Bank of Canada - Clear consensus to ease, we expect two further 25bps moves

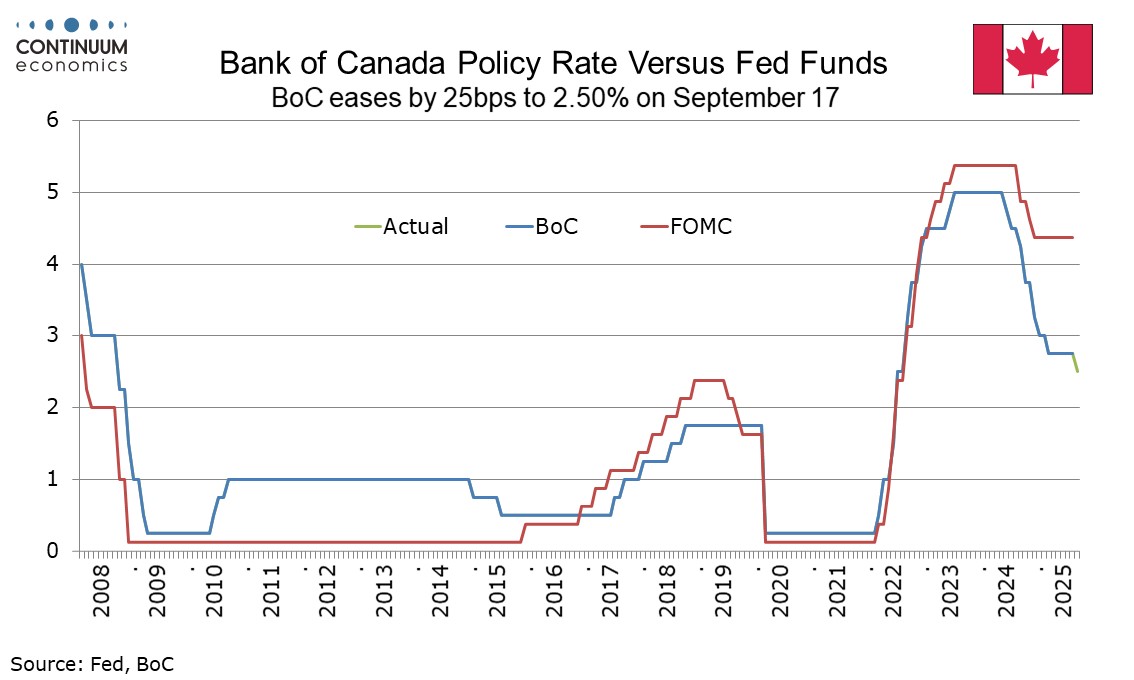

The Bank of Canada’s decision to ease today for the first time since March, by 25bps to 2.50% was as the market expected. We expect two further easings from the BoC, in Q4 of this year and Q1 of 2025, which would take the rate to 2.0%, which is likely to prove the floor.

The BoC had a clear consensus to keep rates on hold at its last meeting in July but this time had a clear consensus to ease. Three factors were noted. Firstly, the labor market softening further, with weak employment reports for July and August which more than fully erased strength in June that was fresh at the time of July’s meeting. Sectors sensitive to trade led the job losses. Secondly, while signals remain mixed recent inflationary data suggests underlying inflationary pressures on inflation have diminished. Headline inflation is below target at 1.9% but excluding tax changes the rate is seen as 2.5%. The BoC’s preferred core rates remain near 3.0%, but monthly momentum has faded, with ex food and energy CPI (not one of the BoC’s core rates but a decent guide to the underlying picture) having seen two straight 0.1% gains after seasonal adjustment. Thirdly the removal of most of Canada’s retaliatory tariffs against the US has reduced upside inflationary risk.

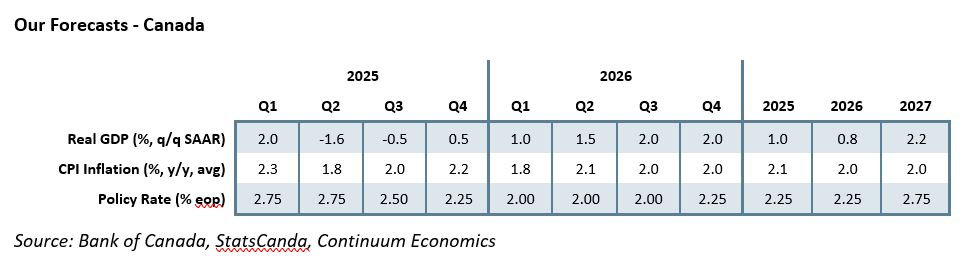

The BoC provides little forward guidance, and the BoC states it will continue to assess the risks, look over a shorter horizon than usual and be ready to respond to new information. Policy will be dependent on incoming data and potentially policy developments. Our view is that after a decline in Q2 that was fully explained by net exports Canadian GDP will show a more broadly based subdued picture in the second half of the year, while underlying inflation will continue to move towards the 2.0% target. We expect two further easings, in Q4 2025 and Q1 of 2026, with the next move more likely to come in December than October. In 2026 we expect growth to gradually pick up while inflation stabilizes near 2.0%. We expect that in Q4 2026, the BoC will start to move rates back towards neutral with a 25bps tightening to 2.25%. The BoC sees the neutral range as being 2.25-3.25%.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.