Bank of Canada - Consensus to hold, but cautious bias towards easing

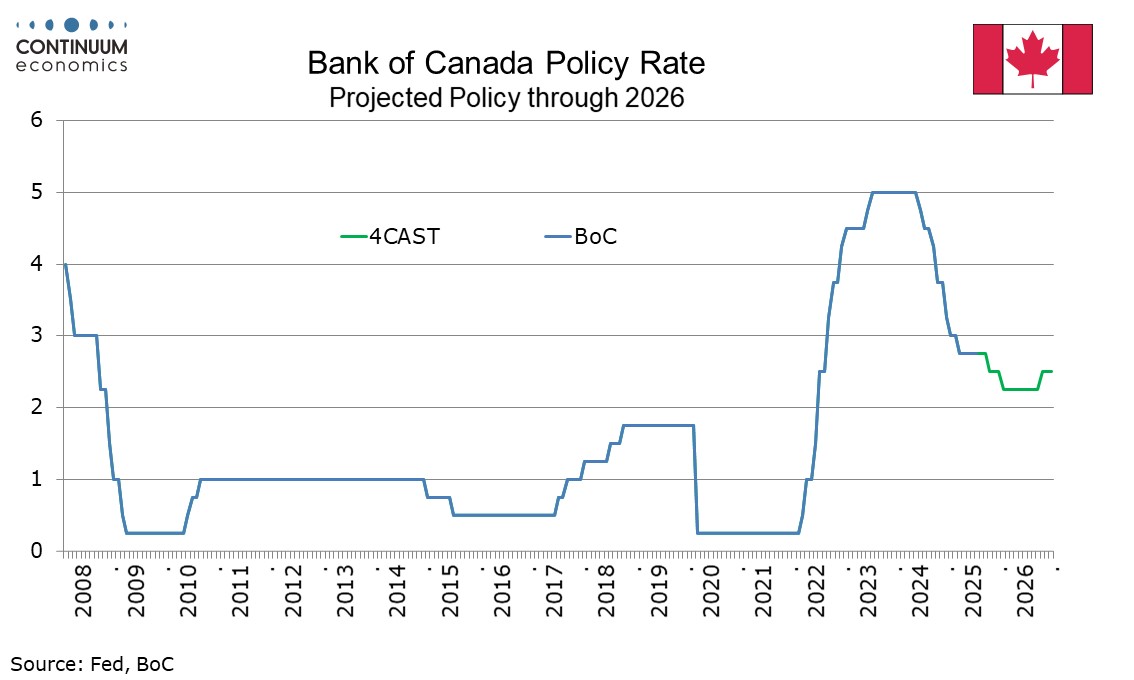

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now expect the low to be reached in January 2026 rather than October 2025.

We now expect easings in October of 2025 and January of 2026, each meetings on which a quarterly Monetary Policy Report will be released. In 2026 we expect a tightening in October. Currently rates are in the midpoint of the 2.25-3.25% range the Bank Of Canada sees as neutral. As the economy is hit by US tariffs and recent strength in underlying inflation fades, we expect the BoC will see scope to lower rates.

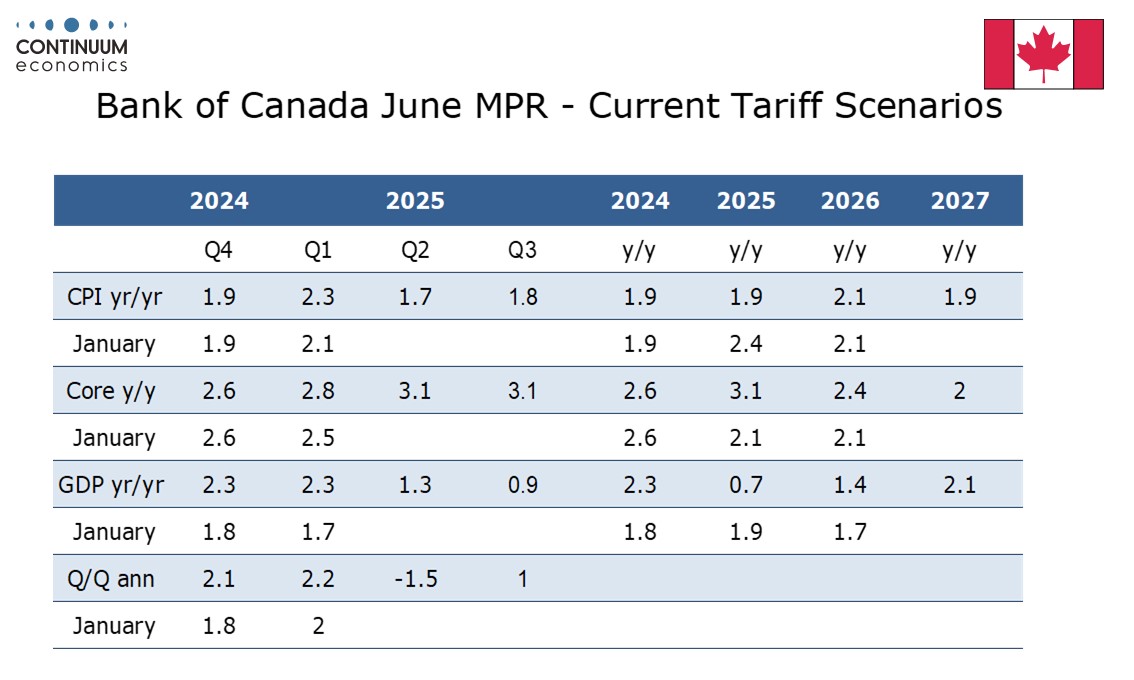

This meeting saw the BoC release a quarterly Monetary Policy report, which presented three scenarios, a central one based on current tariffs, and alternatives based on escalation and de-escalation. The central scenario presented with this report is compared to January’s MPR. April’s MPR presented two scenarios on tariffs, with an implication that the eventual picture would be somewhere in between.

The BoC is forecasting a 1.5% annualized decline in Q2 GDP after a resilient Q1 in which exports were brought forward to avoid tariffs. The forecast suggests May could be weaker than a second straight 0.1% decline projected with April’s report, or that further weakness is expected in June despite a strong gain in employment in that month. In the current tariff scenario GDP resumes growth in the second half of the year to around 1% and picks up further in 2026 and 2027.

Headline inflation has been pulled down by the elimination of the carbon tax but underlying inflation is seen as having increased to around 2.5%. The increase is seen gradually unwinding in the current tariff scenario with inflation remaining close to 2%. The alternative scenarios do not obviously change the policy outlook, with escalation reducing growth but lifting inflation, while de-escalation lifts growth but reduces inflation.

Macklem stated the decision to hold rates at this meeting was based on tariff uncertainty, some resilience in the Canadian economy so far and evidence of underlying inflationary pressures. A clear consensus to hold rates and agreement to proceed carefully does not suggest a rush to move. However Macklem did state that if a weakening economy puts further downward pressure on inflation and the upward price pressures from the trade disruptions are contained, there may be a need for a reduction in the policy rate. He made no mention of a possible tightening, thus showing the BoC’s bias is towards easing. We thus expect the BoC to resume easing, albeit cautiously, with moves in October 2025 and January 2026, when quarterly Monetary Policy reports will be released. We expect the September and December meetings to see no change in policy, though decisions will be dependent on data and the evolution of US policy.