only in 2026 as a means to raise revenue. Now that tariffs have been pursued aggressively in 2025, we have revised our 2025 GDP forecast down to 2.1% from 2.5% and 2025 CPI up to 3.2% from 2.7%. We now expect the Fed Funds target to end 2025 at 4.0%-4.25% rather than 3.75-4.0%. For 2026 we have revised GDP down modestly, to 1.6% from 1.8%, and CPI down modestly, to 2.9% from 3.1%. In December we had expected Fed tightening in 2026, raising the Fed Funds target to 4.5-4.75%. We now expect easing and it to end 2026 at 3.5-3.75%. Trump’s unpredictably means that the margin for surprises to our forecasts remains large.

Tariffs will lift inflation and hit growth, though probably not dramatically

President Donald Trump inherited an economy that has been growing steadily, continuing to surprise many by its resilience to restrictive Fed policy, and with inflation, while well down from its highs, stubbornly above the FOMC’s 2.0% target. Consumer spending was looking particularly strong, with household balance sheets healthy. Recession risks looked low with the Fed having plenty of scope to lower rates should the economy falter, though with the budget deficit above 6% of GDP, there is little scope for further fiscal policy support.

Trump’s unexpectedly aggressive actions on tariffs have since generated a sharp rise in uncertainty, putting continued progress in moving inflation back to target at risk, making Fed easing more difficult to deliver. Rising uncertainty, damage to supply chains and likely recessions in Mexico and Canada are significant risks to the economic outlook. Recession talk has been amplified by Atlanta Fed calculations based on January data that Q1 GDP could come in negative. This pessimism looks overdone. The negative GDP arithmetic comes largely from a dramatic rise in the January trade deficit, where a surge in imports in attempt to beat threatened tariffs is likely to be quickly reversed, and a weak month from January consumer spending, which was largely due to bad weather and contrasted by a strong month from personal income. While Q1 GDP is likely to come in below trend, we expect it to be at 0.7% annualized, and in Q2 we expect a rebound to 3.3%. This would put the first half of 2025 at 2.0% annualized, a slight slowing from 2024, but not a worrying one.

Looking ahead however, we expect a further slowing in GDP growth to a 1.4% pace in the second half of 2025, which we expect to persist in the first half of 2026. While stock market turmoil may persuade Trump to scale down his actions, a significant dose of reciprocal tariffs looks set to be imposed in April, which will follow tariffs already imposed on China, steel and aluminum, and non-USMCA-compliant goods from Canada and Mexico. The Fed’s most recent Beige Book shows that contacts expect the tariffs to be largely passed onto consumers, while even in January price indices in most manufacturing surveys picked up. This is likely to be produce stronger inflation data for Q2, keeping core PCE prices closer to 3.0% than 2.0% on a yr/yr basis through Q1 2026.

Persistent inflation will restrain growth by restraining real disposable income, while employment growth is likely to slow, probably to around 100,000 per month, due to both slowing demand and reduced labor supply as immigration controls are tightened. Policy uncertainty will weigh on business investment. Fiscal policy is likely to see the Trump tax cuts from his first term sustained, which will be supportive for business sentiment, but there appears little scope to provide anything to consumers, with promises to remove taxes on social security, overtime and tips unlikely to be delivered. With the Republican Congress demanding spending cuts, most notably on Medicaid which will hit millions of lower income consumers, fiscal policy may be a net negative for the GDP outlook.

The risks for a modest hit to growth turning into a negative spiral, in which slowing employment growth feeds further into personal income and back into employment is real, though with Trump having plenty of flexibility on trade policy, a worst-case scenario is not our central view. Still, Trump looks highly unlikely to back down on tariffs altogether, leaving a boost to inflation and a hit to growth intact, and likely to persist for some time.

Unless the economy faces recession, FOMC easing will be cautious

With the economy facing a slowdown and fiscal policy having limited scope to respond, the role of the FOMC will be crucial. The FOMC’s recent commentary has not had a hawkish tone, suggesting that restrictive policy can persist if both the labor market and prices remain firm, but easing could be seen if only one of the two softens. However, we feel that a scenario where tariffs cause inflation to be around 0.5% above where it would have otherwise have been and growth is around 0.5% slower is not one in which the Fed would feel comfortable about easing in. That Q2 is likely to be a strong one for both growth and inflation is likely to delay easing well beyond that quarter. Some might argue that tariffs would be a one-time increase to prices but in a tight labor market the risk of second round effects would be real. Reduced labor supply as immigration falls will keep gains in unemployment modest. If inflation remains stable above 2.5% the Fed would probably need recessionary signals to ease sharply. This is not to be ruled out, but is not our central scenario.

We expect only one 25bps easing in 2025, in Q4, which would be the second straight quarter of below potential growth, and two in 2026, in Q2, assuming yr/yr inflation drops as the introduction of tariffs drops out, and Q4. This would leave the Fed Funds target at 3.5-3.75% at the end of 2026, above the Fed’s current 3.0% estimates of where neutral lies, but in a less globalized word, risk is that the long-term neutral rate will increase. In addition to the moderate easing that we expect, the Fed is likely to end Quantitative Tightening, probably by late 2025 to avoid tightening liquidity too much.

A situation where the FOMC is likely to be cautious about easing is likely to generate the anger of President Trump. The term of Chairman Jerome Powell is due to finish in May 2026, and his reappointment is unlikely. The risk of Fed credibility being undermined by Trump appointing a successor seen as too willing to follow White House demands is a risk, though the majority of FOMC voters will remain independent thinkers. That being the case it may not be in Trump’s interest to appoint an outsider to head the Fed. Looking at potential insiders that he may consider, Governor Christopher Waller appears more likely than most. He was appointed to the FOMC by Trump in his first term and has downplayed the inflationary risks of tariffs in recent comments.

A key event for 2026 will be the Midterm elections. Under a view that the economy will look less than satisfactory at that point, the Democrats look likely to overturn the current narrow Republican majority in the House, but would probably fail to recapture the Senate. This would restrict Trump’s options in many areas of policy, but not, crucially, tariffs. Assuming that the tariff picture will have stabilized and inflation is by then closer to, if not yet on, target, we would expect GDP growth to regain some momentum in late 2026. However, the acceleration would probably be modest if the slowdown is as modest as in our central scenario, with the Fed seeing the long term growth potential at 1.8%.