U.S-China Trade Tensions Ease, US-Canada Tensions Escalate

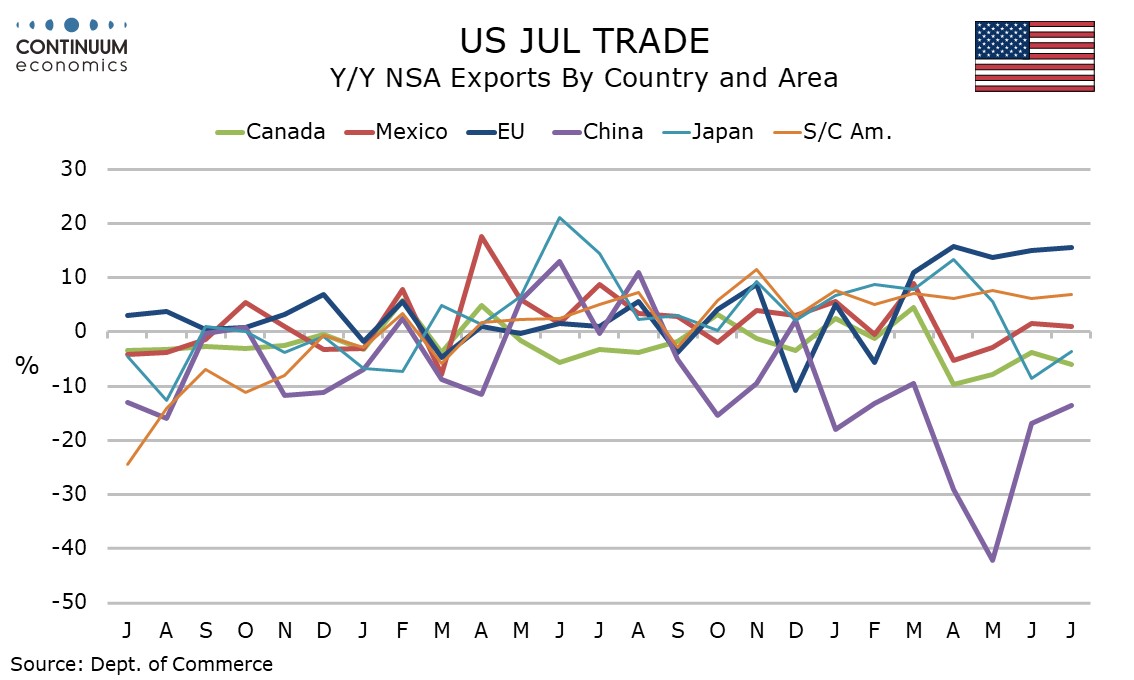

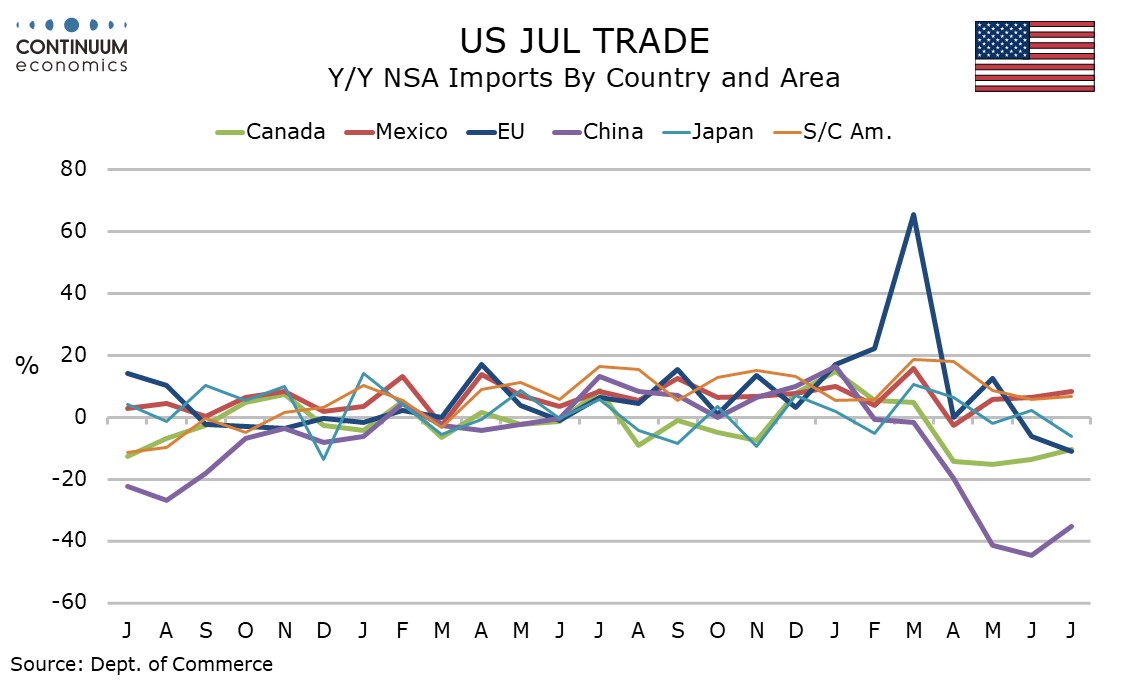

Trade tensions between the US and China appear to be easing, with it looking increasingly unlikely that the US will impose a threatened extra 100% tariff on China on November 1. However trade tensions with Canada have increased, with Canada receiving an extra 10% tariff, adding to downside economic risks and uncertainty in Canada. While we are not revising our call that the Bank of Canada will pause on Wednesday, the latest developments leave the call a close one.

It never looked very likely that Trump would impose the 100% extra tariff on China, with his rhetoric having turned more conciliatory soon after the threat was made. China has proven that it has leverage given its dominance of rare earth supply, with current signals that it will postpone the extra controls it recently announced for a year. The US also appears set to regain access to the Chinese market for soybean exports, which had become a significant issue in the US politically given problems faced by US farmers.

Trump does not look like quickly backing down from his additional 10% tariff on Canada, though it is unclear whether it will impact the majority of Canadian exports to the US that are USMCA compliant. If not, the economic impact will be moderate. Before the recent escalation the US and Canada appeared to be making progress on steel and aluminum trade barriers, while Canada had removed most of its retaliatory tariffs against the US. The recent escalation follows a TV advert produced by Canada’s largest province of Ontario, that quoted a speech from former US President Reagan expressing support for the benefits of free trade, that came within a speech in which he justified selective tariffs on Japan. The Justification did not appear in the advert. Tariffs imposed on an entire country because of an advert produced by a provincial government are of dubious legal authority and Trump may be testing the limits of his powers as the Supreme Court prepares to consider a challenge to his tariffs.

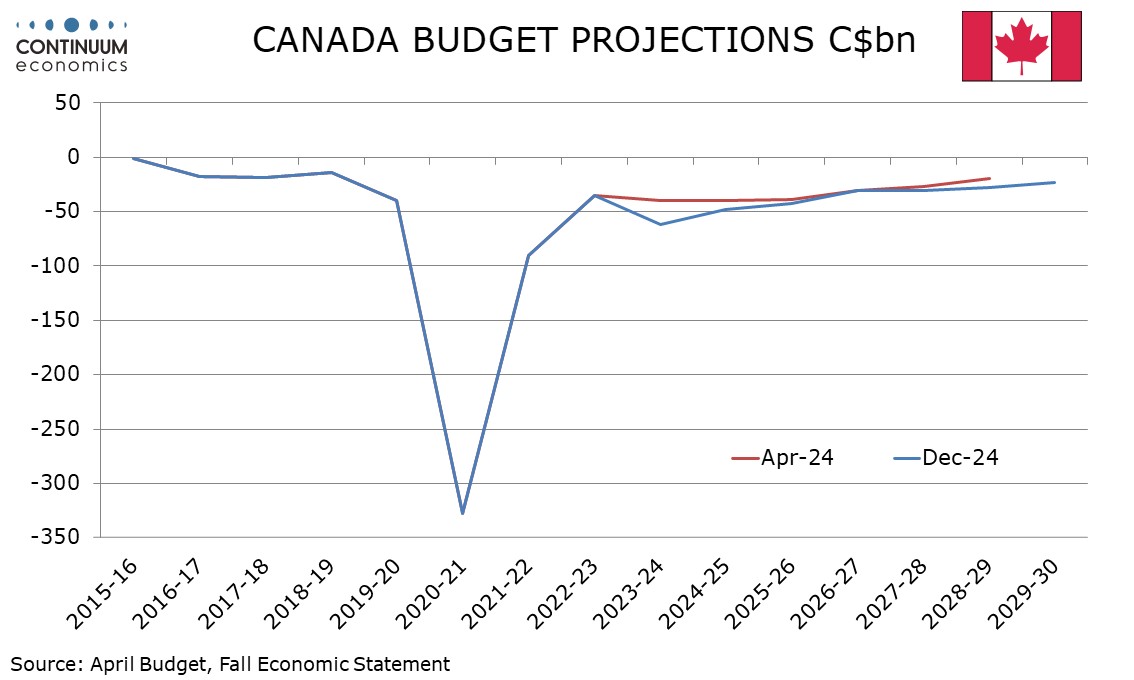

Even if the extra tariffs are limited in extent, they do add to downside economic risks in Canada, but could potentially add to upside Canadian inflationary risks if Canada decides to retaliate. It leaves the Bank of Canada facing increased uncertainty as Wednesday’s rates decision approaches. Until this latest spat the downside growth and upside inflationary risks from trade had appeared to have eased somewhat. Canada also faces risks from its upcoming budget on November 4, which is likely to see deficit projections revised higher despite some probable measures to reduce the deficit, a budget that must receive some support from other parties with the governing Liberals slightly short of a minority.

We had felt that recent stronger than expected data would allow the Bank of Canada to pause at this meeting. Uncertainty ahead of the budget and the tariff picture remaining fluid could be used as extra justifications for a pause. On balance, in the absence of Canadian retaliation which would add to Canadian inflationary risks, the downside growth risks coming from trade dispute marginally increase the chances of an ease. However we have not seen enough to change our call, with a pause still a bigger risk than seen by the market.