Outlook

View:

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 01, 2025

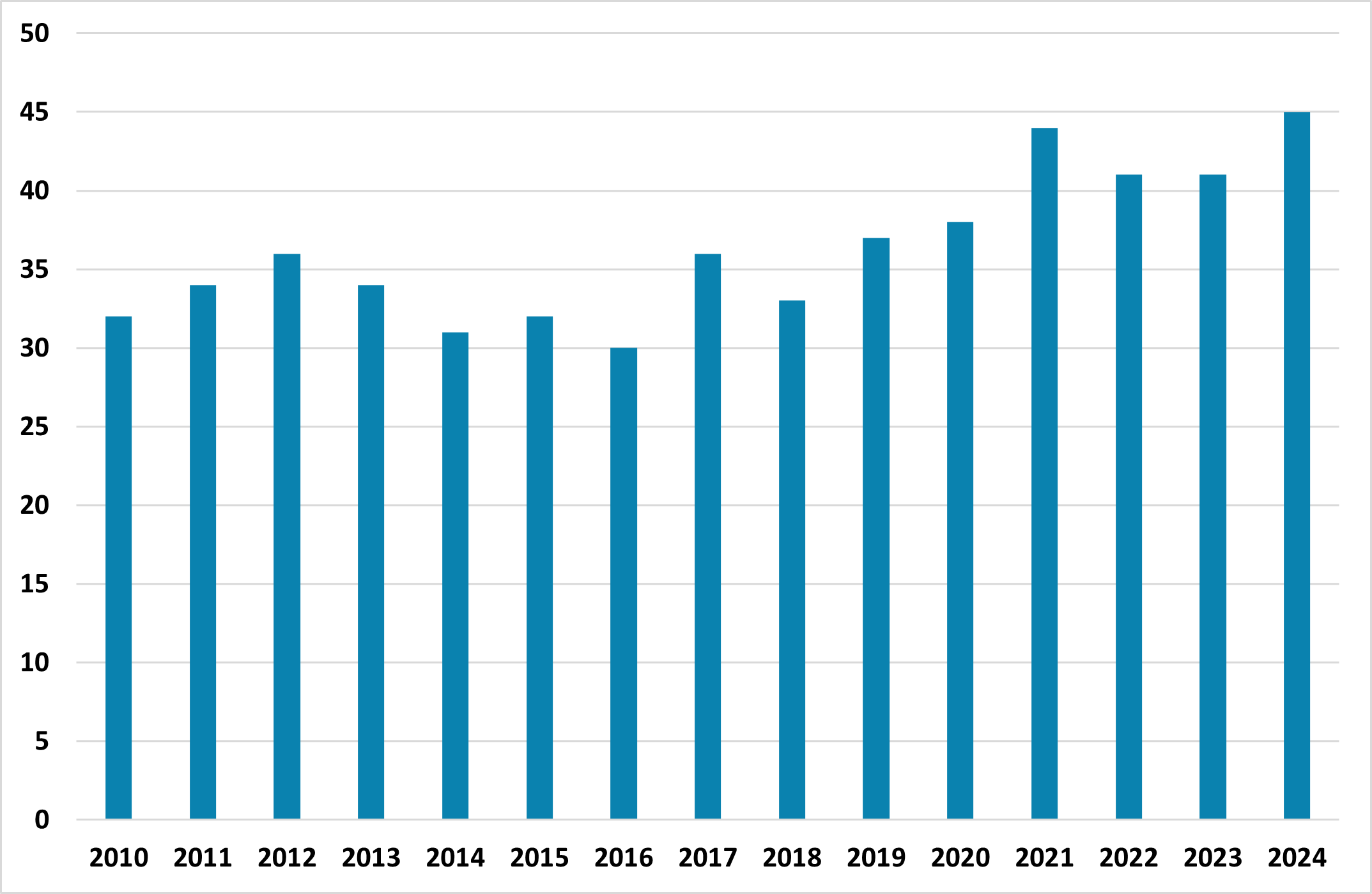

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 26, 2025

France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

August 26, 2025 7:35 AM UTC

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 02, 2025

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Asia/Pacific (ex-China/Japan) Outlook: Slower Trade, Softer Inflation, and Looser Policy

June 24, 2025 9:24 AM UTC

· Asia’s growth profile in 2025 reflects a region navigating structural transition amid external strain. Investment-led economies like India are benefitting from infrastructure spending, industrial policy momentum, and political continuity. In contrast, trade-reliant markets such as V

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

DM FX Outlook: USD uncertainty increases as Trump changes the rules

June 24, 2025 7:05 AM UTC

· Bottom Line: After making initial gains after the election, the USD has followed a similar path to the first Trump presidency, falling back steadily this year as optimism on the economy has faded, with the introduction of tariffs contributing to more negative sentiment. Much as in the

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

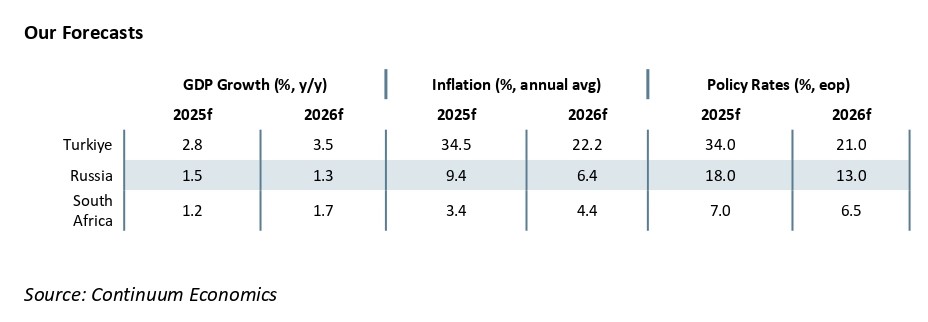

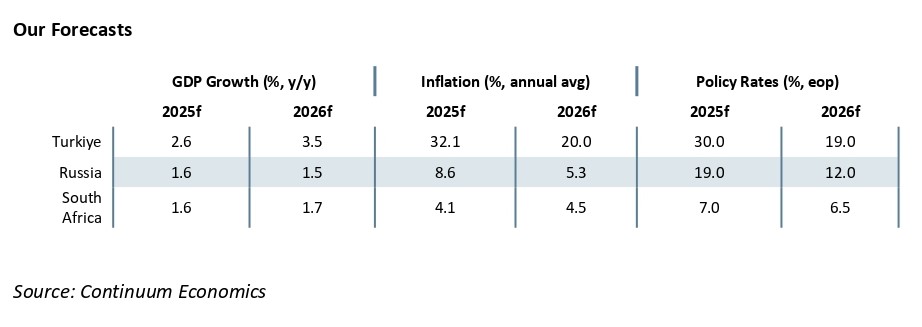

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 23, 2025

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

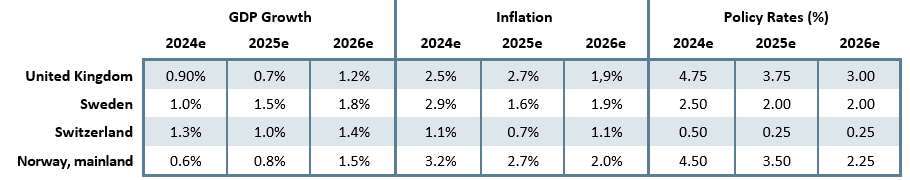

Western Europe Outlook: The First Shall be Last…

June 23, 2025 7:46 AM UTC

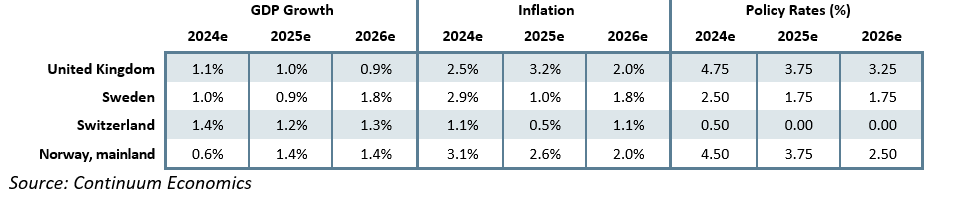

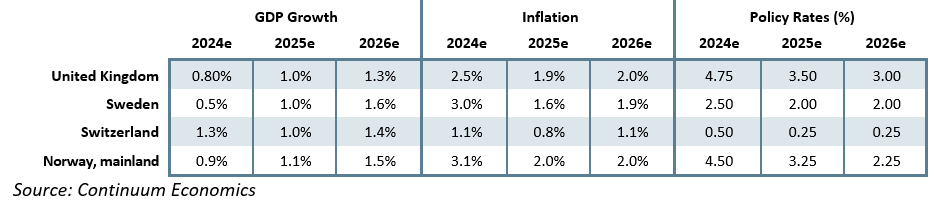

· In the UK, we have upgraded 2025 growth by 0.3 ppt back to 1.0%. But this is purely a result of the Q1 front-loading and instead masks what we think will be essentially a flat GDP profile into 2026. The BoE will likely ease further in H2 by at least 50 bp and maybe faster and then i

Japan Outlook: Hot Inflation Partially Transitory

June 23, 2025 3:00 AM UTC

· Growth in private consumption remains sluggish in Q1 2025 on negative real wages. Wage hike in 2025 so far looks little affected by U.S. tariffs and should remain above 2% for the rest of 2025. The subtle change in business price/wage setting behavior will be supportive for consum

June 20, 2025

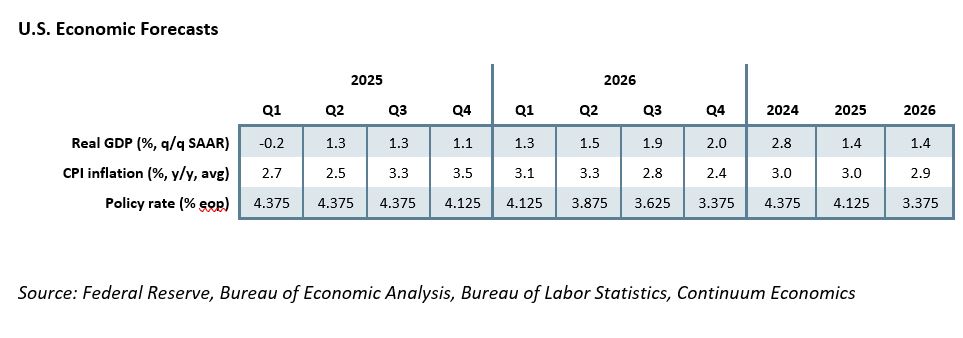

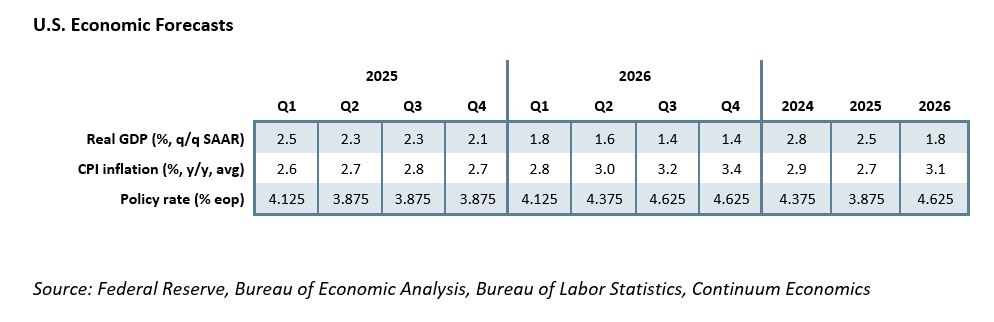

U.S. Outlook: Slowdown but not Recession, Cautious Fed Easing

June 20, 2025 2:14 PM UTC

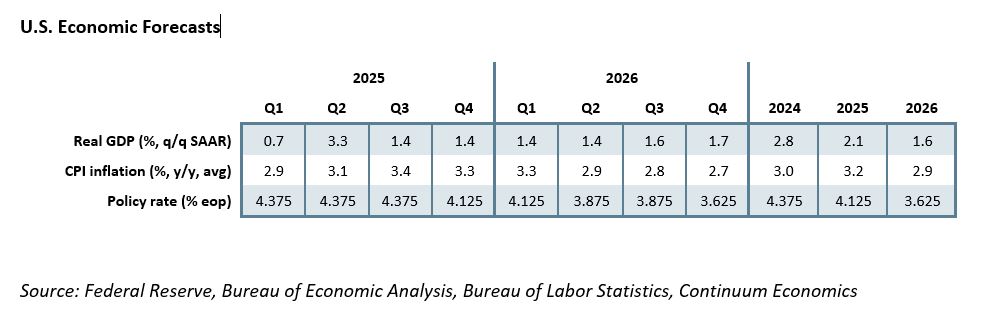

• Policy uncertainty remains high and final details of the tariffs will depend on the decisions of the courts as well as those of President Trump. However the magnitude of the tariffs is becoming easier to predict than the detail. Trump looks set to insist on a minimum average tariff of at

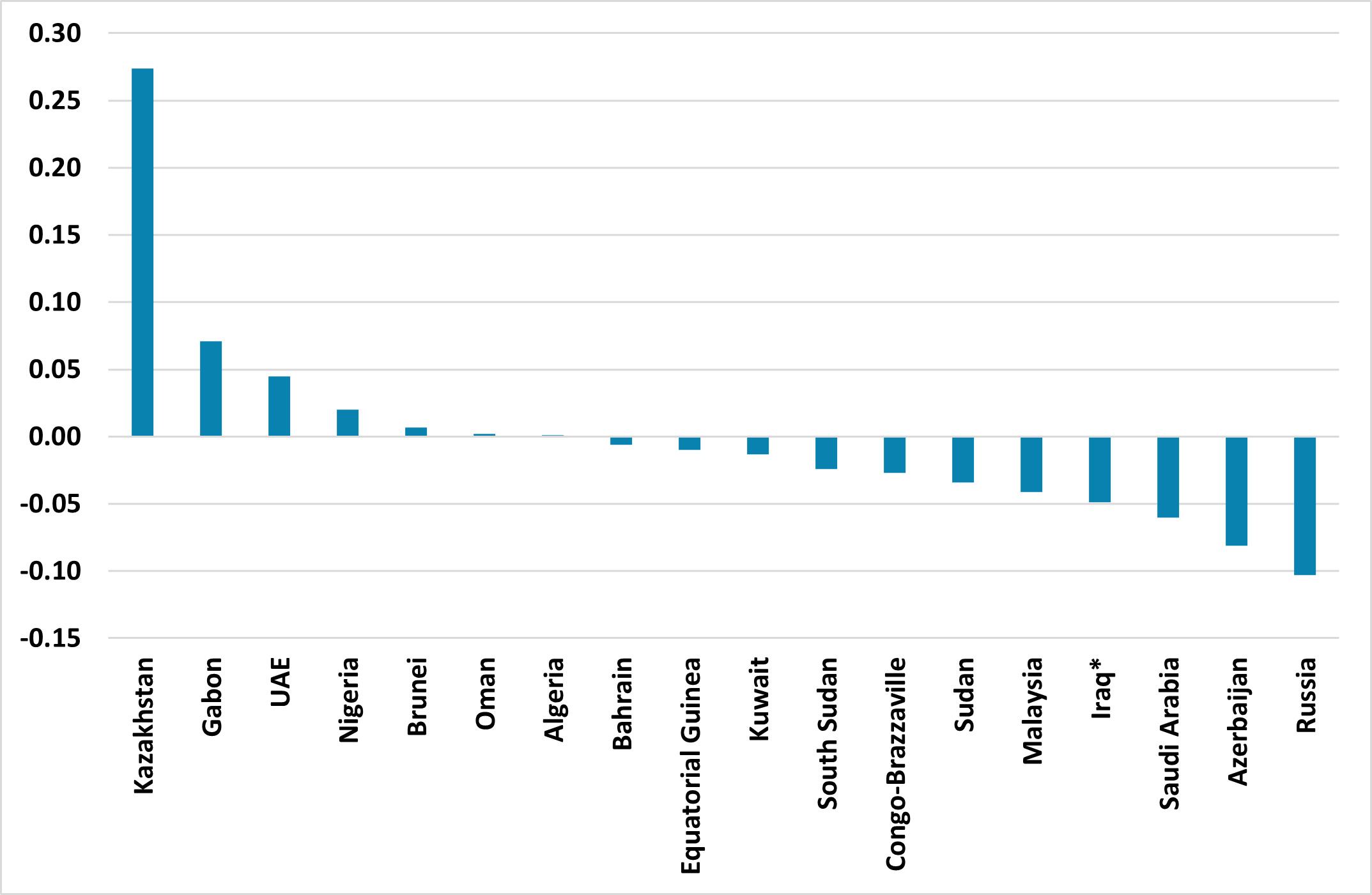

Commodities Outlook: Policy Realignment

June 20, 2025 9:30 AM UTC

In Q2 2025, eight OPEC+ countries pledged a faster oil supply hike, motivated by market share losses, internal frictions, and geopolitical shifts. However, actual output has fallen short due to overproduction offsets, domestic consumption, and capacity limits. Further gradual increases are expected,

China Outlook: Reasonable but Unbalanced Growth Trade

June 20, 2025 7:30 AM UTC

• China GDP growth remains reasonable though unbalanced. Net exports will take a hit from the trade freeze in April/May, with the impact likely to ease in H2 with the trade truce. We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tari

March 27, 2025

March 26, 2025

LatAm Outlook: Navigating the Uncertainty

March 26, 2025 9:56 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico institutional reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump victory, and the menaces of Trump imposing tar

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

Equities Outlook: Turbulence Ahead

March 26, 2025 9:05 AM UTC

· U.S. trade wars will likely hurt U.S. growth and raise inflation, with only small to modest Fed easing and a 10yr budget bill that will likely be neutral to negative for the economy. With valuations still very high (Figure 1), we see scope for a correction to extend into mid-year th

March 25, 2025

Western Europe Outlook: Price Pressures - Puzzling or Possibly Persistent!

March 25, 2025 10:47 AM UTC

· In the UK, we continue to retain our below-consensus GDP picture for this year, with growth actually downgraded and with downside risks that may actually be both increasing and materializing. The BoE will likely ease further through 2025 by at least 75 bp and maybe faster and into 202

Asia/Pacific (ex-China/Japan) Outlook: Resilience Through Realignment

March 25, 2025 10:44 AM UTC

· In 2025, growth across emerging Asia will remain steady but uneven, with investment-driven economies such as India and Malaysia outperforming on the back of infrastructure and industrial policy momentum. While global demand is set to recover modestly, geopolitical friction and tariff

Japan Outlook: Inflation Sustainably Above 2%?

March 25, 2025 10:00 AM UTC

· Private consumption will have a modest growth in 2025 along the gradual change in business price/wage setting behavior before slowing to average in 2026. Wage hike in 2025 looks to be at least on par with 2024 after early result of the spring wage negotiation. SMEs are going to be

DM Rates Outlook: Policy Divergence

March 25, 2025 9:30 AM UTC

• 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias. 10yr U.S. Treasury yields can be helped by this easing and see a move down through 2025. However, the budget deficit will likely be 6.5-7.0%

DM FX Outlook: USD under pressure as Trump policies disappoint

March 25, 2025 8:51 AM UTC

· Bottom Line: The market had expected the Trump presidency to see further fiscal expansion and consequent tight Fed policy and high US yields. But the combination of less tax cuts than previously expected and more aggressive tariff increases have led to reduced expectations for US grow

EMEA Outlook: Mixed Prospects Due to Global Uncertainties and Domestic Dynamics

March 25, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 4.1% and 4.5% in 2025 and 2026, respectively, despite there are upside risks to inflation such as remaining power cuts (loadshedding), tariff hikes by Eskom, spike in food and housing prices, and global uncertainties. We

March 24, 2025

U.S. Outlook: How Much Damage Will a Trade War Do?

March 24, 2025 3:45 PM UTC

• The U.S. economy, consumer spending in particular, ended 2024 looking healthy, but with inflation still above its 2.0% target if well off its highs. The Trump administration’s more aggressive than expected trade war has made a return to the inflation target more difficult and raised dow

Commodities Outlook: Shifting Dynamics

March 24, 2025 11:00 AM UTC

The oil market faces mixed forces, including geopolitical pressures, demand concerns, and supply shifts. OPEC+ plans production hikes, driven by stricter U.S. sanctions on Iran and Russia and President Trump’s push for more supply. However, global demand prospects, especially in the U.S. and China

China Outlook: Construction and Trade Headwinds v Policy Stimulus

March 24, 2025 9:00 AM UTC

We look for 4.5% GDP growth in 2025. Though residential property investment will subtract less from GDP growth, net exports will also be a drag on the economy in 2025 due to the trade war with the U.S. Further fiscal stimulus beyond March’s NPC measures will be required to achieve a 5% GD

December 30, 2024

December 24, 2024

December Outlook Webinar on Jan 7: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 24, 2024 8:30 AM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

December 20, 2024

EMFX Outlook: Hit From Tariffs, Before Divergence

December 20, 2024 10:00 AM UTC

· EM currencies on a spot basis will remain on the defensive in H1 2025, as we see the U.S. threatening and then introducing tariffs on China imports – 30% against the current average of 20%. China’s response will likely include a Yuan (CNY) depreciation to the 7.65 area on USD/CN

DM FX Outlook: USD to edge lower despite high yields

December 20, 2024 8:28 AM UTC

· Bottom Line: Recent strong US data has bolstered the USD, with the Trump election victory also supportive due to expectations of tax cuts and tariffs which are seen leading to less Fed easing than previously expected. While we still see the USD weakening through 2025 as Fed easing red

Japan Outlook: Lukewarm Japan and BoJ

December 20, 2024 12:00 AM UTC

· Due to the slow recovery in consumption, 2024 GDP has been revised lower to -0.5%. Private consumption will continue to grow throughout 2025/26 gradually as business price/wage setting behavior gently shift and Japanese consumers adapting to higher inflation. Wage growth in 2025 wil

December 19, 2024

Western Europe Outlook: Divergent Policy Thinking

December 19, 2024 2:12 PM UTC

· In the UK, perhaps the main story in our outlook is that we retain our below-consensus GDP picture for next year, with growth of 1.0% and with downside risks. The BoE will likely ease further through 2025 by at least 100 bp and maybe faster and beyond.

· As for Sweden, d

DM Rates Outlook: Policy and Spread Divergence

December 19, 2024 12:07 PM UTC

• 2yr U.S. Treasury yields can decline initially as the Fed finishes easing (Figure 1), but as the sense grows that the rate cut cycle is stopping, we see the 2yr swinging to a small premium versus the Fed Funds rate – as the market debates the risks of a future tightening cycle. For 10y

Asia/Pacific (ex-China/Japan) Outlook: Trump Tariffs, China +1 and Growth

December 19, 2024 10:57 AM UTC

Emerging Asian economies are projected to lead global growth in 2025, with India and Southeast Asia at the forefront. These regions will anchor resilience in Asia, even as China's economic growth remains moderate.

Inflation trajectories will vary across Asia, with India experiencing sticky prices

Outlook Overview: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 19, 2024 9:25 AM UTC

· The U.S. economy momentum remains reasonable before President elect Trump’s policies impact in 2025 and 2026. While high uncertainty exists on the scale and timing of policies, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats

U.S. Outlook: Healthy Economy Facing Policy Risks

December 19, 2024 8:01 AM UTC

• The U.S. economy, consumer spending in particular, has continued to show surprising resilience, and is growing at a pace probably in excess of long-run potential near 2.0%. Inflation has fallen significantly from its highs, with core PCE inflation now running slightly below 3.0%, but rema

December 18, 2024

LatAm Outlook: Economic Shifts

December 18, 2024 5:21 PM UTC

· Brazil and Mexico economy are likely to decelerate in terms of growth in 2025, although we see this being stronger in Mexico. Mexico legal reforms and its close ties with U.S. increases uncertainty for 2025, especially after Trump elections, although we see tariffs in 2025 as unlikely

Jan 7 Outlook Webinar: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

December 18, 2024 1:23 PM UTC

The U.S. economy’s momentum remains reasonable before the impact of President-elect Trump’s policies in 2025 and 2026. While high uncertainty exists on the scale and timing of policy, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats