United Kingdom

View:

September 17, 2025

UK CPI Review: A Pause Before a Peak?

September 17, 2025 6:29 AM UTC

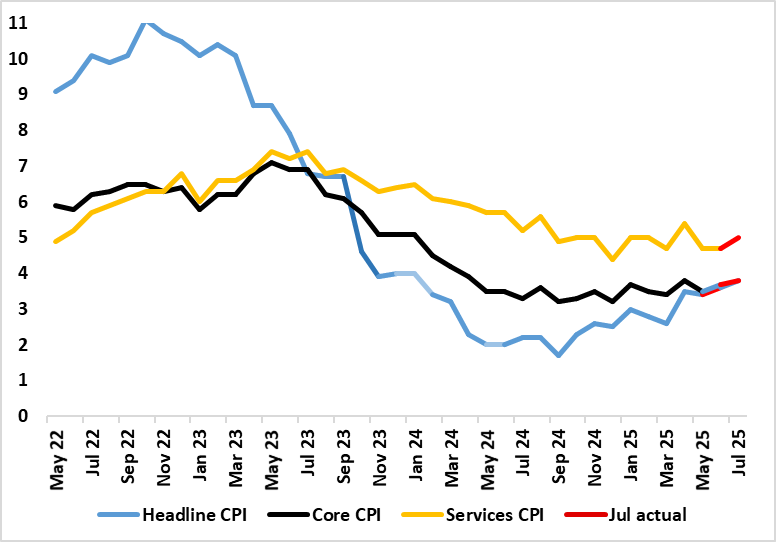

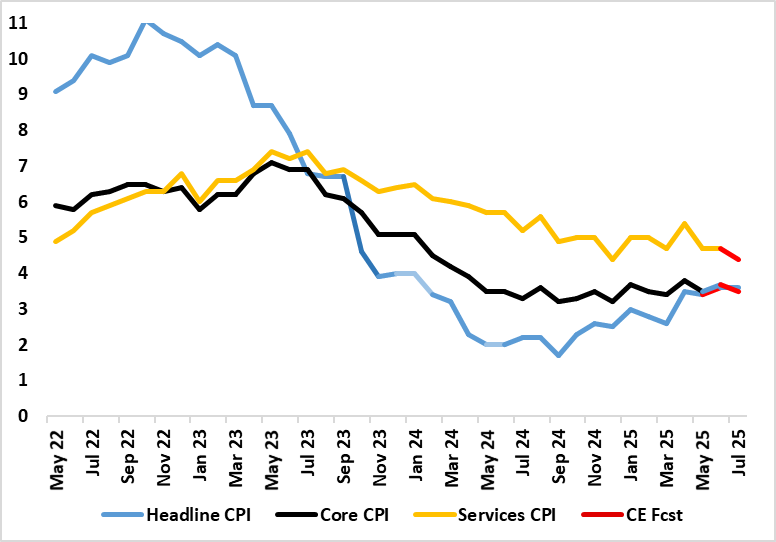

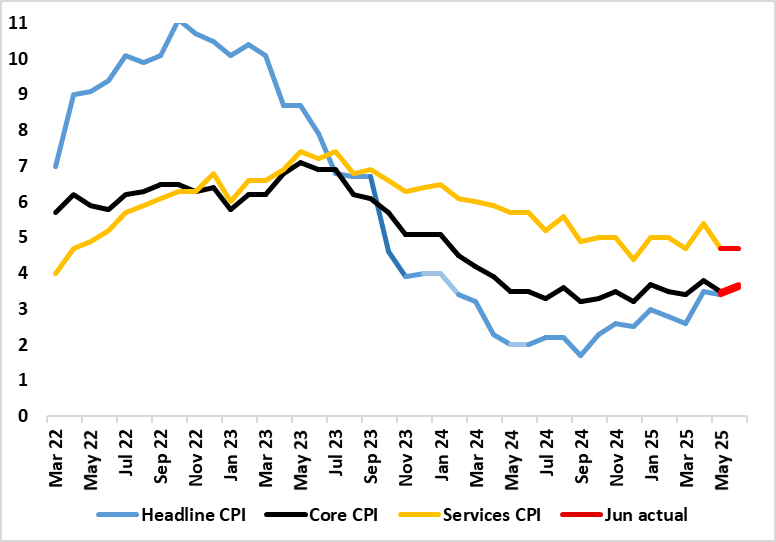

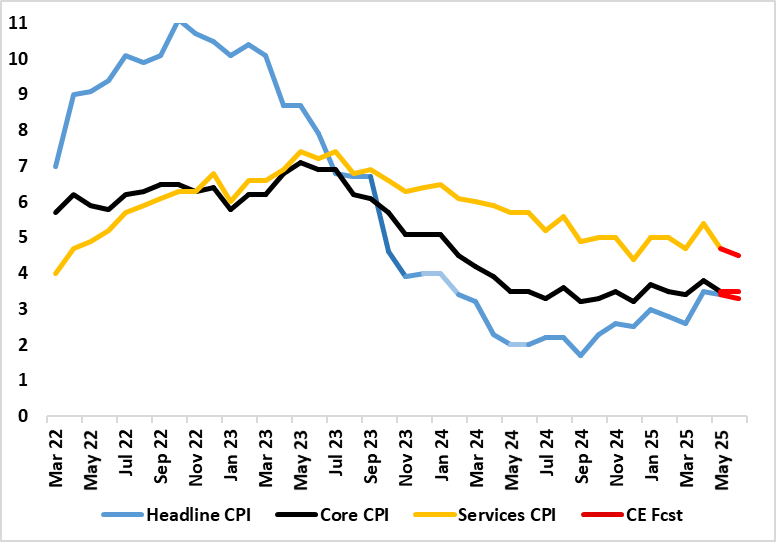

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel (and food) costs, the headline stayed there in the August figure, this foreshadowing a likely rise th

September 12, 2025

UK GDP Review: Conflicting Signs

September 12, 2025 6:52 AM UTC

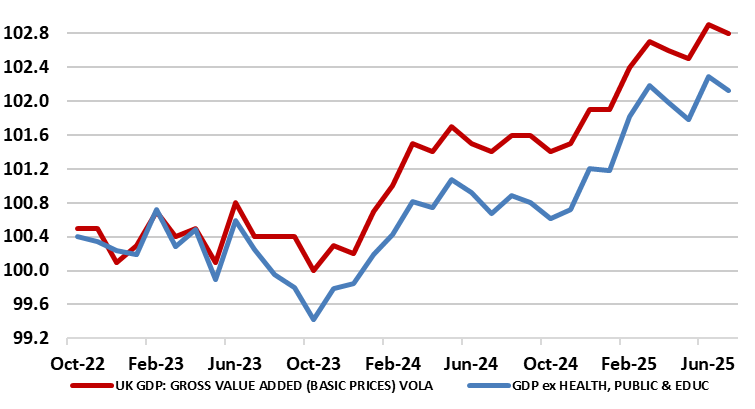

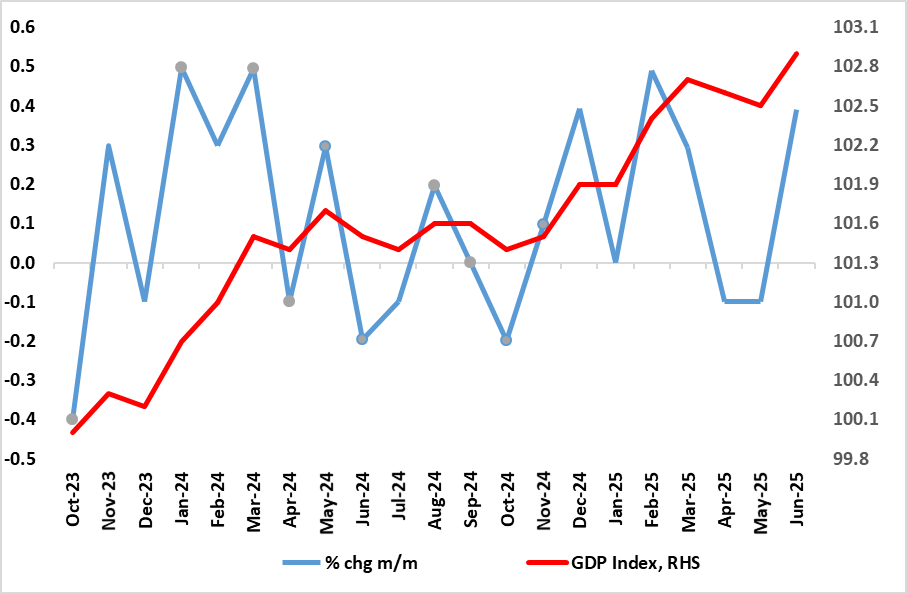

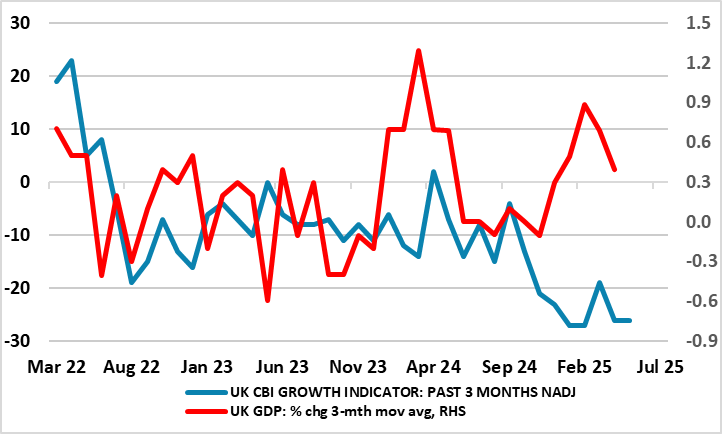

Although we are pointed to a flat m/m GDP outcome for the July data, thereby matching the official outcome, the actual outcome was a small m/m fall (before rounding). The three-month rate slowed a notch to 0.2% but we think this overstates what is very feeble momentum, which may actually be nearer

September 10, 2025

DM Rates: Steeper Yield Curves: More to Come?

September 10, 2025 10:55 AM UTC

Steeper yield curves are a function of monetary easing cycles, budget deficits, lower central bank holdings of government bonds, a move towards pre GFC real rates and shifting demand from pensions funds and life insurance companies. Scope exists for further steepening in the U.S., EZ and UK with m

UK CPI Preview (Sep 17): Goods Inflation the Recent Problem, Not Services?

September 10, 2025 9:05 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Partly due to rounding and fuel (and possibly food) costs, we see the headline rising a notch to 3.9% in the August figure, this foresh

September 09, 2025

BoE Preview (Sep 18): Guilty on Gilts?

September 9, 2025 3:54 PM UTC

That the BoE will keep Bank Rate at 4% after this month’s MPC meeting is all but certain. Indeed, the MPC majority has hinted that the recent regular quarterly pace of easing seen so far in the cycle may be slowed or paused amid price persistence concerns. This reflects the MPC majority’s co

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 28, 2025

August 25, 2025

Jackson Hole: Fed/ECB/BOJ and BOE on Labor Markets

August 25, 2025 9:02 AM UTC

Fed Powell focused on the cyclical softening of employment to back a more dovish undertone. In contrast other central bank heads focused on structural labor market issues. While ECB Lagarde was pleased with the post COVID EZ picture, current economic softness still leaves us forecasting two furt

August 20, 2025

UK CPI Review: Special Factors Pull Inflation Even Higher, but is that an Excuse?

August 20, 2025 6:47 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. And still the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in lin

August 19, 2025

UK Labor Market: Is the BoE too Complacent?

August 19, 2025 10:10 AM UTC

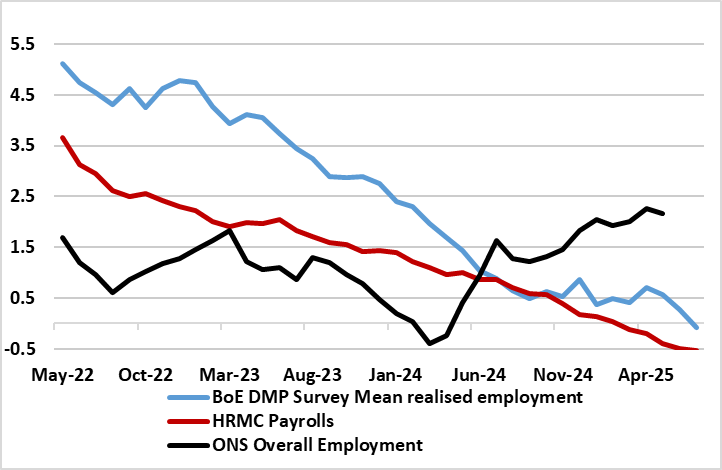

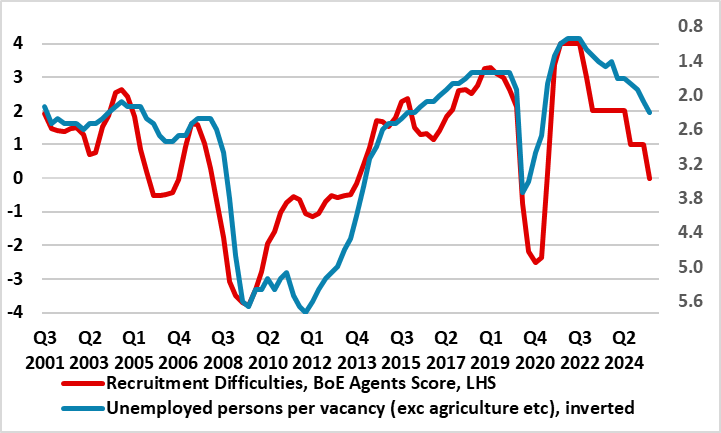

Unlike the Fed, which has dual mandate of curbing inflation and promoting employment, the BoE remit is purely the former. But it is clear that labour market considerations weigh heavily on the dovish contingent of the MPC and possibly increasingly so. However, we feel that the BOE is not fully e

August 18, 2025

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 14, 2025

UK GDP Review: Fresh Upside Growth Surprise But Partly Inventory Driven?

August 14, 2025 7:02 AM UTC

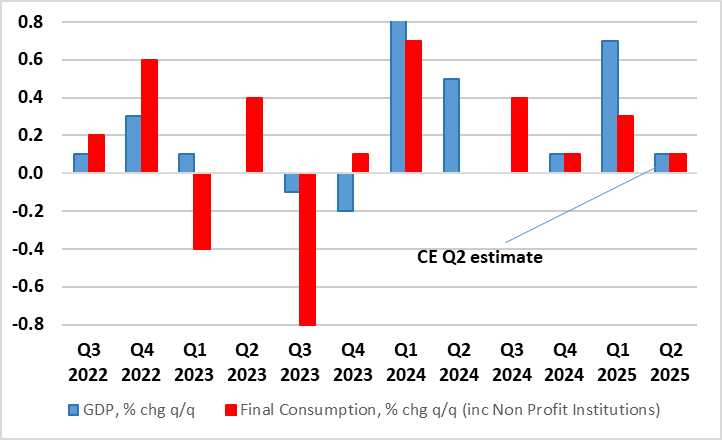

To what extent better in June GDP, not least it having been the warmest even such month in England, lay behind the fresh upside surprise that saw the economy grow 0.4%, twice generally expected and with the falls of the two previous months pared back so that a clearer uptrend has emerged (Figure 1).

August 11, 2025

UK CPI Preview (Aug 20): Services Inflation Fall Afresh r as Headline Stabilises?

August 11, 2025 2:24 PM UTC

After the upside (and broad) June CPI surprise, we see CPI inflation steady at 3.6% in July, 0.2 ppt below BoE thinking. Our relatively lower estimate factors in lower services inflation (Figure 1) and a fall back in that for food, the former allowing the core rate to unwind the increase to 3.7% s

August 07, 2025

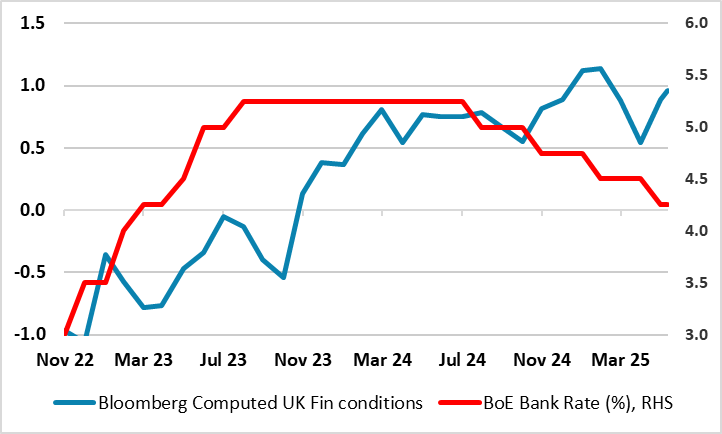

BoE Review: The (Fiscal) Elephant in the Room as the BoE Splits

August 7, 2025 12:48 PM UTC

The widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relativel

August 06, 2025

UK GDP Preview (Aug 14): Small GDP Rises Hardly Worth Shouting About?

August 6, 2025 2:48 PM UTC

There are some better signs as far as June GDP is concerned, not least it having been the warmest even such month in England. But we see only a 0.1% m/m rise (Figure 1), even with slightly better property and retail signals for the month. However, such an outcome, while a contrast to the two suc

August 05, 2025

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 31, 2025

BoE Preview (Aug 7): Labour Market Softness to Trigger Further Cut, But Fiscal Risks Loom

July 31, 2025 7:14 AM UTC

After what was widely considered to be a dovish hold at the last (June) MPC meeting (Bank Rate staying at 4.25%) which saw three dissents in favor of easing at that juncture, a 25 bp reduction is very much on the cards for the August decision. Likely to discuss its two alternative scenarios still,

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

UK Labor Market – No Lack of Slack

July 17, 2025 6:58 AM UTC

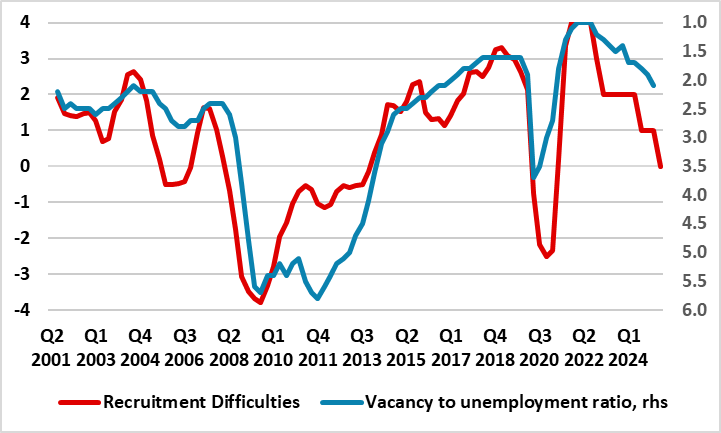

Even the BoE has acknowledged that the UK economy is developing slack in its labor market that we suggest is now not so much less tight but decidedly loose. Indeed, just days after BoE Governor Bailey suggested that signs of increasing labor market slack might prompt faster rate cuts, more such evid

July 16, 2025

UK CPI Review: Services Inflation Fails to Fall Further as Headline Surprises on Upside?

July 16, 2025 6:42 AM UTC

Calendar effects have been accentuating swings in UK CPI data of late and these may have reoccurred in the June numbers partly explaining June numbers which surprised on the upside. Indeed, June saw the headline and core rise a further 0.2 ppt – the former to an 18-mth high of 3.6%. Moreover, se

July 14, 2025

UK BoE Hints of Faster Easing Backed up by Survey Data?

July 14, 2025 8:38 AM UTC

Somewhat ironically, just as BoE Governor Bailey suggested that signs of increasing labor market slack might prompt faster rate cuts, more such evidence accumulates. In fact, as monthly survey compiled by Markit pointed to not only weaker pay pressures, falling job rolls (Figure 1) and a steep ris

July 11, 2025

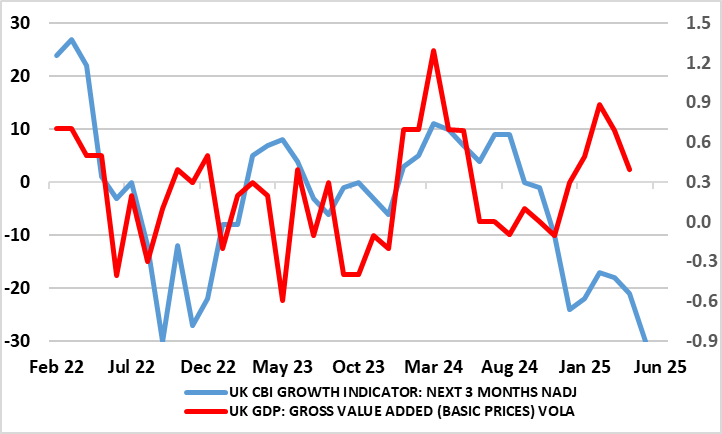

UK GDP Review: Another Downside Surprise

July 11, 2025 6:28 AM UTC

After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But that 0.3% m/m drop was almost repeated in the May numbers (Figure 1), where a further albeit smaller (ie 0.1%) fall occurred, but very much below consensus. Admittedly

July 09, 2025

UK CPI Preview (Jul 16): Services Inflation to Fall Further?

July 9, 2025 2:05 PM UTC

Calendar effects have been accentuating swings in UK CPI data of late. Indeed, the timing of Easter may have been a partial factor in the May CPI, where a distinct drop back in services and core rates failed to make the headline drop, which instead stayed at 3.4% in line with BoE thinking due to hig

UK: Risk Picture Rising and Broadening

July 9, 2025 12:35 PM UTC

The BoE’s latest message from its Financial Policy Committee notes that UK household and corporate borrowers remain resilient in aggregate while the UK banking system remains in a strong position even if economic, financial and business conditions became substantially worse than expected. But th

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

UK GDP Preview (Jul 11): Another Large Downside Surprise?

July 3, 2025 9:12 AM UTC

After two successive upside surprises, a correction back in monthly GDP was not entirely a wholesale surprise for April GDP. But we see that 0.3% m/m drop being repeated in the looming May numbers (Figure 1), thereby adding to a gloomier economic backdrop most recently highlighted by growing signs

July 02, 2025

UK: Tax Rises Looming?

July 2, 2025 8:34 AM UTC

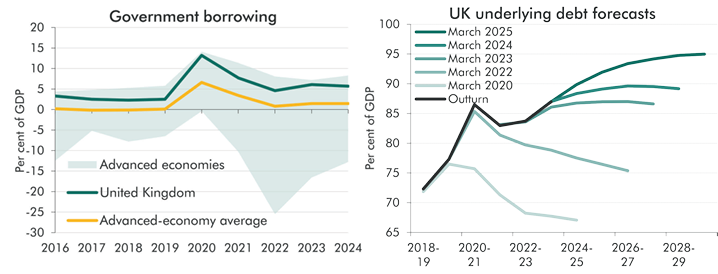

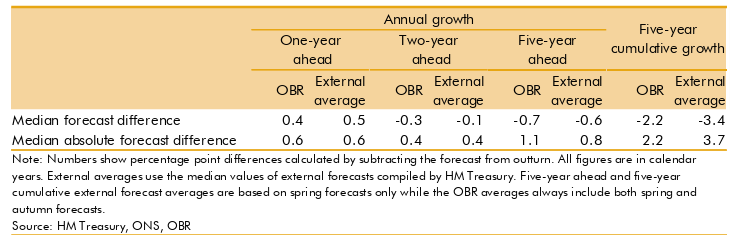

The politically damaging climb-down on welfare spending yesterday also saw the government face an additional fiscal hole after the fiscal watchdog (the Office for Budget Responsibility, OBR) hinted it has been repeatedly overestimating growth. Indeed, in its annual Forecast Evaluation Report, it s

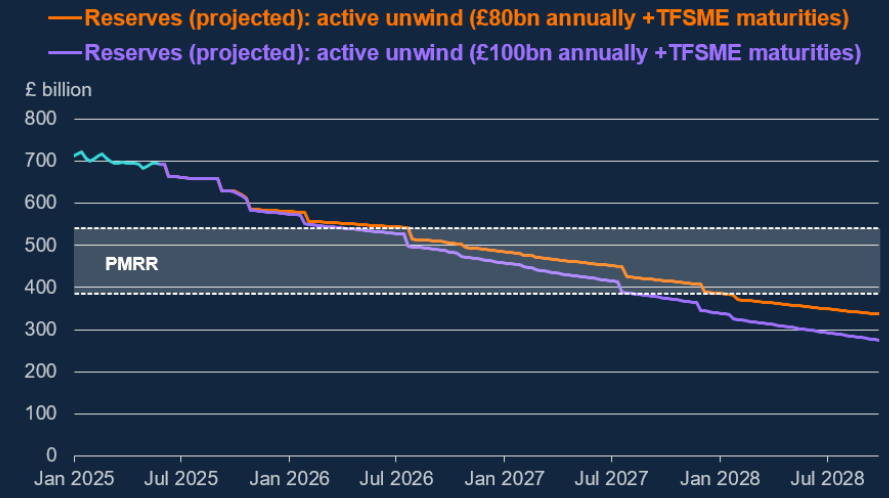

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol

June 30, 2025

U.S. and Asia Defense Partners

June 30, 2025 7:30 AM UTC

· Japan, S Korea and Australia could eventually agree to some extra commitment to increase (self) defence spending in the next 5-10 years though perhaps not targets like NATO countries. This could come as part of the trade deal negotiations currently underway. Japan and S Korea

June 27, 2025

UK Labor Market: Now not Less Tight but Genuinely Loose

June 27, 2025 8:30 AM UTC

It is clear(er) that the labor market is the key variable that the BoE is looking at to assess policy amid a backdrop where the official view is that current demand weakness may not be creating much, if any, slack as the supply side is equally anaemic. In this regard, it is also clear(er) that the

June 26, 2025

June 25, 2025

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

DM FX Outlook: USD uncertainty increases as Trump changes the rules

June 24, 2025 7:05 AM UTC

· Bottom Line: After making initial gains after the election, the USD has followed a similar path to the first Trump presidency, falling back steadily this year as optimism on the economy has faded, with the introduction of tariffs contributing to more negative sentiment. Much as in the

June 23, 2025

Iran: Measured Next Steps?

June 23, 2025 3:17 PM UTC

A measured or modest Iran retaliation could be used by the U.S. to seek a path back towards negotiation. Israel would likely want to continue to degrade Iran nuclear and military facilities, but the U.S. could eventually pressure Israel to stop. This is our baseline, though the military attac

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

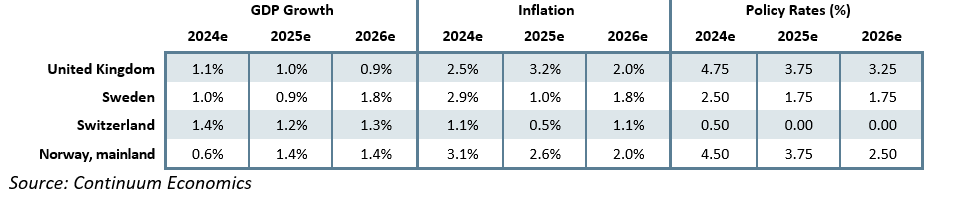

Western Europe Outlook: The First Shall be Last…

June 23, 2025 7:46 AM UTC

· In the UK, we have upgraded 2025 growth by 0.3 ppt back to 1.0%. But this is purely a result of the Q1 front-loading and instead masks what we think will be essentially a flat GDP profile into 2026. The BoE will likely ease further in H2 by at least 50 bp and maybe faster and then i

June 19, 2025

BoE Review : Labour Market Softness Triggers a Dovish Hold

June 19, 2025 11:51 AM UTC

A stable BoE policy decision was always the most likely (Bank Rate staying at 4.25%) as the MPC discussed its two alternative scenarios still, but possibly where hawks have been forced into diluting what were previous concerns about a ‘tight’ labor market. In fact, partly based on what was see

June 18, 2025

UK CPI Review: Services Inflation Falls Clearly

June 18, 2025 6:40 AM UTC

As for the UK, the main near-term inflation story was (and remains) what would happen after the April data when a series of energy, utility, post office and some other regulated and service price rises fell due, albeit now offset somewhat by a fall in petrol prices. The result was a notch higher t

June 13, 2025

BOE QT: Slowdown in September?

June 13, 2025 8:15 AM UTC

BOE QT is part of the reason behind both a steeper yield curve and subdued M4 and lending growth. The MPC in September will likely accept that to avoid impacting the monetary transmission mechanism that annual rundown of gilts needs to be slowed from GBP100bln pa to GBP75bln. Internal differences

June 12, 2025

BoE Preview (Jun 19): Splits to Continue?

June 12, 2025 12:57 PM UTC

A stable BoE policy decision next Thursday is most likely (Bank Rate staying at 4.25%) as the MPC discusses various scenarios still, possibly with any hawks diluting what were previous concerns about a ‘tight’ labor market. In fact, we see two dissents in favor of a 25 bp rate cut albeit where

Trump Tariffs: China and July 9 Reciprocal Deadline

June 12, 2025 7:17 AM UTC

We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S., most likely agreed in Q4 2025 and to be implemented in 2026. However, a 35% probability exist of no deal and this could eventually mean higher tariffs (Fig

UK GDP Review: GDP Overstating Activity Less Clearly But Looking Weaker?

June 12, 2025 6:54 AM UTC

After two successive upside surprises, a correction back in monthly GDP could be expected for the April data, especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs. In addition, real estate activity seems to have dropped after the raisin