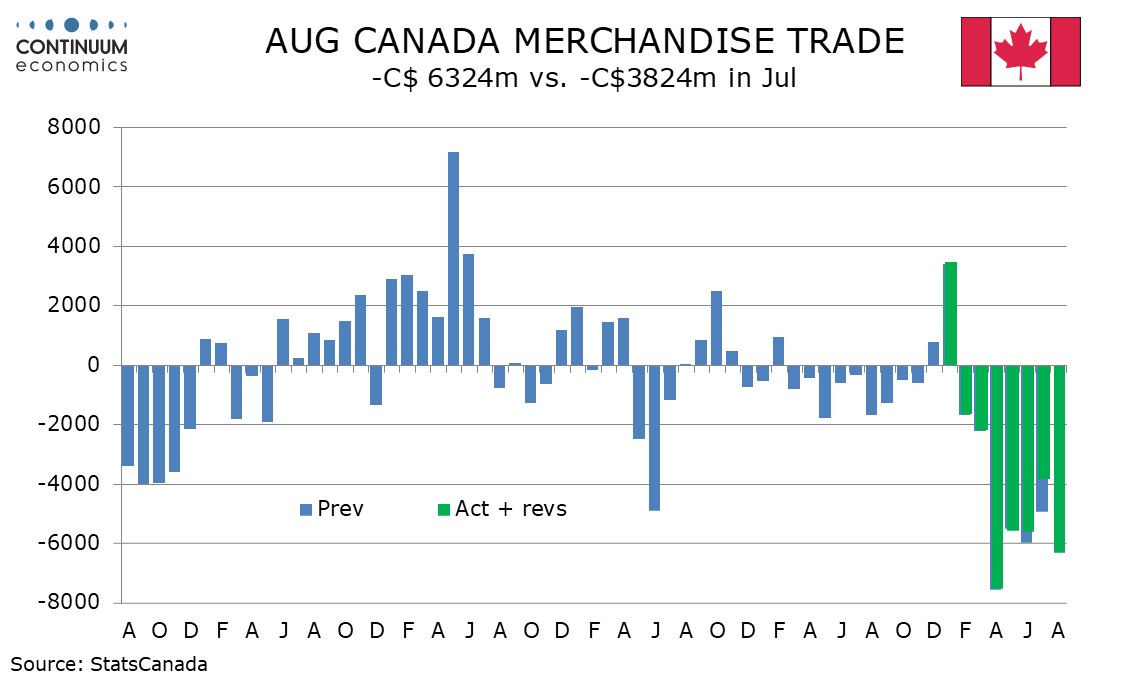

Canada August trade deficit inflated by moves in gold, but damage from U.S. tariffs is clear

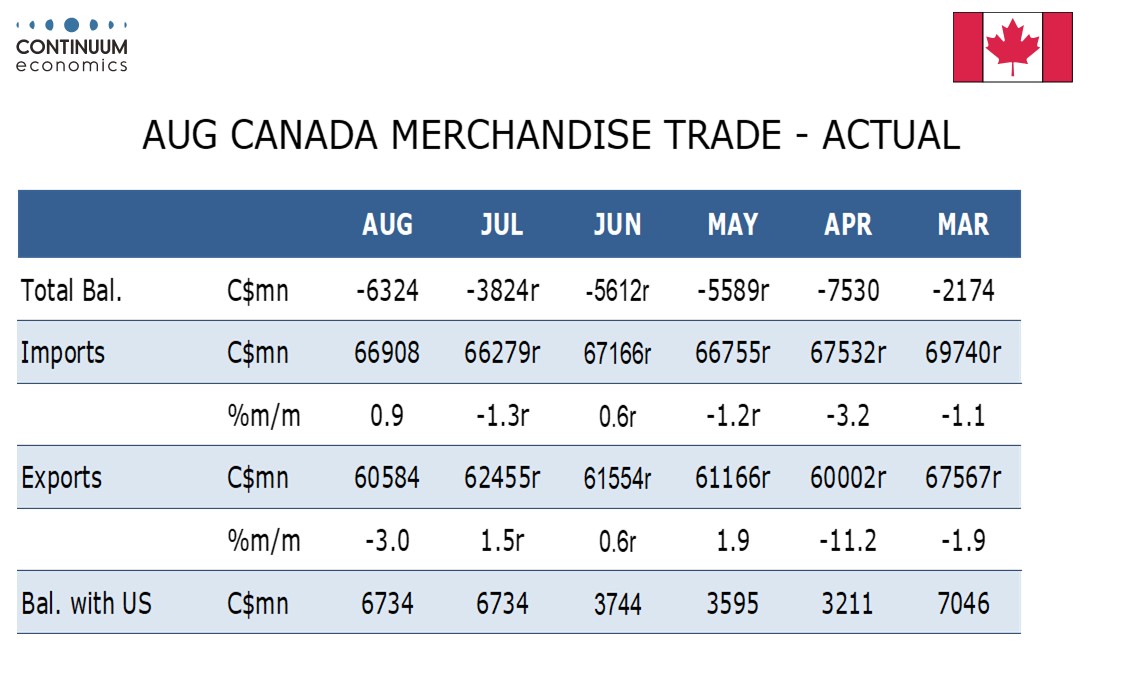

Canada’s August trade deficit of C$6.32bn is up from C$3.82bn (revised from C$4.94bn) in July and the widest since April, suggesting the Canadian economy remains pressured by the impact of US tariffs. However the August deficit is inflated by strong movements in both exports and imports of gold.

Exports fell by 3.0% after three straight monthly increases, all of which were modest in comparison with a plunge in April as US tariffs were implemented. However August’s export decline was inflated by a fall of 11.4% in unwrought gold, which led a 7.6% fall in metal and non-metallic mineral products. However this sector explained only 35% of the overall exports decline, in which most major components fell, with the notable exception of a 3.0% increase in consumer goods.

Imports increased by 0.9%, but fell by 1.0% excluding a surge in unwrought gold. Prices also supported import values, with overall imports down by 0.3% in real terms. Prices were less of an issue for exports, with exports down by 2.8% in real terms.

On a yr/yr basic nominal exports are down by 5.5% while nominal imports are up by 1.7%, showing the damage done by US tariffs. To the USA, yr/yr exports are down by 8.8% while imports from the USA are down by 6.6%. Canadians have switched to other countries for their import needs but Canadian exporters have struggled to find new markets to replace those lost in the USA.