Bank of Canada Preview for September 17: Weak data justifies resumption of easing

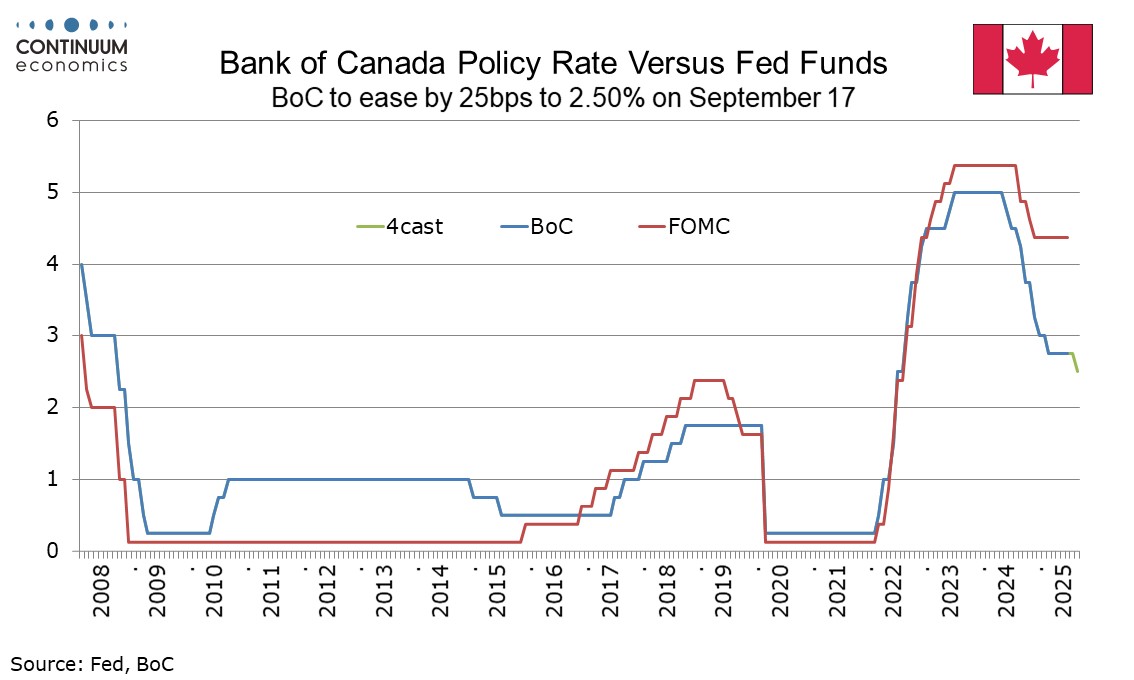

After the Bank of Canada’s last meeting on July 30 we expected rates to be left on hold in September before easing resumed in October. However with data since that meeting having been mostly weak, a 25bps easing, the first move since March, now looks likely at the September 17 meeting, to 2.5%. We expect two more easings from the BoC, in Q4 2025 and Q1 2026, which would take the rate down to 2.0%.

After the July meeting BoC Governor Tiff Macklem stated that there was a clear consensus to leave rates steady. However minutes from the meeting showed a difference in opinion on the future outlook. Some felt the BoC may already have done enough and that further easing may only take effect as demand was recovering, boosting price pressures, while others felt that further support would be needed given persistent economic slack. The decision to hold at the meeting reflected three factors, uncertainty on US trade policy, resilience in the Canadian economy so far and that underlying price pressures remained.

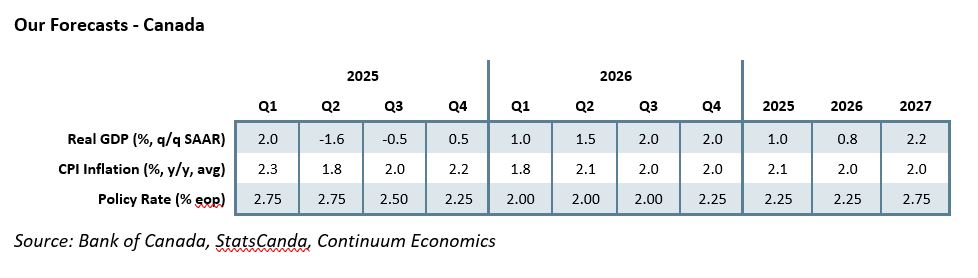

Since that meeting a strong June rise in employment has been more than fully reversed with August’s report being particularly weak, taking unemployment to 7.1%, its highest since August 2021. This was the clinching factor in changing our call. Q2 GDP was weak at -1.6% annualized though that was close to a -1.5% BoC forecast, and outside a plunge in exports the details showed resilience in domestic demand. August CPI is due the day before the BoC meets. July’s CPI was however acceptably subdued, even with the core rates remaining above target, with ex food and energy CPI up only 0.1% on the month after seasonal adjustment. US trade policy remains uncertain, but Fed easing looks increasingly likely, and that Canada has removed some of the retaliatory tariffs on US goods reduces inflationary risks in Canada.

We expect the Canadian economy to see a second straight decline, albeit modestly at -0.5% in Q3, and while we expect growth to resume in Q4 we do not expect growth sufficient to narrow the output gap to emerge until the second half of 2026. Headline inflation is currently below the 2.0% target due to the abolition of a carbon tax but the BoC’s core rates remain closer to 3.0%. However, we expect that by the second half of 2026, headline and core inflation will have converged onto the target. A near term outlook of an increasing output gap and core inflation falling towards target justifies further easing. A low in rates of 2.0% which we expect to be reached in Q1 2026 would be below the BoC’s current 2.25-3.25% estimate of the neutral range. We expect the BoC to lift rates to 2.25% in Q4 2026 as the output gap starts to narrow, and return rates to 2.75%, the midpoint of the neutral range, in 2027.