Bank of Canada - Hawkish Ease with Current Rate Level Seen as Appropriate

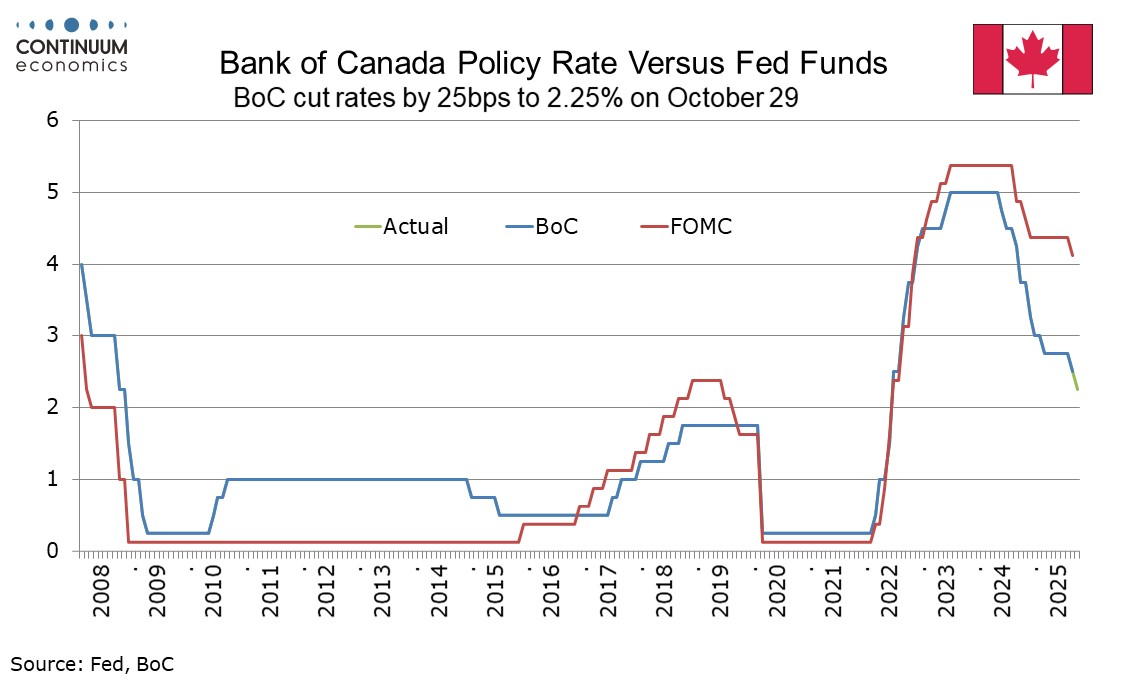

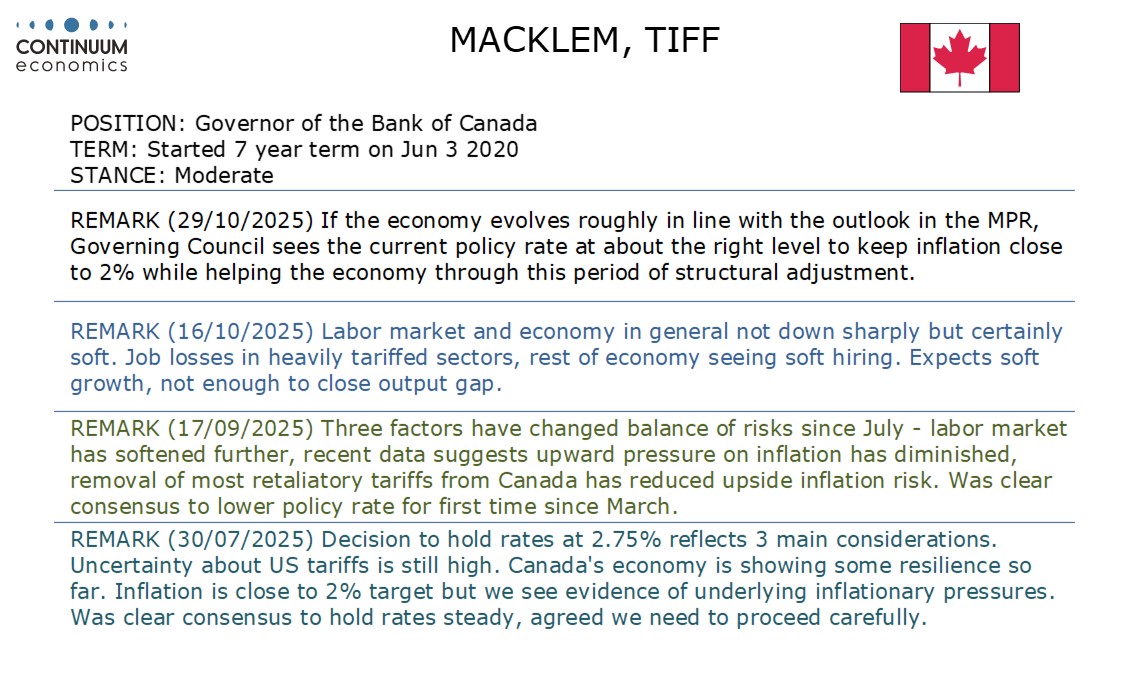

The Bank of Canada delivered a hawkish easing, cutting rates for the second straight meeting by 25bps, to 2.25%, but stating that if inflation and activity evolve in line with its projection, the current rate is seen as about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment (brought about by US tariffs).

While any move in the next six months is likely to be lower, that might require a recession which is not the BoC’s central view. We now expect steady policy from the BoC through the first three quarters of 2026. Policy is now at the low end of the neutral range of 2.25-3.25%, and in time the BoC is likely to return to its midpoint. We expect one 25bps tightening in Q4 2026 and one more in early 2027.

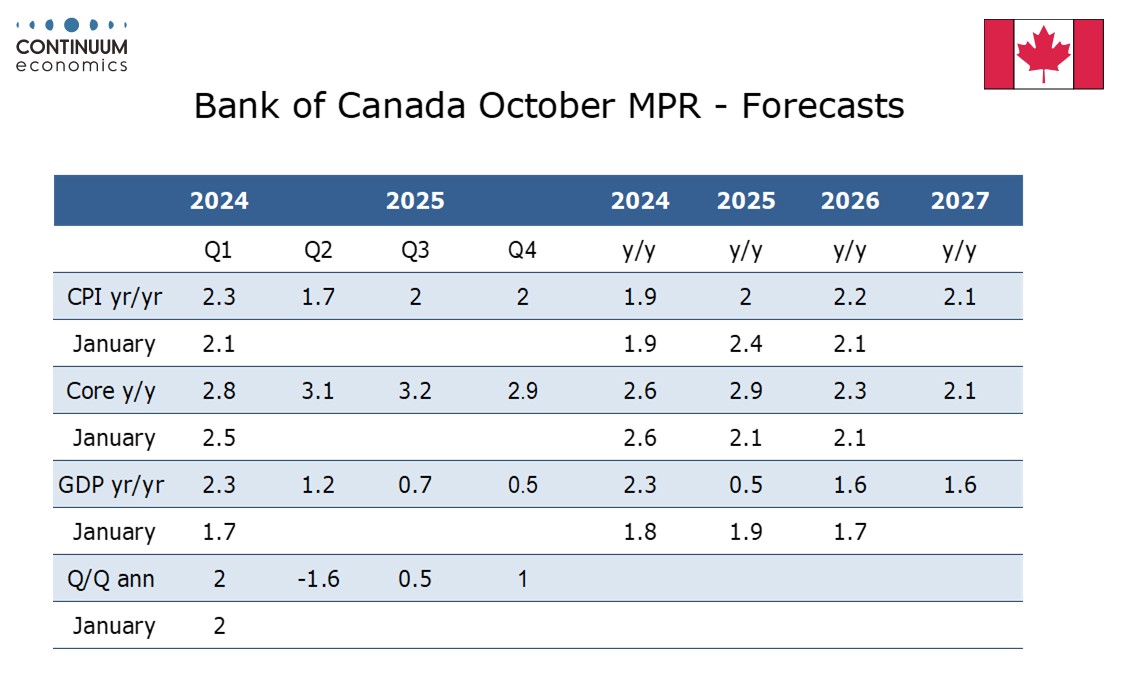

This meeting saw a quarterly Monetary Policy report produced and with the BoC seeing the effects of US trade actions as somewhat clearer, returned to its usual practice of making an economic forecast. April saw three scenarios presented, depending on various trade policy outlooks. Subdued GDP growth is seen in the second half of this year at 0.5% annualized in Q3 and 1.0% in Q4, though 2026 and 2027 are both seen firmer at 1.6% Q4/Q4. This would leave 2025 GDP at only 0.5% Q4/Q4, well below a January estimate of 1.9% and even 2026 has been marginally downgraded. US tariffs are seen doing permanent damage to potential output, limiting BoC potential to boost demand while maintaining low inflation. The BoC states that it is focused on ensuring continued confidence in price stability.

CPI is seen at 2.0% Q4/Q4 in 2025 compared to 2.4% in January but CPI has been cut by around 0.5% due to the April abolition of the carbon tax. Core inflation, seen as the average of CPI-Median and CPI-Trim is seen at 2.9% in Q4 compared to 2.1% in January’s forecast. However expanding the range of indicators and considering the distribution of components leads the BoC to see underlying inflation as around 2.5% and it expects this pace to ease in the months ahead. A surprisingly strong September CPI of 2.4% yr/yr does not seem to have caused much alarm with Q4 seen at 2.0%. The BoC has also downplayed a surprisingly strong September employment report, noting that it followed two sizeable losses and describing the labor market as remaining soft.

Governor Tiff Macklem stated that US tariffs have weakened the Canadian economy and while this weakness is restraining price pressures it has also raised costs. These opposing forces are seen as roughly offsetting, keeping inflation close to the 2% target. Recent weekend events, in which tariffs on Canada were increased, are seen as a reminder of uncertainty and the need to be humble on economic forecasts. The BoC calculated the average US tariff on Canadian exports as 5.9% (this includes the latest measures) and the average Canadian tariff on imports from the US as 1.0%.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.