Commodities Outlook: Strategic Caution

The oil supply outlook depends on OPEC+ policies, with the reversal of the voluntary 2.2 million b/d cuts being officially delayed until April 2025. However, we expect the progressive rollover of these barrels into the market to be further postponed at least until the third quarter of 2025, as the cartel assesses global economic developments. Non-OPEC production will continue to rise, undermining OPEC+’s efforts to support prices. With moderate demand growth foreseen in China and the U.S., we forecast WTI to reach USD 65 by the end of 2025 and USD 60 by the end of 2026.

We anticipate that central bank demand will continue supporting gold prices in 2025, although demand from these entities will moderate from the record levels seen in 2022 and 2023, as it did in 2024. Rising U.S. bond yields could provoke outflows from physical gold-backed ETFs, and a stronger USD would make gold relatively more expensive. While consumer demand in China is expected to remain subdued, gold could receive support from China’s investors and from India, where demand may strengthen in line with the country's economic outlook. We forecast gold prices to reach USD 2,750 by the end of 2025 to then fall to USD 2,650 by the end of 2026.

Copper prices are heavily influenced by demand in China, with the property sector crisis weighing negatively on consumption. However, China’s leadership in electric vehicles and solar panels offers some hope. In the U.S., Trump's policies, including tariffs and deprioritizing energy transition efforts, could weaken demand. Chile's production is set to rebound, while Peru faces setbacks and is likely to lose ground to the Democratic Republic of Congo, which is expected to become the second-largest copper producer. We forecast copper at USD 9,000 by end 2025 and at USD 9,600 by the end of 2026.

Oil: OPEC+'s Dilemma

The outlook for oil supply heavily relies on the policies to be adopted by OPEC+. As anticipated, the group of countries within OPEC+ that implemented voluntary supply cuts of 2.2 million b/d since November 2023 delayed its production hike—originally scheduled for October 2024—to April 2025. The key question then becomes whether this group of countries will stick to the new timeline, or if once again, they decide to push back the production hike further. Our central view is that they will delay the production hike at least until the third quarter of 2025. We believe the cartel's latest decision was strategically aimed at providing additional time to assess potential shifts in the global economic landscape, particularly in light of Donald Trump returning to leadership in the U.S.

Delving further into the cartel’s decision, we believe their choice to progressively return these barrels to the market will not be backed by a surge in demand—consistent with our global economic projections. Instead, we identify three potential factors that could influence the cartel’s decision and lead them to ultimately choose to hike production:

Market Share: The decision by OPEC+ countries to cut output has led them to lose global market share, declining from 50.7% in 2022 to a projected 46.1% in 2025, according to EIA figures. This implies not only reduced oil-related income for these countries but also that non-OPEC countries have gained market share; benefitting from both higher production and stable prices.

Frictions: Reports indicate that several OPEC+ countries are exceeding their production quotas. This, combined with lower income resulting from their reduced output levels, could result in overproduction and internal distrust within the cartel, effectively undermining their ability to influence the market. Therefore, pressure—particularly from less developed members of the cartel (or threats to exit the group)—could lead to a loosening of OPEC+’s production policies.

Sanctions/Geopolitics: Should the U.S. implement stricter sanctions on Iran, Russia, or Venezuela—or further escalate existing ones—this could create additional opportunities for OPEC+ countries to increase their production. Furthermore, while not our central scenario, if Trump were to impose tariffs on Mexico and Canada, this could undermine his objective of lowering energy costs in the U.S., potentially leading him to pressure other OPEC+ nations to ramp up production.

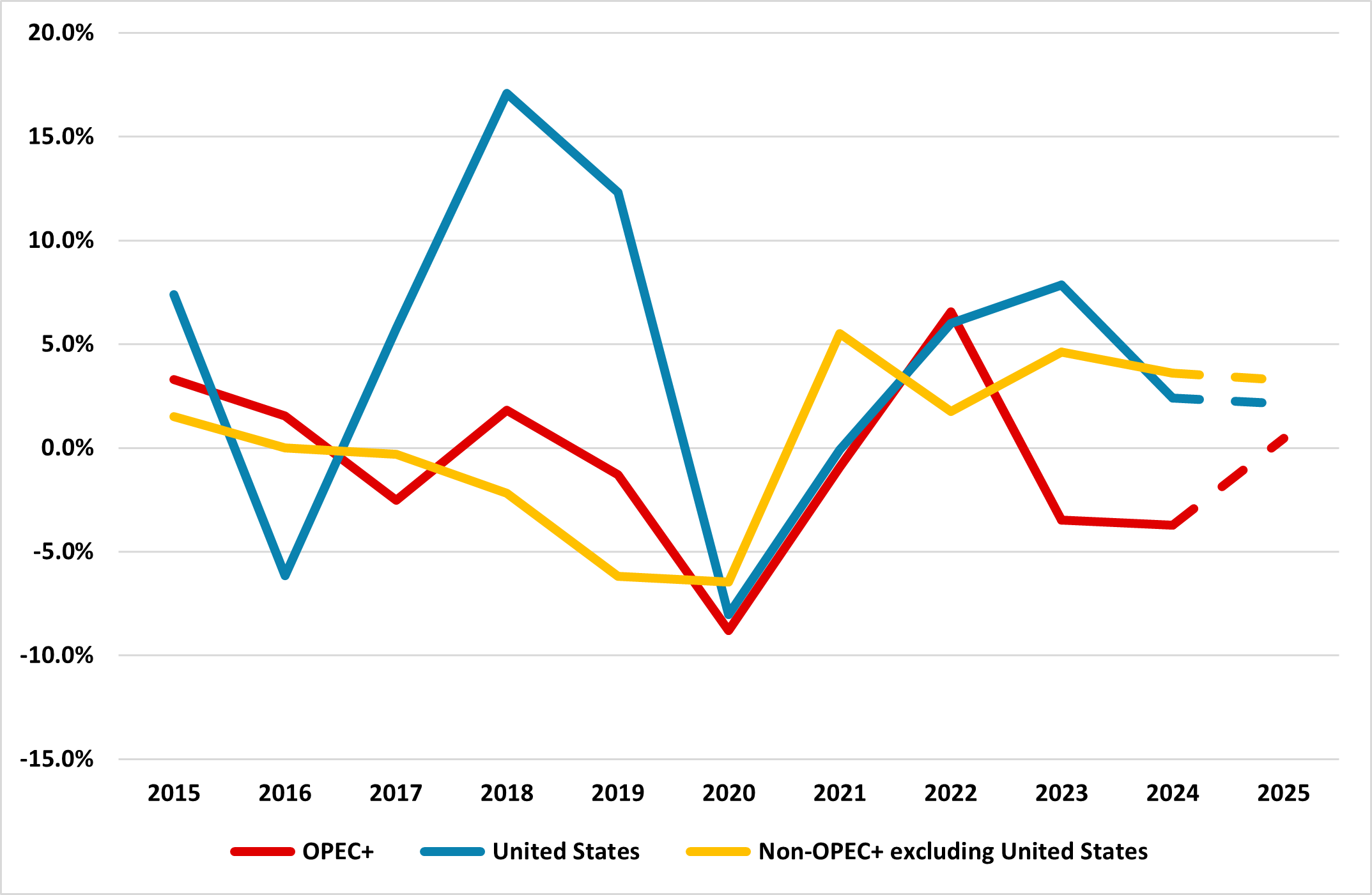

Outside of OPEC+, we expect production to continue rising in countries such as Guyana, Brazil, and Canada. We also anticipate that U.S. production will keep growing, though not at the level suggested by Trump (3 million barrels of oil-equivalent per day), due to a lack of incentives for private firms to expand production in a challenging and uncertain economic environment. Overall, production from these non-OPEC countries will continue to put pressure on OPEC+’s efforts to support oil prices through production cuts (Figure 1).

Figure 1: Crude Oil Supply YoY Growth

Source: Continuum Economics / EIA

We remain cautious about oil demand prospects for the next two years. Indeed, we lean towards moderate oil consumption growth, in line with our global economic outlook—particularly in China and the U.S. In China, we believe multiple factors will influence the country’s oil demand. First, as outlined in our U.S. chapter, we expect Trump to increase tariffs on China during the H1 2025, which will result in higher costs for China, both due to the tariffs themselves and a stronger USD against the CNY. Second, weak consumer confidence, low income growth, a lack of stimulus for the consumption sector, and sluggish economic growth are likely to cap demand for oil—though some positive numbers are expected for jet fuel demand, as we still see some positive indicators in tourism post-COVID. Third, the trend of EV adoption is set to continue; for instance, China’s Passenger Car Association reported that sales of electrified vehicles in November rose 50.5% YoY, accounting for 51.8% of overall sales. In the U.S., we foresee a moderate economic outlook, which is likely to cap oil demand. For instance, we expect the U.S. to experience consistent deceleration after the third quarter of 2025. We also anticipate the end of monetary policy easing by mid-2025, which will further hinder oil consumption growth. Should Trump impose tariffs on Canada and Mexico, this would also cause oil prices in the U.S. to rise. Moreover, the EV trend in the U.S. is not as strong as in China due to a lack of infrastructure.

Taking the factors outlined above into account, we forecast WTI to reach USD 65 by the end of 2025. Looking into 2026, we expect the gradual production increase from OPEC+ countries to have already begun and possibly ended by the end of the year; moreover, we expect the reversal of the group-wide production cuts (3.66 million b/d) to start in 2027. Output from non-OPEC countries is expected to remain strong. On the demand side, further weakening of the U.S. economy and a lack of recovery in China’s demand are likely to suppress oil prices. We currently forecast WTI at USD 60 by the end of 2026.

Risks to our outlook include a stronger-than-expected demand recovery in large economies such as the U.S. and China. Another risk stems from OPEC+’s policy. In particular, a major shift could occur if the cartel deepens the existing production cuts or, on the other hand, if they start returning barrels to the market sooner or faster than expected.

Copper: China Stimulus and Trump

Copper prices are highly influenced by demand in China, and we expect multiple factors to determine the consumption of this metal in the country both in 2025 and 2026. The boom in the property sector over the past two decades was a key driver of the commodity’s price. However, the property crisis has weighed on copper prices. As discussed in our China chapter, despite the various measures implemented by the government, we believe the property sector remains a drag on the country’s growth. We consider the announced measures insufficient to revitalize the sector and, in our central scenario, expect the stimulus policies to be announced in 2025 to also fall short. All of these elements weigh negatively on China’s copper consumption.

On the upside, China continues to take the lead in the EV and solar panel industries, alongside a boost in investment in its electricity grid. These factors have become the cornerstone and hope for the copper industry. Nevertheless, this trend is not without risks. For instance, the record levels of electric vehicles in China have been dependent on the government’s trade-in programs (a similar situation applies to home appliances, which also require copper). They will likely be extended in 2025, though the impact may be diminished. Another potential risk stems from the oversupply in these industries, which could eventually lead to a decline in copper demand and a potential reset for the sectors.

In the U.S., the arrival of Donald Trump to the presidency poses risks to the copper industry in several ways. First, the elected president’s intention to increase tariffs could threaten copper demand by making it more expensive. Second, deregulation and tax cuts may exert pressure on inflation, causing the Fed to stop easing by mid-2025 and tighten by 2026. These measures are expected to appreciate the USD against some EM currencies, making copper relatively more expensive. Third, a second Trump administration may deprioritize energy transition efforts, and some policies adopted under Biden could be reversed or enforced less rigorously, which could negatively impact copper demand.

In terms of supply, Chile recorded its highest monthly copper production of the year in October of 2024 and is set for a rebound in output after enduring mining setbacks. In this regard, the Chilean Copper Commission (Cochilco) expects the country’s copper production to increase by 6% in 2025. The second-largest producer, Peru, is facing a different scenario. The country’s Ministry of Energy and Mines (Minem) reported a 0.7% YoY decline in copper output in October, and it is unlikely that they will meet their goal of 2.9 million tonnes this year (up from 2.8 million tonnes in 2023). As we head into 2025, it is expected that the Democratic Republic of Congo will surpass Peru to become the second-largest copper producer, especially as the Kamoa-Kakula mine establishes new production records. We remain cautious and forecast copper to end 2025 at USD 9,000.

Besides demand from the renewables sectors in China and the U.S., in 2026 the metal may find extra support from two additional factors. First, copper demand from India is set to grow, supported by the infrastructure sector. Likewise, the emergence and growing importance of alternative industries, such as data centers and artificial intelligence, will further drive copper demand. From a supply perspective, significant shortages are not yet expected; however, by year-end, some supply concerns may arise as major mine discoveries become rarer and opening new mines faces rising costs, greater complexity, and political challenges. We project copper to end 2026 at USD 9,600.

Gold: Central Banks’ Demand Moderation

Gold has historically shown a negative correlation with real yields; that is, when real yields increase, gold prices tend to fall due to the asset’s non-yielding feature. However, this relationship broke down in 2022. Despite rising yields, gold prices have edged higher, primarily due to rising demand from central banks. As we look into 2025, the key question is whether this demand will continue to support the metal’s price or if the trend will fade.

We anticipate that gold demand will remain supported by central banks. Specifically, we foresee these entities—led by the PBOC, which has been fundamental in this trend—continuing to diversify their reserves and hedge against currency depreciation, geopolitical risks, and high debt/fiscal deficits in some advanced and large EM economies. Additionally, Trump threats against BRICS will only increase reserve diversification from USD into gold. Nevertheless, we remain cautious, and project that the record levels of central bank demand seen in 2022 and 2023 will moderate, as they did in 2024 (Figure 2). High gold prices, driven by a stronger USD and potential trade deals, could limit demand from these entities and thus weaken any possible price rally.

From an investor perspective, we expect the Fed to end its monetary easing cycle by the end of the first half of 2025. More importantly, as we highlighted in our DM rates chapter, we expect 10-year U.S. government bond yields to rise from current levels to 4.6% by the end of 2025. This would likely result in outflows from physical gold-backed ETFs, as investors seek alternative, yield-generating assets. In China, one of the most relevant markets for gold demand, investors may continue to bet on gold, especially if sectors such as real estate remain weak. On the consumer side, particular attention needs to be paid to two countries: China and India. In China, consumer demand for gold is expected to moderate, in line with the country’s projected economic growth. In India, however, with an economic growth rate of 6.5% in FY 2026, consumer demand for gold could see some support.

Global conflicts, including the war in Ukraine and the Israel-Iran tensions, are expected to deescalate in the coming year, as highlighted in our EMEA outlook, thereby reducing the geopolitical risk premium. We foresee gold’s price reaching USD 2,750 by the end of 2025. Looking ahead to 2026, we expect a similar framework to the one outlined for 2025. Central bank demand is likely to persist at a moderate pace, consumer demand will remain constrained by a stronger USD, and a shift from monetary easing to tightening could drive further ETF outflows, we project 10-year U.S. government bond yields at 4.5% by the end of 2026. Overall, we forecast gold’s price to lose some ground, finishing 2026 at USD 2,650 by the end of the year.

Figure 2: PBOC Gold Holdings

Source: Continuum Economics / PBOC