DM Government Bond Saints v U.S.

· Overall, although the fiscal saints (Australia/Canada/Germany/Sweden) have merits over the U.S. in the scenario where Fed independence is undermined and more Fed rate cuts occur than warranted by the economics, the 10yr area of other government bond markets may not outperform. 10yr government bond spreads versus the U.S. are more driven by actual and expected policy rate spreads. Aggressive Fed easing could stop 10yr U.S. yields from moving higher! A better hedge against major Fed independence fears is DM currencies, especially where they are undervalued like the Japanese Yen (here).

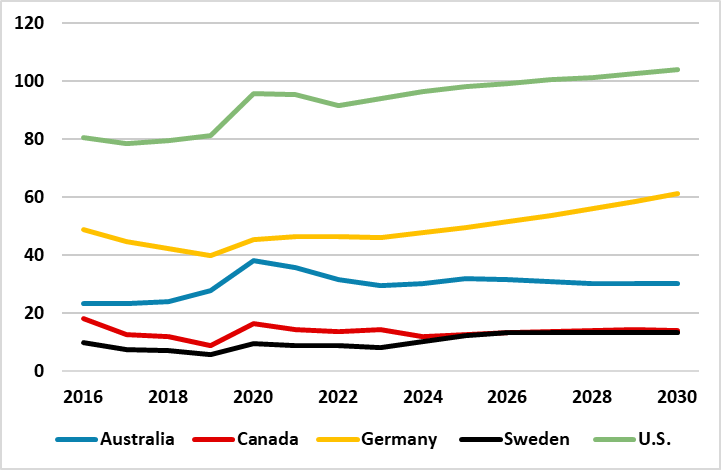

Some DM economies have low government debt levels and controlled budget deficit trajectory. Can they decouple from the U.S. into 2026, if Fed independence is materially undermined by the Trump administration (this is an alternative scenario and our baseline is for gradual Fed easing)?

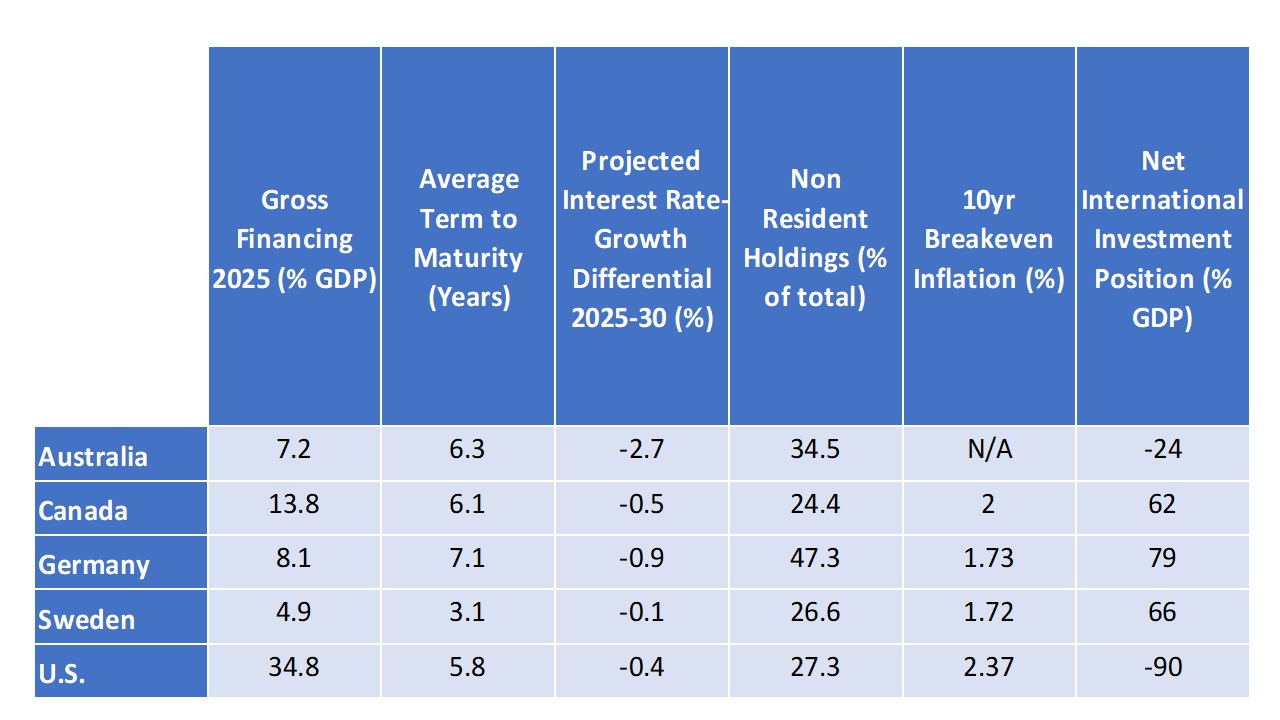

Figure 1: Key Fiscal and Structural Metrics (%)

The baseline scenario for U.S. Treasuries we outlined in the DM rates outlook (here) involves gradual Fed easing, as the Trump administration does not materially change the Fed Funds rate versus what would normally happen depending on the growth/inflation picture that the U.S. faces. However, if the Trump administration succeeds in materially changing Fed voting on actual policy rates and undermines Fed credibility, will other DM bond markets be able to be safe havens from fears of adverse spillover from the U.S.? As we outlined in the DM Rates Outlook (here), Japan is not really a substitute given BOJ normalization desires and the prospects of higher nominal and real JGB yields. Gilts need the BOE to dramatically slow QT, which is materially increasing net supply and leaving the UK vulnerable to adverse spillover from the U.S.. France and Italy struggle with long-term fiscal sustainability and ECB QT at 3% of GDP. Are DM countries with low government debt trajectories (Figure 1 and 2), a safe alternative to Treasuries as Fed independence is challenged in 2026?

Figure 2: Net General Government Debt/GDP (%)  Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

Although 10yr Canada, Germany and Sweden are at yield discounts to the U.S., this is not only driven by the net government debt/GDP ratio but also depends on other structural fundamentals. The 10yr breakeven inflation rates in Canada, Germany and Sweden (Figure 1) are below those in the U.S. Meanwhile, these three countries are large net creditors/GDP, while the U.S. has a large net international investment position deficit.

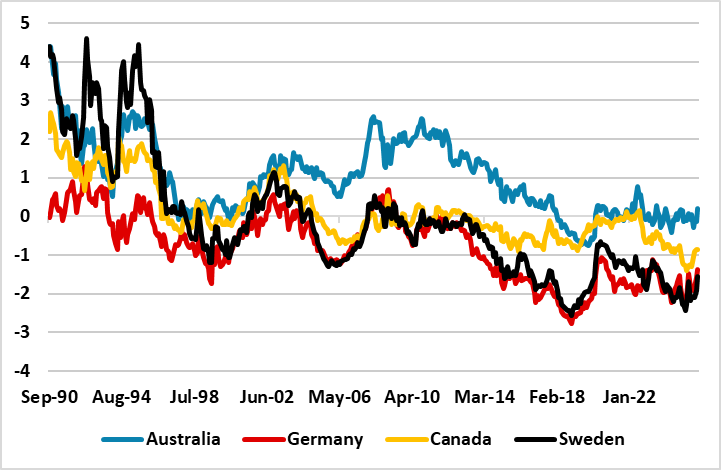

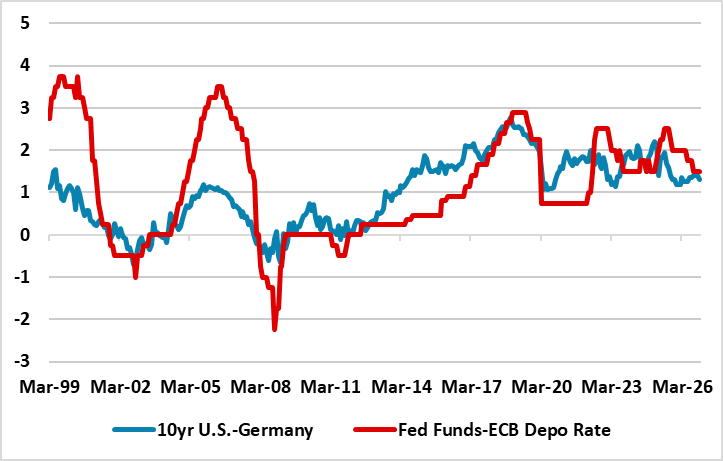

A further key driver of the 10yr spread is the actual policy spread versus the U.S.. For example Figure 4 shows 10yr U.S.-Germany and Fed Funds v ECB Depo rate. More Fed tightening than the ECB in 2006 and 2018-19 drove the spread wider. Long-term success in keeping underlying and breakeven inflation below the U.S. helps drive the 10yr bond spread for Canada, Germany and Sweden (Figure 3). However, expectations for the policy spread are important as well as the actual policy spread. The narrowing of the 10yr U.S. Treasury spread versus Bunds this year reflects expectations that the Fed will cut around 125bps by end 2026 versus nothing further from the ECB – Figure 4 includes our projections where we see a further 50bps from the ECB and also our 10yr yield spread forecast between Treasuries and Bunds.

Figure 3: 10yr spread versus U.S. Treasuries (%) Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

Figure 4: 10yr U.S.-Germany and Fed Funds-ECB Depo Policy Spread (Including CE Projections) (%)

Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

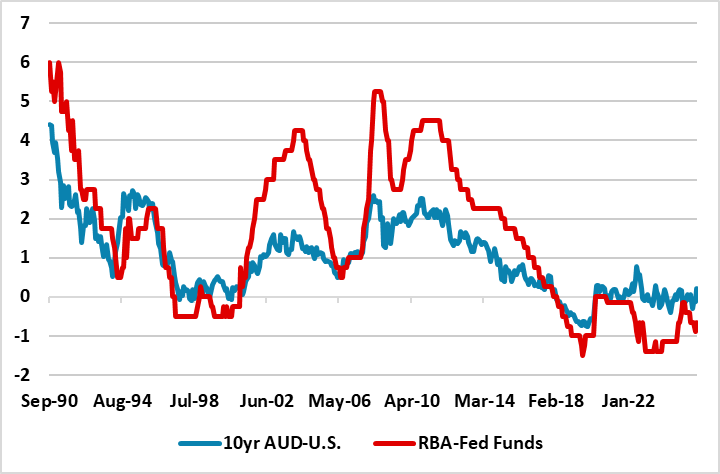

10yr Australia-U.S. in Figure 3 is different, with a small discount or premium to the U.S. over the last 5 years, despite a much better fiscal position. Though Australia is also a net debtor like the U.S., we see the main driver for the 10yr spread being relative policy rate spreads. Figure 5 shows that the RBA policy rate has been at only a small discount to the U.S. in the last 5 years, while the market expectation is that RBA policy rate and Fed Funds will likely both land around 3% by end 2026. The RBA 2-3% inflation target means that the neutral policy rate estimates (2.7%) are not that different from the Fed (3%).

Figure 5: 10yr Australia-U.S. and RBA-Fed Funds Policy Spread (%) Source: Datastream /Continuum Economics

Source: Datastream /Continuum Economics

Overall, though the fiscal saints have merits over the U.S. in the scenario where Fed independence is undermined and more rate cuts occur than warranted by the economics, the 10yr area of other government bond markets may not outperform. 10yr government bond spreads versus the U.S. are more driven by actual and expected policy rate spreads. Aggressive Fed easing could stop 10yr U.S. yields from moving higher. A better hedge against major Fed independence fears is DM currencies, especially where they are undervalued like the Japanese Yen (here).