Canada August CPI - Subdued enough for a BoC easing

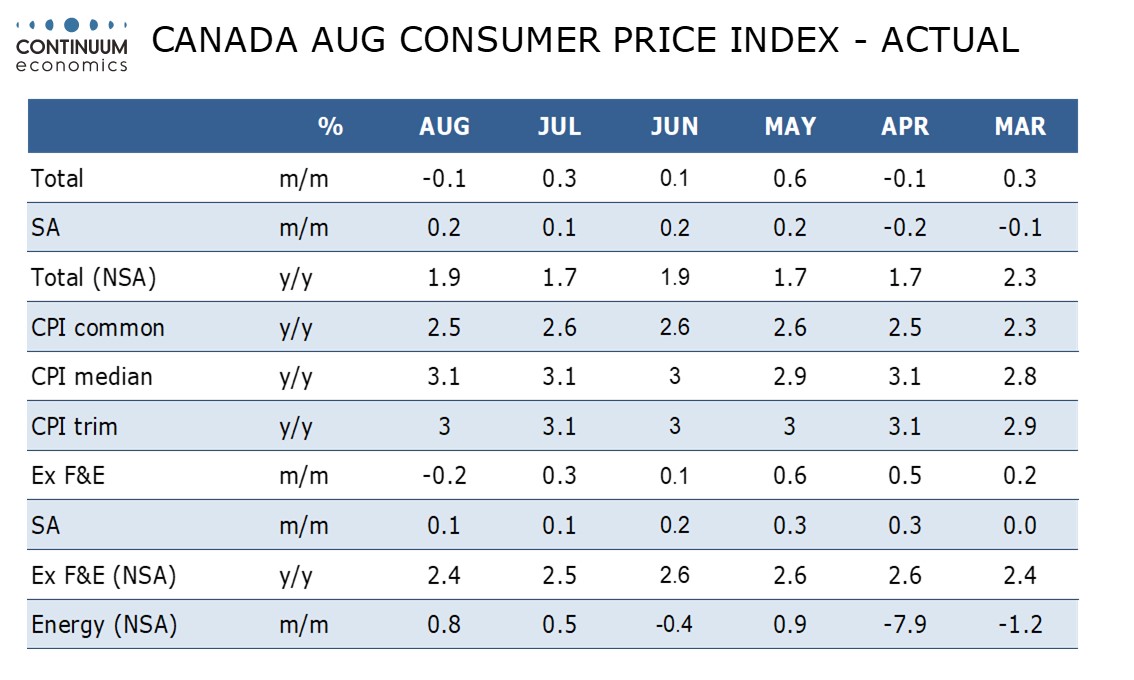

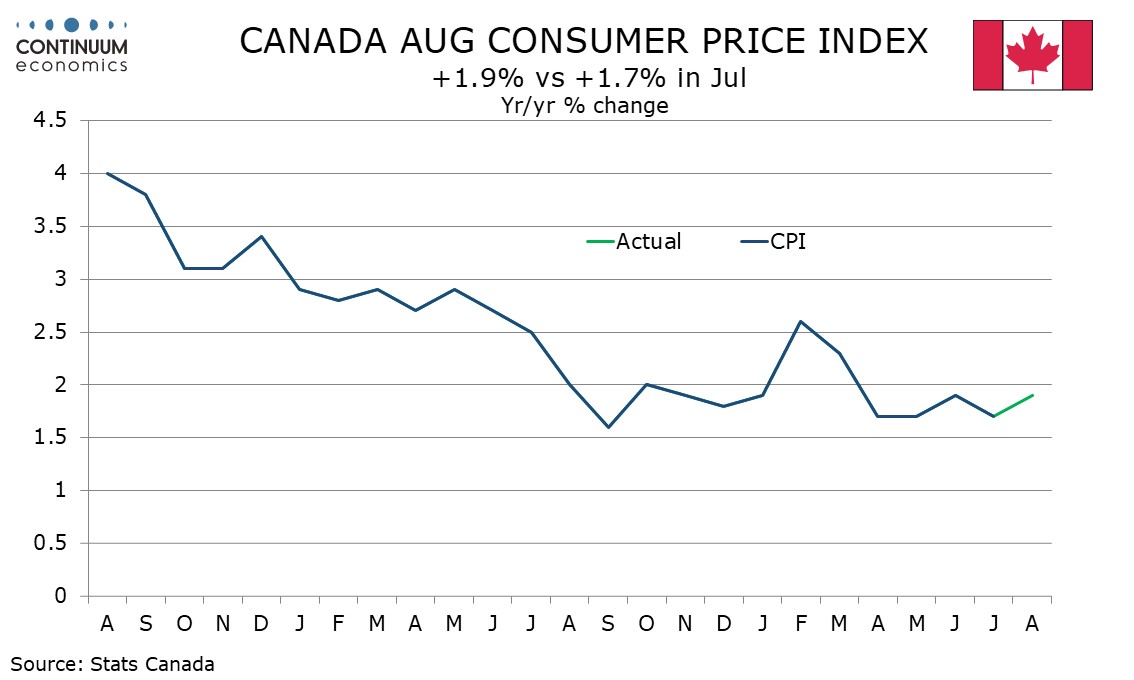

August Canadian CPI at 1.9% yr/yr reversed a July dip to 1.7% yr/yr and remains restrained by around 0.7% by the abolition of the carbon tax. Core rates remain above target but are on balance marginally softer while monthly details also look acceptably subdued. The data is not an obstacle to an expected Bank of Canada easing tomorrow.

On the month CPI fell by 0.1% and rose by 0.2% seasonally adjusted. Ex food and energy a 0.2% decline was seen with the seasonally adjusted gain only 0.1% for a second straight month. This implies a subdued underlying picture.

Yr/yr ex food and energy growth of 2.4% from 2.5% is at its slowest since March.

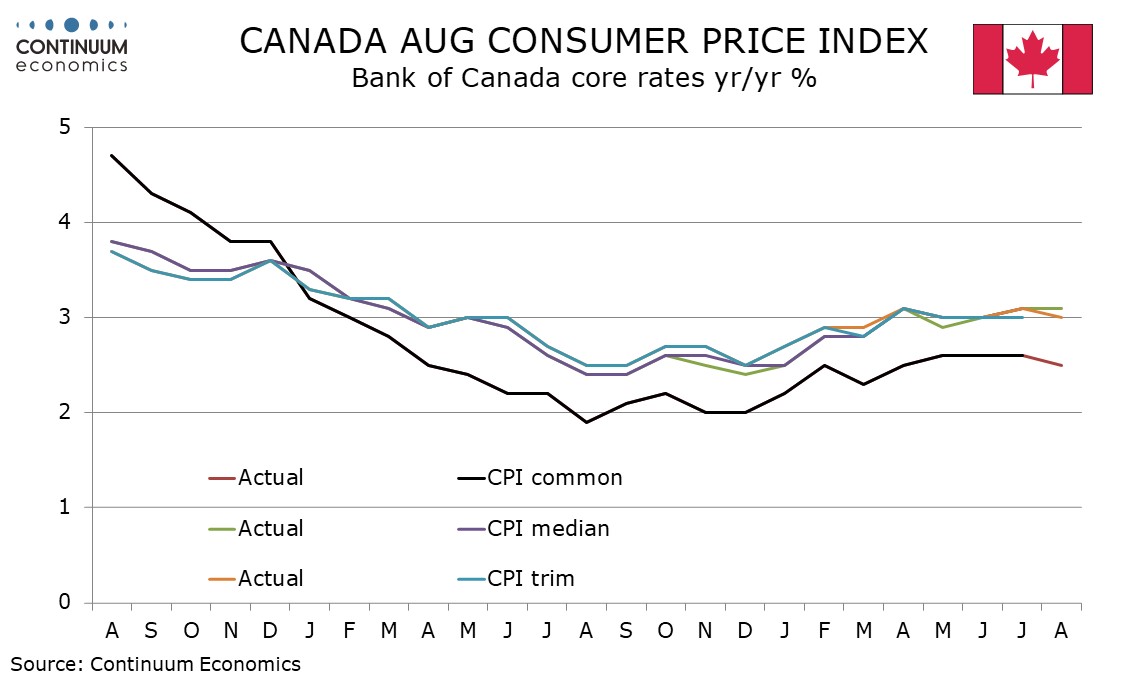

The ex food and energy rate is not one of the BoC’s three core rates. Here CPI-Common slowed to 2.4% from 2.5% and CPI-Trim slowed to 3.0% from 3.1%, CPI-Median was unchanged at 3.1$%. These rates remain above the 2.0% target and have not changed much in recent months, but the data looks subdued enough to allow the BoC to ease after recent weak GDP and particularly employment data.