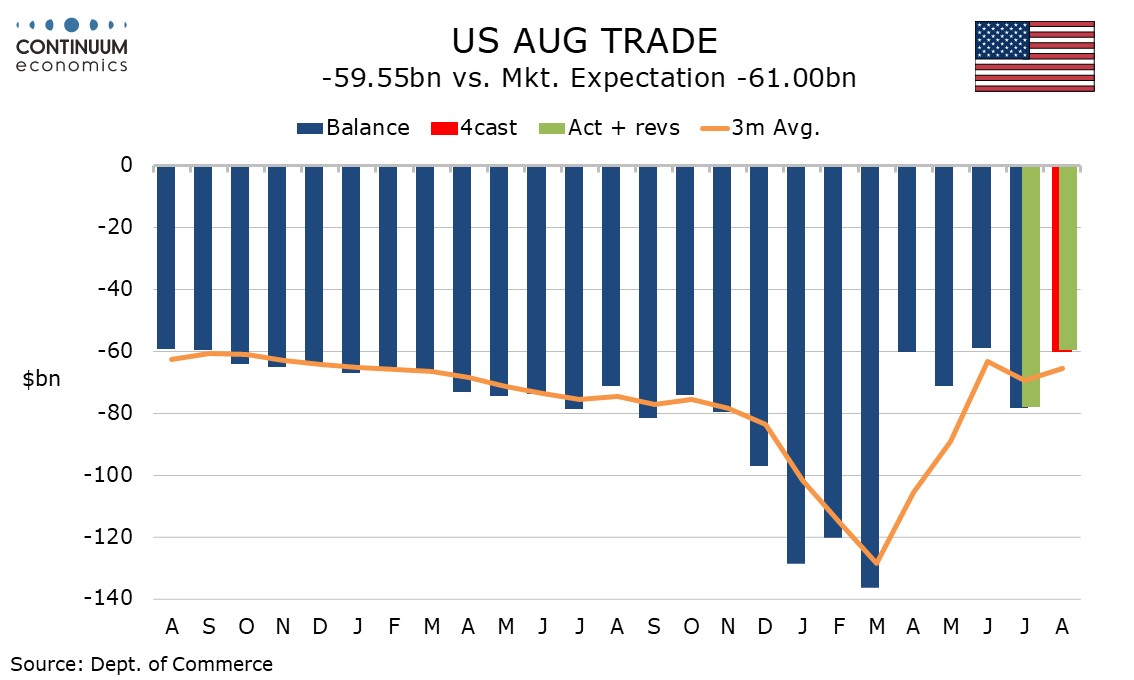

U.S. August trade deficit slips back after bounce in July, still in correction from inflated pre-tariff deficits

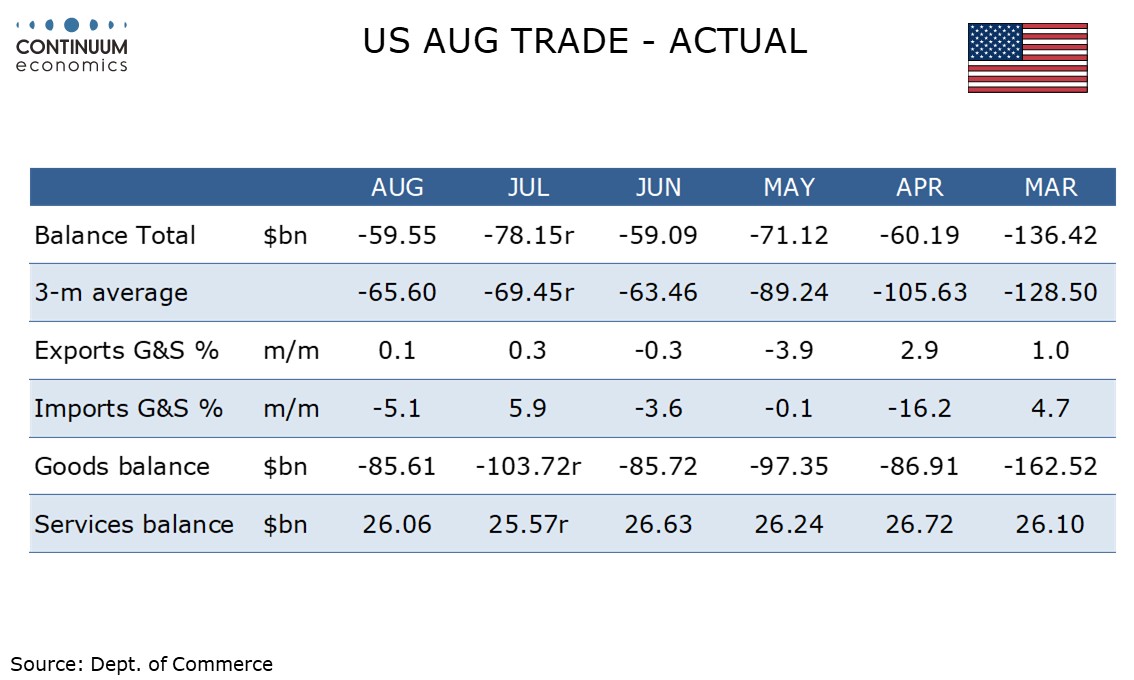

August’s delayed trade deficit of $59.55bn is narrower than expected, down significantly from July’s $78.5bn, but still marginally above June’s $59.09bn. Despite July’s bounce, the deficit remains in a correction from the inflated pre-tariff levels of Q1 which saw a record deficit of $136.42bn in March.

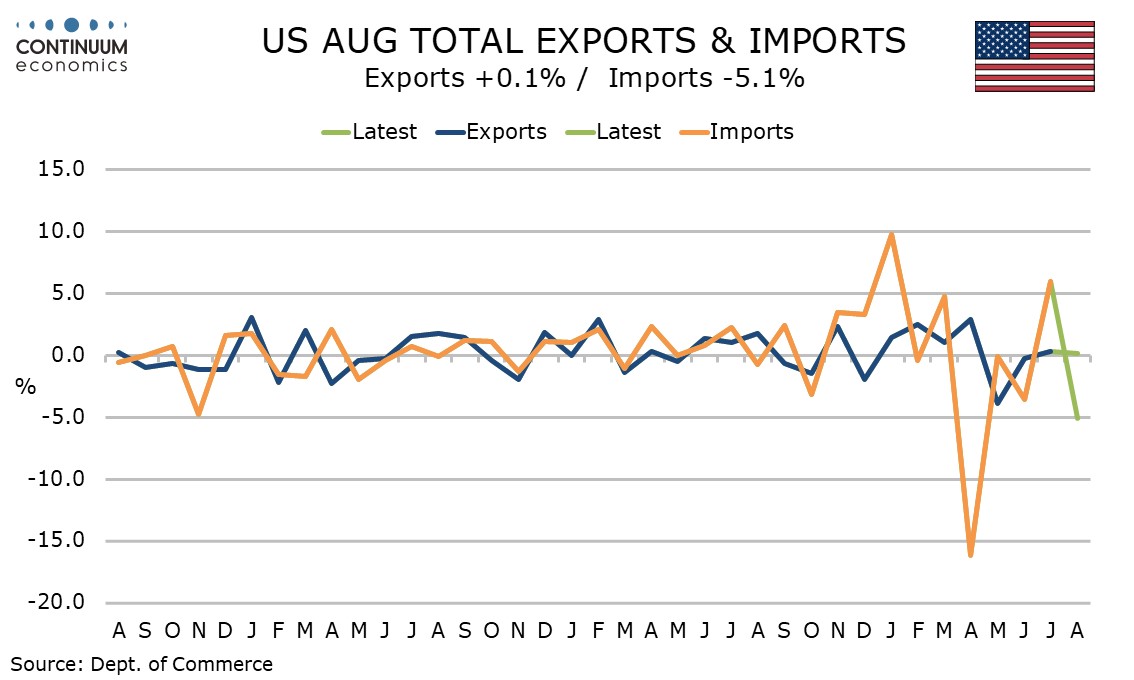

Goods exports fell by 0.3%, less than a 1.3% fall seen in advance goods data released back in late September and have changed very little since falling by 5.7% in May following four straight gains. On a yr/yr basis goods exports are little changed, up by 0.6%.

Goods imports fell by 6.8% after a 6.9% increase in July’s which was the first increase since March. Goods imports are down by 3.8% yr/yr, not a dramatic fall considering we are still correcting from a 31.0% yr/yr increase in March ahead of the tariffs.

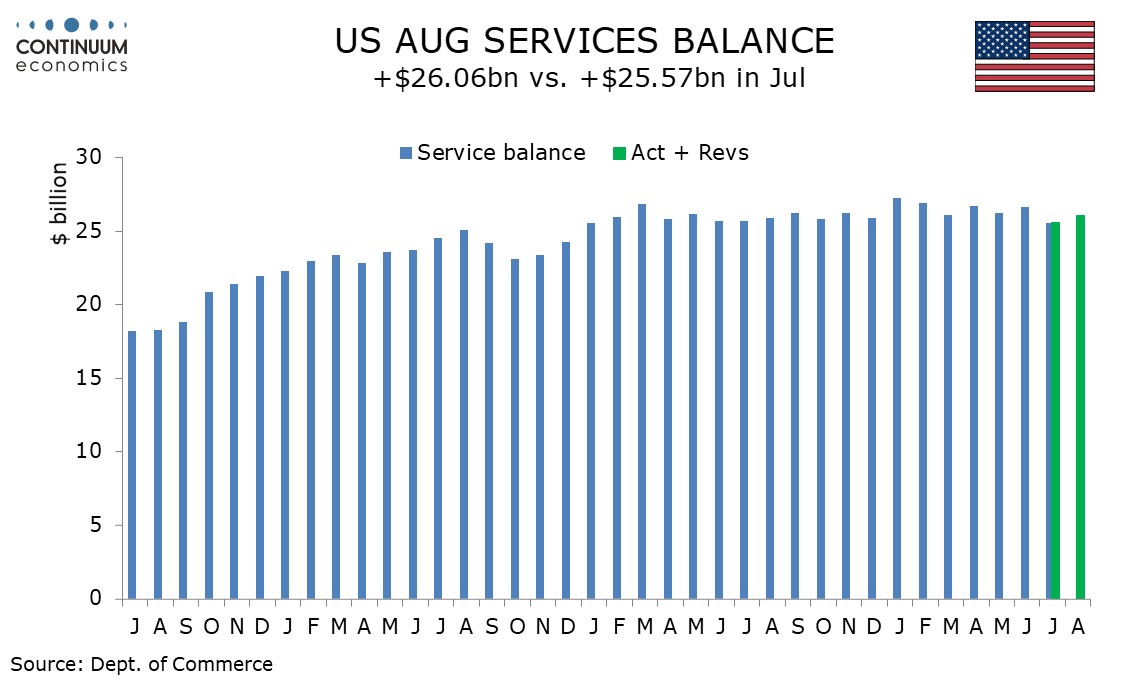

The services surplus of $26.06bn is up from $25.57bn in July but still below levels seen in January through June. Service exports rose by 0.8% on the month and 4.1% yr/yr while service imports rose by 0.4% on the month and 5.4% yr/yr.

On the month overall exports rose by 0.1% for a 1.9% yr/yr increase while overall imports fell by 5.1% for a 1.9% yr/yr decline.

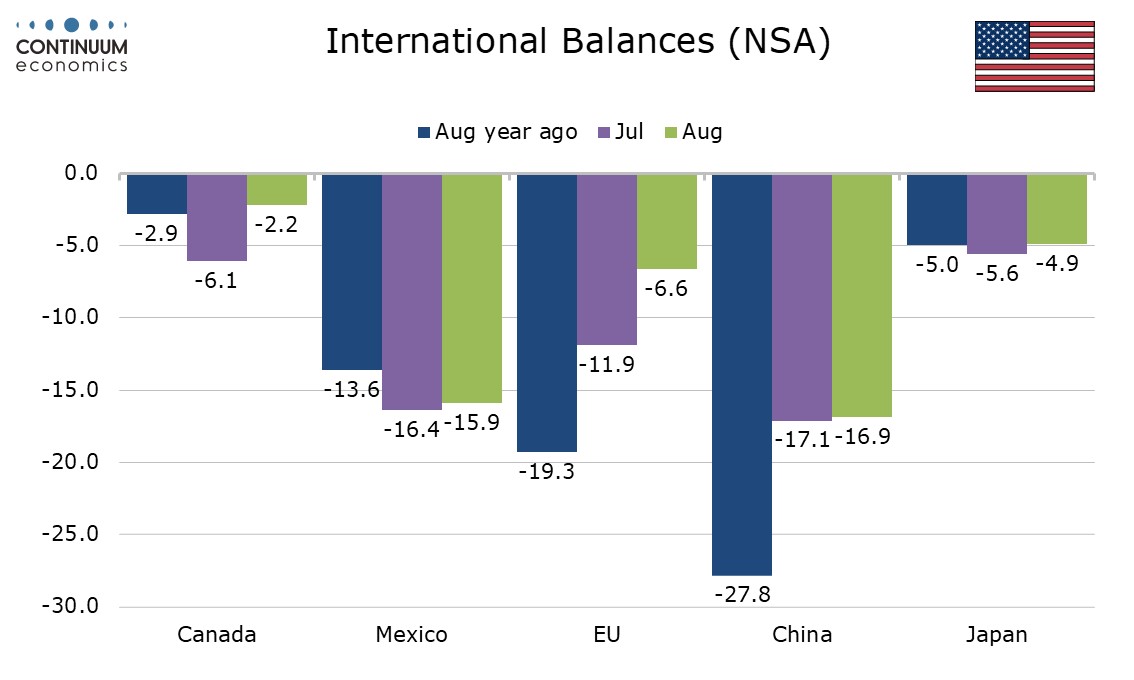

Data by country shows a significant narrowing in the deficit with Canada after a significant increase in July, and that is consistent with data from Canada which released its own August trade data on schedule, though its September data has been delayed due to the absence of inputs from the US due to the government shutdown. In August both exports to and imports from Canada were down by around 10% yr/yr.

There was also an improvement in the surplus with the EU to which exports remain firm but from which imports have fallen sharply. The deficit with China was little changed but both exports and imports are down by more than 30% yr/yr. The deficit with Japan slipped marginally but here both exports and imports are holding up.