Canada Q3 GDP rebounds as imports plunge but domestic demand marginally negative

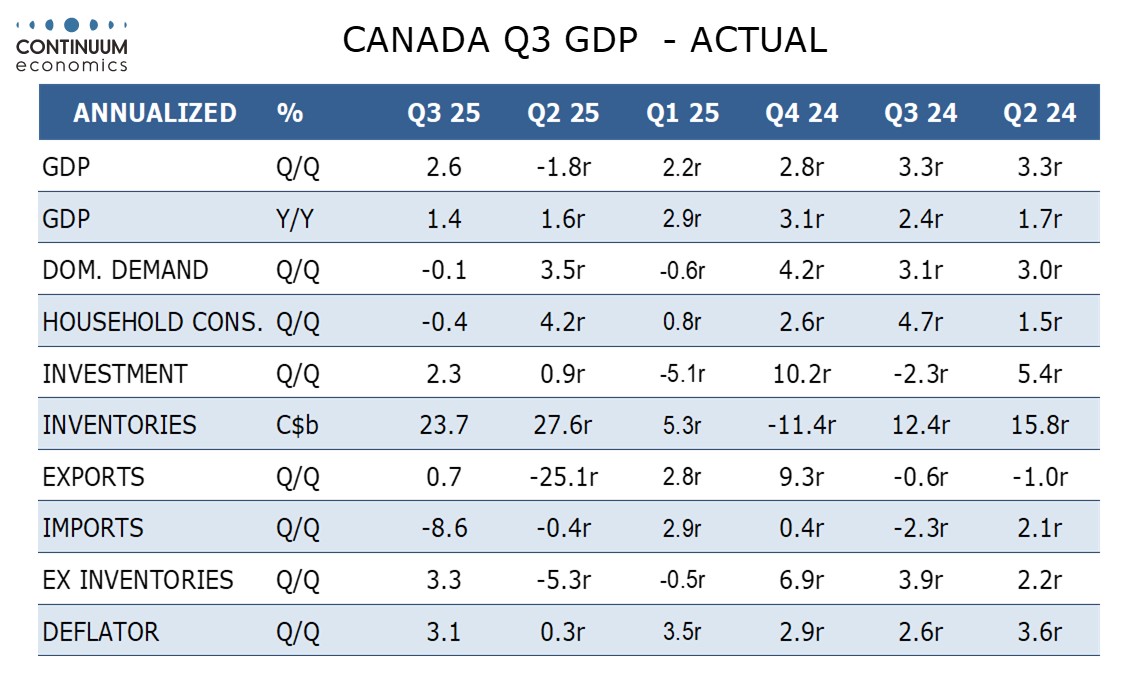

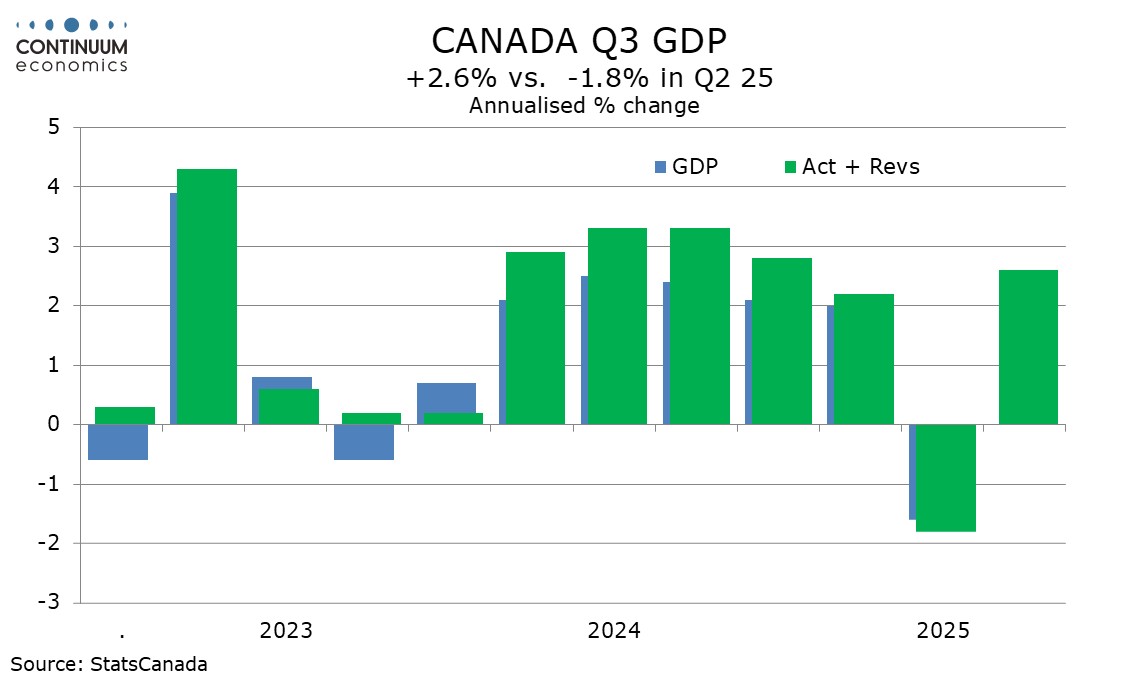

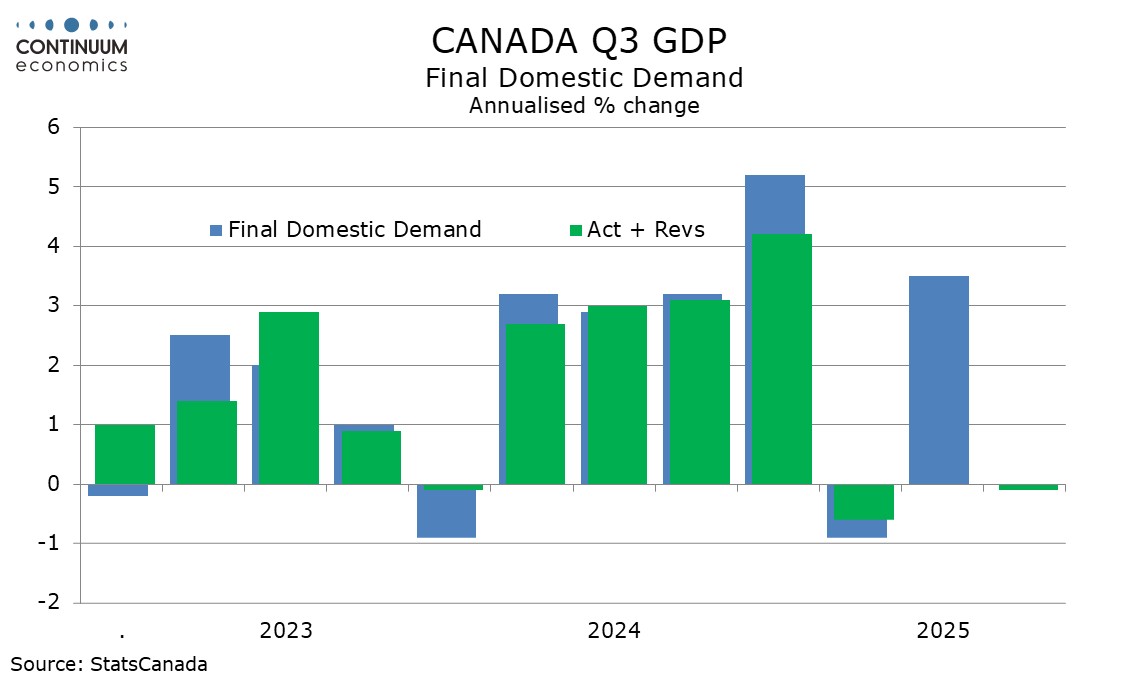

Canada’s 2.6% annualized increase in Q3 GDP is sharply higher than expected though the surprise comes largely from a sharp fall in imports. Domestic demand was almost unchanged with a 0.1% annualized decline. September GDP grew by 0.2% on the month, but the preliminary estimate for October is weak, with a 0.3% decline.

This data suggests it is very unlikely that the Bank of Canada will consider easing when it meets on December 10, having already signaled rates are likely to remain on hold unless data surprises. However, the details of the data are not strong enough for it to start considering a tightening. Historical revisions were however positive, with Q4 2024 now up 3.1% yr/yr rather than 2.3%.

Consumption fell by 0.7% annualized with household consumption down by 0.4%. Gross fixed capital formation rose by 2.3% annualized with strength in government. Business fixed capital was up a marginal 0.2% with strength in housing at 6.7% but weakness elsewhere. Housing is supported by BoC easing but investment elsewhere is being hit by the impact of tariffs.

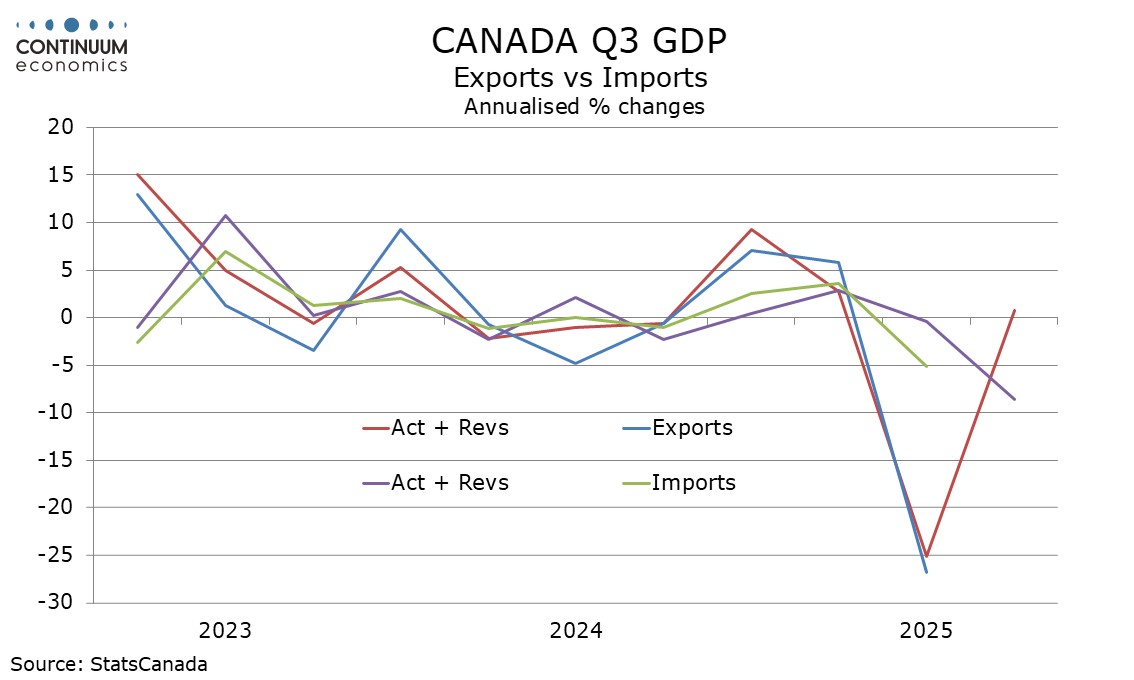

Exports rise by a modest 0.7% annualized after a 25.1% post-tariff plunge in Q2 with imports plunging by 8.6% providing most of the lift to Q3. Weakness in imports does not imply economic strength in Canada and there are some questions about the data with September trade data still absent due to the absence of inputs from the US due to the government shutdown there. Inventories were a modest negative after a strong positive in Q2.

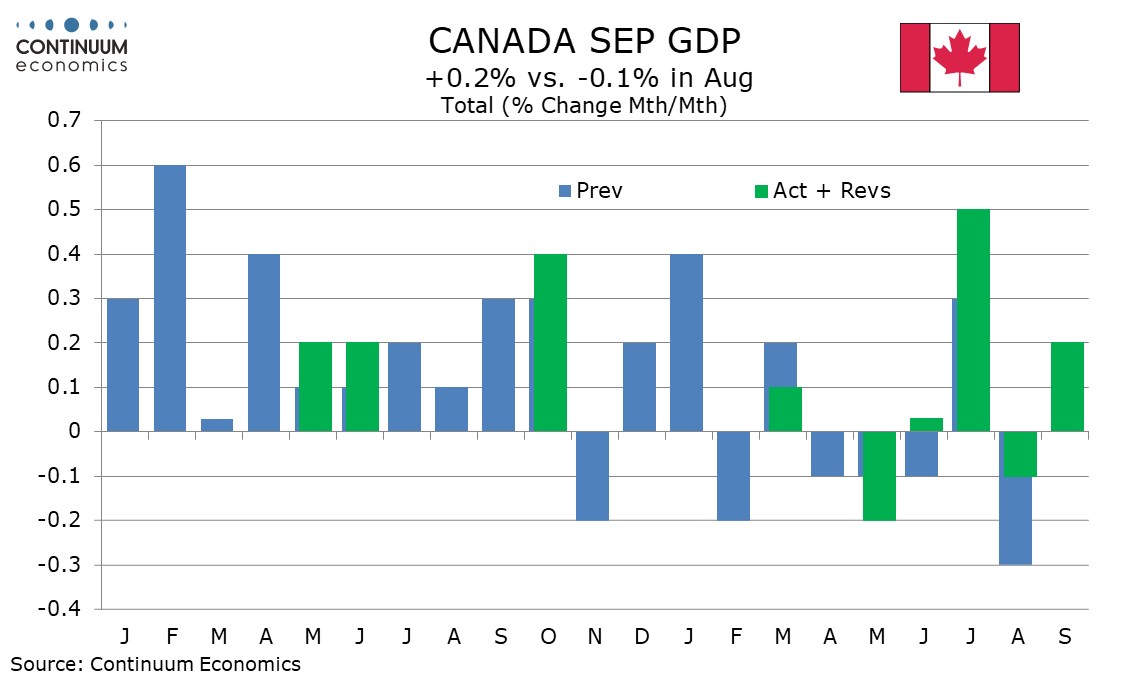

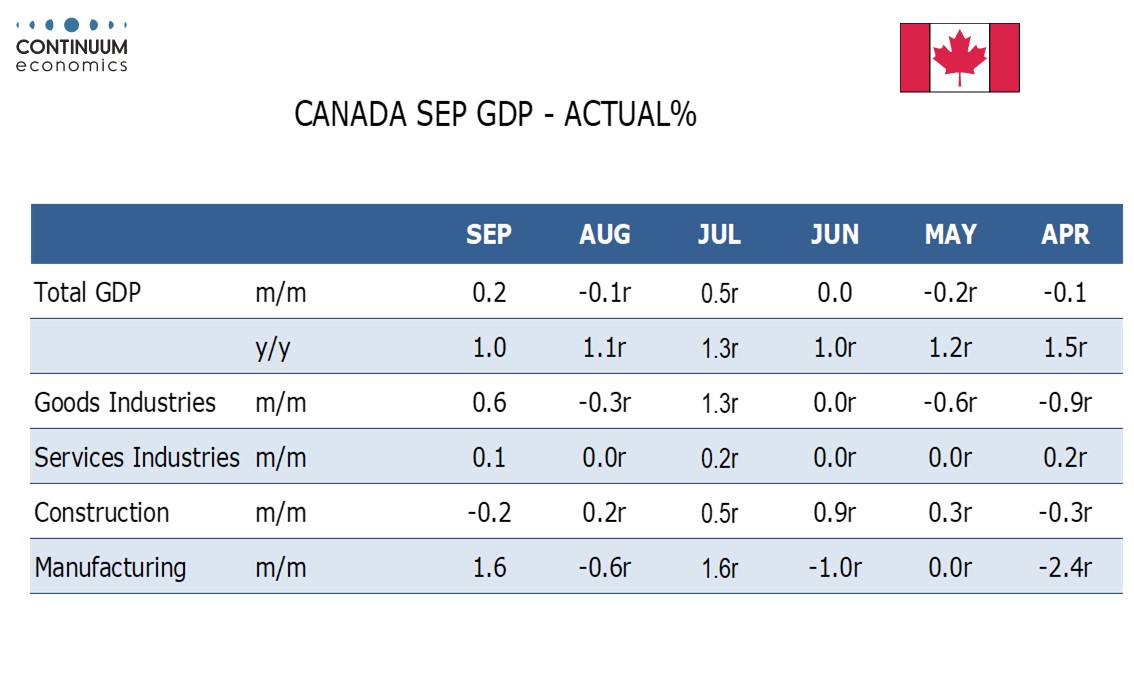

A 0.2% rise in September GDP is as the preliminary data given with August’s report signaled. August however was revised to -0.1% from -0.3% and July revised to a 0.5% increase from 0.3%, explaining why Q3 surprised so sharply while September came in as expected. September detail shows the rise led by goods at 0.6%, and that by manufacturing at 1.6%. Services saw a subdued rise of 0.1%.

The preliminary estimate for October is weak at -0.3%, getting Q4 off to a weak start, with negatives in oil and gas extraction, education and manufacturing, partially offset by gains in mining, quarrying and supports services. If October falls by 0.3% and November and December are unchanged Q4 GDP would fall by 0.8% annualized.

The Q3 GDP deflator at 0.8%, 3.1% annualized was on the firm side, though probably not enough to alarm the BoC. Yr/yr growth of 2.4% is little changed from 2.3% in Q2, and consistent with the message of the CPI that inflation is a little above the 2.0% target