Preview: Due November 28 - Canada Q3/September GDP - September rebound to keep Q3 positive

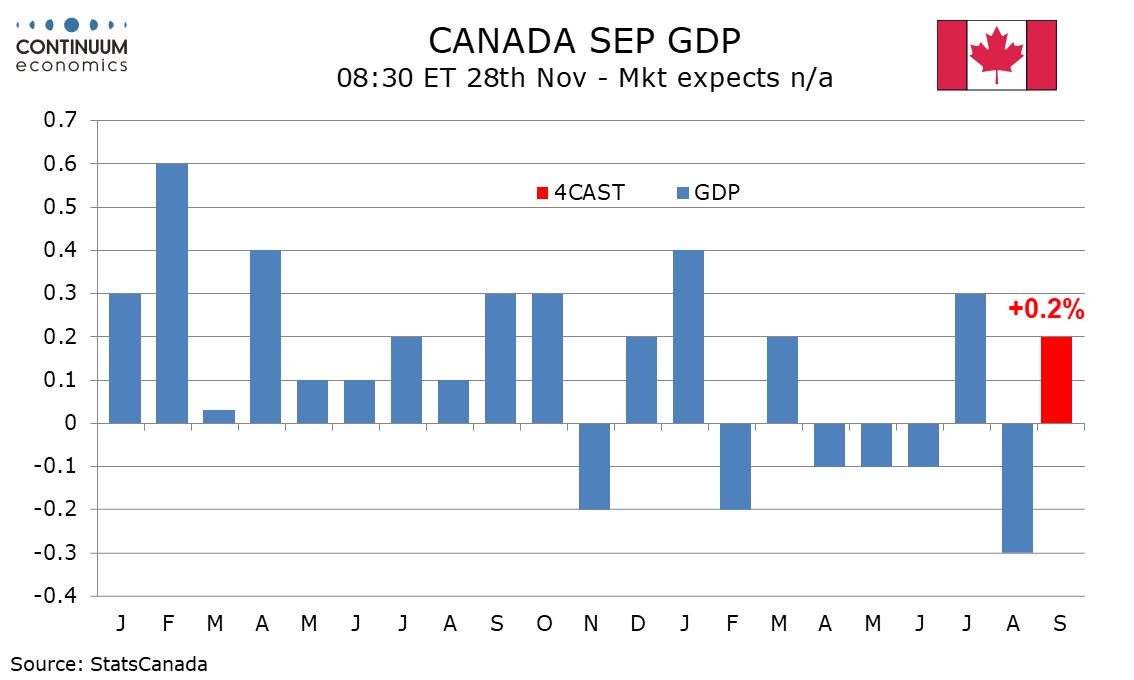

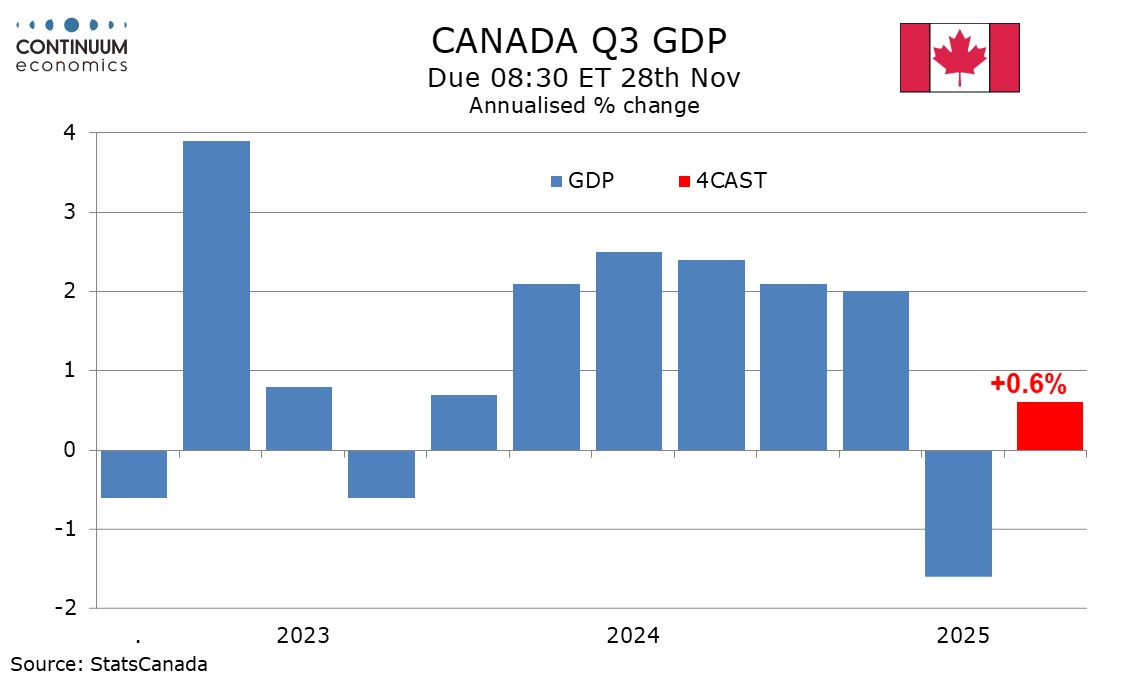

We expect Q3 Canadian GDP to increase by 0.6% annualized, marginally stronger than a 0.5% estimate made by the Bank of Canada with October’s Monetary Policy report, with September GDP to increase by 0.2% on the month, slightly stronger than a preliminary estimate of 0.1% made with August’s data.

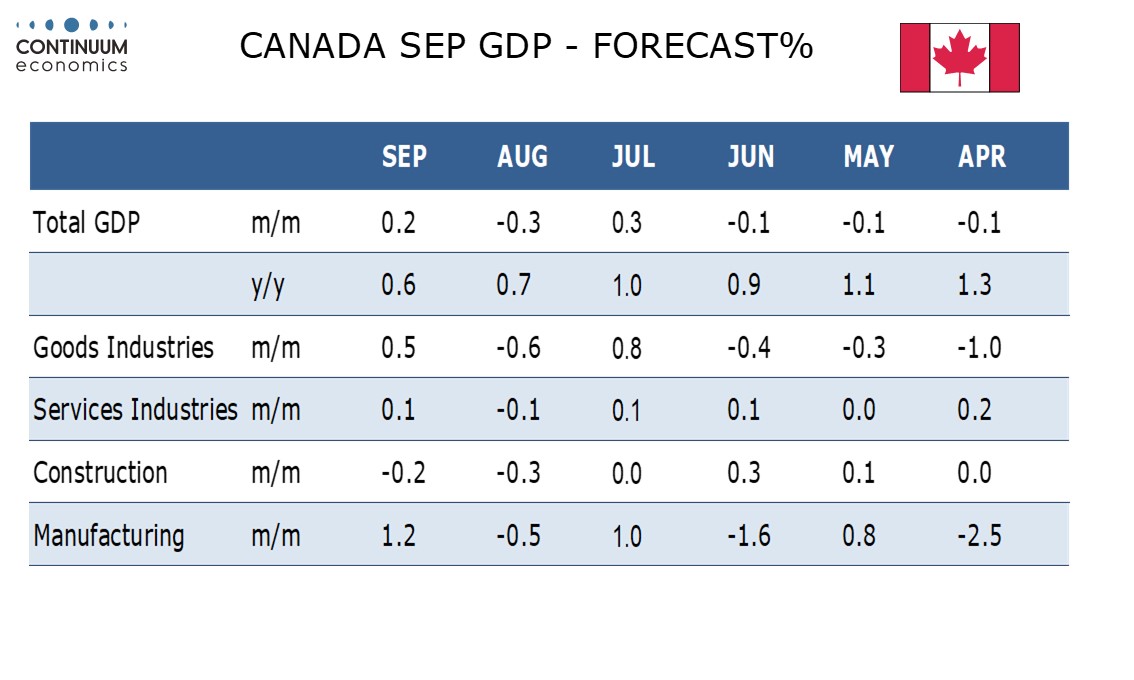

August GDP with a 0.3% decline reversed a 0.3% increase seen in July but risk for September appears to be on the upside, with both manufacturing and wholesale sales having exceeded preliminary estimates in September. August GDP was restrained by a 1.7% decline in transportation and warehousing, which took 0.075% off GDP, largely because of a strike by flight attendants at Air Canada, while a 2.3% fall in utilities, which is sensitive to weather and took 0.04% off GDP, looks set for a correction.

A 0.6% annualized increase in Q3 GDP would follow a 1.6% decline seen in Q2, and thus keep Canada out of a technical recession. There is extra uncertainty on this release because September trade data has been delayed due to absence of data which is normally provided by the United States but saw the government shutdown in October. We assume a September Canadian deficit of C$5.5bn, narrower than August’s C$6.3bn and Q2’s average of C$6.2bn but wider than July’s C$3.8bn.

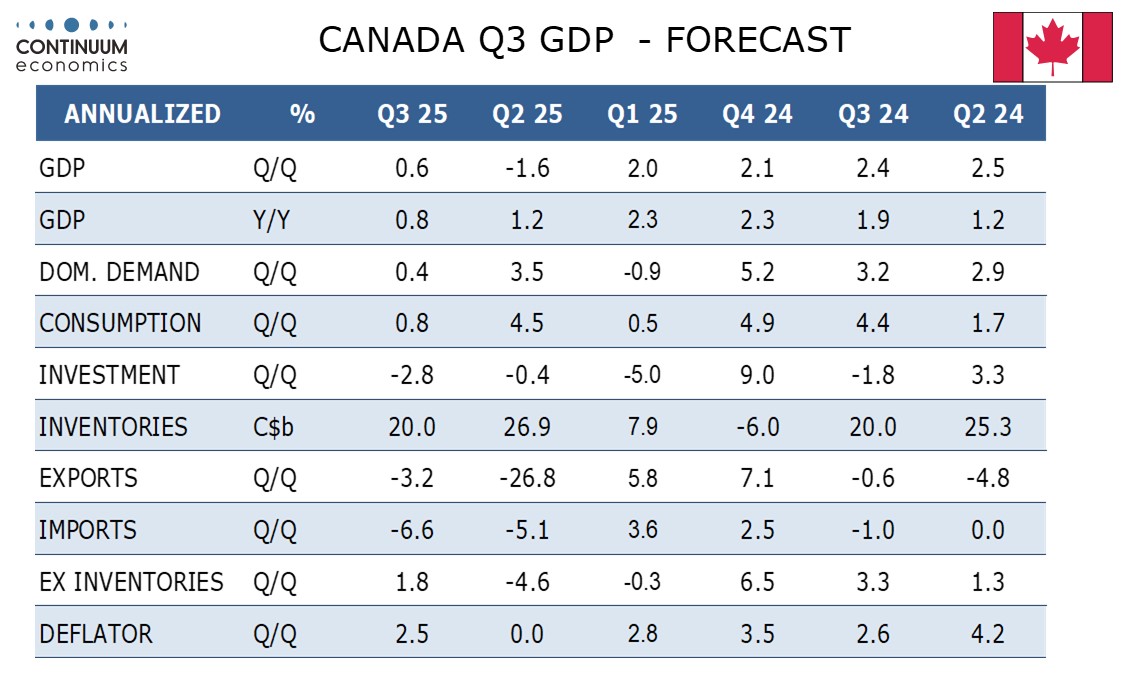

We expect net exports to add 1.4% annualized to Q3 GDP after taking off a massive 8.1% in Q2 as US tariffs were implemented, with exports down by 3.1% annualized but imports down by a steeper 6.6%. Weakness in imports, which contribute positively to GDP, could be offset by slowing in inventories, which we expect to take 1.2% off GDP after adding 3.0% in Q2.

The underlying picture will be better illustrated by domestic demand, which we expect to rise by a modest 0.4% annualized after a healthy 3.5% increase in Q2. We expect a modest 0.8% annualized increase in consumer spending with retail sales having declined in July and expected to do so in September with a rise in August in between. We expect a modest 0.5% annualized increase in government but a 2.8% decline in fixed capital investment keeping overall domestic demand subdued.

We expect a 0.6% (2.5% annualized) increase in the GDP deflator, which would leave yr/yr growth in the deflator at 2.2%. We expect a 0.5% rise in the deflator for domestic demand. Export prices look set to see a slightly stronger rise in Q3 than import prices, though September data remains absent.