Bank of Canada Preview for July 30: Hold after firm data with uncertainty high

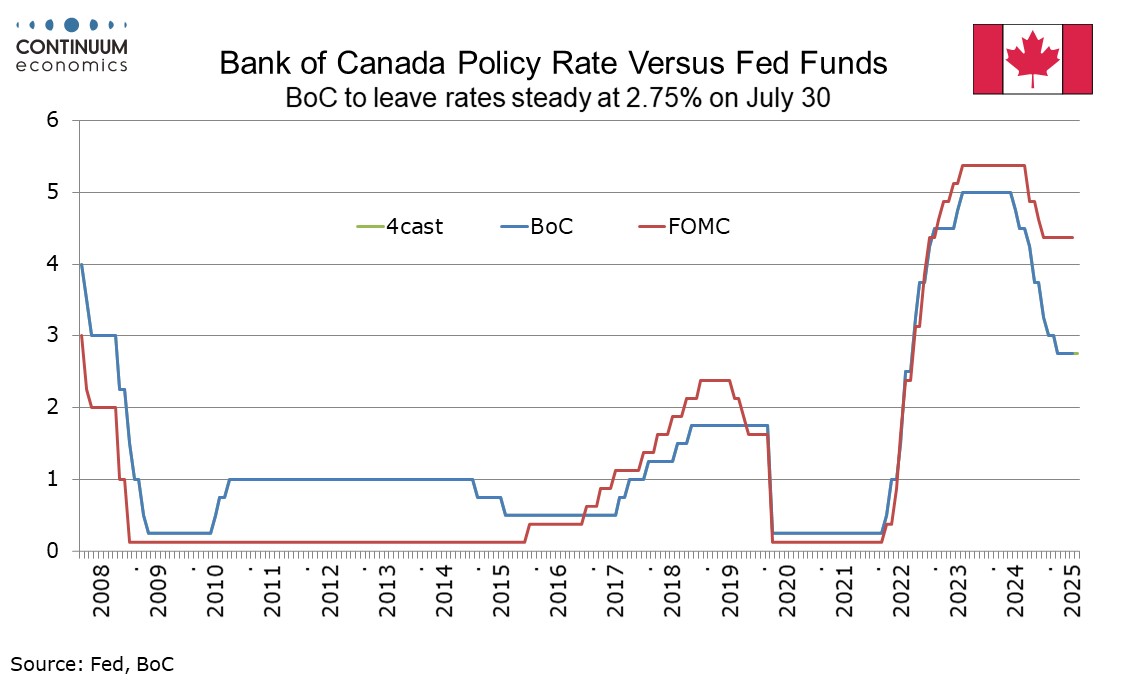

The Bank of Canada meets on July 30 and what had been seen as a close call between a 25bps easing and unchanged now looks likely to leave rates unchanged at 2.75%. Continued above target core CPI data and a strong employment report for June argue against easing, though uncertainty remains high with increased US tariffs scheduled for August 1. We do not believe the BoC is done with easing.

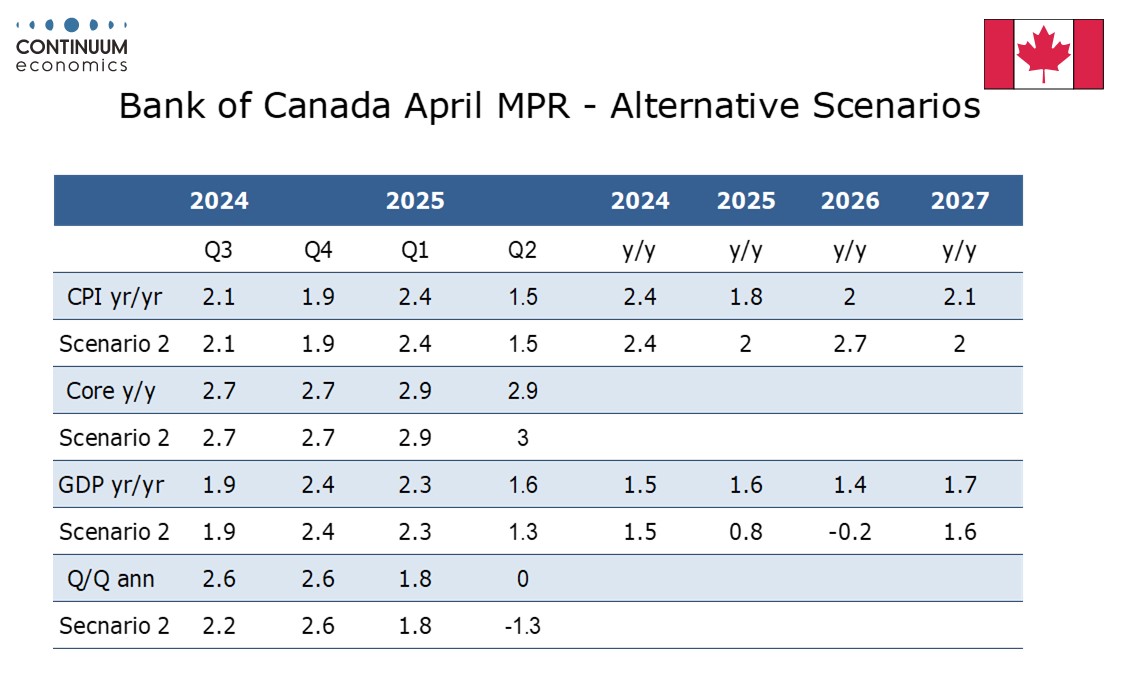

This meeting will see the BoC deliver a quarterly Monetary Policy report. The last MPR released in April saw the BoC, rather than doing its usual forecast, deliver two separate scenarios, one in which most tariffs are negotiated away but the process is unpredictable, and a second scenario where uncertainty persists and more US tariffs are added. With fresh tariffs scheduled for August 1 but far from certain given a history of Trump climbdowns, the BoC may continue to present two separate scenarios.

Since April’s MPR was produced, Q1 GDP at 2.2% annualized came in a little above the BoC’s forecast but this was offset by a downward revision to Q4, with yr/yr growth as forecast at 2.3%. Q2 appears to be heading for an outcome closer to the flat projection of scenario 1 than the 1.3% annualized decline from scenario 2. This assumes May GDP will see a second straight 0.1% decline in line with a preliminary estimate made with April data but June will see a modest increase given a surprisingly strong June employment rise of 83k. Inflation has been stronger than the BoC projected, with Q2 seeing CPI average 1.8% versus a 1.5% April projection and the average of CPI-Median and CPI-Trim being 3.05% in Q2, above a 2.9% or 3.0% April projection depending on tariff scenarios. CPI ex food and energy rose by 0.3% seasonally adjusted in each month of Q2.

After easing in March to 2.75% the BoC held rates steady in April and June. The key sentence from June’s statement could be repeated word for word. It read “with uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, Governing Council decided to hold the policy rate as we gain more information on US trade policy and its impacts. Uncertainty means that the BoC is likely to give little forward guidance. However our view is that US tariffs, even if not meeting the 35% threatened for August 1, will be sufficient to push Canada into a modest recession, and that inflation will lose momentum in the second half of the year, assuming no aggressive Canadian retaliatory tariffs. Under such a scenario renewed easing is likely this year. Should Trump fully follow though with his threats, we would expect two 25bps easings later this year, but on a less aggressive tariff scenario we would expect only one.