Asia/Pacific (ex-China/Japan) Outlook: Trump Tariffs, China +1 and Growth

Emerging Asian economies are projected to lead global growth in 2025, with India and Southeast Asia at the forefront. These regions will anchor resilience in Asia, even as China's economic growth remains moderate.

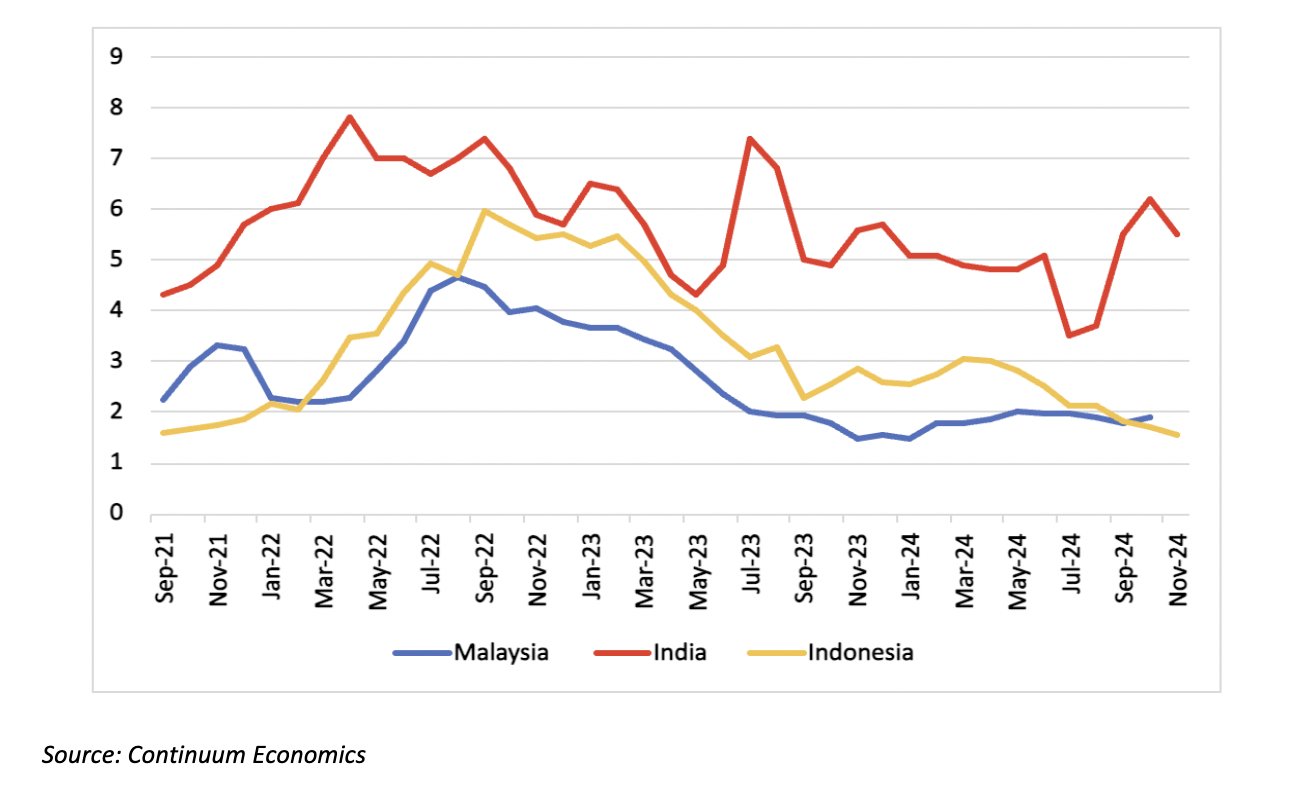

Inflation trajectories will vary across Asia, with India experiencing sticky prices and Malaysia seeing a rise, as subsidy withdrawal continues. Minimum wage hikes will support demand but also drive up price pressures. The Federal Reserve’s anticipated 2025 rate cuts will influence policy shifts in Emerging Asia, though the adjustments are likely to be more measured to safeguard financial stability and also as Trump tariff threats against China will weaken the Yuan and soft Asian currencies generally. Policy easing will likely slow in 2026.

Countries are set to prioritise investments in infrastructure as the China+1 strategy attracts increased foreign investments. Fiscal consolidation is expected to improve as governments channel resources toward development-oriented spending rather than populist measures, though Indonesia may remain an exception.

The potential imposition of U.S. trade tariffs on Chinese goods could create ripple effects across Asia. While it may pressure economies with strong linkages to China, it could also accelerate the China+1 strategy, benefiting nations like India, and the Philippines, as they absorb redirected investments and production capacities. Vietnam could face direct tariff threats by the U.S. (here).

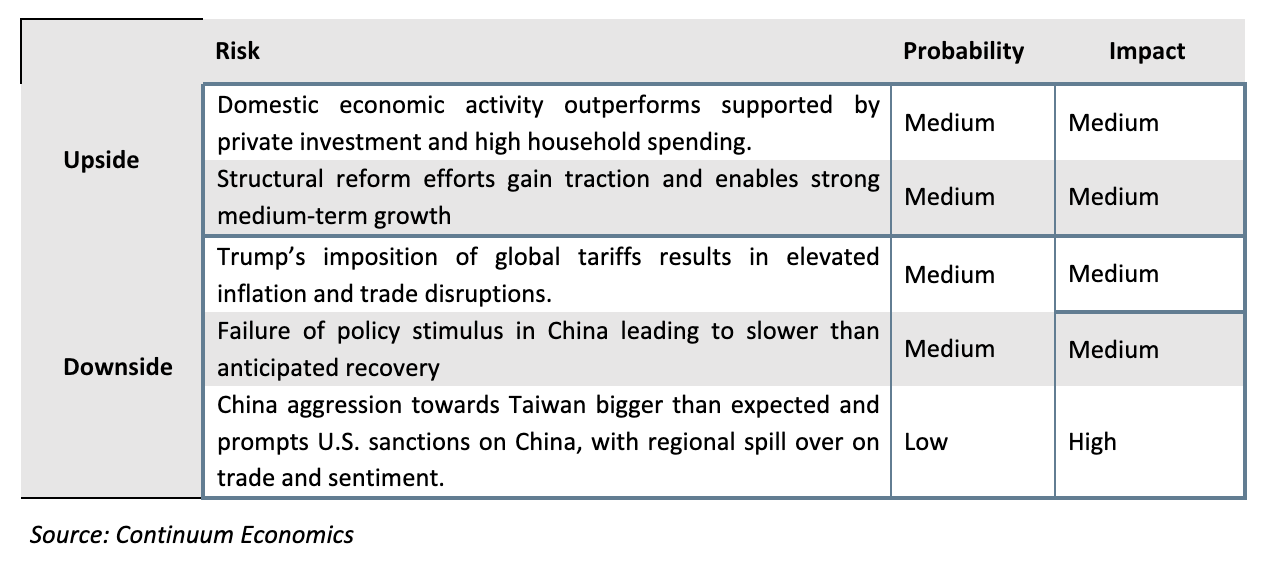

Key Risks: U.S. trade tariffs and shifting trade dynamics, slower than anticipated growth in China, structural weaknesses, and climate-related vulnerabilities remain the primary risks to Asia’s growth prospects.

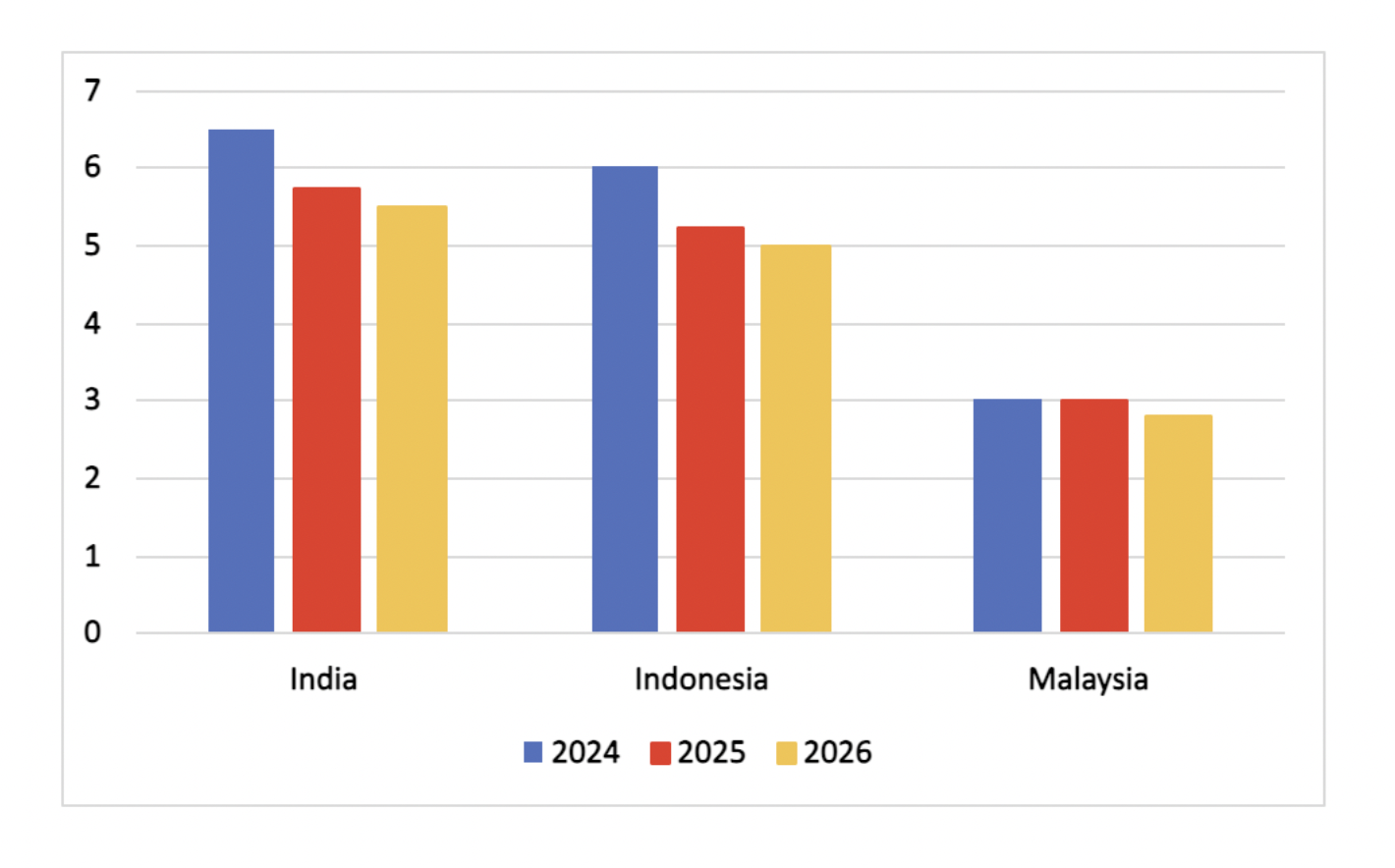

Forecast changes: Lower-than-expected growth and easing private consumption in India has prompted a downward revision to our forecast for 2025. Meanwhile, Indonesia is expected to face slightly lower inflation than previously forecast in 2025. On the policy front, we now expect no rate cuts in Malaysia in 2025, and only three cuts in both India and Indonesia of 25bps each.

Our Forecasts

Risks to Our Views

Growth Momentum and Economic Resilience

With the spectre of U.S. trade tariffs looming over China, only moderate growth in China, and the outlook for Asia is uncertain. The region’s economies are projected to expand at a slower pace, primarily driven by domestic consumption, strategic investments in technology, and a favourable inflationary environment allowing some policy easing. Despite challenges, Emerging Asia remains a vital contributor to global economic growth.

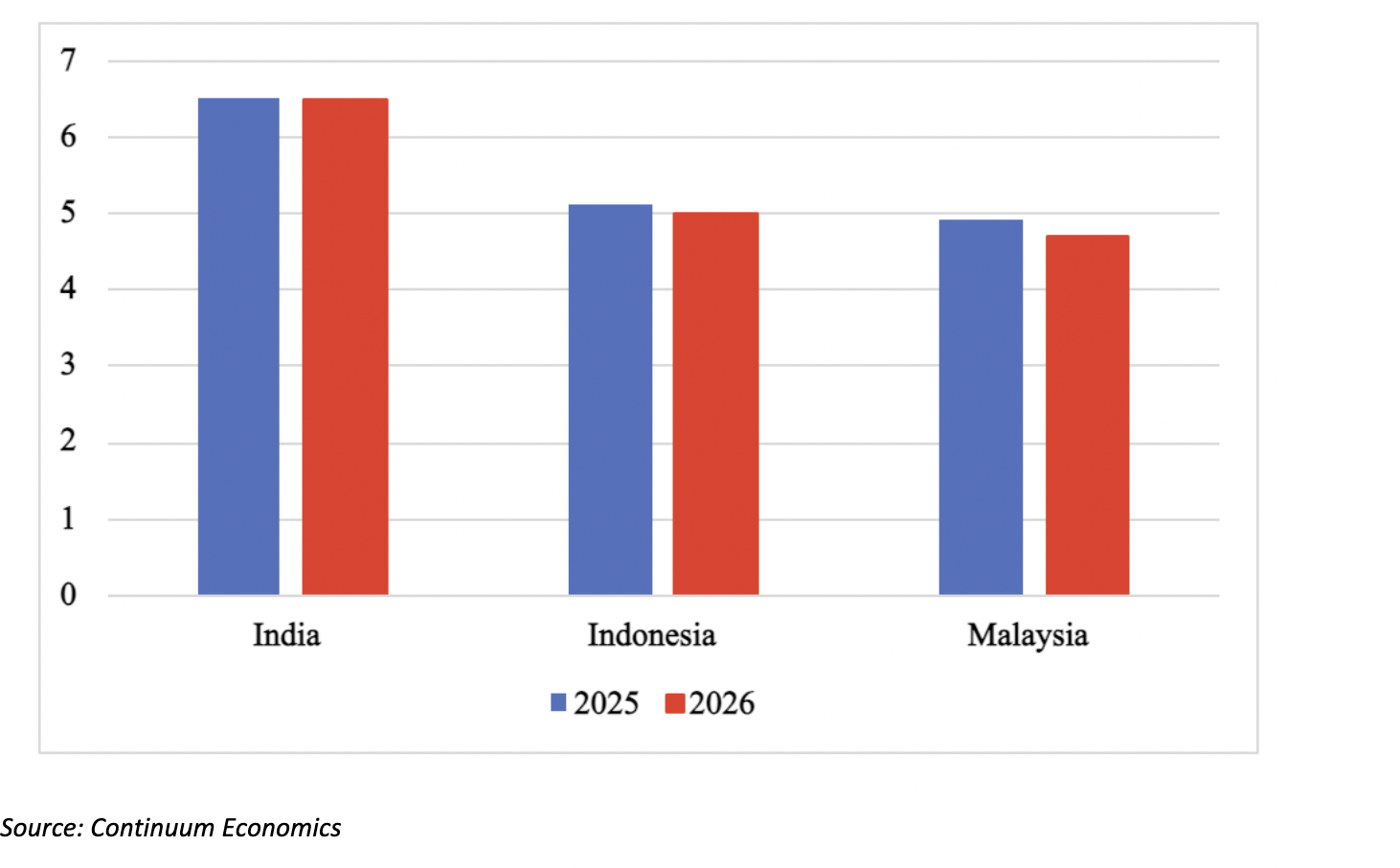

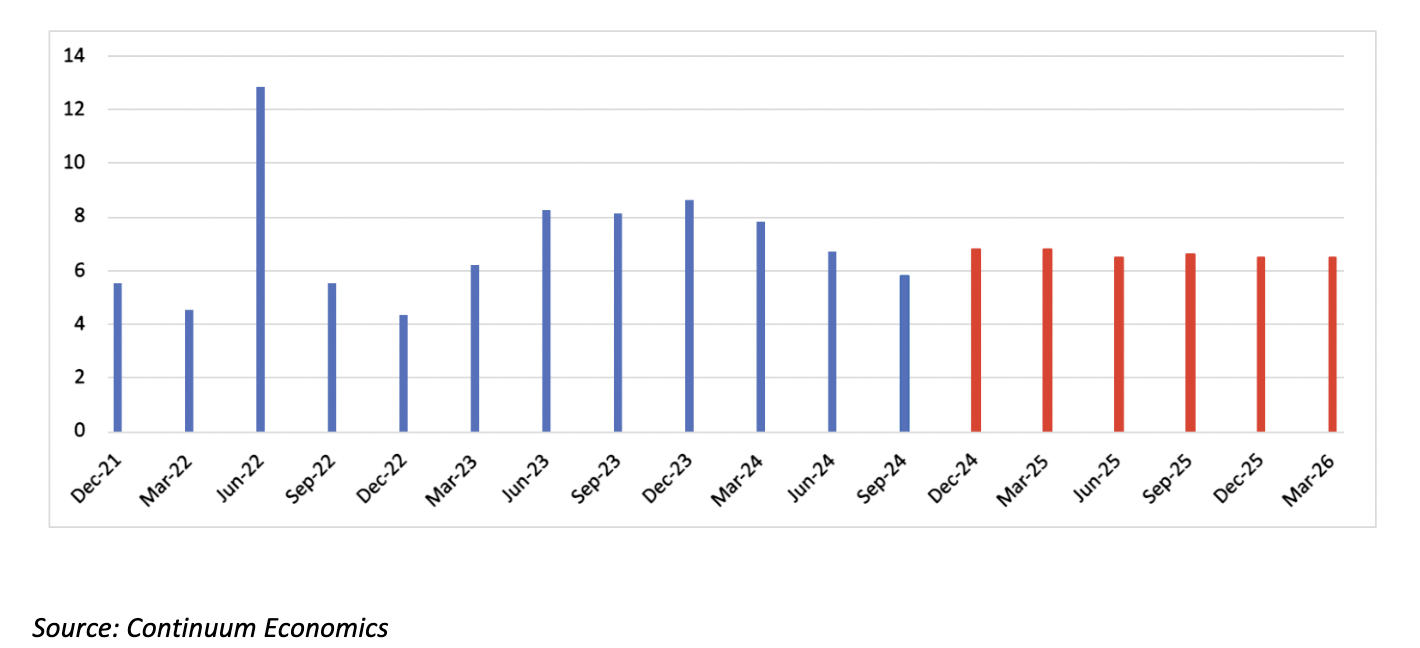

Figure 1: Real GDP Growth Forecast 2025-26 (% change, y/y)

In 2025, the region is expected to experience stable but decelerating growth, influenced by ongoing economic restructuring in China. Our projections indicate that China's growth may slow to 4.5%, primarily due to structural shifts (population aging/slowing productivity) and external pressures, including anticipated increases in U.S. tariffs on Chinese imports. The latter could lead to a decline in China's export competitiveness and ripple effects throughout Asia, impacting demand for imports from neighbouring countries. Yet, amid these headwinds, countries like India and Indonesia are anticipated to maintain robust growth rates fuelled by rising domestic demand and infrastructure investments – they are also not on the Trump administration radar (here).

In 2025, the region is expected to experience stable but decelerating growth, influenced by ongoing economic restructuring in China. Our projections indicate that China's growth may slow to 4.5%, primarily due to structural shifts (population aging/slowing productivity) and external pressures, including anticipated increases in U.S. tariffs on Chinese imports. The latter could lead to a decline in China's export competitiveness and ripple effects throughout Asia, impacting demand for imports from neighbouring countries. Yet, amid these headwinds, countries like India and Indonesia are anticipated to maintain robust growth rates fuelled by rising domestic demand and infrastructure investments – they are also not on the Trump administration radar (here).

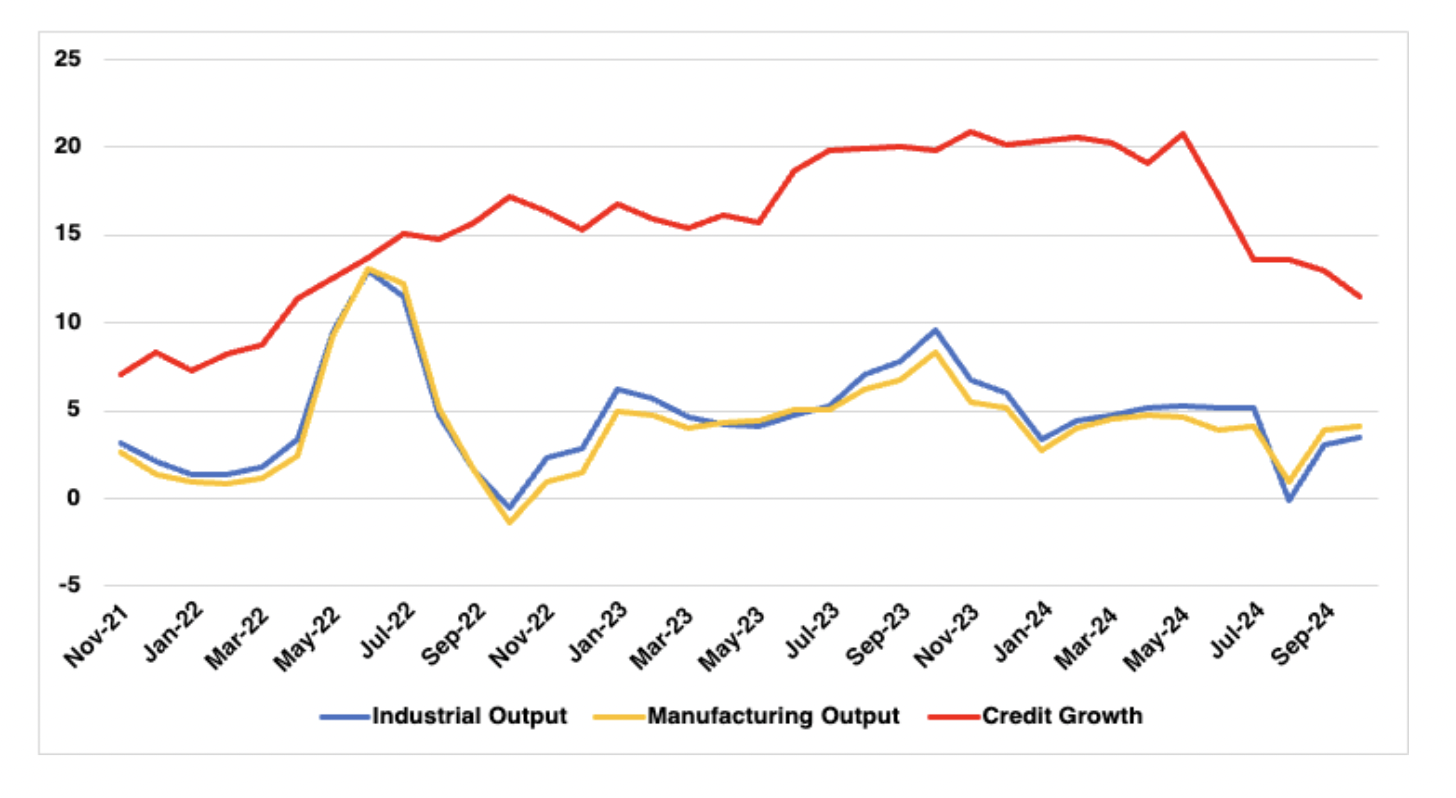

Figure 2: Asia Inflation Trajectory (% change, yr/yr)

Inflationary pressures are expected to ease across Asia, with central banks shifting from tight monetary policies to more accommodative stances. Falling commodity prices and reduced supply chain disruptions will contribute to price stability. While inflation will vary by country—especially in sectors like energy and food—overall moderation will provide policymakers with the flexibility to stimulate growth through fiscal measures. On the monetary front, policy will be broadly accommodative but the pace and quantum of easing will vary from country to country depending on inflation trajectories (see Our Forecasts).

Trade dynamics will shift as countries strengthen intra-Asia ties through bilateral agreements and regional pacts. However, geopolitical tensions, particularly between the U.S. and China, could disrupt trade flows and create uncertainties. Countries with significant trade surpluses with the U.S. may face risks if tensions escalate further (example Vietnam). In summary, while Emerging Asia's outlook for 2025 reflects a blend of resilience and caution, strategic investments and domestic demand will be crucial for sustaining growth amidst external pressures, including U.S. tariffs and geopolitical challenges.

Figure 3: Benchmark Policy Rate Forecast (%)

India: Priced Out of Progress?

India’s economy has shown resilience in the face of challenges over recent years, but the pace of growth is now moderating. We expect the growth to plateau around the 6.5-6.7% range in the medium term. India's growth trajectory for the upcoming year FY26 (April 2025-March 2026) is expected to remain positive, although at a slower pace than previously anticipated. The government’s commitment to infrastructure development and the expansion of the manufacturing sector, coupled with strong consumption in rural areas, will continue to support overall growth. However, several challenges loom. For FY26, we expect India’s GDP growth to decelerate further to around 6.5%, down from an estimate 6.6% in FY25 (April 2024-March 2025). The slowdown is attributable to weaker-than-expected private consumption, which has been constrained by high living costs and persistently low urban purchasing power. Elevated price pressures over FY24 have drained urban savings leading to cautious discretionary spends. Although rural consumption is rising, it is unlikely to fully offset the softness in urban demand.

Figure 4: India Growth Forecast (% yr/yr)

Moreover, private investment is only gradually recovering from the pandemic shock, and corporate margins remain pressured due to tight lending conditions. Nonetheless, private investment trends, along with developments in bank credit, debt issuance, and external commercial borrowing, indicate a rising momentum in infrastructure-related sectors such as chemicals, cement, metals, machinery, and power. The real estate market is thriving at both premium and mid-tier levels, with growth expected to extend into lower-tier cities. Meanwhile, exports, while benefiting from lower global crude oil prices and a recovery in demand for pharmaceuticals and consumer electronics, will likely face headwinds, particularly from potential U.S. tariffs on China and potentially EU. Despite these risks, a combination of government fiscal policies and moderate commodity prices will provide some cushion to growth.

Figure 5: India Industrial Output, Manufacturing Output, Credit Growth (% yr/yr)

The government’s substantial public spending on infrastructure—particularly through projects like the Bharatmala national highway expansion, multi-modal logistics parks, and increased railway and airport investment—will continue to stimulate economic activity. In addition, the expansion of the Production-Linked Incentive (PLI) schemes, particularly in sectors like pharmaceuticals, chemicals, and electronics, are expected to help sustain growth in manufacturing. Infrastructure projects are expected to generate substantial multiplier effects on growth in FY26 and FY27 (April 2026-March 2027), improving India's operational landscape. The government will continue to avoid large-scale populist measures, which would hinder fiscal consolidation efforts. Instead, it will maintain a focus on infrastructure development and the expansion of the PLI schemes to support manufacturing. Government initiatives aimed at promoting exports, coupled with rising interest in the large yet underutilised domestic market and a shift away from reliance on China, will prompt multinationals to collaborate with local firms for export-oriented manufacturing. However, the reduced majority of the BJP-led NDA government may hinder its capacity to implement necessary reforms to attract the investment.

The agricultural sector is expected to experience moderate growth, buoyed by favourable monsoon conditions and a pick-up in rural demand, although challenges like low productivity and inadequate investment in climate-adaptive farming practices will persist throughout 2025 and 2026. On the services front, India’s growing digital economy will remain a key driver of economic expansion. This sector is expected to continue benefiting from a surge in demand for IT, financial services, hospitality, and telecommunications. Tourism demand will also remain strong in FY26. Services exports could face headwinds in FY27 because of tariffs from the US.

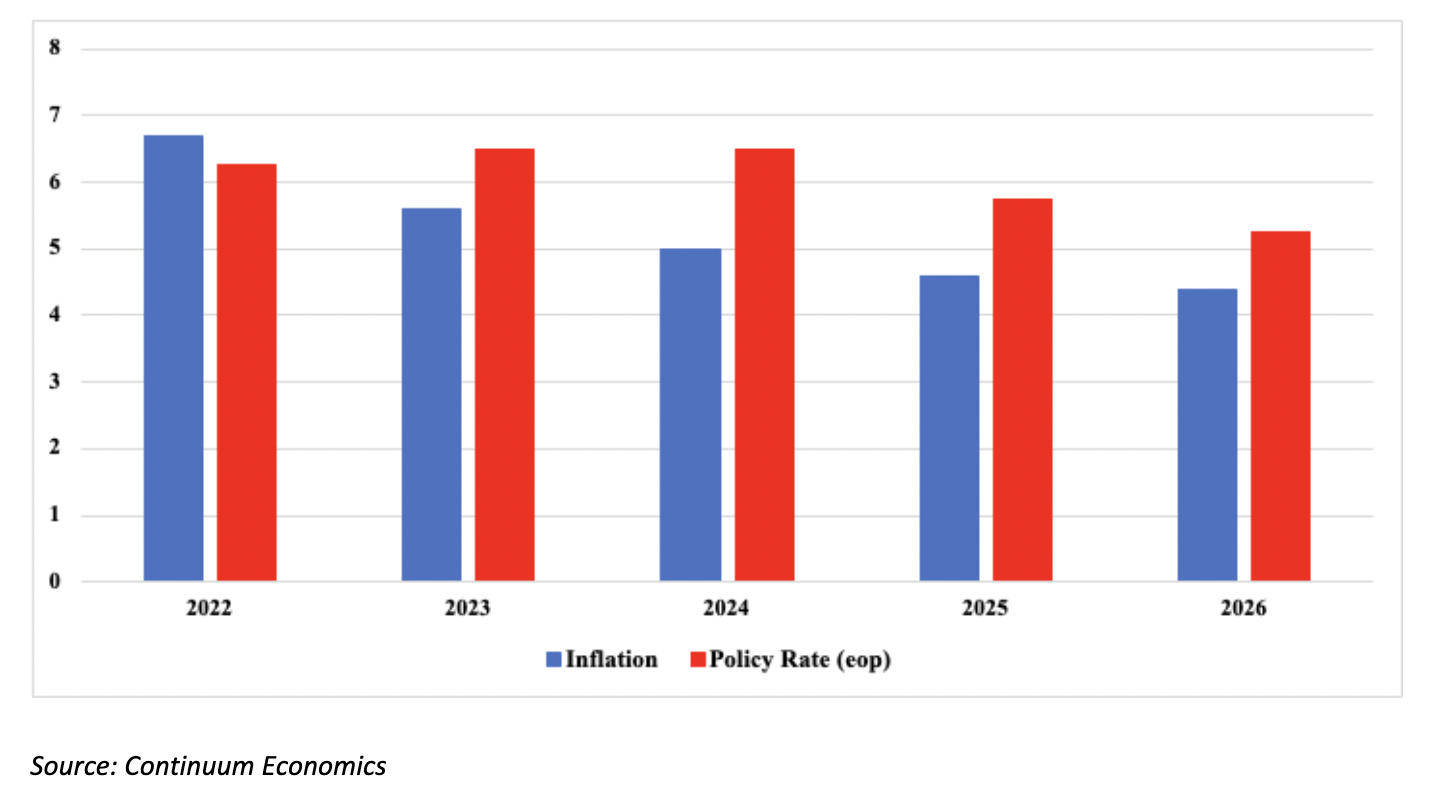

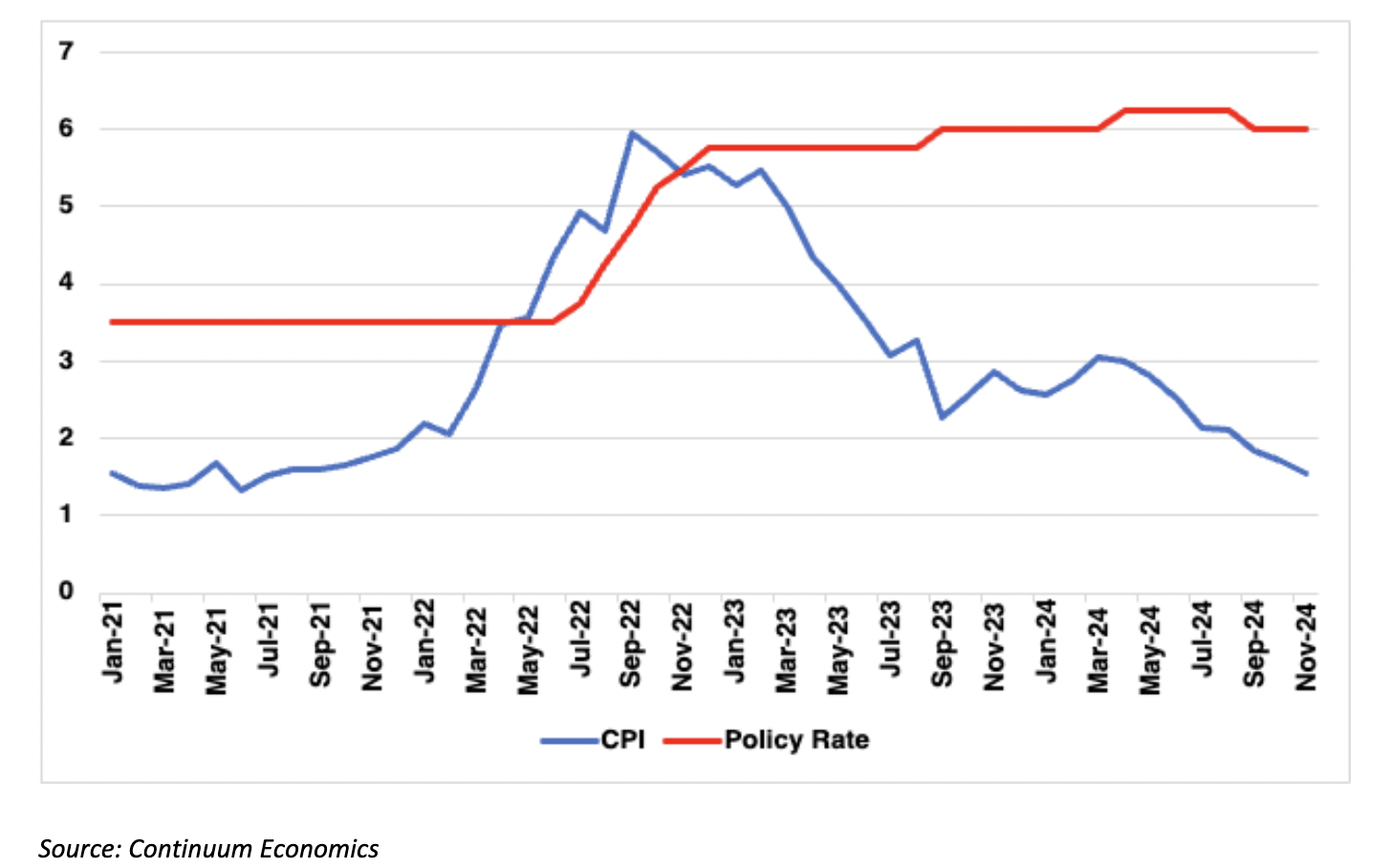

Figure 6: India Inflation and Policy Rate Forecast

Inflation, which has remained a significant concern for India’s central bank, is expected to moderate in 2025. Consumer price inflation is forecast to decelerate to 4.6%, from an estimated 5% in 2024, as global commodity prices soften and domestic demand pressures ease. This will be aided by strong agricultural output, with the rabi (winter) cropping season expected to ease food price inflation, and the government’s efforts to manage food supply, including reductions in import duties on key commodities like wheat. However, inflationary pressures will persist in the short term, particularly in rural areas, where improved incomes could spur demand for durable goods and vehicles. The central bank will closely monitor these developments, as any significant uptick in demand could offset the moderating impact of global commodity price trends.

The Reserve Bank of India (RBI) faced significant challenges in managing inflation in FY25, which has remained persistently above its medium-term target of 4%. Following an aggressive tightening cycle and a long rate pause, the RBI is now expected to start easing rates in 2025. The central bank is likely to cut the repo rate by 25 basis points to 6.25% in February 2025, as inflation shows signs of subsiding and the effects of high interest rates on consumption and investment become more pronounced. The RBI is expected to continue its easing cycle, with a total reduction of 75 basis points by the end of 2025, bringing the policy rate to 5.75%. With inflation expected to moderate further in 2026, the central bank will have more room to focus on supporting growth, and cut rate by another 25bps in 2026.

India’s economy faces a mixed outlook in 2025, with slower-than-expected growth, but a continued focus on infrastructure and manufacturing investment will provide critical support. While inflationary pressures will moderate, the central bank’s monetary policy will remain cautious, with gradual easing expected to boost growth prospects in the medium term. The government’s fiscal policies will continue to prioritise infrastructure and manufacturing, while fiscal consolidation efforts will help manage public debt. Despite risks such as global economic headwinds and domestic policy challenges, India’s strong demographic profile, its expanding services sector, and the growing importance of manufacturing will ensure that it remains one of the world’s fastest-growing economies in the coming years.

Indonesia: Keeping the Momentum Alive

Indonesia’s economy is expected to sustain 2024 growth levels in the near term. Indonesia's real GDP growth is expected to remain steady at 5% in 2025, moderating only slightly to 4.9% yr/yr in 2026. The main engine of this growth will be private consumption, which is anticipated to accelerate slightly due to moderating inflation and a more relaxed monetary policy. This increase in consumption is likely to offset a slowdown in the growth of goods and services exports. The potential hike in wages anticipated in 2025 will also be supportive of increased domestic demand. Furthermore, a combination of supply-chain diversification and supportive industrial policies will continue to attract both private and foreign direct investment (FDI). Despite these positive trends, real GDP growth will fall short of Mr. Prabowo's ambitious target of 8% between 2026 and 2029. However, his goals are expected to sustain government consumption during this period, with public spending focused on essential infrastructure projects and social assistance initiatives. Additionally, a resurgence in inbound tourism, particularly from Southeast Asia and China, will bolster levels of service exports. Looking ahead, external demand may weaken starting late 2025 due to a more assertive U.S. trade policy. Although Indonesia may not be directly impacted by U.S. tariffs, its commodity exports could decline as global business sentiment and investment wane.

Meanwhile, the Job Creation Perppu, which streamlines employment practices, is poised to enhance private investment, particularly in construction, mining, and export-oriented industries. Notably, increased investment in metal processing is expected to sustain export growth from 2026. While Indonesia may struggle to attract labour-intensive manufacturing FDI compared to regional competitors with similar wage levels, targeted industrial policies will create advantages for sectors such as automotive, chemicals, electronic components, and metals. Chinese manufacturer, BYD plans to launch its factory in January 2026.

Figure 7: Indonesia Real GDP Growth (% yr/yr)

Work on the new capital Nusantara is expected to be sustained. Civil servants will start relocating to the new capital after Eid al-Fitr in 2025 and Prabowo is expected to relocate the capital in 2028-29, indicating that the infrastructure work will continue in the coming years. Further, there are expectations of increased investments from multinationals such as Apple in 2025. Apple has announced an investment of USD1bn in Indonesia, with plans to start producing mesh components in the country. In recent years, exports of base metals, including processed nickel, have seen substantial growth and are projected to be the fastest-growing segment during the forecast period. This growth is fuelled by heavy investments in nickel processing and electric vehicle (EV) manufacturing, positioning Indonesia as a key player in global nickel supply chains. Currently, Indonesia leads the world in nickel exports, with figures more than double those of its closest competitor. However, potential oversupply in global nickel markets poses downside risks that could negatively impact prices in the near term.

The government’s budget deficit is expected to widen in 2025, driven by increased spending on social aid, education, and healthcare. A new tax on entertainment-related goods has been proposed but faces significant resistance, delaying its nationwide implementation. Additionally, the Prabowo administration plans to increase the budget deficit cap to 3% of GDP and allow government debt to rise from 42.7% to 50% of GDP. The government’s focus on education and healthcare aims to foster a skilled workforce for higher-value manufacturing, especially in EVs, while military and social welfare expenditure will likely increase. Efforts to raise tax revenue will include a VAT increase from 11% to 12% and measures to expand the tax base. However, Indonesia's low tax/GDP ratio remains a challenge due to its informal economy and poor tax compliance.

Figure 8: Indonesia Headline Inflation and Policy Rate (% yr/yr)

Indonesia may encounter some inflationary challenges from imported goods, but the overall outlook suggests that inflation will remain manageable in 2025 and 2026, bolstered by favourable domestic conditions and external influences such as India's rice export policies. Inflation in Indonesia is anticipated to average 2.7% in 2025, driven by rising prices for imported commodities like rice and petroleum, largely due to a weaker rupiah. Looking ahead, inflation is projected to remain relatively modest, averaging 3.1% in 2026, with expansionary fiscal policies potentially nudging inflation higher. Inflationary pressures could also emerge from fluctuations in commodity prices and possible trade tensions between the U.S. and China.

In conclusion, while Indonesia's economic outlook remains stable with a consistent growth forecast, it faces challenges from China’s growth trajectory and US trade tariffs on China/EU.

Malaysia’s Subsidy Squeeze in 2025

Malaysia's growth forecast for 2025 and 2026 indicates a resilient economic outlook, with GDP projected to grow by 4.9% in 2025 and 4.7% in 2026. This positive trajectory is supported by several key factors, including robust domestic demand, increased private investment, and favourable government policies. The primary driver of Malaysia's growth will be sustained household spending, bolstered by a favourable labour market and ongoing government initiatives under the Madani Economy Framework. The government's commitment to fiscal sustainability is evident in its record-high budget for 2025, which emphasises development expenditure while aiming to broaden tax revenue through measures like targeted subsidy rationalisation and new taxes on dividends. Additionally, the planned increase in the monthly minimum wage by 13% to MYR1,700 will support low-income earners and stimulate consumption, in our view.

Fiscal consolidation will be a central policy theme in both 2025 and 2026, with a primary focus on subsidy rationalisation. The government has already removed electricity subsidies for the top 10% of consumers and replaced the blanket diesel subsidy with a targeted approach. By mid-2025, subsidy rationalisation will extend to petrol, although it will be limited to the top 15% of income earners, with minimal inflationary effects. Key subsidies for essential goods like eggs and cooking oil will remain, but a leaner fiscal space will support enhanced welfare spending for vulnerable groups.

Several major policy initiatives complement the Madani Economy framework, including the National Energy Transition Roadmap (NETR), the midterm review of the 12th Malaysia Plan (12MP), and the New Industrial Master Plan 2030 (NIMP2030). The NETR aims to reduce Malaysia’s reliance on fossil fuels, with a focus on renewable energy and carbon capture technologies. The government is also prioritizing high-tech industries such as semiconductors, with a MYR25bn (USD5.4bn) fiscal support under the National Semiconductor Strategy (NSS). However, the shortage of skilled labour poses a significant challenge to its success. The 12MP review emphasizes infrastructure development, particularly in East Malaysia, and aims to propel green industries and digitalization. A controversial export ban on rare earths has been introduced, but Malaysia's relatively limited resource base and environmental concerns may limit its success in upstream processing.

Malaysia is forecast to maintain a current-account surplus in 2025 and 2026, driven by robust trade in electronics and other intermediate goods. The "China+1" strategy, which encourages companies to diversify away from China, will benefit Malaysia, especially in the electronics sector. However, palm oil exports to the EU are expected to decline due to the EU's deforestation law, and Malaysia will look to alternative markets, including Saudi Arabia and Qatar.

Consumer price inflation are forecast to rise to 2.3% in 2025, up from an estimated 1.9% in 2024, driven by the removal of petrol subsidies and wage increases. Inflationary pressures should ease gradually from 2026, as commodity prices stabilise, and the impact of fuel subsidy cuts wanes. Bank Negara Malaysia (BNM) is expected to maintain its key policy rate (overnight policy rate, OPR) at 3% through 2025. Inflation risks are expected to rise in 2025 due to domestic policies, including the rationalisation of fuel subsidies, civil-service wage increases, and a rise in minimum wages. Over the medium term, BNM is expected to gradually reduce interest rates starting 2026 and beyond to balance growth, inflation, and currency stability. We expect the OPR to be cut to 2.8% by end-2026.

Despite the optimistic forecast, several risks could impact Malaysia's economic performance. Global trade dynamics, particularly potential U.S. tariff risks, pose significant threats to export-driven sectors. A slowdown in major trading partners, especially China, could dampen demand for Malaysian exports.

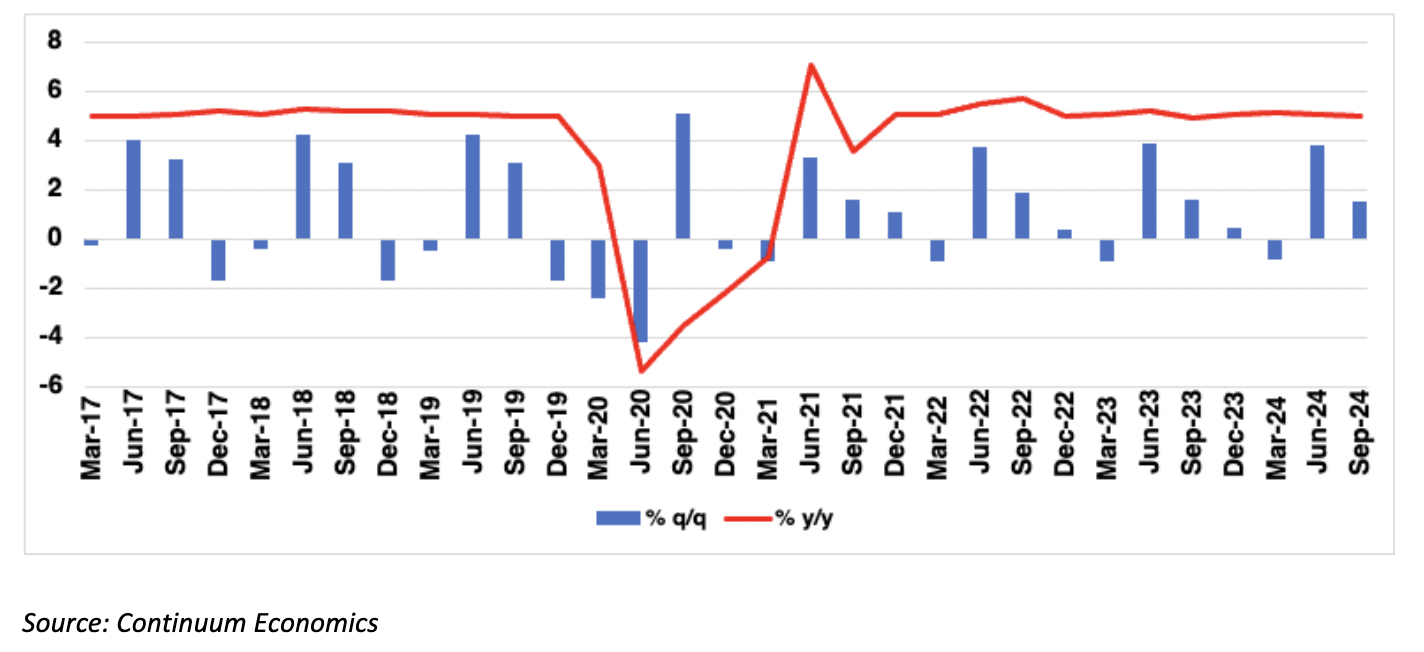

Australia: Close but no Cigar

Growth in Australia has reached its lowest point since COVID-19 at 0.3% in Q3 2024. Domestic demand has shown early signs of recovery as headline inflation treads lower. But households seem to have turn to more savings rather than spending at high prices and see saving ratio rose two quarter in a row to 3.2%. Even so, Australia’s labour market continue to exceed expectations strongly but the RBA suggested that the wage pressure is not proportionate to the strength in employment, even when the unemployment rate reversed to 3.9% with gains mostly in full time position. Wage price index y/y has rotated from the high of 4.2% to 3.5% and should be moderating in the coming quarters with the lagged effects of the GDP slowdown. Household balance sheets stays restrained by mortgage payment but supported by house prices recover from the trough of a brief correction.

However, with real wages in positive territory and with headline CPI entered the RBA’s target range, we should see more recovery in private consumption in 2025/26. Yet, the RBA has downplayed the CPI moderation by government energy subsidy and referred to trimmed mean CPI at 3.5% y/y to show underlying inflation remains. Although commodity export remains a critical contributor to GDP, government spending and investment are carrying most of the weight for the last quarters in 2024 as export prices fell alongside demand. Public investment revived after quarters of slowing, mainly focused in hospital and road project. The RBA highlighted the uncertainty in the global economy and persistent underlying inflation, but are getting closer to inflation target. While they did not change their forecast of first rate cut in middle of 2025, we believe the first cut could come in as soon as February 2025 if inflation continue to moderate (headline below 2.5% and trimmed mean below 3%). Our central economic forecast is little changed and believe the Australian economic growth will remain modest in 2025 (1.9%) and pick up its pace in 2026 (2.4%).

Global long-term demand for Australian commodity remains solid with strong demand for Australian coal and iron. Coal export has exceeded iron ore for the first time in decades and seems to have stronger growth momentum from developing economy demand. Regional Japan and China and Vietnam, Philippines and Thailand are providing growing demand. While the Chinese property sector has acquired less steel and iron ore, other demand globally is helping Australian commodity exports.

We forecast headline y/y CPI to tread lower for Q1 2025 as household continue to replenish their savings before rebound in Q2/3 2025 and we look for 2.3% for the year as a whole. The pace of CPI moderation has been faster than anticipated from the expansion of electricity rebates, as well as lower export and import prices. It is also that clear Australian households are focusing on essential items with private consumption being flat, only essential items are showing growth.

The RBA is getting close to the first rate cut and kept the rhetoric of data dependency. Unless there is a structural shift in the global inflation picture, headline inflation should get closer to the mid point of 2-3% target range and fulfilled RBA’s forward guidance to ease. The RBA held the cash rate at 4.35% in December, but we see the RBA cutting by 25bps in Q1 2025 as trimmed mean inflation inch closer to 3%. We see 135bps of cuts in 2025 at a gradual pace and the RBA moving back towards neutral policy rates of 3.0% rates by end 2025. We then see the RBA on hold in 2026.