Outlook Overview: The Trump Effect- Tariffs, Fiscal Shifts and Geopolitics

· The U.S. economy momentum remains reasonable before President elect Trump’s policies impact in 2025 and 2026. While high uncertainty exists on the scale and timing of policies, the strategic bias is clear – sizeable tax cuts that will boost the budget deficit; tariffs (threats and actual) to get trade and other concessions; immigration crackdown and less war in the world. This led us to see a boost to the U.S. economy and inflation into 2026, which will likely cause the Fed to end easing at 3.75-4.00% by June 2025 and undertake 75bps of tightening in 2026.

· The economic and policy outlooks for other countries around the world depend on the spill over of new U.S. policies but also divergent domestic conditions. In DM, EZ recovery is slow due to lagged energy price shock/ECB tightening still feeding through, and the high prospect of some tariffs against Germany and/or EU. Though Germany will likely undertake fiscal stimulus and relax its debt brake post-election/other EZ countries and the EU are unlikely to. ECB policy rates are thus set to fall to 2% in 2025. On balance, we also feel that a ceasefire will be seen in Ukraine in 2025 followed by multi-party peace talks, which will reduce geopolitical uncertainty. Other European countries will also extend easing, especially the UK. BOJ policy tightening will also continue in H1 2025, as inflation remains high enough for some further policy normalization before Japan’s economy slows and the policy rate peaks at 0.5%.

· In EM, China will likely see a true stimulus package of Yuan3-5trn in 2025, plus Yuan weakness to partially counterbalance the adverse effects of a trade war on growth, with 4.5% GDP growth is likely for 2025 and 2026. Other Asia EM countries will have to deal with the spillover from trade wars including Yuan weakness, plus an initially generally strong USD in H1 2025, which will slow policy easing. However, these headwinds can ease late 2025, as we expect a new U.S./China trade deal to ease tensions.

· Other major EM are divergent, though we feel that Mexico will likely reach a deal with the Trump administration in 2025, as it compromises to keep the important relationship with the U.S. Meanwhile, though the Trump administration will return to maximum pressure on Iran, Donald Trump has no interest in starting a war.

· For financial markets, 2025 will likely be a game of two halves. US exceptionalism will likely drive US equities to extend outperformance in H1, while the USD rises further as tariff (threats and actual) escalate. However, 10yr U.S. Treasury yields will likely push higher, which can hurt the U.S. equity market and the USD will likely lose ground in H2 on concerns about the U.S. economy medium term against a backdrop of an overvalued USD. 10yr U.S. yields can spike to 5% and prompt a U.S. equity market correction in 2026. Ex U.S. Equities will likely have a choppy 2025, but India and Brazil look good in 2026. Germany and UK can decouple with no rise in 10yr yields, as the ECB and BOE keeps easing.

· Risks to our views: If new fiscal policy stimulus is moderate rather than aggressive and tariffs are targeted, then the U.S. inflation risks would be less and the Fed could continue easing in H2 2025. Alternatively, an 8-9% of GDP budget deficit could see intense funding pressure that drives up 10yr U.S. yields to above 5.5% that hurts the U.S. economy, and causes a bear market in U.S. equities.

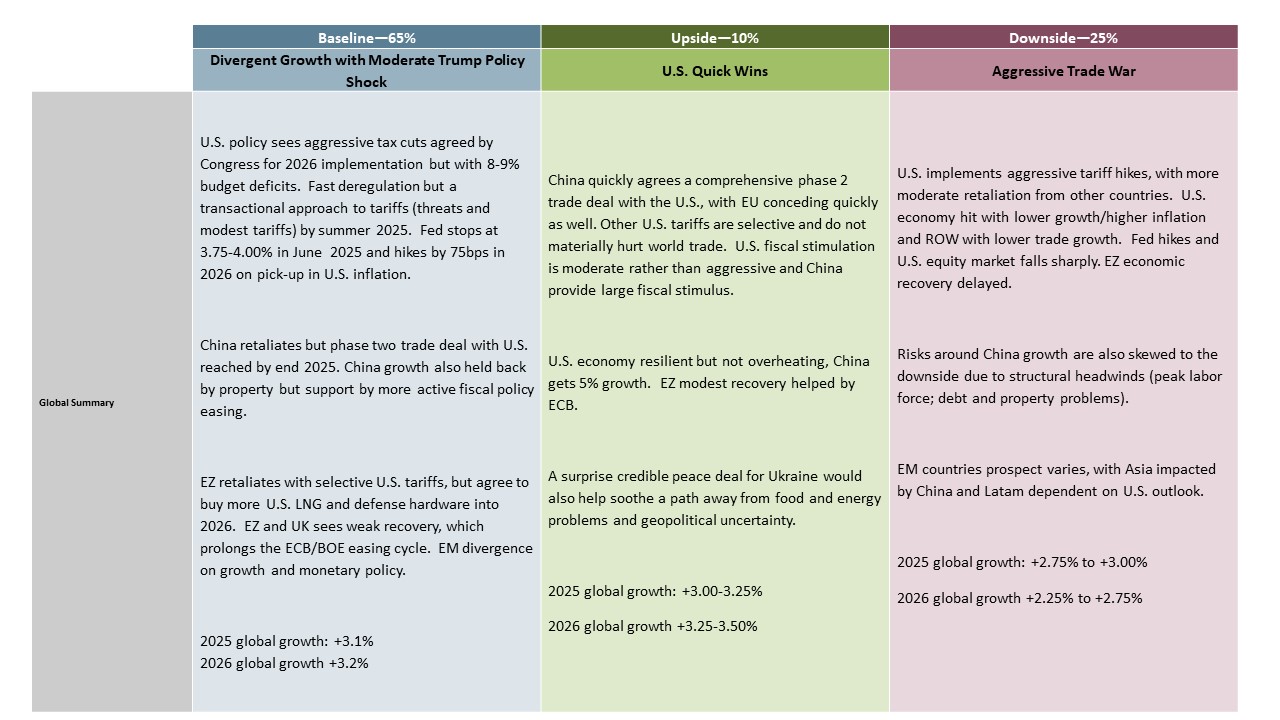

Figure 1: Economic Scenarios

Source: Continuum Economics

Market Implications

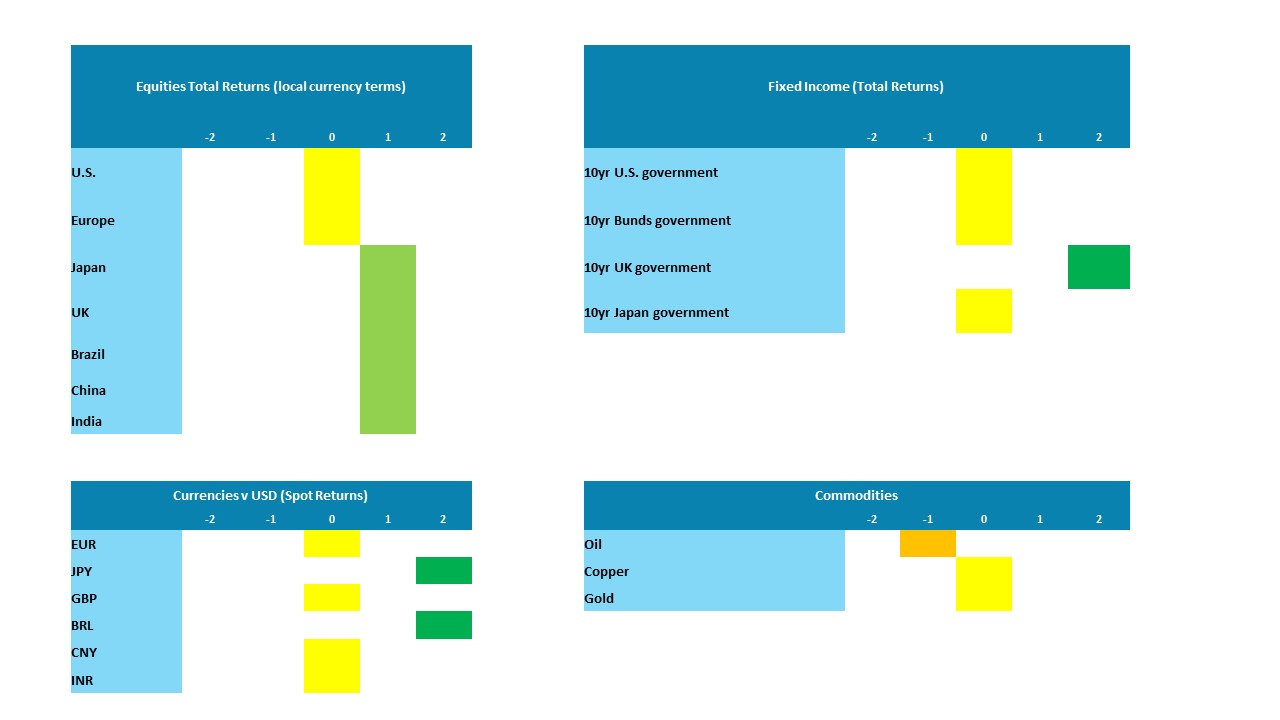

Figure 2: Asset Allocation for the Next 12 Months

Source: Continuum Economics Note: Asset views in absolute total returns from levels on December 18 2024 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

· Government Bonds. U.S. 10yr yields can move sideways with Fed easing in H1 2025, but then are likely to push higher H2 to 5% as the prospect of an 8-9% budget deficit causes concerns over heavy issuance in the U.S. Germany and UK can decouple with no rise in 10yr yields, as the ECB and BOE keep easing. JGB yields can keep rising as BOJ tightens further in H1 2025.

· Equities. H1 2025 can see U.S. exceptionalism pushing U.S. equities still higher and outperforming other DM equity markets. H2 2025 will likely see a drift lower on concerns that overvaluation is high in the face of high and rising 10yr U.S. Treasury yields. 2026 will likely see a U.S. equity market correction. Japan preferred in DM for 2025, and EM Asia ex China in the EM space.

· FX. U.S. growth/tax cuts and tariffs against China will likely strengthen USD in H1 2025, especially EM currencies as China will likely undertake Yuan depreciation to 7.65 on USDCNY. However, USD is more overvalued than Trump’s 1st term and USD will likely see a H2 reversal against DM majors and select EM (BRL/MXN).

· Commodities. WTI oil prices are forecast to end 2025 at USD65. China stimulation, plus healthy U.S. growth will help demand, but OPEC+ will cap prices by removing voluntary cuts followed by official production cuts in 2026. Gold underpinned by renewed central bank buying including China, though high real interest rates risk intermittent corrections.

Figure 3: Key Events

| February 23, 2025 | German Federal Election | After a collapse of what was always a strained three-party coalition, an early general election is now slated for February. Opinion polls suggest that the current main opposition CDU will become the largest party but will require the support of either/both the Greens and SPD who are part of the current administration – none will work with the very right-leaning AfD. Whichever coalition is formed, and given the CDU’s drift to the right, there will be fresh strains, most notably over defence spending and Ukraine, but there may be some agreement on amending the debt brake currently hampering budget policy. |

| From July 2025 | French Parliamentary Election | The surprise snap parliamentary election last July, much to President Macron’s consternation actually made his minority government even weaker, instead creating three clear factions with the legislature. Opinion polls suggest that when a fresh election occurs (which cannot occur before July due to the constitution) this will not change materially with adverse fiscal and economic implications. President Macron may come under pressure to resign, but is likely to try and complete his term which runs to 2027 but the political impasse, via any possible fiscal and economic crunch could yet trigger further political upheaval. |

| By September 27, 2025 | Australia House of Parliament election | The Australian election will see 150 seats from House of Representative's and more than half of the Senate’s seats to be contested. Early polls are seeing a pretty close call with the ruling labor party slightly in disadvantage. |

| By October 20, 2025 | Canada Federal Election | Canada’s election is likely to deliver a Conservative majority, led by Pierre Poilievre, ending the tenure of Liberal Prime Minister Justin Trudeau that has persisted since 2015. A business friendly-government would likely be seen, but plans to balance the budget while cutting taxes may be difficult to combine. We would expect no major change from the current stance of modest budget deficits, but Trump may be less inclined to place tariffs on a Conservative-governed Canada than a Liberal one. |

| October 26, 2025 | Argentina Legislative Election | Argentina will hold legislative election in 2025. Half of the Chamber of Deputies (127 seats from 257) will be renovated for a four-years mandate. Additionally, one third of the Senate (24 seats for 74) will also be renovated for a 6-years mandate. Most of the polls are pointing that President Javier Milei party will increase the participation of his far-right party, La Libertad Avanza, in both houses while other centre-right parties, such as PRO, will likely lose seats. The left and centre-left are expected to diminish in seats and they will likely be more fragmented than before. |

| July 27, 2025 | Japan House of Councillors election | The LDP’s approval rating continues to slide and we may see the LDP losing more seats in the future if the current economic picture does not change or more scandal being exposed. The 2025 House of Councillors Election is scheduled for July 27. It will elect half of the 248 Councillors (Upper House). Currently, polls are showing that the ruling LDP will continue to lose seats. |

| ctober 4 and 26, 2025 | Brazil General Election | In 2026, Brazil will hold general elections to elect the next President, renew all the Chamber of Deputies seats, and two-thirds of the Senate, while also electing the governors of all Brazilian states. Lula will likely seek re-election, while the candidate representing the right/center-right remains undefined, as Jair Bolsonaro is expected to be ineligible due to decisions by electoral authorities. The likely scenario is that the governor of São Paulo will succeed Bolsonaro in an attempt to challenge President Lula. However, an irrational decision by Bolsonaro, such as nominating his son for the presidency resulting in a fragmented opposition, cannot be ruled out. |

| November 3, 2026 | U.S. Mid Term Elections | All seats in the House and a third of the seats in the Senate will be up for election. With the current Republican majority in the House of five seats being marginal even a modest level of disappointment in the Trump administration could see the Democrats gain control of the House, but it will be a lot harder for the Democrats to make the necessary gain of 4 seats in the Senate. |

Source: Continuum Economics