Equities Outlook: U.S. Exceptionalism v Valuations

· The glory days of exceptionalism for U.S. equities will likely extend in Q1 2025 to bring the S&P500 to 6200-6300. The problem is that valuations have now become stretched with S&P500 ex magnificent 7 on a forward P/E of 19 and valuations out of line with real bond yields (Figure 1). This means that the good news must keep on coming to sustain the higher market levels, while any bad news would leave the U.S. equity market vulnerable to a healthy correction. We feel that into Q2 2025 news will become less friendly for the U.S. equity market with an end to Fed easing by Q3 2025 and fears of 2026 tightening/huge budget deficit and bond supply lifting U.S. Treasury yields across the board. 2025 corporate earnings growth expectations at 15% are also too rich and this could mean a gradual derating process for forward P/E ratio occurs. Additionally, not all the Trump administration tariffs will quickly lead to trade or other concessions and this will reopen concerns about a stagflation hit to U.S. equities. We would see the S&P500 at 6000 for end 2025. 2026 is more threatening for the U.S. equity market and we see the S&P500 at 5700 for end 2026.

· EZ equities face a tug of war between reasonable valuation/more ECB rate cuts/Ukraine ceasefire v French budget woes/Trump tariff threats and slow economic recovery. This all points to a rollercoaster in 2025 for EZ equities, though by end 2025 we would see a 2.5% outperformance versus the S&P500, as a lot of bad news is discounted. 2026 can also see a modest 5% outperformance versus the U.S., as lagged easing helps to broaden the EZ recovery. We prefer UK domestic equities (FTSE250), with a better recovery and less at risk from tariffs.

· 2025 will likely have ups and downs for China equities, with a Yuan3-5trn of true fiscal stimulus to be announced but a trade war highly likely with the U.S. However, as 2025 progress, we expect Yuan depreciation as a partial offset against tariffs and eventually a 2 U.S. trade deal. We can see China equities outperforming the U.S. by around 5% (mostly after the trade deal is agreed) in 2025. Indian equities remain in a corrective phase, as the market remains clearly overvalued and domestic investors will likely slow purchases. If the 12mth fwd P/E ratio gets down to 20, then this should be a base to restart a multi-year rally given reasonable corporate earnings prospects for 2025 and beyond. We look for around 7.5% outperformance versus the U.S. in 2025 and 15% outperformance in 2026. We prefer EM Asia ex China on a multi-year view, given controlled inflation; reasonable valuations outside India and long-term corporate earnings prospects.

· Risks to our views: Fed does not tighten in 2026 and U.S. Treasuries yields are lower than our baseline and S&P500 rallies to 6500. Alternatively, 10yr yields rise to 5.50-6.00% on huge supply and cause more of a derating of the P/E ratio – S&P500 down to 5100.

Figure 1: 12mth Fwd S&P500 P/E Ratio and 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2025

U.S. Equities have growth momentum, Fed easing and dominant tech and AI, while the incoming Trump administration will likely deliver sizeable tax cuts in 2026 and deregulation. The glory days of exceptionalism for U.S. equities will likely extend in Q1 2025 to bring the S&P500 to 6200-6300. The problem is that valuations have now become stretched with S&P500 ex magnificent 7 on a forward P/E of 19 and valuations out of line with real bond yields (Figure 1). This means that the good news must keep on coming to sustain the higher market levels, while bad news would leave the U.S. equity market vulnerable to a healthy correction. Bad news can come in the form of escalating trade wars that hurt U.S. and global growth expectations or inflation fears that lead to fears that the Fed could have to stop easing at 4% or alternatively tighten in 2026. A 3rd alternative is that the economy slows down more than expected in 2025 to reawaken the hard v soft landing debate and hurts corporate earnings expectations – this is less threatening than the first two scenario or higher inflation, as the market would assume the Fed eases to 2.5% or below.

We feel that into Q2 2025 news will become less friendly for the U.S. equity market with an end to easing by September 2025 and fears of 2026 tightening/huge budget deficit and bond supply lifting U.S. Treasury yields across the board. In turn this can stretch equity v bond yield valuation to breaking point (Figure 1). 2025 corporate earnings growth expectations at 15% are also too rich and this could mean a gradual derating process for forward P/E ratio occurs. Additionally, not all the Trump administration tariffs will quickly lead to trade or other concessions and this will reopen concerns about a stagflation hit to U.S. equities. We would see the S&P500 at 6000 for end 2025.

2026 is more threatening for the U.S. equity market, as huge funding pressures from an 8-9% of GDP budget deficit will push 10yr Treasury yields still higher. The Fed will also face a dilemma on leaning against inflation risks from tax cuts and tariffs by actually starting a tightening cycle – we see 100bps of tightening from the Fed. Additionally, though non tech AI earnings look solid multi-year, a gap exists between AI buildout and AI adoption and profits. This could see the tech sector support shine less brightly for U.S. equities. Thus, we see the S&P500 at 5700 for end 2026, as derating of the fwd P/E ratio requires a small market decline as well as all corporate earnings feeding into derating the multiple. This is like 2022.

If 10yr U.S. Treasury yields spike to 5.50-6% on huge supply and Fed tightening reality, then the derating of the fwd P/E ratio could be quicker and more aggressive. We could see 5100 in this alternative scenario for the S&P500.

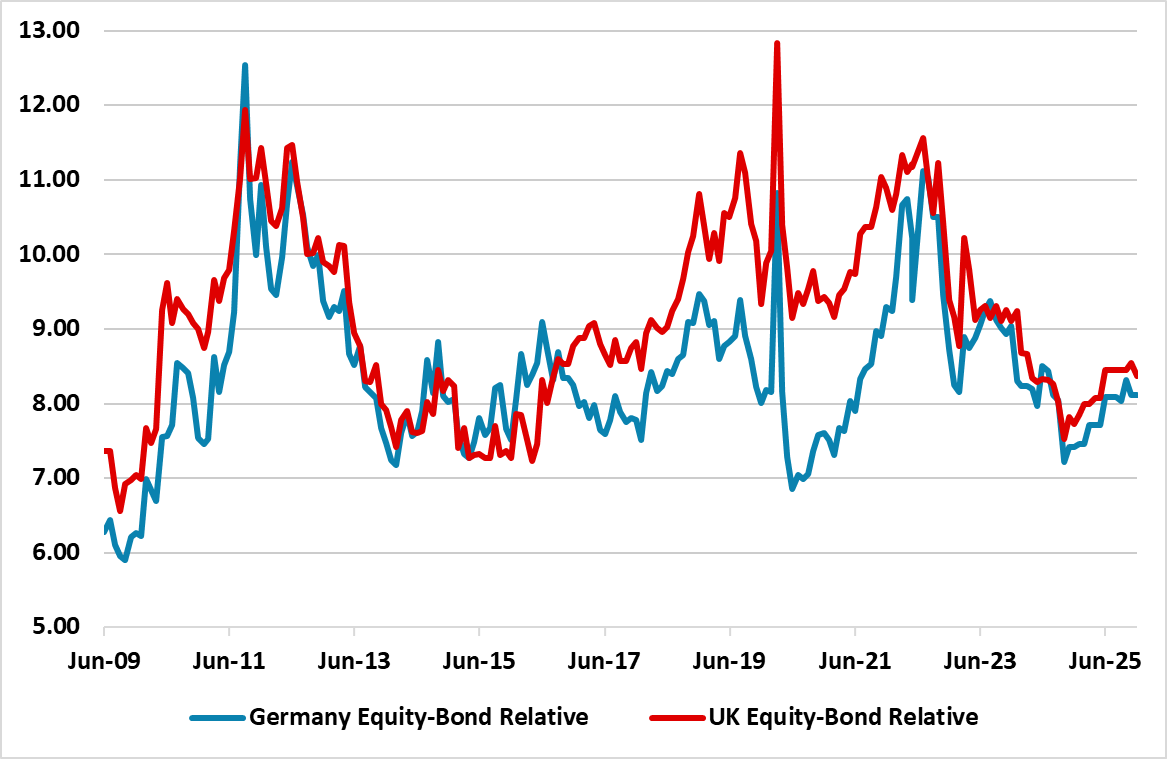

Figure 2: Germany/UK 12mth Earnings Yield minus 10yr Real Government Bond Yield (using 10yr breakeven inflation)

Source: Continuum Economics. Continuum Economics projections until end-2025 using 10yr breakeven inflation and Bund/Gilt yield forecasts.

In terms of other DM equity markets, sentiment towards EZ equities is poor due to a weak economic recovery; concerns over structural growth potential and geopolitical risks from the escalation in Ukraine. Gradual ECB easing is helping in absolute terms, but the underperformance versus U.S. equities remains sharp in narrative and percentages. However, we would see a Ukraine ceasefire from Q2 2025 followed by multi-party peace talks that will lower EZ geopolitical risk (here). Additionally, we look for the ECB to ease to 2% in 2025 given inflation is now under control, which can make equity-cash or bond comparisons more favorable to equities (Figure 2). Even so, EZ equities must also deal with either political tensions or chaos in France, which in the worst case could lead a French budget crisis that prompts wide EUR concerns/risk off (here). Furthermore, internal difference in the EU will mean that they are not quick to reach trade concessions with the Trump administration that is highly likely to threat and introduce some tariffs against Germany and the EU. However, we do see China reaching a trade deal with the U.S. in late 2025, which will likely lift the mood. Finally, the odds remain against a major EU wide structural investment or defense fund that would change the structural narrative. This all points to a rollercoaster in 2025 for EZ equities, though by end 2025 we would see around 2.5% outperformance versus the S&P500, as a lot of bad news is discounted. 2026 can also see a modest 5-7.5% outperformance versus the U.S., as lagged easing helps to broaden the EZ recovery.

UK domestic equities (FTSE250) should outperform, as the BOE is too optimistic on growth and inflation and will likely speed up easing and decouple Gilt yields from the U.S. (here) – while the surge in government spending will help the economy. Additionally, the UK will likely be less impacted by the Trump administration’s policies, with the U.S. running a trade surplus with the UK and as the UK military helps the U.S. in its Asia pivot (here). We also see 125bps of BOE cuts in 2025 versus only 50bps currently discounted. FTSE250 can outperform the S&P500 by 5% in 2025 and 10% in 2026. The FTSE100 outperformance versus the U.S. will be smaller, given that the 2025 trade threats and tariffs will impact commodity demand that is an important part of the FTSE100.

Japan equities can still benefit from the structural improvement in corporate earnings, but this could be counterbalanced by cyclical earnings worsening. The JPY remains extremely undervalued versus the USD and we see a sustained recovery in 2025 and 2026 that will be a headwind to earnings. Additionally, we see GDP slowing, as Japanese consumers remain reluctant to accept higher prices and this squeezes profit margins. Meanwhile, Japan will likely improve the 2019 trade deal with the U.S. to avoid a trade war with the U.S., which could help provide some protection from spillover of a 2025 U.S./China trade war. We see Japanese equities outperforming the U.S. by 5% in 2025 and a further 7.5% in 2026.

Emerging Markets

The China equity rally after the September policy stimulus was larger than we expected and has now removed a fair portion of the undervaluation on an equity only basis – though the market still remains cheap on an equity-real bond yield basis compared to other major EM equity markets (Figure 3). 2025 will likely have ups and downs, with a Yuan3-5trn of true fiscal stimulus to be announced but a trade war highly likely with the U.S. likely to hurt the market in H1 2025. However, as 2025 progresses, we expect Yuan depreciation as a partial offset against tariffs and eventually a 2 U.S. trade deal. We can see China equities outperforming the U.S. by around 5% (mostly after the trade deal is agreed) in 2025. Structural headwinds to growth (residential construction/population aging/slowing productivity) and aggressive disinflation will however remain large and further fiscal stimulus will be required for 2026. We see a 10% outperformance versus U.S. equities in 2026. However, we see this as a tactical opportunity, as we prefer EM Asia ex China strategically.

Figure 3: China Earning-Bond Yield Relative Cheap Compared to Other Big EM’s (%)

Source: Continuum Economics. CAPE Earnings Yield-10yr Real government bond yield

Indian equities remain in a corrective phase, as the market remains clearly overvalued and domestic investors will likely slow purchases. If the 12mth fwd P/E ratio gets down to 20, then this should be a base to restart a multi-year rally given reasonable corporate earnings prospects for 2025 and beyond. We look for around 7.5% outperformance versus the U.S. in 2025 and 15% outperformance in 2026. We prefer EM Asia ex China on a multi-year view, given controlled inflation; reasonable valuations outside India and long-term corporate earnings prospects.

Figure 4: Brazil 12mth Fwd Earnings Yield and BCB SELIC Policy Rate (%)

Source: Datastream/Continuum Economics.

Brazil equities have underperformed as the BCB has hiked interest rates and domestic players worry about the fiscal trajectory (here). However, equity valuations are cheap now, while 10yr real bond yields are high and discounting too much bad news on the fiscal front. With the Brazilian real undervalued, Brazil carry and fixed income trades can become attractive after initial USD strength in H1 2025. Moreover, we would see the BCB switching back to easing in H2 2025, as inflation is controlled and this can allow the Brazilian equity market to outperform the U.S. by 5% in 2025, despite selective trade wars for the U.S. Cumulative BCB rate cuts should be larger in 2026, while the trade wars will be turning to trade deals and concessions that will help commodity sentiment. We see scope for 15% outperformance versus the U.S. in 2026.