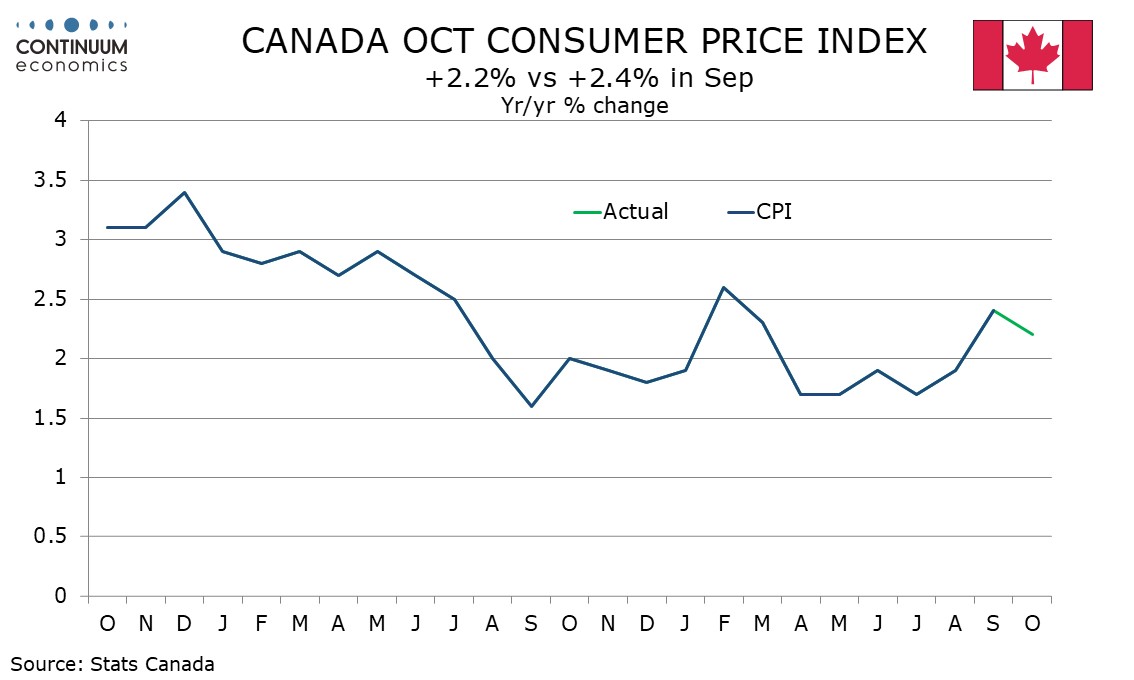

Canada October CPI - BoC core rates mostly slower, but still running above target

October Canadian CPI has slowed to 2.2% yr/yr from 2.4% in September, though excluding gasoline the yr/yr increase was 2.6% in each month. The BoC’s core rates were however mostly slower, CPI-Median at 2.9% from 3.1%, CPI-Trim at 3.0% from 3.1%, though CPI-Common was unchanged at 2.7%. Year ago strength assisted the slowing in yr/yr data.

On the month before seasonal adjustment CPI rose by 0.2% overall but by a sharp 0.7% ex food and energy. Seasonally adjusted the gains were a subdued 0.1% overall but a still quite firm 0.3% ex food and energy, the latter led by a 0.6% seasonally adjusted increase in shelter. Cell phone charges also saw a significant acceleration.

Shelter rose by 0.6% both before and after seasonal adjustment. The biggest contrast between unadjusted and seasonally adjusted data came from clothing and footwear, which rose by 1.3% unadjusted but fell by 0.4% seasonally adjusted. A 0.3% yr/yr decline in clothing and footwear suggests a subdued underlying picture in the sector. Shelter is up by 2.5% yr/yr.

The ex food and energy rate is not one of the BoC’s core rates but accelerated on a yr/yr basis to reach 2.7% from 2.4%, reaching its highest pace since February. Overall CPI is restrained by around 0.7% due to April’s elimination of the Carbon Tax. Underlying inflation is still running ahead of the BoC’s 2.0% target and suggests that the BoC is unlikely to ease further in the near term, if at all.