Bank of Canada Minutes from July 30 - Differences of opinion on whether further easing would be needed

The Bank of Canada has released minutes from its July 30 meeting, which saw rates left unchanged at 2.75% with Governor Macklem stating after the meeting that there was a clear consensus to do so. However the minutes show that some felt the rate had been reduced sufficiently, while others felt that more policy support would be needed.

Those who felt enough had been done noted that the rate was now in the middle of the estimated neutral range and that the economy was showing resilience to US tariffs. They felt the BoC may already have done enough and that given policy lags, further easing may only take effect as demand was recovering, boosting price pressures. Others felt that further support would be needed given persistent economic slack. If upside risks to inflation failed to materialize there could be scope to ease further and support the economy’s adjustment to the reconfiguration of global trade.

At the meeting steady policy and a 25bps easing were both discussed, and the deliberation focused on three main factors. These were uncertainty on US trade policy, resilience in the Canadian economy so far and that underlying inflationary pressures remained. Policy was left unchanged but members agreed it was important to reiterate that if a weakening economy put further downward pressure on inflation and that upward prerace pressures from trade disruptions were contained, there may be a need for a further reduction in the policy rate. Members agreed to proceed carefully.

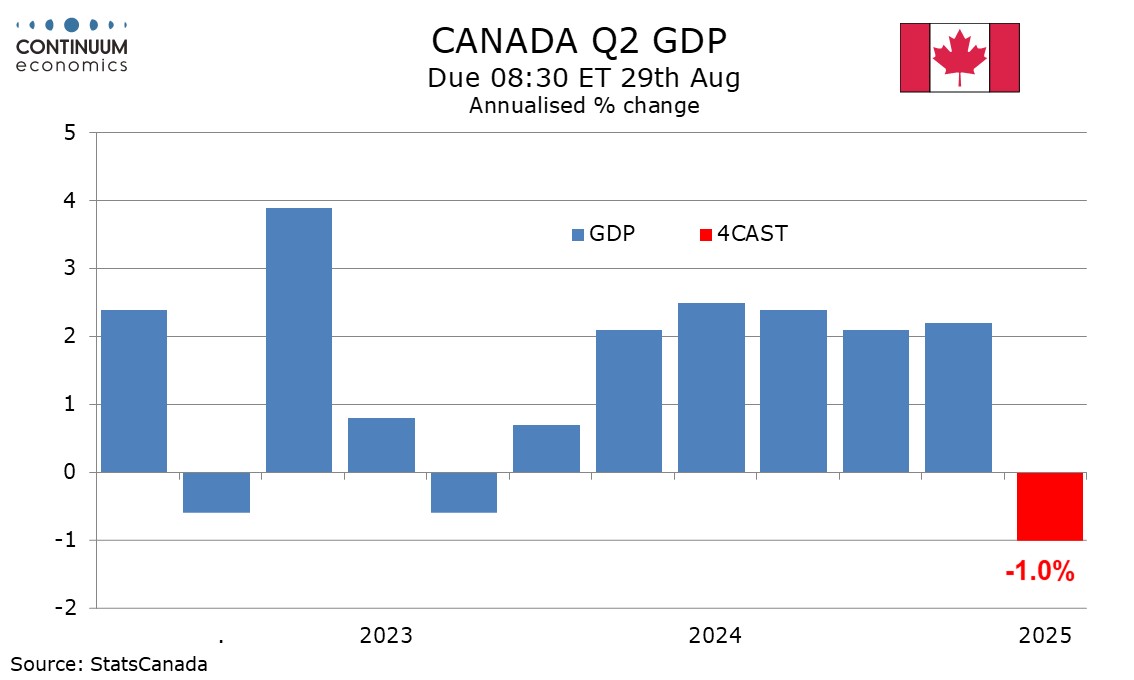

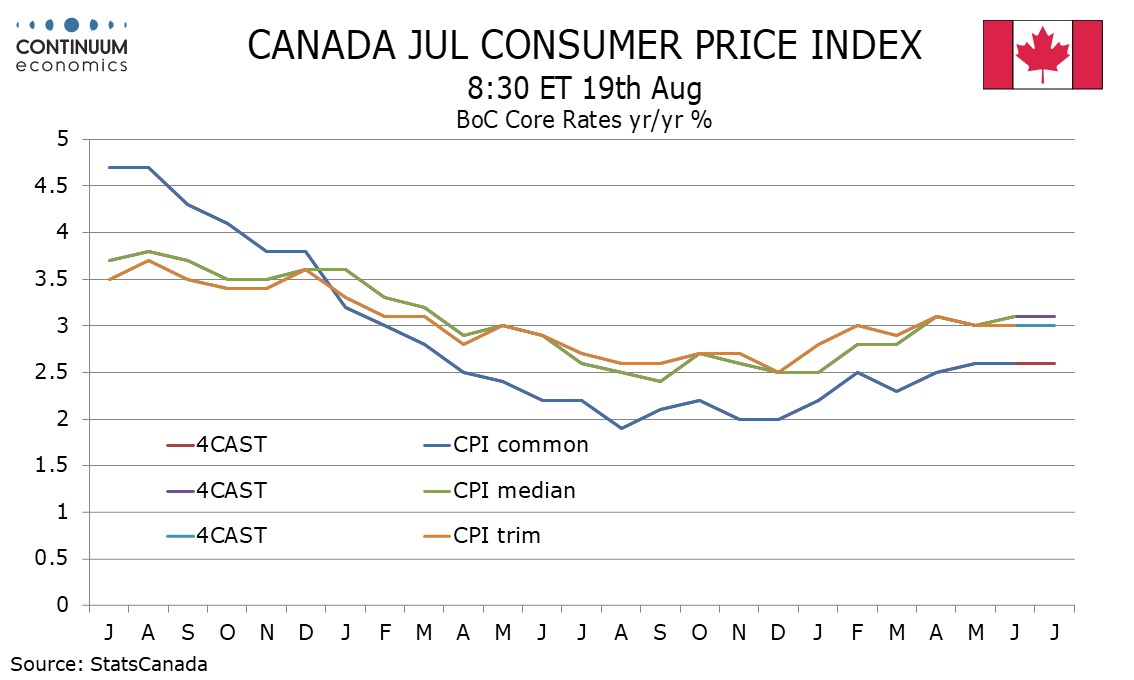

Members also saw the global economy as more resilient to trade turmoil than expected. Q2 Canadian GDP was seen negative with Q1 having seen pull-forward of exports, with Q2 consumption and government seen stronger but business and housing investment weaker. It was agreed that the labor market remained soft despite stronger June data. July data subsequently reversed much of June’s gain. Underlying inflation was assessed to be around 2.5%, up from around 2%, which is near target, in the second half of 2024. Still, the impact of tariffs on inflation as seen as modest so far. Members agreed that the degree of firmness in underlying inflation as important for policy.

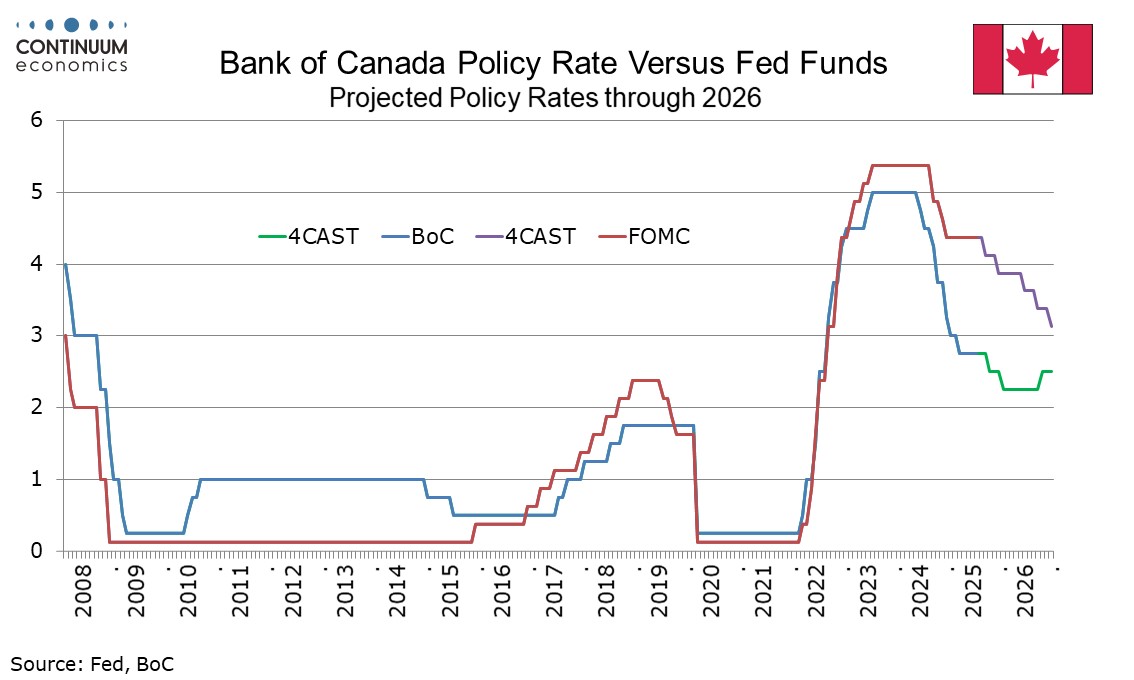

These minutes do not suggest any urgency for further easing, but easing could be seen if Canadian data deteriorates or underlying inflation moves back towards the 2% target. We continue to expect the BoC to hold again in September, before easing twice more, in October this year and January of 2026.