Preview: Due August 29 - Canada Q2/June GDP - Exports plunge to send GDP lower

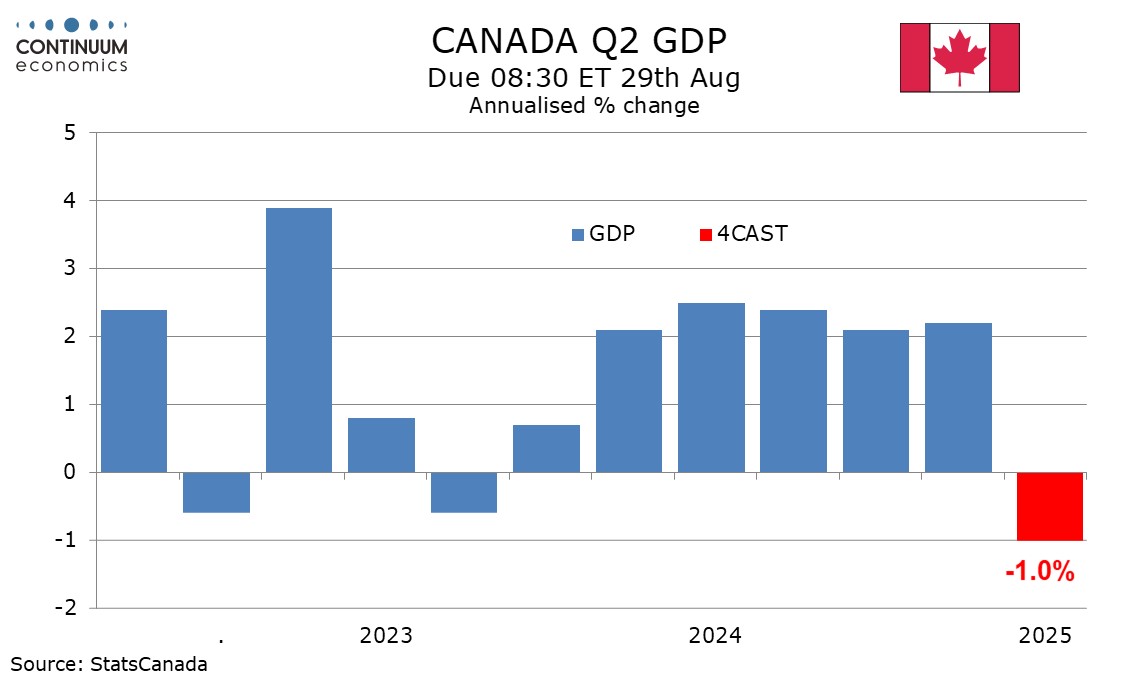

We expect Q2 Canadian GDP to fall by 1.0% annualized after five straight gains marginally above 2.0%. This would be slightly stronger than a Bank of Canada forecast of -1.5% but weaker than what monthly GDP data is likely to imply for the quarter, with June seen rising by 0.1%.

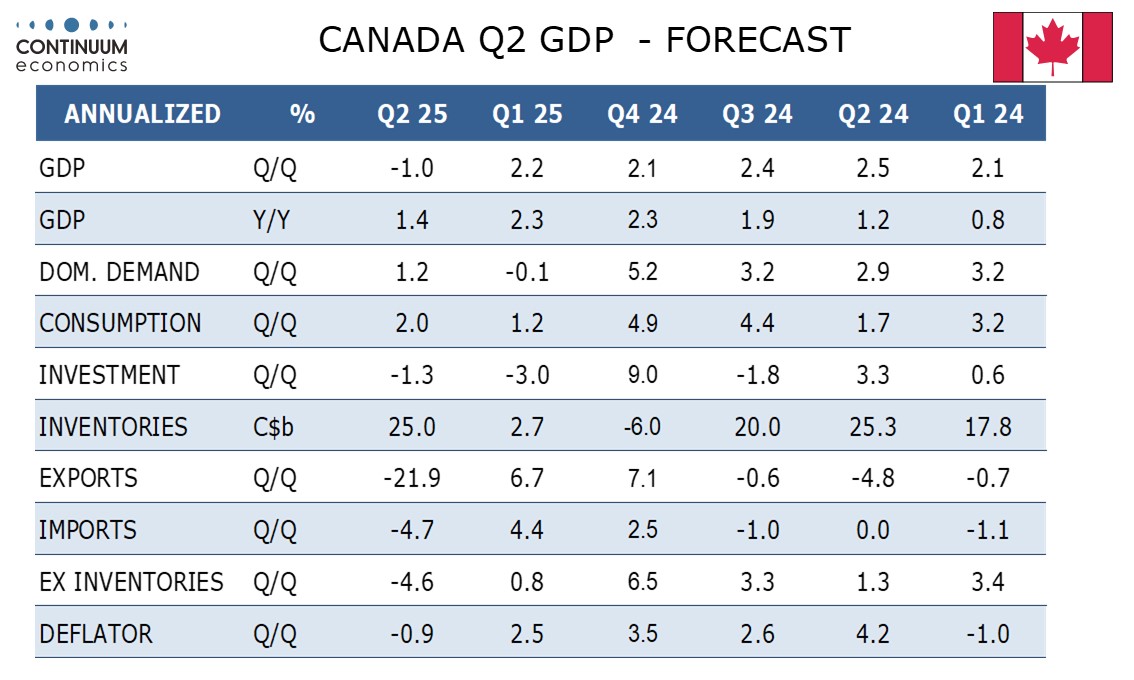

The data will be hit by a sharp plunge in exports, more than fully reversing two straight strong gains, after the implementation of US tariffs. We expect net exports to take 5.8% off GDP despite imports also correcting from recent strength. Some offset from the net exports weakness is however likely from inventories returning to a normal pace of growth after two weak quarters.

We expect a 1.2% increase in domestic demand after a decline of 0.1% in Q1, which followed a strong 5.2% increase in Q4. We expect consumer spending to improve to 2.0% from a 1.2% rise in Q1, a less negative outcome from fixed investment supported by housing, and a correction in government from a weak Q1. We expect a 0.2% decline (0.9% annualized) in the deflator, dragged below zero by a sharp fall in export prices.

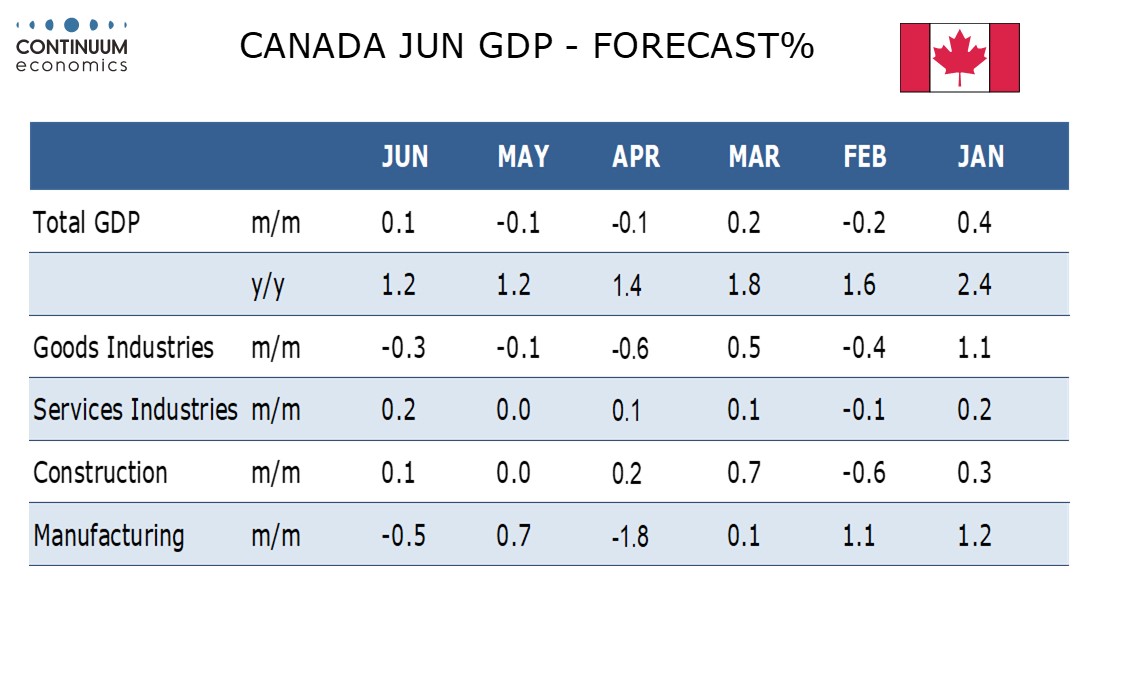

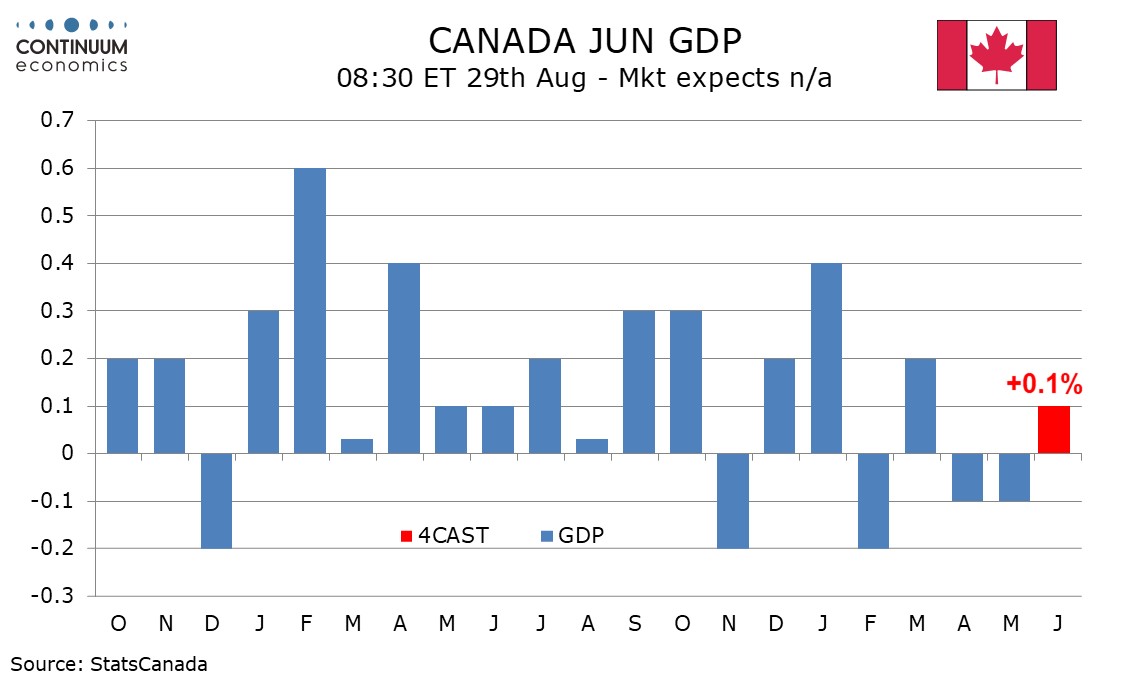

We expect a 0.1% increase in June GDP to follow declines of 0.1% in April and May, in line with the estimate made with May data, with gains seen in retail and wholesale but renewed slippage in manufacturing after a May increase.

This would leave the monthly data showing quarterly GDP almost unchanged, unless there are negative back month revisions. However, given the sharp decline in exports as seen in monthly trade data, a decline in the quarterly GDP data looks difficult to avoid.