Canada

View:

January 06, 2026

Markets 2026

January 6, 2026 9:58 AM UTC

• For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, b

January 02, 2026

Preview: Due January 8 - U.S. October Trade Balance - Exports to correct from stronger September

January 2, 2026 3:40 PM UTC

We expect an October trade deficit of $60.5bn, up from September’s $52.8bn which was the narrowest since June 2020. The deficit would be marginally above August’s $59.3bn, while remaining well below July’s $77.2bn and March’s record $136.4bn when imports surged ahead of the tariff announceme

December 17, 2025

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 15, 2025

Canada November CPI - Underlying trend has slowed

December 15, 2025 1:48 PM UTC

November Canadian CPI at 2.2% has held steady at October’s pace, and is slightly weaker than expected. The Bank of Canada’s core are are on balance weaker, with CPI-Median and CPI-Trim falling to 2.8% from 3.0%, though CPI-Common (less important to the BoC) edged up to 2.8% from 2.7%.

December 11, 2025

U.S. Initial Claims rebound from holiday drop, September trade deficit falls on surge in gold exports

December 11, 2025 2:14 PM UTC

After a sharply below trend outcome last week of 192k (revised from 191k) in a week that included the Thanksgiving holiday and may have seen seasonal adjustment problems, initial claims have rebounded above trend to 236k. The 2-week average is 214k, slightly below the 218k seen two weeks ago and the

December 10, 2025

Bank of Canada - Rate Level Still Appropriate Despite Stronger Data

December 10, 2025 4:21 PM UTC

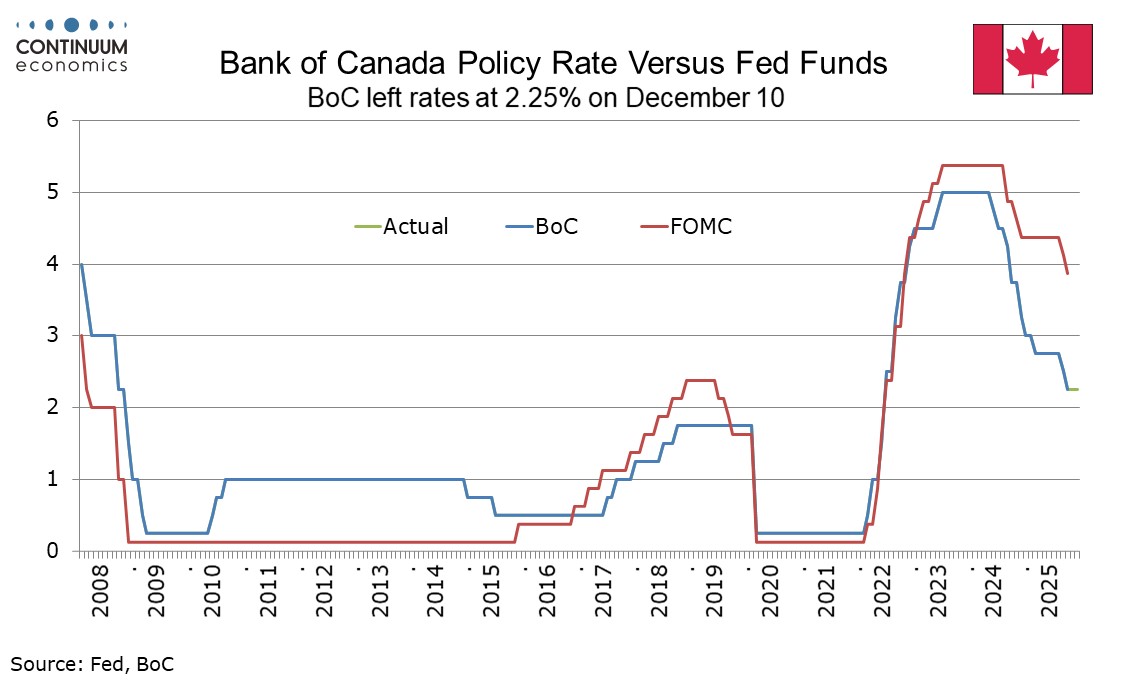

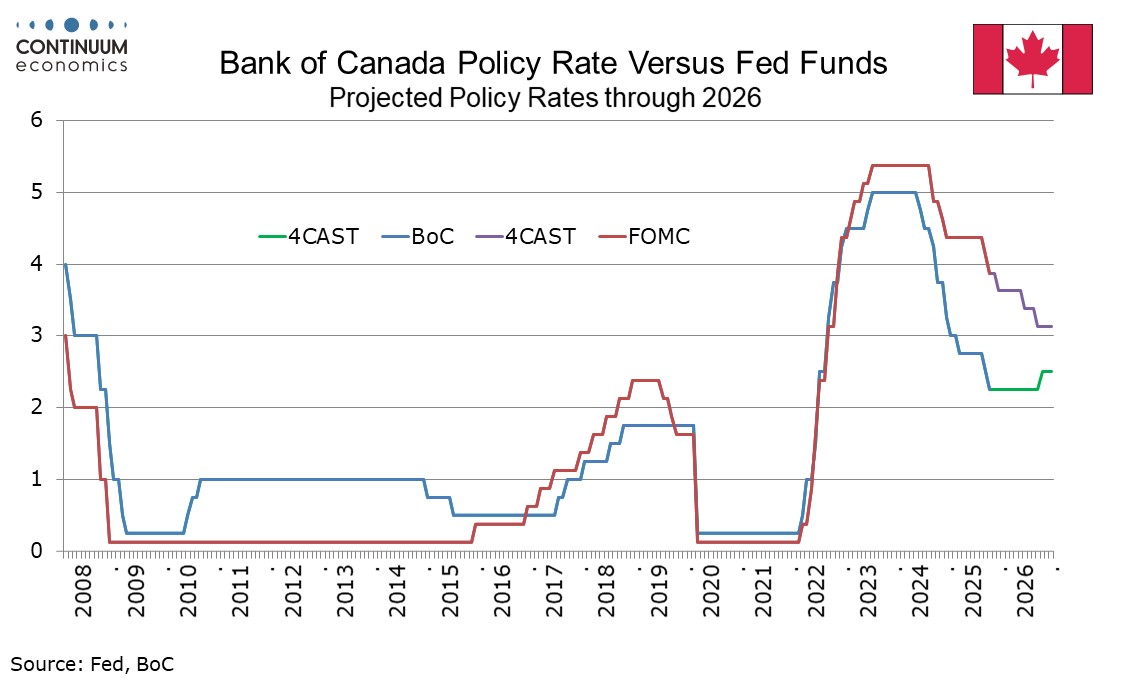

Since the Bank of Canada eased rates to 2.25% in October and stated that policy was now at an appropriate level, Canada has delivered stronger than expected data on GDP and employment. The data has not been dismissed, but the BoC view that policy is at an appropriate level persists after today’s m

Preview: Due December 11 - U.S. September Trade Balance - Canadian data suggests a wider deficit

December 10, 2025 1:48 PM UTC

We expect a September trade deficit of $70.5bn, up sharply from August’s $59.6bn but still below July’s $78.2bn. We expect exports to fall by 0.5% after a 0.1% August increase while imports rise by 2.8% after a 5.1% July decline. This could weigh on estimates for Q3 GDP, now due on December 23

December 09, 2025

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 05, 2025

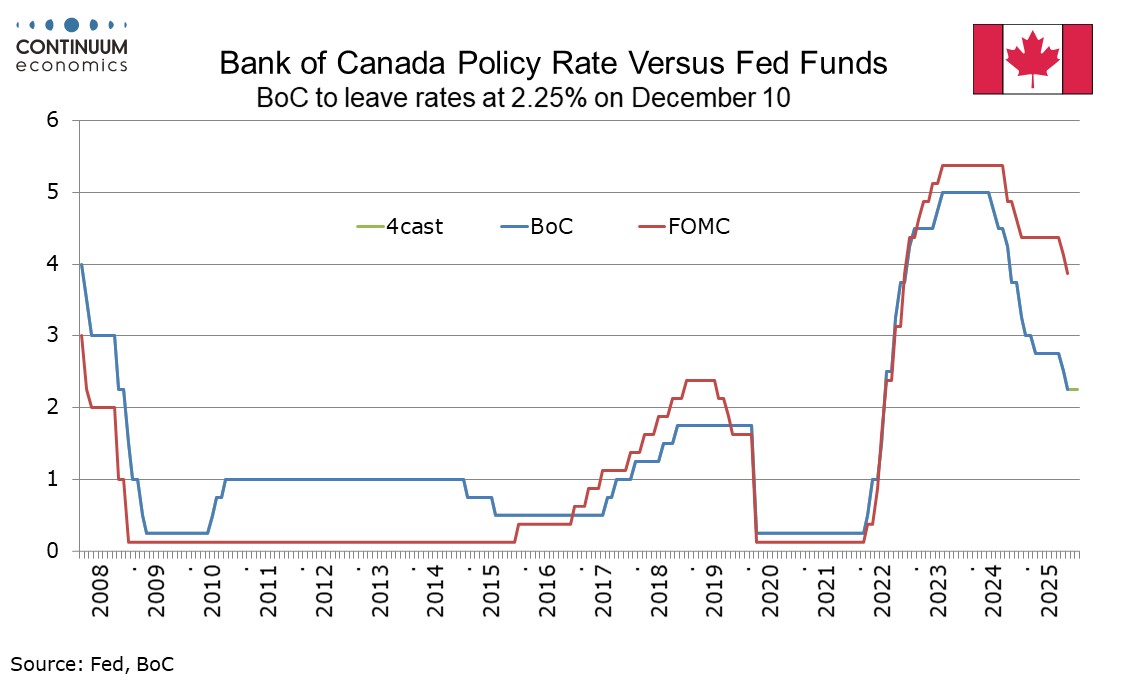

Bank of Canada Preview for December 10: Stronger data reinforces case for a pause

December 5, 2025 2:31 PM UTC

The Bank of Canada looks highly likely to leave rates at 2.25% when it meets on December 10. After easing in both September and October, the BoC after its October move stated rates were now at about the right level if the economy evolved in line with its expectations. With Q3 GDP and November employ

November 28, 2025

Canada Q3 GDP rebounds as imports plunge but domestic demand marginally negative

November 28, 2025 2:14 PM UTC

Canada’s 2.6% annualized increase in Q3 GDP is sharply higher than expected though the surprise comes largely from a sharp fall in imports. Domestic demand was almost unchanged with a 0.1% annualized decline. September GDP grew by 0.2% on the month, but the preliminary estimate for October is weak

November 27, 2025

USMCA Renegotiation: Hostage To Trump

November 27, 2025 2:55 PM UTC

• Trump could decide to go on an early offensive over the July 2026 USMCA review or could wait until after the November congressional elections to act tough given it could cause new cost of living fears for U.S. voters. This could mean that at times the USMCA negotiations are upsetting fo

November 26, 2025

Preview: Due November 28 - Canada Q3/September GDP - September rebound to keep Q3 positive

November 26, 2025 12:58 PM UTC

We expect Q3 Canadian GDP to increase by 0.6% annualized, marginally stronger than a 0.5% estimate made by the Bank of Canada with October’s Monetary Policy report, with September GDP to increase by 0.2% on the month, slightly stronger than a preliminary estimate of 0.1% made with August’s data.

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 19, 2025

U.S. August trade deficit slips back after bounce in July, still in correction from inflated pre-tariff deficits

November 19, 2025 2:00 PM UTC

August’s delayed trade deficit of $59.55bn is narrower than expected, down significantly from July’s $78.5bn, but still marginally above June’s $59.09bn. Despite July’s bounce, the deficit remains in a correction from the inflated pre-tariff levels of Q1 which saw a record deficit of $136.42

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Preview: Due November 28 - Canada Q3/September GDP - September rebound to keep Q3 positive

November 17, 2025 6:58 PM UTC

We expect Q3 Canadian GDP to increase by 0.6% annualized, marginally stronger than a 0.5% estimate made by the Bank of Canada with October’s Monetary Policy report, with September GDP to increase by 0.2% on the month, slightly stronger than a preliminary estimate of 0.1% made with August’s data.

Canada October CPI - BoC core rates mostly slower, but still running above target

November 17, 2025 2:06 PM UTC

October Canadian CPI has slowed to 2.2% yr/yr from 2.4% in September, though excluding gasoline the yr/yr increase was 2.6% in each month. The BoC’s core rates were however mostly slower, CPI-Median at 2.9% from 3.1%, CPI-Trim at 3.0% from 3.1%, though CPI-Common was unchanged at 2.7%. Year ago st

November 12, 2025

Bank of Canada Minutes from October 29 reinforce steady policy message after a 25bps easing

November 12, 2025 7:18 PM UTC

The Bank of Canada has released minutes from its October 29 meeting, and after a 25bps easing members agreed that monetary policy was now close to the limits of what it could do to support the economy under current circumstances. They agreed to be as clear as possible to communicate that policy was

November 04, 2025

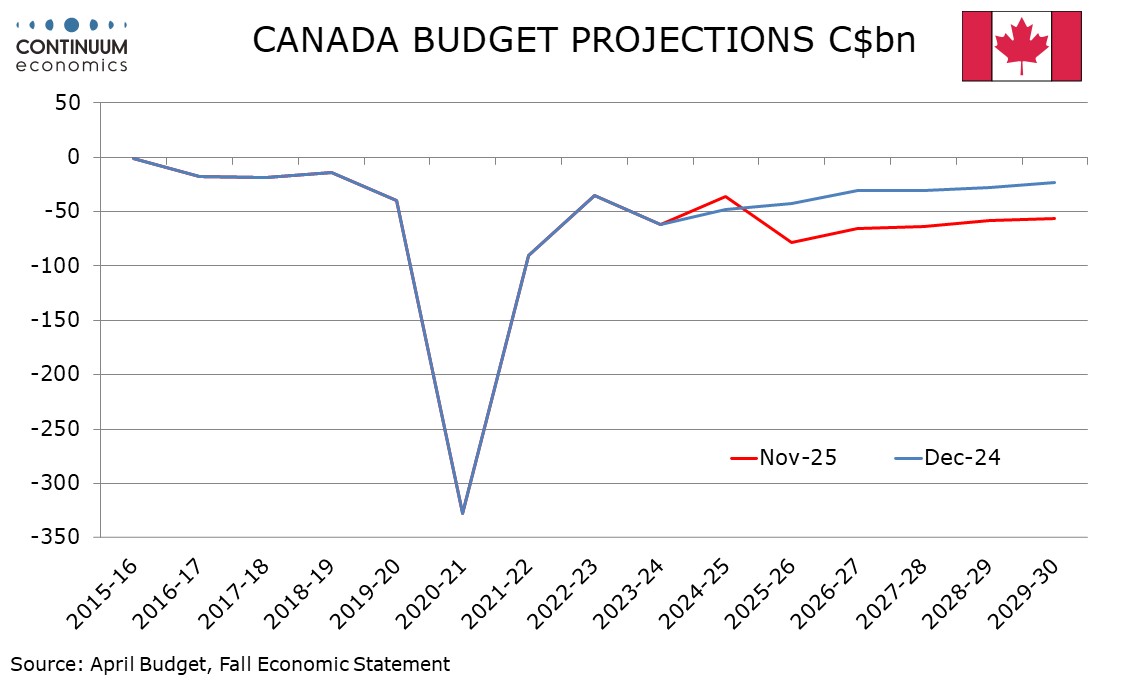

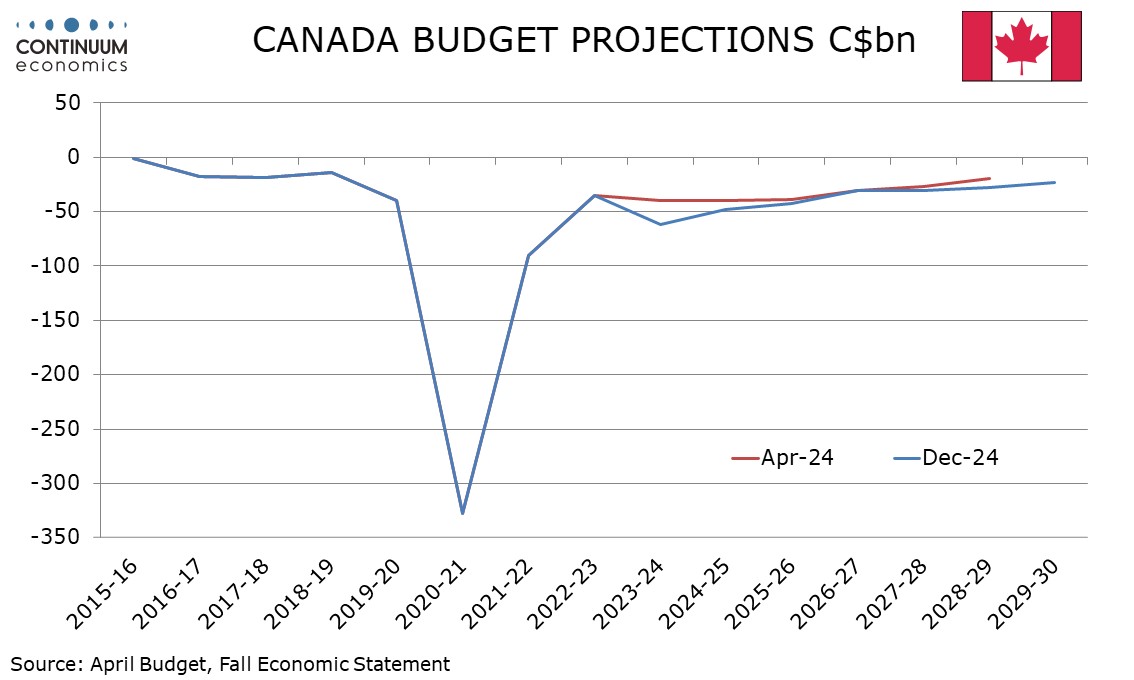

Canada Budget Sees Larger Deficits, Slower Growth

November 4, 2025 9:58 PM UTC

Canada’s budget has seen the deficit for 2025-26 revised up to C$78.3bn from C$42.2bn in the December 2024 statement, which will now be 2.5% of GDP versus 1.3%, still a level that is quite small compared to many other developed countries. The deficit is projected to slip after that, reaching C$56.

November 03, 2025

October 31, 2025

U.S./China Trade Framework: Avoiding Escalation

October 31, 2025 7:48 AM UTC

· The U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. The economic effects will likely be small and the deal main aim app

October 29, 2025

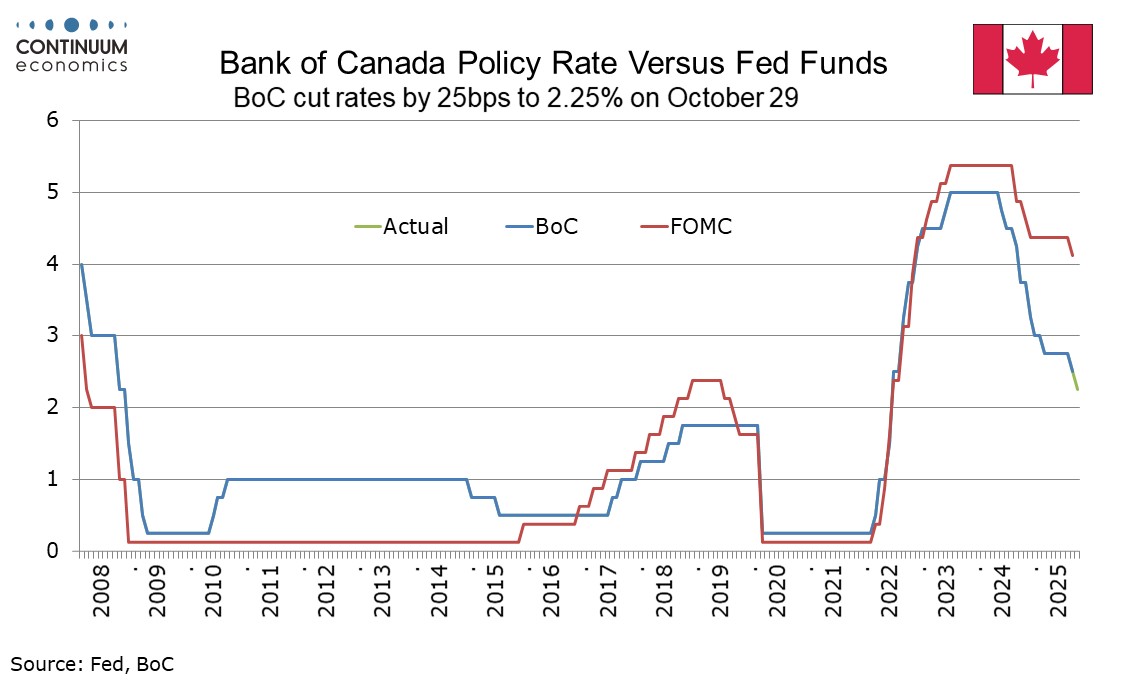

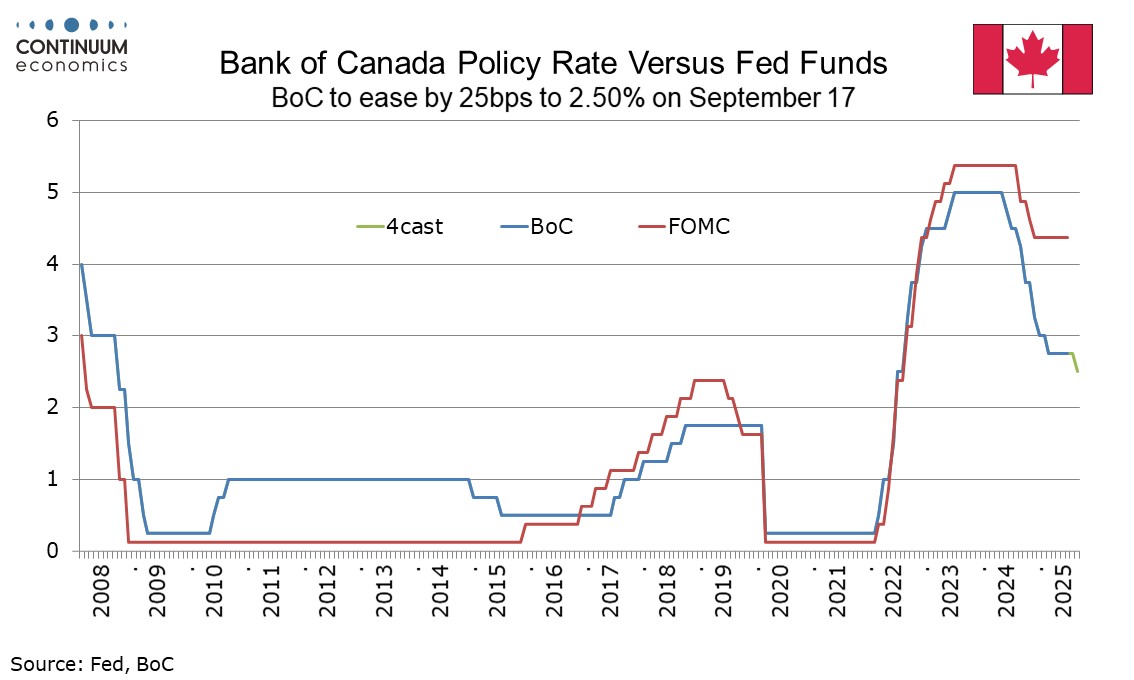

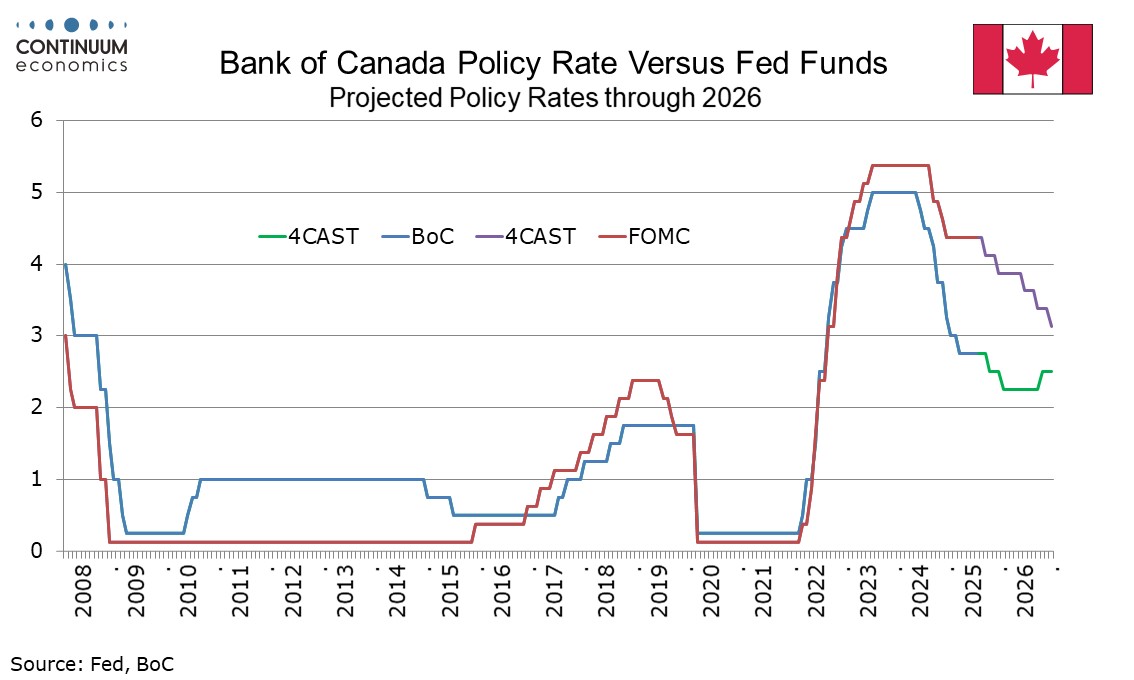

Bank of Canada - Hawkish Ease with Current Rate Level Seen as Appropriate

October 29, 2025 3:40 PM UTC

The Bank of Canada delivered a hawkish easing, cutting rates for the second straight meeting by 25bps, to 2.25%, but stating that if inflation and activity evolve in line with its projection, the current rate is seen as about the right level to keep inflation close to 2% while helping the economy th

October 27, 2025

U.S-China Trade Tensions Ease, US-Canada Tensions Escalate

October 27, 2025 3:32 PM UTC

Trade tensions between the US and China appear to be easing, with it looking increasingly unlikely that the US will impose a threatened extra 100% tariff on China on November 1. However trade tensions with Canada have increased, with Canada receiving an extra 10% tariff, adding to downside economic

October 21, 2025

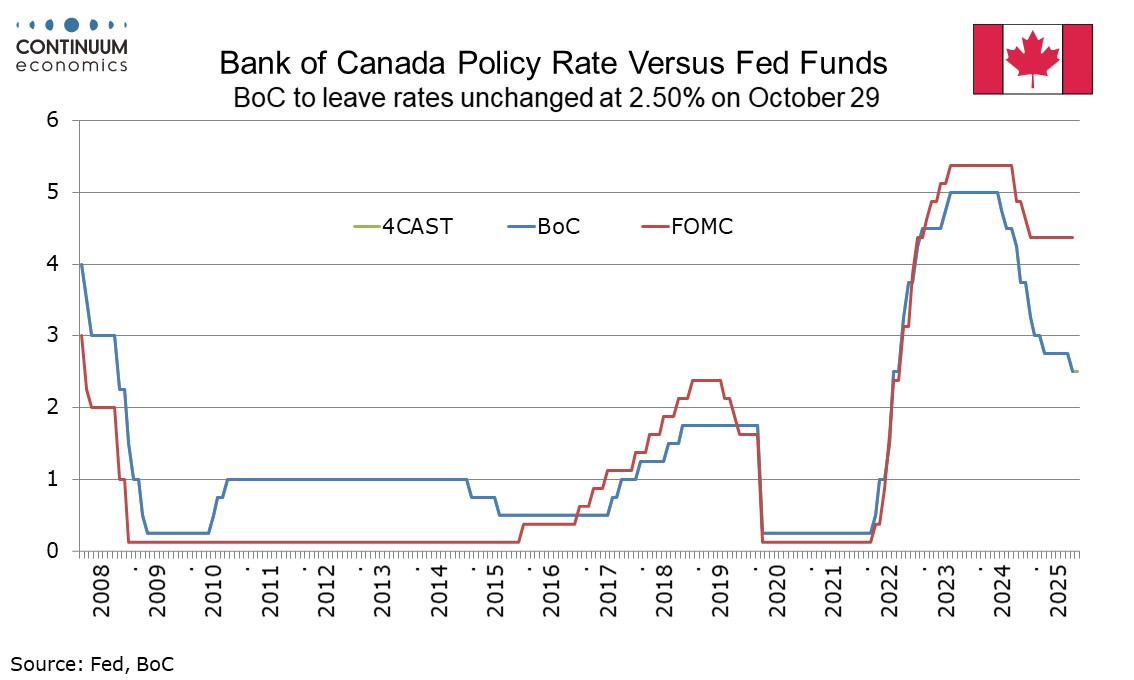

Bank of Canada Preview for October 29: A Pause before easing resumes in December

October 21, 2025 3:52 PM UTC

While we do not believe the Bank of Canada is done with easing, we expect the October 29 meeting to see rates left on hold at 2.50% given that most recent data have been on the firm side of expectations, though not strong enough to rule out a move. A pause in October would follow easing in September

Canada September CPI - Not alarmingly strong but argues against BoC easing next week

October 21, 2025 12:59 PM UTC

September Canadian CPI at 2.4% from 1.9% yr/yr is stronger than expected with the Bank of Canada’s Bank of Canada’s core rates also mostly marginally firmer. The monthly details do not look alarmingly strong but, particularly after a strong employment report, the data argues against a BoC easing

October 20, 2025

Canada - BoC Q3 Business Outlook Survey - Unlikely to shift BoC's views

October 20, 2025 3:52 PM UTC

The Bank of Canada’s Q3 business outlook survey is mixed though overall probably does not change the Bank of Canada’s view very much. The overall business outlook indicator of -2.28 is marginally improved from Q2’s -2.40 but leaves the index is a fairly narrow and marginally negative range. Th

October 07, 2025

Canada August trade deficit inflated by moves in gold, but damage from U.S. tariffs is clear

October 7, 2025 12:56 PM UTC

Canada’s August trade deficit of C$6.32bn is up from C$3.82bn (revised from C$4.94bn) in July and the widest since April, suggesting the Canadian economy remains pressured by the impact of US tariffs. However the August deficit is inflated by strong movements in both exports and imports of gold.

September 30, 2025

Trump Tariffs: China, Mexico and Semiconductors

September 30, 2025 8:00 AM UTC

· Our baseline (60% probability) remains that a U.S./China trade deal will be agreed in Q4/Q1 2026 and it is possible though unlikely that this could be announced at the Trump/Xi meeting at the October 31 APEC summit – China requests that the U.S. changes policy on Taiwan could slo

September 29, 2025

DM Government Bond Saints v U.S.

September 29, 2025 7:35 AM UTC

· Overall, although the fiscal saints (Australia/Canada/Germany/Sweden) have merits over the U.S. in the scenario where Fed independence is undermined and more Fed rate cuts occur than warranted by the economics, the 10yr area of other government bond markets may not outperform. 10yr go

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

September 17, 2025

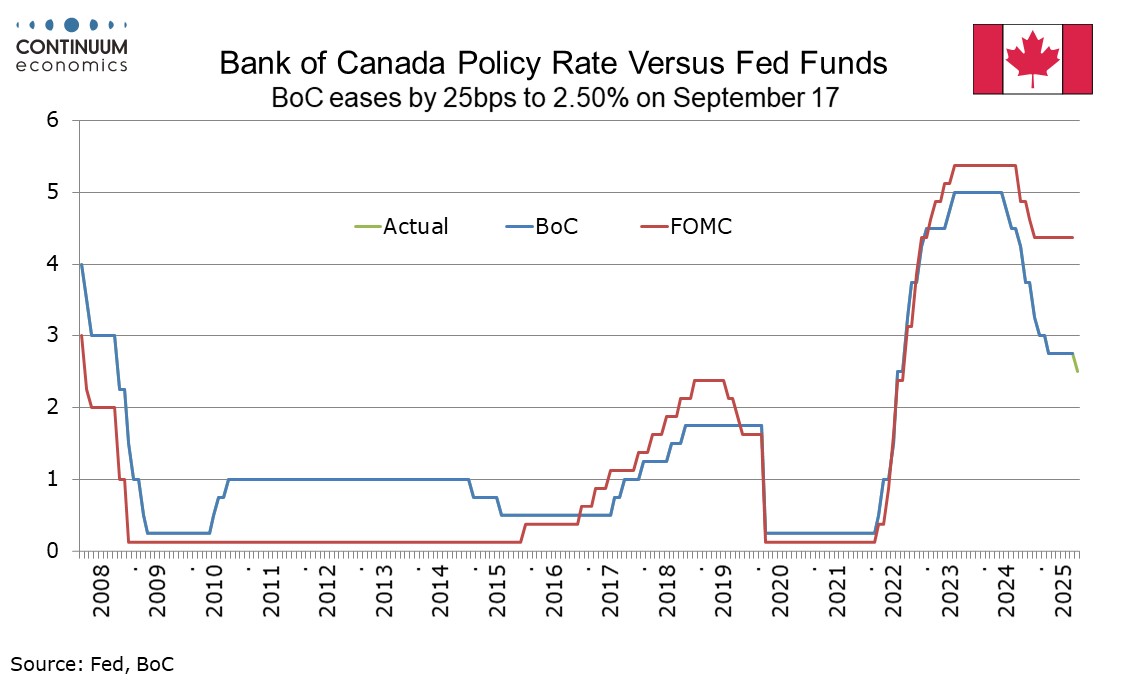

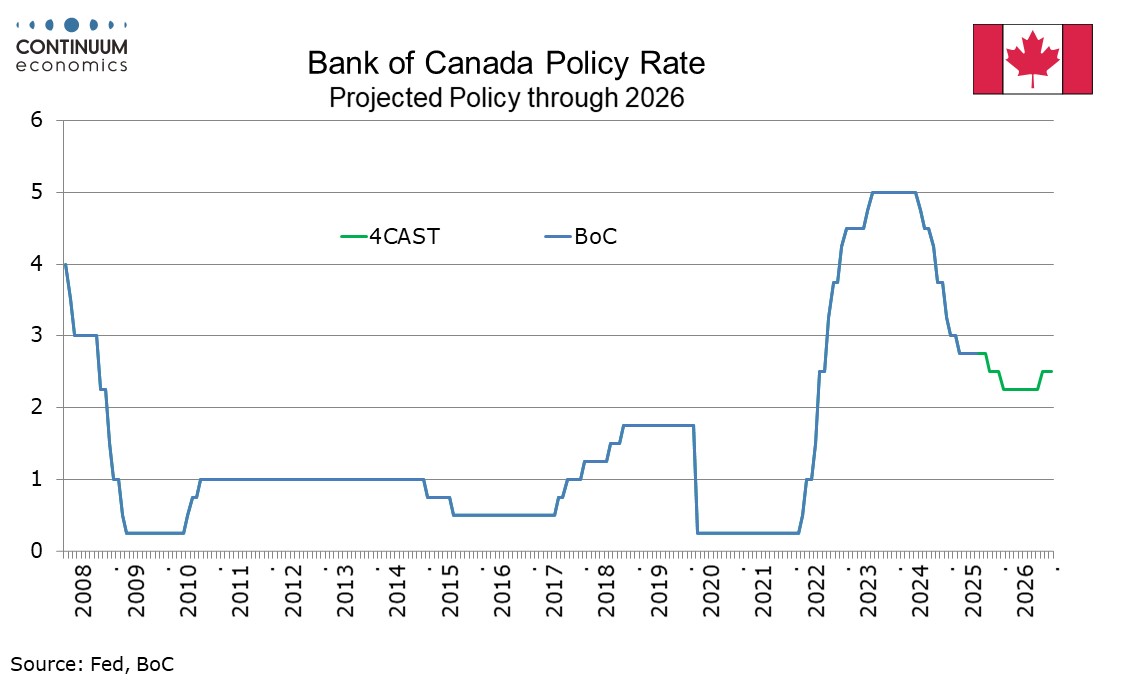

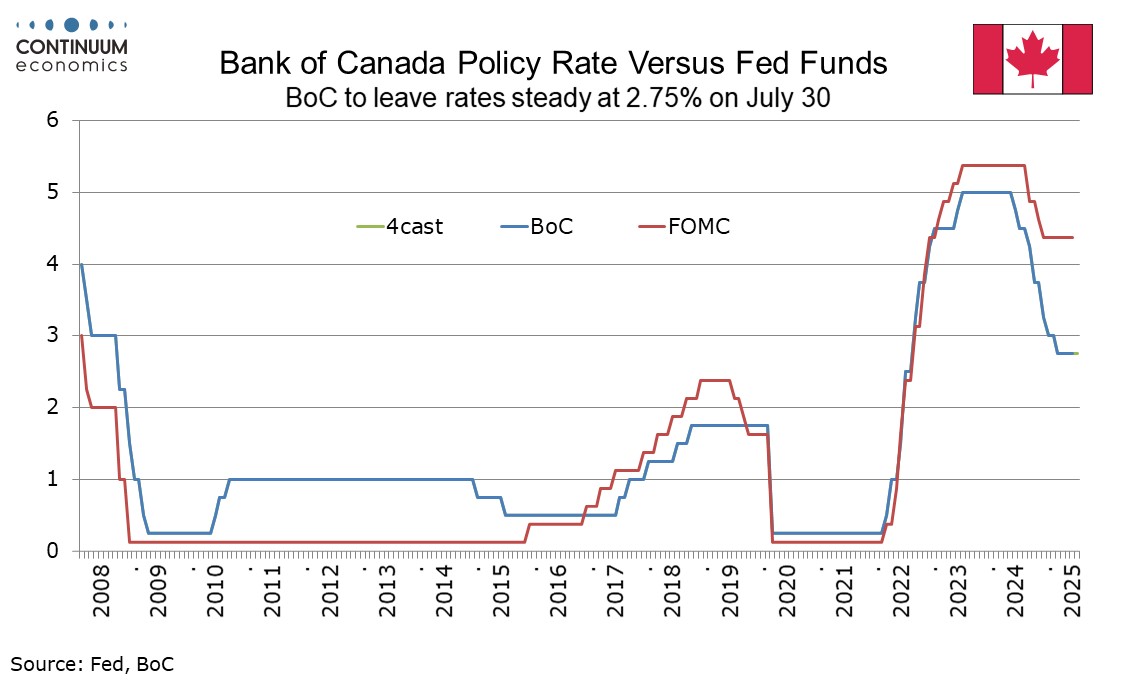

Bank of Canada - Clear consensus to ease, we expect two further 25bps moves

September 17, 2025 3:46 PM UTC

The Bank of Canada’s decision to ease today for the first time since March, by 25bps to 2.50% was as the market expected. We expect two further easings from the BoC, in Q4 of this year and Q1 of 2025, which would take the rate to 2.0%, which is likely to prove the floor.

September 16, 2025

Canada August CPI - Subdued enough for a BoC easing

September 16, 2025 1:04 PM UTC

August Canadian CPI at 1.9% yr/yr reversed a July dip to 1.7% yr/yr and remains restrained by around 0.7% by the abolition of the carbon tax. Core rates remain above target but are on balance marginally softer while monthly details also look acceptably subdued. The data is not an obstacle to an expe

September 09, 2025

Bank of Canada Preview for September 17: Weak data justifies resumption of easing

September 9, 2025 6:26 PM UTC

After the Bank of Canada’s last meeting on July 30 we expected rates to be left on hold in September before easing resumed in October. However with data since that meeting having been mostly weak, a 25bps easing, the first move since March, now looks likely at the September 17 meeting, to 2.5%. We

September 04, 2025

July US trade deficit up as imports bounce, deficits with Canada and China increase

September 4, 2025 1:36 PM UTC

July’s US trade deficit of $78.3bn was not far off expectations, but up sharply from $59.1bn in June. Imports bounced by 5.9% after three straight declines, while exports saw a modest rise of 0.3% after two straight declines.

August 28, 2025

Preview: Due August 29 - Canada Q2/June GDP - Exports plunge to send GDP lower

August 28, 2025 2:17 PM UTC

We expect Q2 Canadian GDP to fall by 1.0% annualized after five straight gains marginally above 2.0%. This would be slightly stronger than a Bank of Canada forecast of -1.5% but weaker than what monthly GDP data is likely to imply for the quarter, with June seen rising by 0.1%.

August 13, 2025

Bank of Canada Minutes from July 30 - Differences of opinion on whether further easing would be needed

August 13, 2025 7:32 PM UTC

The Bank of Canada has released minutes from its July 30 meeting, which saw rates left unchanged at 2.75% with Governor Macklem stating after the meeting that there was a clear consensus to do so. However the minutes show that some felt the rate had been reduced sufficiently, while others felt that

August 11, 2025

Preview: Due August 29 - Canada Q2/June GDP - Exports plunge to send GDP lower

August 11, 2025 7:54 PM UTC

We expect Q2 Canadian GDP to fall by 1.0% annualized after five straight gains marginally above 2.0%. This would be slightly stronger than a Bank of Canada forecast of -1.5% but weaker than what monthly GDP data is likely to imply for the quarter, with June seen rising by 0.1%.

August 05, 2025

June US trade deficit falls on weak imports, Canada trade deficit increases on one-time imports bounce

August 5, 2025 1:02 PM UTC

June’s US trade deficit of $60.2bn is even lower than expected, down from $71.7bn in May and in slipping marginally below April’s $60.3bn has reached its lowest level since September 2023. Exports fell by 0.5%, a second straight decline, but imports fell by 3.7%, a third straight fall as strong

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 30, 2025

Bank of Canada - Consensus to hold, but cautious bias towards easing

July 30, 2025 3:34 PM UTC

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 15, 2025

Bank of Canada Preview for July 30: Hold after firm data with uncertainty high

July 15, 2025 3:30 PM UTC

The Bank of Canada meets on July 30 and what had been seen as a close call between a 25bps easing and unchanged now looks likely to leave rates unchanged at 2.75%. Continued above target core CPI data and a strong employment report for June argue against easing, though uncertainty remains high with

Canada June CPI - Argues against a July BoC easing

July 15, 2025 1:18 PM UTC

June CPI was as expected with yr/yr growth at 1.9% after two straight months at 1.7%, though without April’s abolition of the Consumer Carbon Tax would be standing around 2.5%. The Bank of Canada’s core rates showed no progress lower, and coupled with Friday’s strong employment report for June