Bank of Canada - Rate Level Still Appropriate Despite Stronger Data

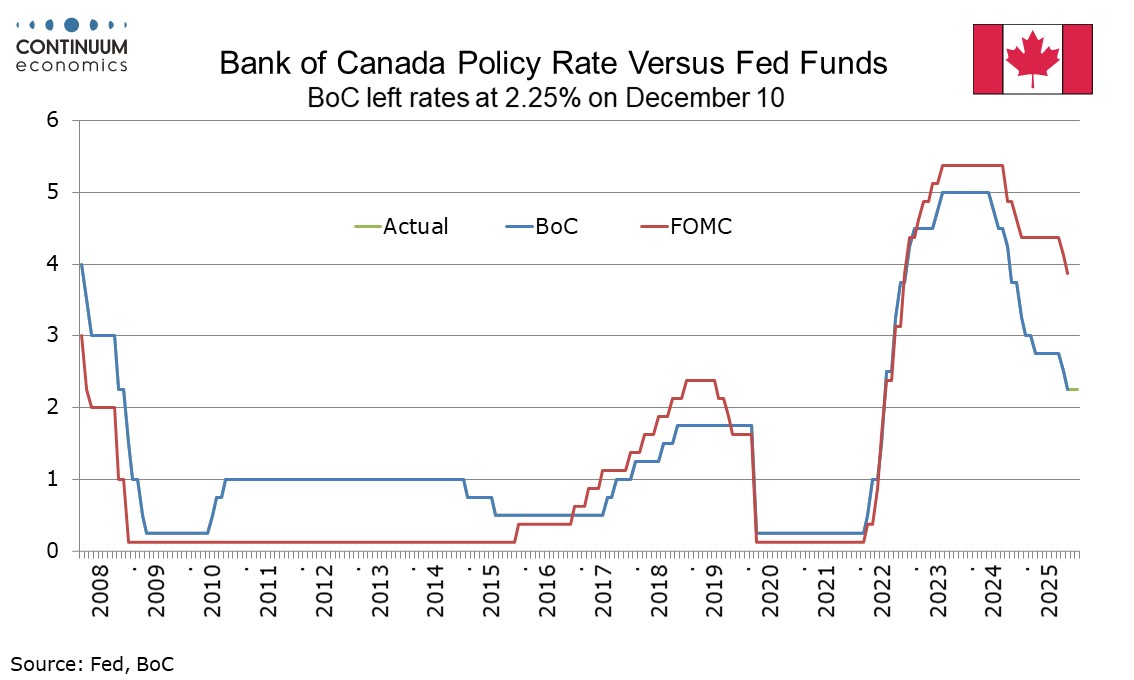

Since the Bank of Canada eased rates to 2.25% in October and stated that policy was now at an appropriate level, Canada has delivered stronger than expected data on GDP and employment. The data has not been dismissed, but the BoC view that policy is at an appropriate level persists after today’s meeting. This suggests tightening is some way off, if subject to the future evolution of data. Our view is that the next move will be a 25bps hike in Q4 2026.

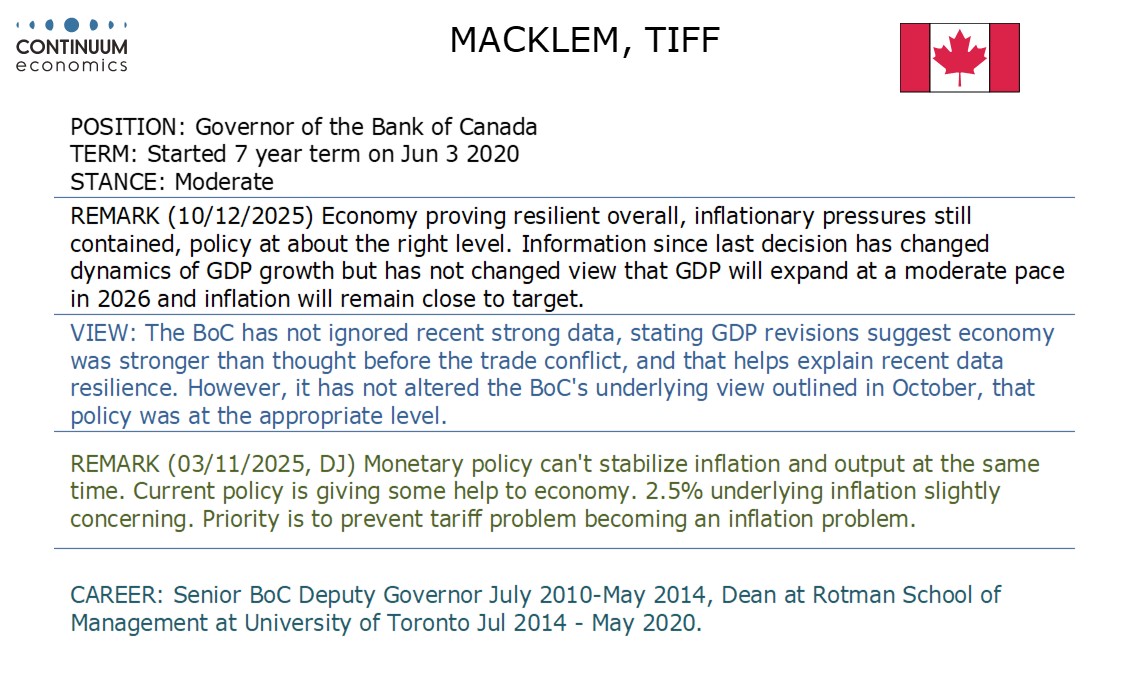

Governor Macklem’s press statement addressed the economic developments in more detail than did the BoC’s statement. He first noted upward revisions to GDP in 2022, 2023 and 2024 as suggesting the economy was healthier than thought ahead of the recent trade conflict and that may help explain resilience in recent data. Q3 GDP with a 2.6% annualized rise was much stronger than the BoC’s October forecast of 0.5%, though domestic demand was near flat. Q4 GDP is seen weaker on slippage in net exports but domestic demand is seen picking up, as is GDP in 2026. Three strong months of employment growth were also noted but looking ahead hiring intentions are seen as muted. Inflation is seen as having evolved about as expected with the BoC still seeing the underlying pace as around 2.5%, A near term lift is expected as a sales tax holiday a year ago drops out, but looking ahead the BoC expects economic slack to roughly offset trade-related cost pressures and keep inflation close to the 2% target. Increased spending in the budget is seen boosting both demand and supply, and Macklem does not see it adding to inflationary pressure.

A key sentence in Macklem’s statement was that “while information since the last decision has affected the near-term dynamics of GDP growth, it has not changed our view that GDP will expand at a moderate pace in 2026 and inflation will remain close to target.“ The Bank of Canada remains comfortable with the 2.25% rate, at the bottom end of its neutral range of 2.25%-3.25%. However, the statement notes that this assumes the economy evolving broadly in line with its October projection. Data so far can still be seen as broadly in line with October’s projection, particularly if Q4 GDP comes in significantly below an October projection of 1.0% annualized. In 2026 GDP is expected to rise by 1.6% Q4/Q4. If GDP data in early 2026 comes in significantly stronger than that, and inflation does not move closer towards the 2.0% target after tax distortions fade, tightening could start to be debated, though we feel data will be more in line with the BoC’s October forecasts, and tightening will not be seen until Q4 2026. Recent data has reduced the risk of further easing, but it is not to be ruled out should a significant deterioration in the data be seen.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.