Bank of Canada Preview for December 10: Stronger data reinforces case for a pause

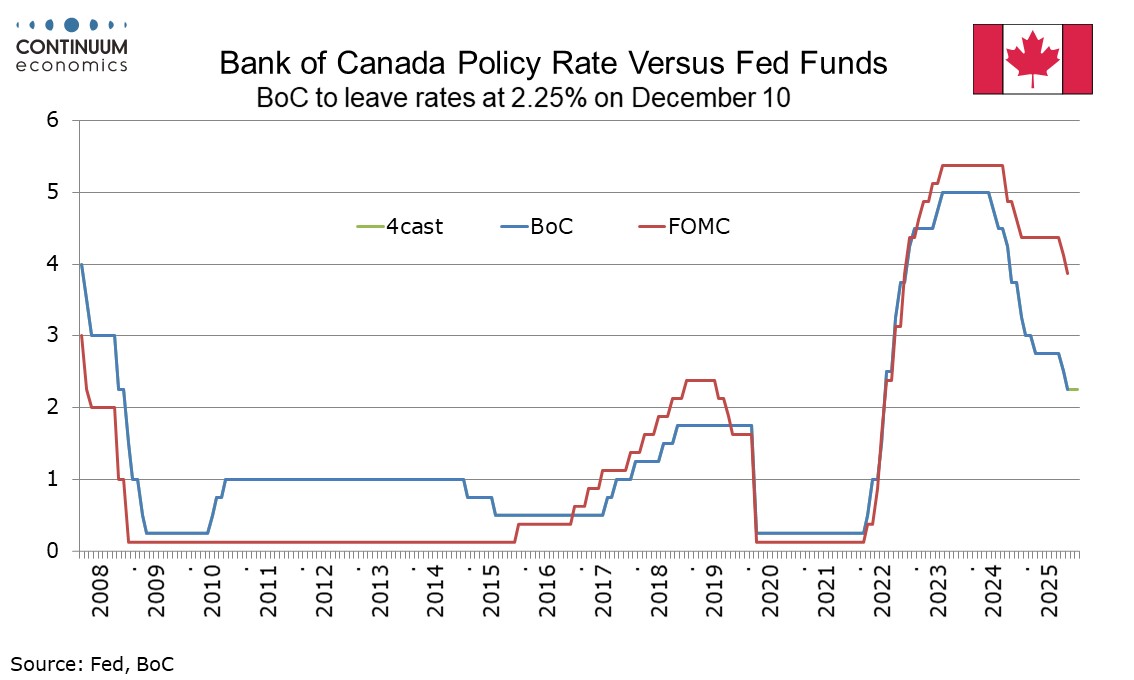

The Bank of Canada looks highly likely to leave rates at 2.25% when it meets on December 10. After easing in both September and October, the BoC after its October move stated rates were now at about the right level if the economy evolved in line with its expectations. With Q3 GDP and November employment having come in stronger than expected, further easing looks increasingly unlikely, but the strength in the data is not yet convincing enough for the BoC to start considering tightening.

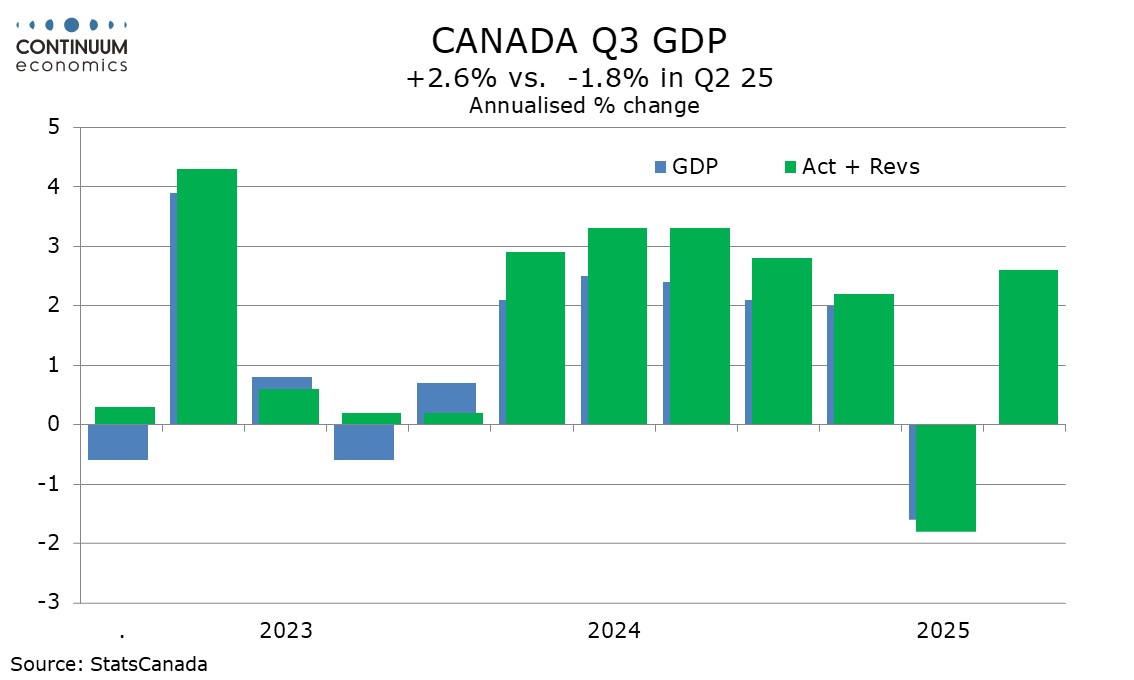

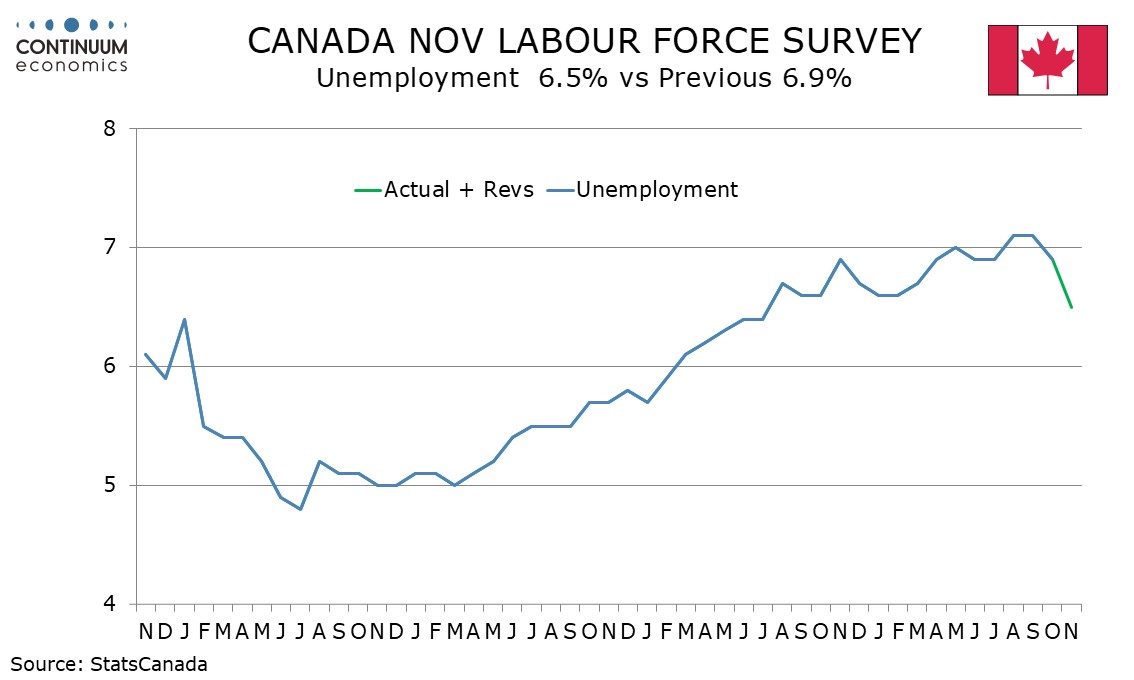

Q3 GDP at 2.6% annualized was much stronger than a 0.5% Bank of Canada projection made with October’s Monetary Policy Report. The Bank of Canada may downplay this strength, coming largely from a sharp fall in imports with domestic demand having fallen by 0.1% annualized, and a preliminary estimate for October GDP being weak at -0.3% on the month. However, upward revisions to each quarter in 2024 may cause the BoC to revise down its estimate of the output gap. A sharp dip in November unemployment, to 6,5%, the lowest since July 2024, from 6.9% in October and a peak of 7.1% in July and August also suggests that the output gap has started to shrink, though the rate is still well up from 5.0% at the end of 2022 and 5.5% immediately before the Covid pandemic. This suggests that a significant output gap remains.

In October the Bank of Canada estimated underlying inflation to be running around 2.5%, above the 2,.0% target, though it expects inflation to ease towards target in upcoming months. October CPI saw headline and core CPI rates marginally lower, so should not have undermined the view, though a bounce in shelter prices was disappointing. The Bank of Canada is likely to continue to see the 2.25% policy rate as appropriate. Should inflation remain stubbornly above target and the Q3 GDP pick up continue in Q4, the BoC may start to consider tightening, but such a move would not be seen until well into 2026. Should inflation fall to target and GDP show renewed weakness, an early 2026 easing is not out of the question, but is looking increasingly unlikely.

This meeting will not see the Bank of Canada updating its economic forecasts, with the next Monetary Policy Report due at the subsequent meeting on January 30. Our view is that the Bank of Canada will not adjust rates again until Q4 2026, when we expect a tightening of 25bps. This assumes that inflation will return to target, and that recent GDP and employment gains have overstated underlying trend.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.