Bank of Canada Preview for October 29: A Pause before easing resumes in December

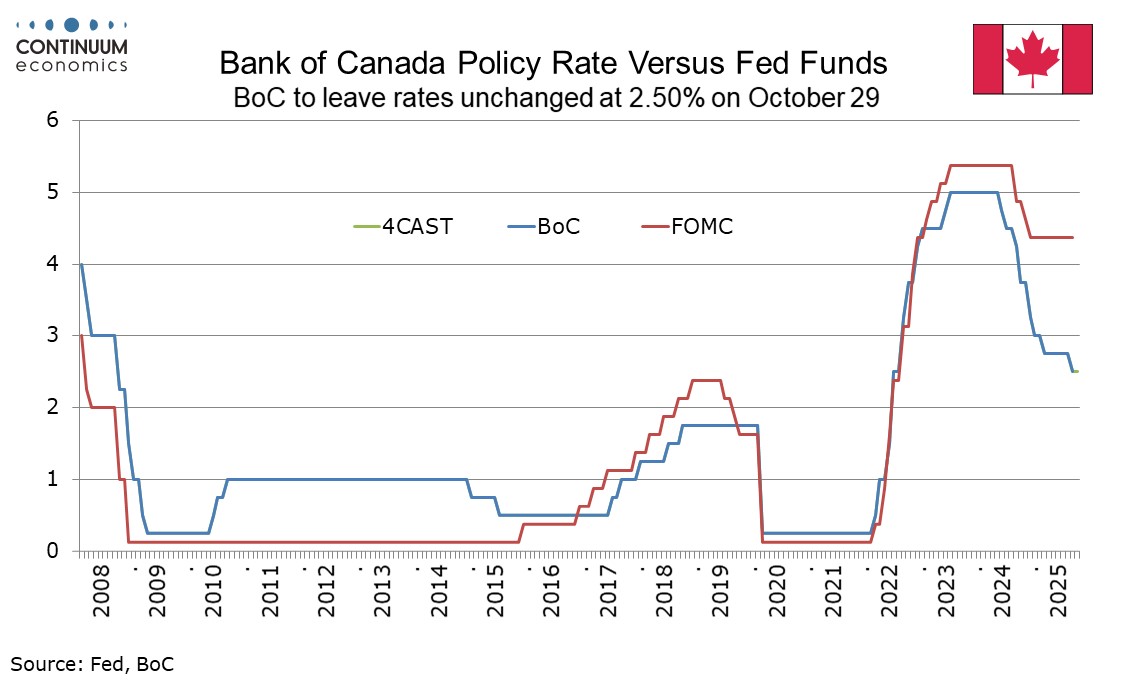

While we do not believe the Bank of Canada is done with easing, we expect the October 29 meeting to see rates left on hold at 2.50% given that most recent data have been on the firm side of expectations, though not strong enough to rule out a move. A pause in October would follow easing in September, which was the first easing since March after pauses in June and July.

The Bank of Canada has been sensitive to data. After July’s hold governor Macklem noted resilience in the economy and underlying inflationary pressures as well as uncertainty over tariffs as justifying a decision to hold, and stated the BoC would proceed carefully. In September Macklem noted three factors as having changed since July, a further softening of the labor market, diminished upward pressure on inflation and removal of Canadian retaliatory tariffs reducing upside inflationary risk.

Since then we have seen a strong rise in September employment that partially reversed losses in July and August which followed a strong June. Strong June data helped justify July’s hold and the two subsequent weak months helped justify September’s ease. Still, Governor Macklem has downplayed the strong September data, describing the labor market as soft. July GDP saw a 0.2% rise to follow three straight declines through Q2, though with the preliminary estimate fir August being flat Q3 still looks likely to come in below potential, not fully reversing a decline in Q2 that was led by a plunge in exports. September CPI at 2.4% yr/yr from 1.9% was stronger than expected with the three Bank of Canada core rates averaging at 3.0%, up from 2.9% in August and the highest since March 2024. Still, monthly data showed the seasonally adjusted ex food and energy rate up by only 0.2% in September after gains of 0.1% in July and August, suggesting subdued underlying pressures through the quarter. The ex food and energy rate is not one of the BoC’s core rates, and at 2.4% yr/yr is softer than all three.

The economic outlook in Canada appears to be of weak growth and core inflation looks set to slow from current elevated yr/yr rates. However with the risk of recession having faded the Bank of Canada may choose to wait for clearer conformation of slowing inflation before the next ease. Uncertainty in the US adds to the case for a pause, both with the lack of data due to the government shutdown and also a contrast noted by Fed Governor Waller between weakness in employment but resilience in GDP. We expect two more easings from the BoC, in December and Q1 2026, which would take the rate down to 2.0%.

This meeting will see a quarterly Monetary Policy Report released, and Governor Macklem has stated that economic forecasts will be delivered, probably reflecting reduced uncertainty over US tariffs. July’s Monetary policy report delivered forecasts assuming a continuation of the tariff situation that prevailed at the time, as well as two alternative scenarios assuming escalation and de-escalation of tariffs. Forecasts with this report will probably look similar to the central scenario from July, though removal of Canadian retaliatory tariffs reduced upside inflationary risks, as noted in September, and reduced downside risks to activity. Q2 GDP at -1.5% annualized came in close to the BoC’s June forecast of -1.5% and Q3 is likely to be not far from a June forecast of 1.0%, though we expect a little below. Q3 CPI at 2.0% came in stronger than June’s 1.8% forecast and the firm September signals a stronger Q4, but the firm BoC core rates were in line with the BoC’s June expectation. In the Monetary Policy Report the BoC uses the average of CPI-Median and CPI-Trim to measure core CPI, not including its third core measure, the slightly softer CPI-Common.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.