Canada - BoC Q3 Business Outlook Survey - Unlikely to shift BoC's views

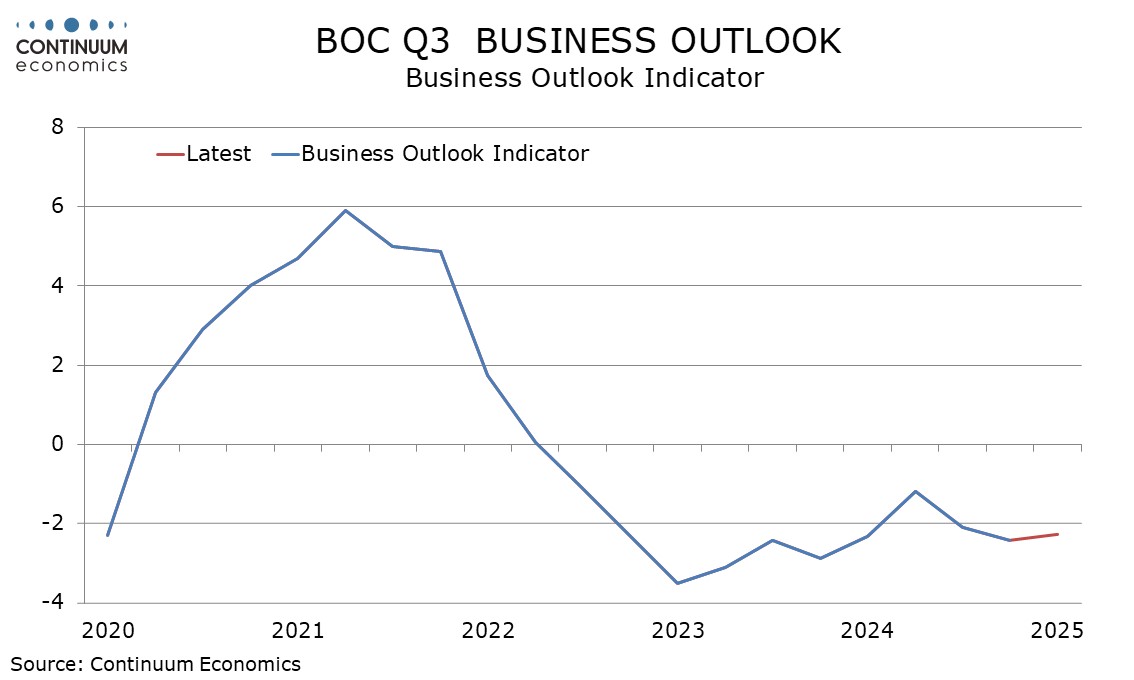

The Bank of Canada’s Q3 business outlook survey is mixed though overall probably does not change the Bank of Canada’s view very much. The overall business outlook indicator of -2.28 is marginally improved from Q2’s -2.40 but leaves the index is a fairly narrow and marginally negative range. The BoC will still want to see tomorrow’s CPI, but this survey does not clearly call for an October easing.

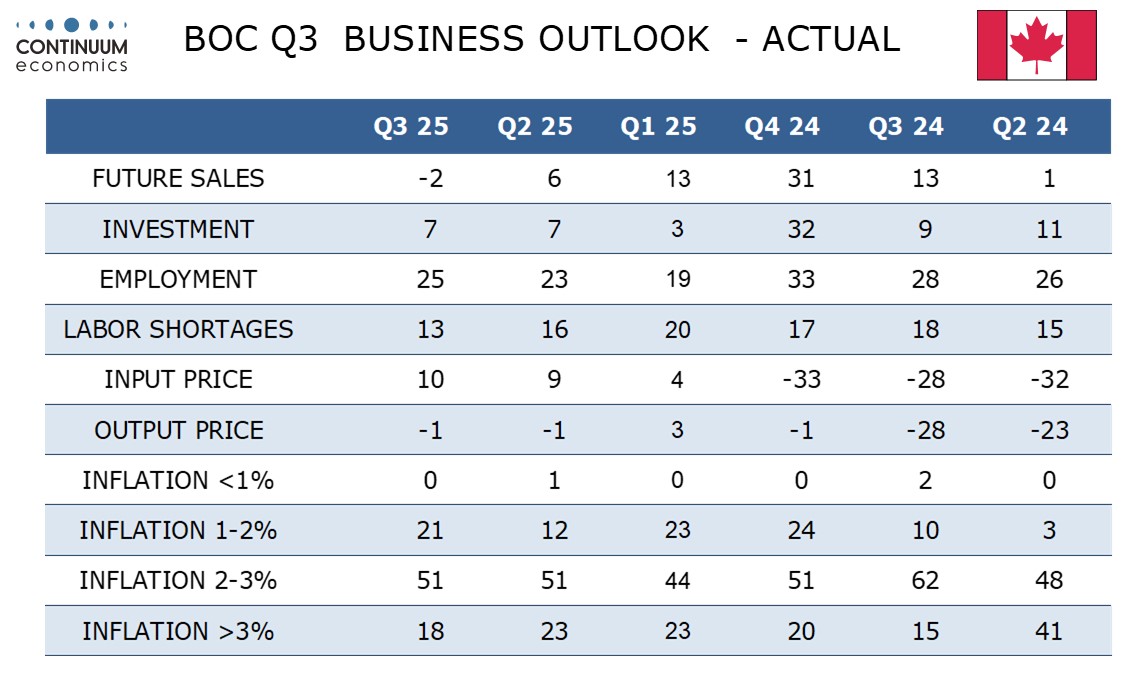

Future sales growth looks weak at -2 from a positive 6 in Q2, and the weakest since Q2 2023. However, indicators of future sales improved to 0 from -6, investment held steady at 7 and future employment actually increased to 25 from 23.

The proportion expecting inflation below the 2% target increased to 21% from 12%, though is slightly below the 23% seen in Q1. Fears of retaliatory tariffs lifting inflation seem to have faded but most still expect above target inflation. Indices for input and output price inflation were little changed at 10 and a subdued -1 respectively.

The separate survey of consumer expectations showed inflation expectations as nixed, the 1-year view down to 4.00% from 4.04% and the 5-year view down to 3.72% from 3.82%, but the 2-year view up to 3.67% from 3.45%. These are all above year ago levels.