Canada November CPI - Underlying trend has slowed

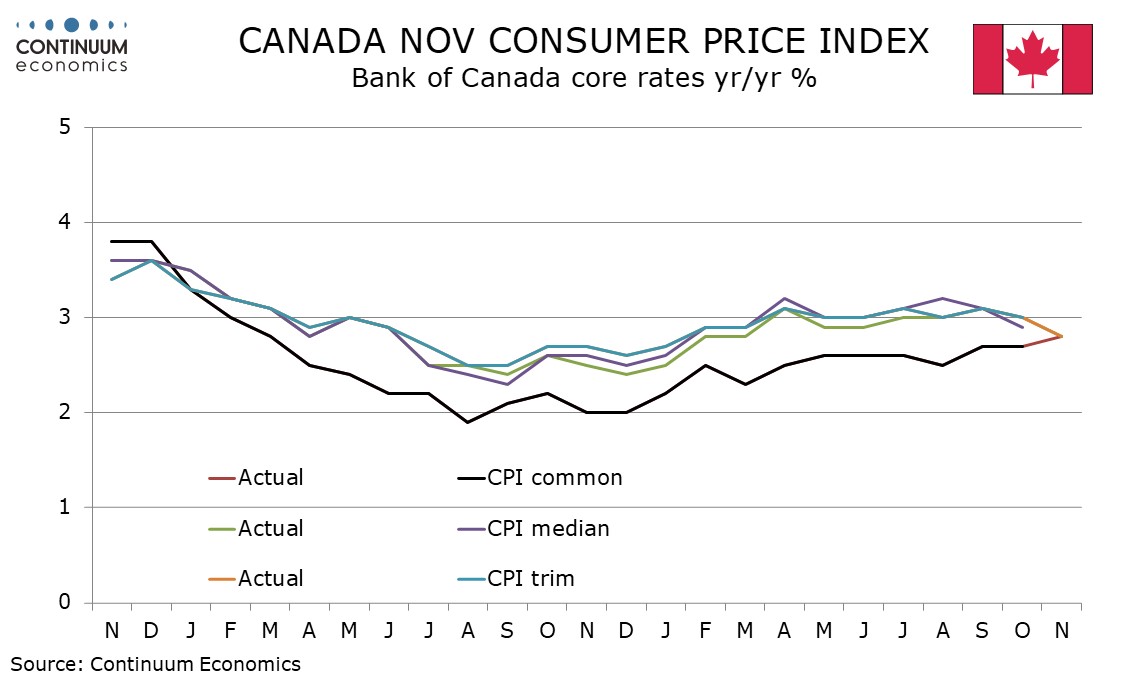

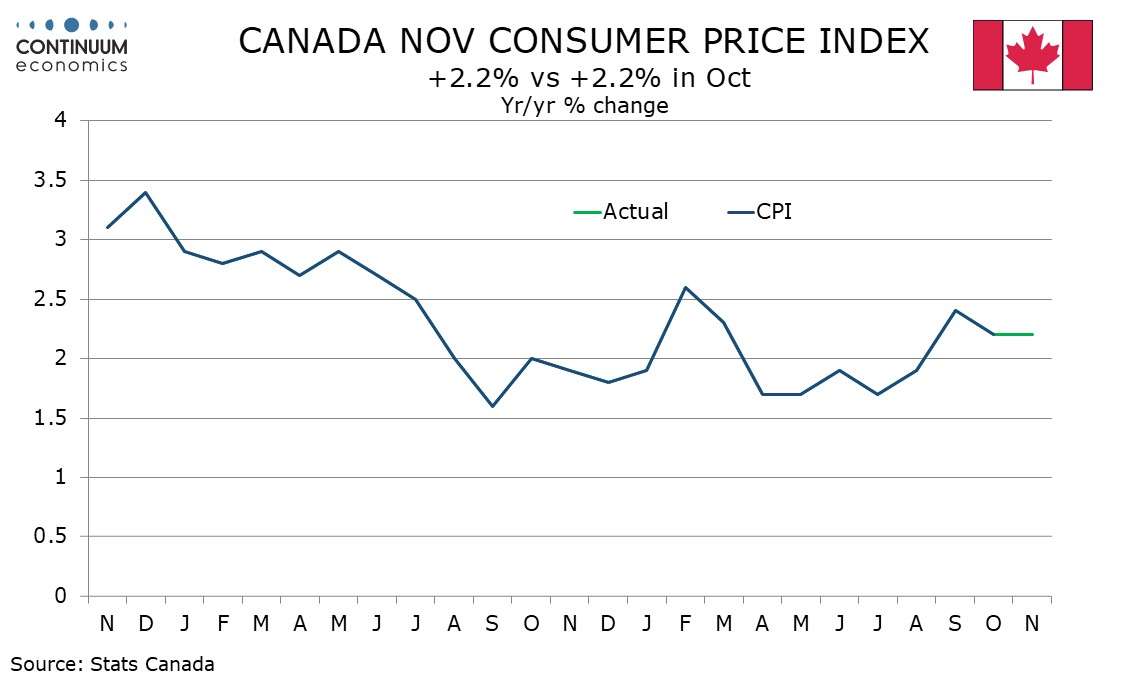

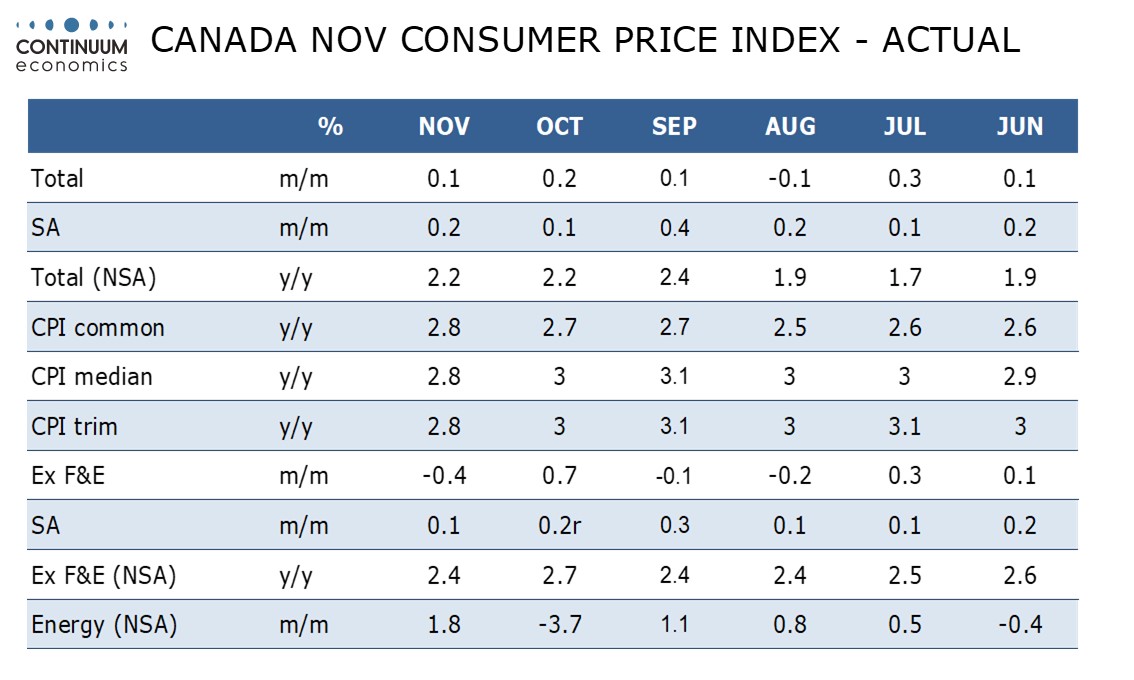

November Canadian CPI at 2.2% has held steady at October’s pace, and is slightly weaker than expected. The Bank of Canada’s core are are on balance weaker, with CPI-Median and CPI-Trim falling to 2.8% from 3.0%, though CPI-Common (less important to the BoC) edged up to 2.8% from 2.7%.

On the month CPI rose by 0.1% with CPI ex food and energy (not one of the BoC’s core rates) seasonally soft at -0.4%. Seasonally adjusted CPI rose by 0.2% overall after a 0.1% increase in October but ex food and energy a 0.1% rise followed a 0.2% increase in October. This suggests a subdued underlying picture.

Seasonally adjusted data shows a strong 0.9% rise in food but the core rate was restrained by shelter slowing to 0.1% after a strong 0.6% increase in October. The ex food and energy rate slowed to 2.4% yr/yr from 2.7% in October, returning to September’s level.

The BoC has warned that yr/yr CPI may be lifted in December through February as a year ago sales tax holiday depresses the year ago base. However underlying price pressures look softer now than they did then so we doubt there will be a strong uptick. Core rates are likely to slow further.