Canada June CPI - Argues against a July BoC easing

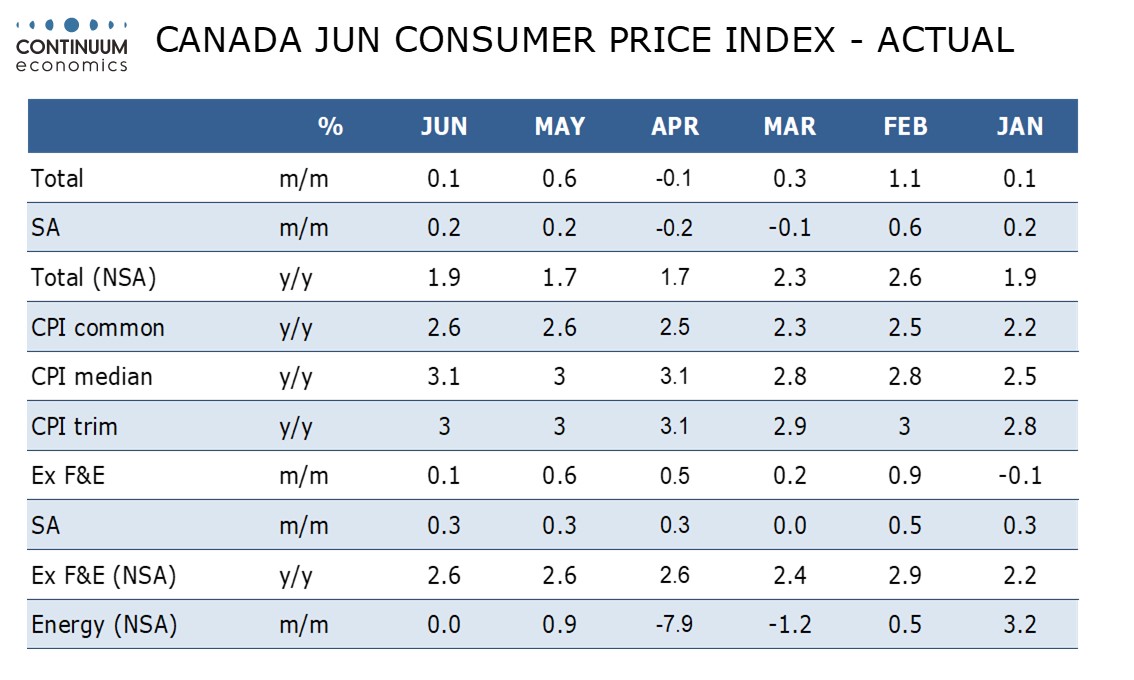

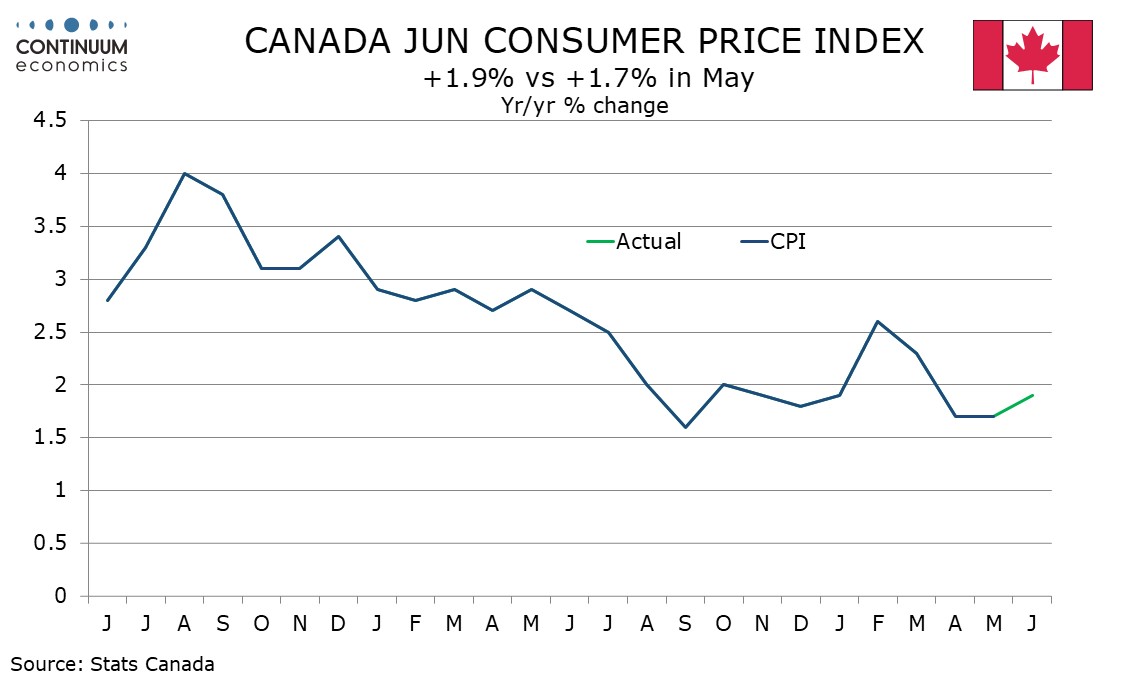

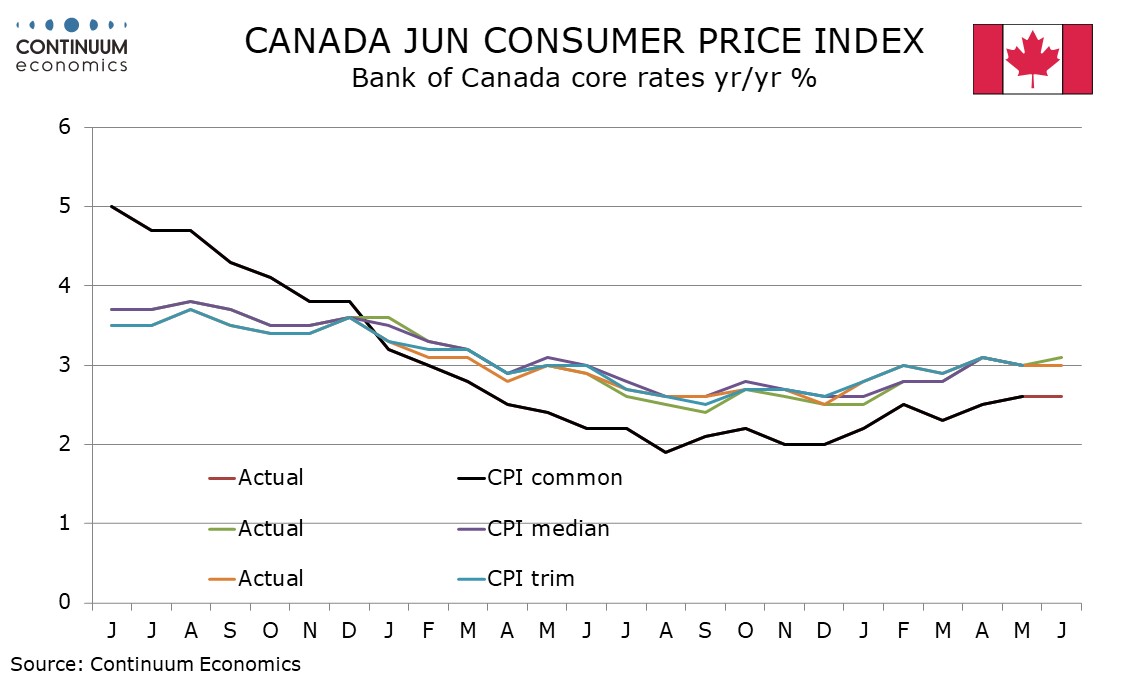

June CPI was as expected with yr/yr growth at 1.9% after two straight months at 1.7%, though without April’s abolition of the Consumer Carbon Tax would be standing around 2.5%. The Bank of Canada’s core rates showed no progress lower, and coupled with Friday’s strong employment report for June argues against an easing from the BoC on July 30.

On the month CPI rose by 0.1% unadjusted and 0.2% seasonally adjusted. Ex food and energy CPI also rise by 0.1% unadjusted but seasonally adjusted saw a third straight gain of 0.3%, and that is a little high for comfort. Yr/yr ex food and energy CPI stands at 2.6% for a third straight month.

The ex food and energy rate is not one of the BoC’s core rates, but each of the three is stubbornly above the 2% target, CPI-Median actually nudging up to 3.1% from 3.0% while CPI-Trim was unchanged at 3.0% and CPI-Common unchanged at 2.6%.

Seasonally adjusted data shows apparel as the strongest component with a 0.7% monthly rise, with the rest of the breakdown mostly subdued while positive, with gains ranging from 0.1% to 0.3%. Yr/yr data shill shows shelter relatively firm at 2.9% but it has lost momentum in recent months, with a moderate monthly gain of 0.2% both adjusted and unadjusted.