Bank of Canada Minutes from October 29 reinforce steady policy message after a 25bps easing

The Bank of Canada has released minutes from its October 29 meeting, and after a 25bps easing members agreed that monetary policy was now close to the limits of what it could do to support the economy under current circumstances. They agreed to be as clear as possible to communicate that policy was now at about the right level to keep inflation at 2% while helping the economy through a period of structural adjustment.

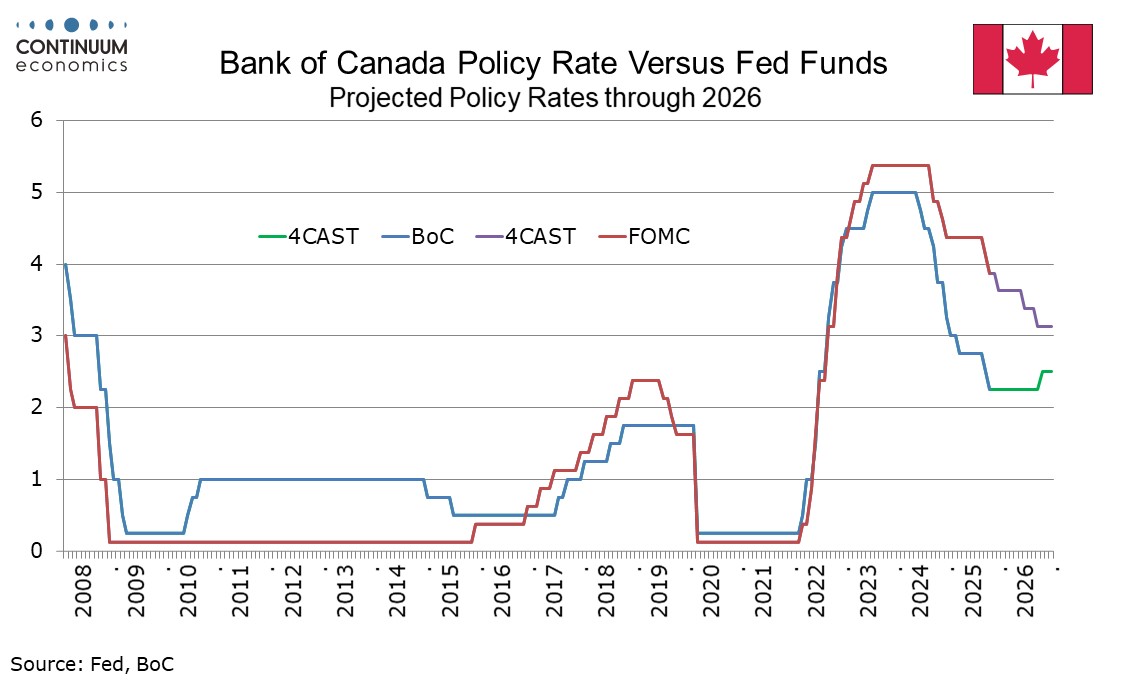

The 25bps easing delivered at the meeting moved the rate to 2.25%, at the low end of the BoC’s 2.25-3.25% neutral range. The minutes reinforce the message of the statement that the BoC would be reluctant to ease further as long as data evolved in line with its expectations, though they did recognize that uncertainty remained elevated and risks to the outlook were higher than usual.

The minutes show agreement that a 25bps easing would be warranted. Some felt waiting for a future meeting would provide more information but the arguments for cutting at the meeting were considered more salient. These included excess supply, labor market weakness, tepid expected growth and inflation seen near the 2% target.

The impact of US trade actions on the Canadian economy as seen was becoming more visible, with targeted sectors severely hit and lower demand impacting the rest of the economy as well. Consumer spending was seen as resilient but the labor market soft, with strong September employment growth following two weak months. Since the meting however October also delivered a strong month of employment growth. GDP was seen recovering from a Q2 contraction but remaining weak in the second half of 2025. September CPI was higher than expected but three and six month measures of the core rates indicated upward momentum seen earlier in the year had dissipated. CPI was seen remaining near the 2% target over the projection horizon.

The BoC concluded that while uncertainty over trade policy remained high that they could now be more forward looking. The economy was seen as on a permanently lower path with GDP seen around 1.5% lower at the end of 2026 than had been forecast in January 2025. Around half of the drop was seen as due to weaker demand and the other half due to structural adjustments. Monetary policy was seen as limited in the amount of support it could provide while maintaining low inflation, but could limit spillovers from hard-hit sectors and provide some stimulus provided inflation is well controlled.