Asia/Pacific (ex-China/Japan) Outlook: Resilience Through Realignment

· In 2025, growth across emerging Asia will remain steady but uneven, with investment-driven economies such as India and Malaysia outperforming on the back of infrastructure and industrial policy momentum. While global demand is set to recover modestly, geopolitical friction and tariff uncertainty—particularly from the US—will weigh on the export outlook for several markets. Commodity demand from China will support Australia’s external sector, but Southeast Asian exports may continue to face headwinds.

· Domestic momentum will be underpinned by resilient private consumption and targeted fiscal spending. However, structural challenges—including weak wage growth in India and fiscal constraints in Indonesia—will continue to limit the breadth of the recovery. In Malaysia, a shift toward industrial upgrading is helping attract sustained FDI, while Australia’s household demand is slowly improving amid recovering real wages. Political stability following recent elections in Indonesia and anticipated continuity in India will help anchor investor sentiment.

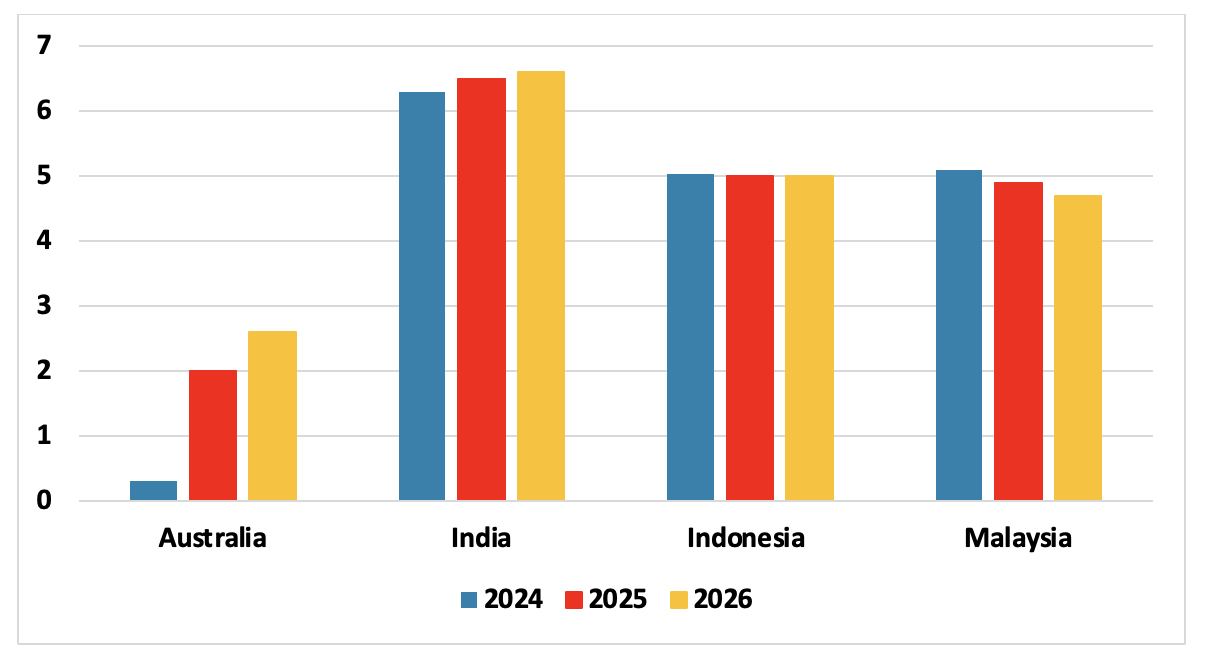

· Inflation is broadly under control across the region, but risks remain. While headline inflation in India, Indonesia and Malaysia has eased, price pressures from fuel and food remain volatile due to climate risks and currency movements. The risk of heatwaves dampening agriculture output in India persists in 2025. Central banks have begun policy easing, though the pace will be gradual and highly data-dependent. The risk of renewed imported inflation and capital outflows—especially in economies with weaker currencies—will keep monetary policy cautiously accommodative.

· The external environment remains complex, with a tepid Chinese demand, a tightly regulated global oil market, and persistent supply chain disruptions acting as constraints. While India and Malaysia are adjusting to the evolving global trade order through industrial policy and diversification, Indonesia’s external performance remains vulnerable to shifting investor sentiment. Overall, Asia’s growth story in 2025–26 will be defined by resilience amid structural realignment, cautious monetary easing, and fiscal recalibration.

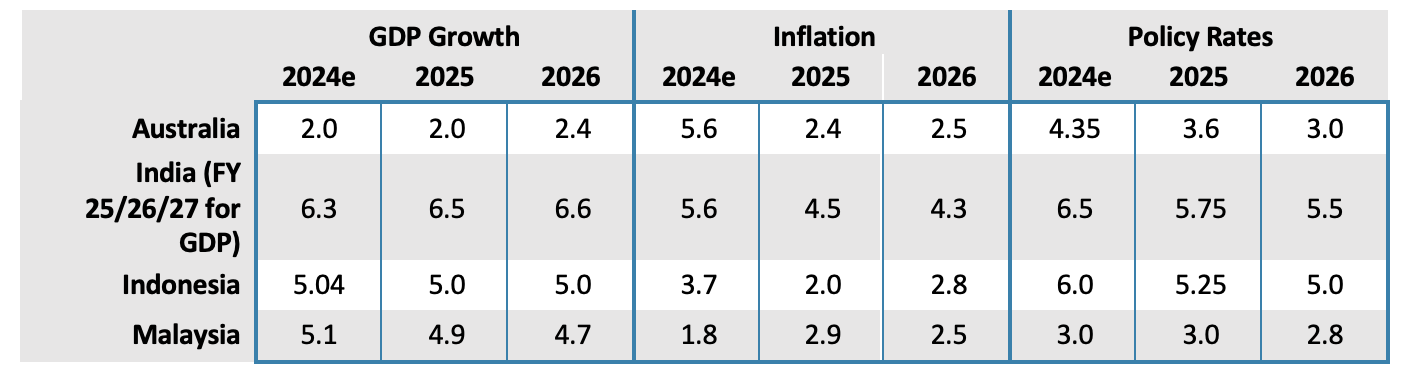

· Forecast changes: Our overall forecasts remain broadly stable. However, sustained public spending and a recovery in private investment towards the end of 2025 have prompted a slight increase in India’s growth forecast for 2026. Meanwhile, given the threat of increased trade protectionism and its global impact Indonesia’s real GDP outlook has been trimmed slightly.

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

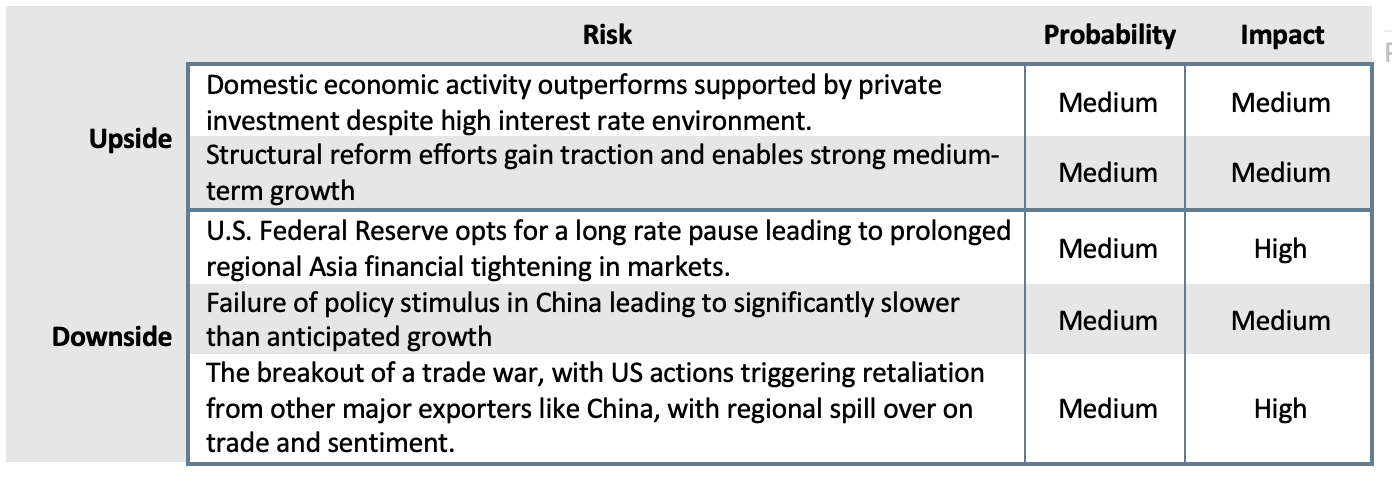

Regional Dynamics: Policy Realignment

The regional growth outlook for 2025 is one of cautious optimism, as Asia’s key markets adjust to a world of higher-for-longer interest rates, shifting trade flows, and persistent geopolitical uncertainty. Economic activity will remain steady, but diverging domestic fundamentals and policy strategies mean the recovery path will be uneven. While India and Malaysia are benefitting from robust investment pipelines and digital sector momentum, Indonesia and Australia face challenges in translating household resilience into sustained acceleration. The anticipated upturn in global trade volumes, particularly in services and select manufacturing inputs, should offer a mild tailwind—albeit one tempered by China’s soft and patchy recovery.

Figure 1: Real GDP Growth Forecast (% yr/yr)

Source: Continuum Economics

Australia and India are entering an investment-led growth phase, with fiscal incentives supporting infrastructure and industry expansion. Malaysia’s policy-driven industrial upgrading continues, while Indonesia’s growth will lean heavily on public transfers and consumption support. However, structural constraints and investor caution—particularly in Indonesia’s regulatory environment—will cap upside potential.

Inflation Stabilising but Still a Watchpoint

Following a period of heightened price pressures, Asia’s inflation environment is becoming more manageable. Headline inflation is tracking within central bank comfort zones across India, Indonesia, and Malaysia, while Australia’s CPI is easing faster than expected. However, food prices and fuel-related costs remain key upside risks, particularly in the event of weather shocks or renewed energy price volatility. El Niño-related disruptions and OPEC+ supply restraint could yet challenge the benign disinflation narrative.

Figure 2: Asia Inflation Trajectory (% change, yr/yr)

Source: Continuum Economics

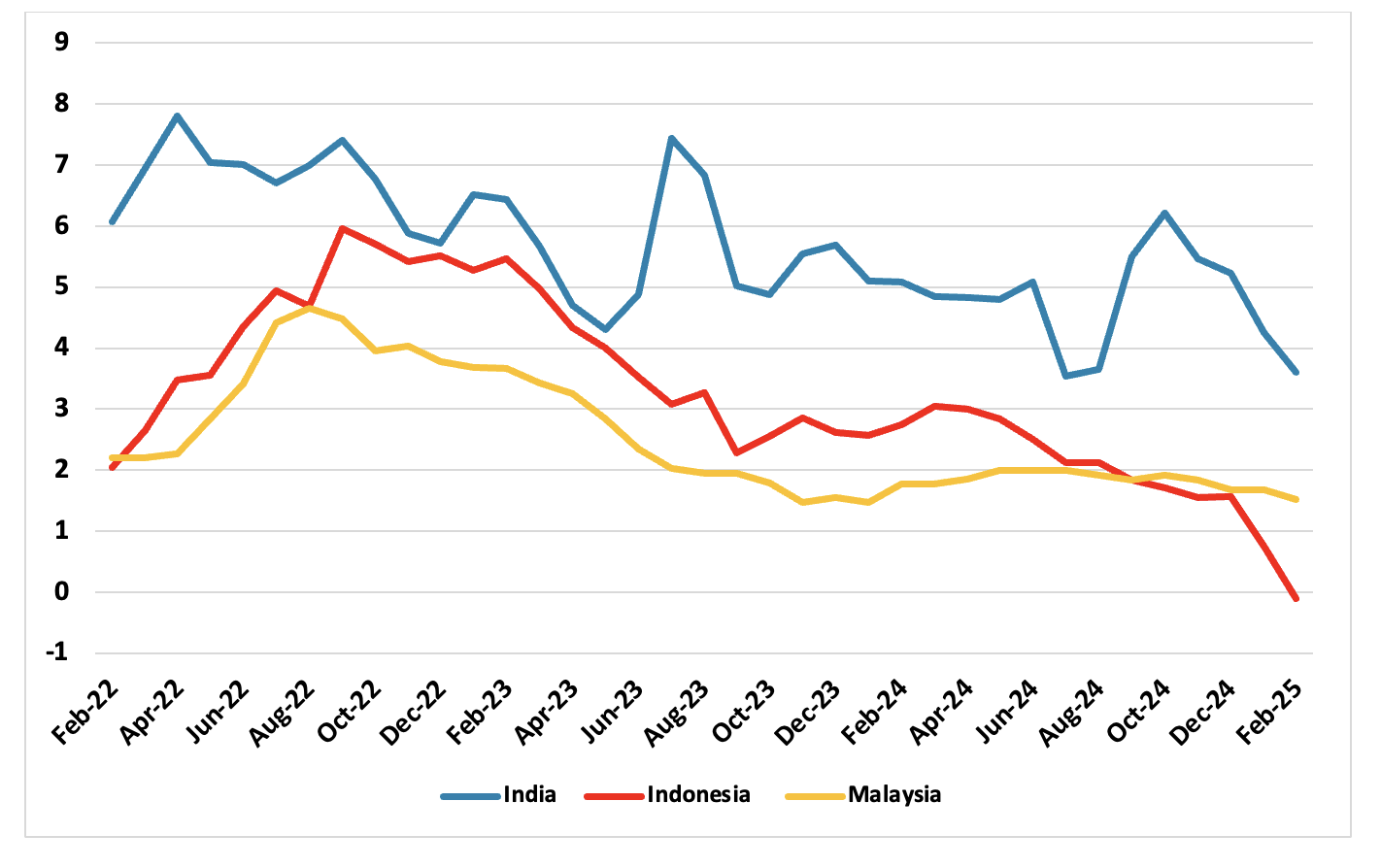

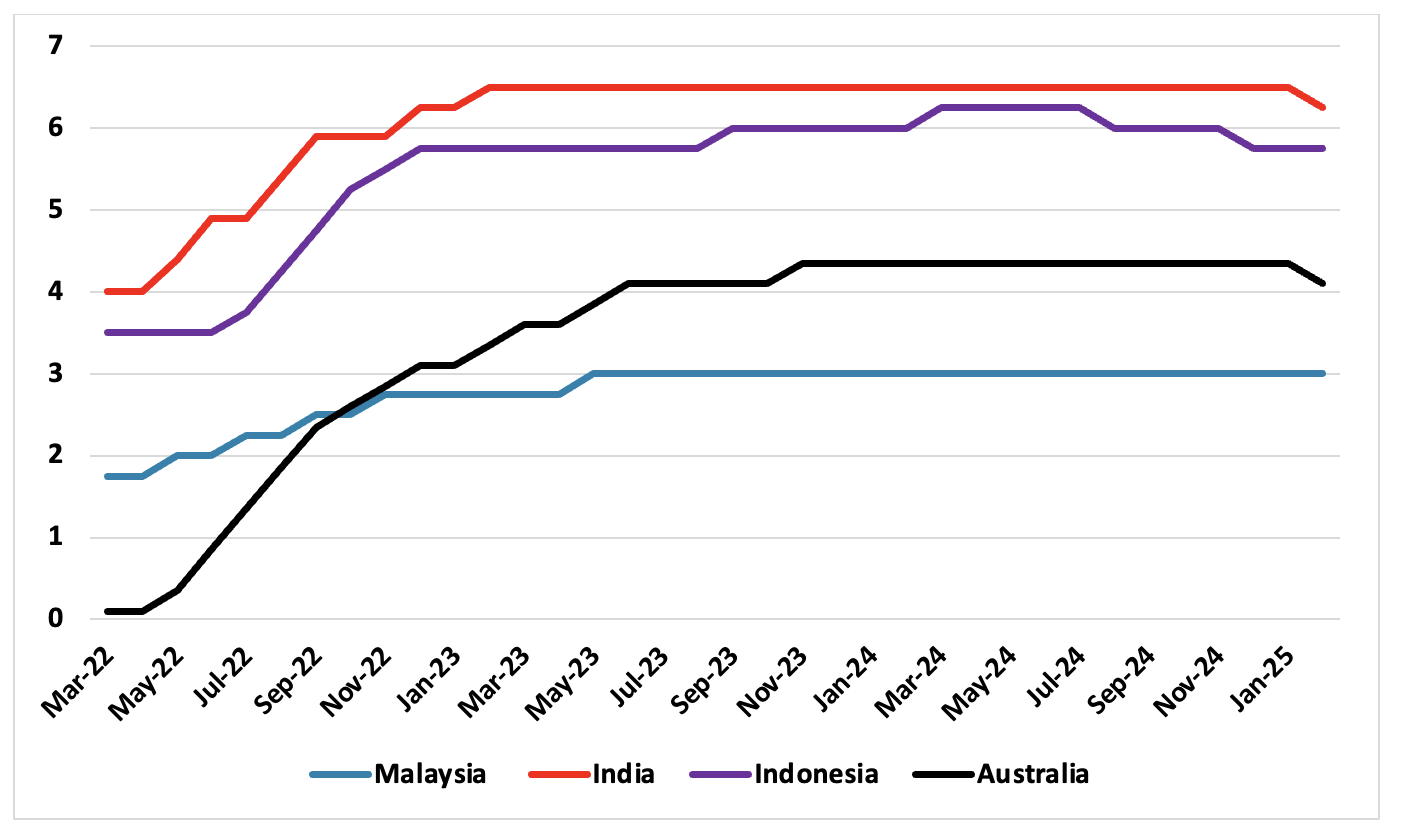

Monetary Easing is Underway—But Will Be Cautious

Central banks across the region have begun easing policy, but are unlikely to move aggressively. The Reserve Bank of India and Bank Indonesia both initiated rate cuts in early 2025, though exchange rate volatility could limit the extent of further action. Australia’s central bank is treading carefully, while Malaysia’s is expected to stay on hold. Real interest rates in some countries remain high relative to historical norms, and further easing will be paced by inflation data and external capital flow dynamics.

Public Spending Will Adjust in Post-Election Landscape

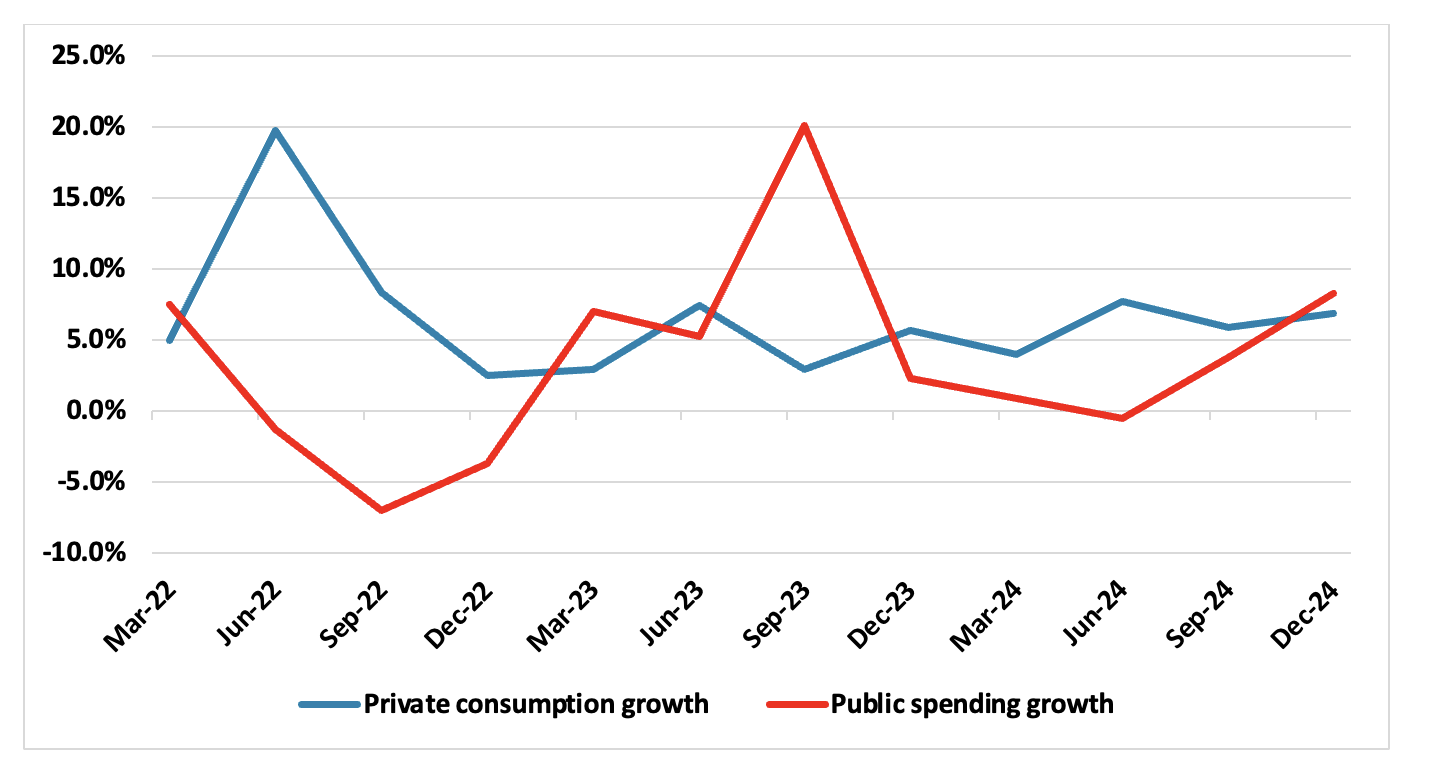

Having ramped up spending in previous years—particularly on infrastructure and welfare transfers—governments across Asia are now signalling a turn toward greater fiscal discipline. India and Malaysia are beginning to reallocate spending toward targeted growth sectors, with continued support for digital infrastructure and green industry. Indonesia’s fiscal space is narrowing, constrained by subsidy costs and slowing revenue. Australia’s public spending trajectory is modestly expansionary but calibrated to avoid inflationary spillovers.

US and China Remain Defining External Anchors

Geopolitical dynamics remain central to Asia’s outlook. US monetary policy, tariff risks, and industrial policy continue to shape capital flows and export strategies. India and Malaysia remain vulnerable to US trade policy, while Australia is seeing a modest windfall from China’s commodity demand. However, China’s subdued domestic recovery and ongoing property sector drag limit its role as a growth engine. Supply chain diversification and trade realignment remain active policy themes across the region. Across Asia’s key economies, a combination of targeted public spending, cautious monetary easing and uneven domestic demand recovery is shaping a moderate but resilient outlook for 2025–26.

Figure 3: Benchmark Policy Rate (%)

Source: Reserve Bank of India, Bank Indonesia, Reserve Bank of Australia, Bank Negara Malaysia

India: Forward Momentum With Uneven Undercurrents

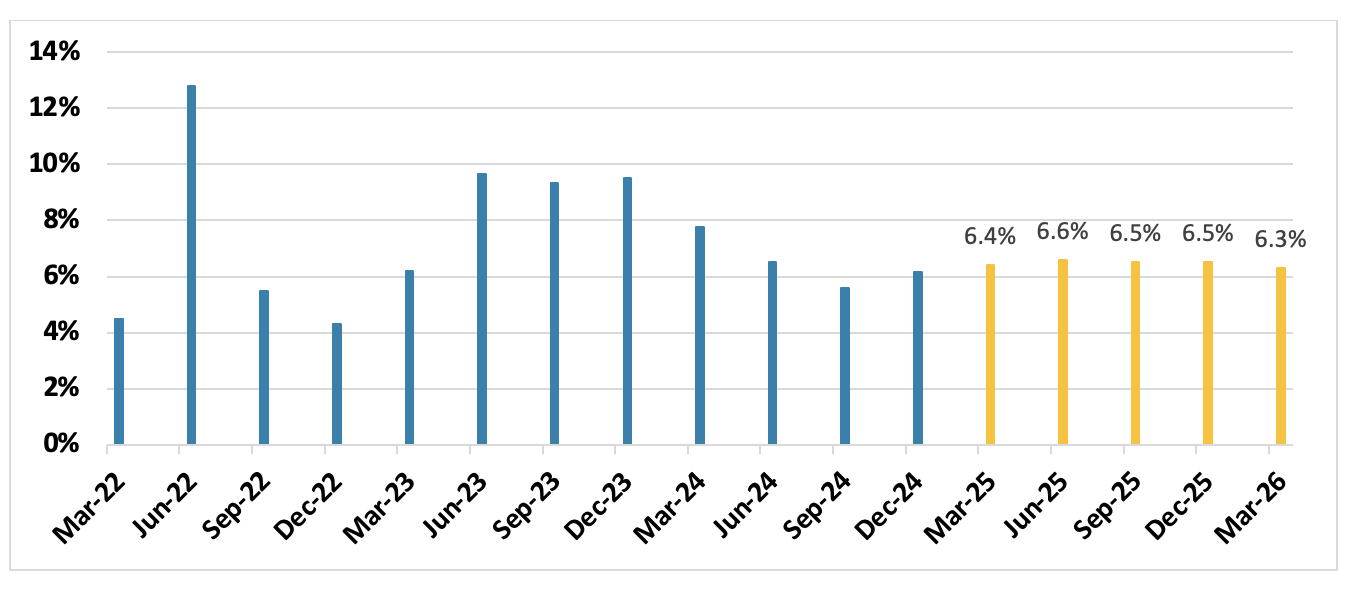

India will retain its position as one of the world’s fastest-growing large economies over 2025 and 2026, though the quality and composition of growth will remain under close investor scrutiny. Real GDP is expected to expand by around 6.5% in FY26 and edge up to 6.6% in FY27. While headline growth is strong by global standards, it masks uneven performance across demand drivers and sectors, with consumption—the traditional backbone of the Indian economy—showing signs of fatigue, particularly in urban centres.

Figure 4: India GDP Forecast (% change, yr/yr)

Source: Continuum Economics

Growth will increasingly be underpinned by investment, state-led infrastructure development, and private capex linked to government policy incentives. A more benign inflation outlook, tax exemptions and the initiation of monetary easing will create space for a recovery in domestic demand, but the pace and breadth of that recovery will depend heavily on how rural income, employment dynamics and fiscal policy play out.

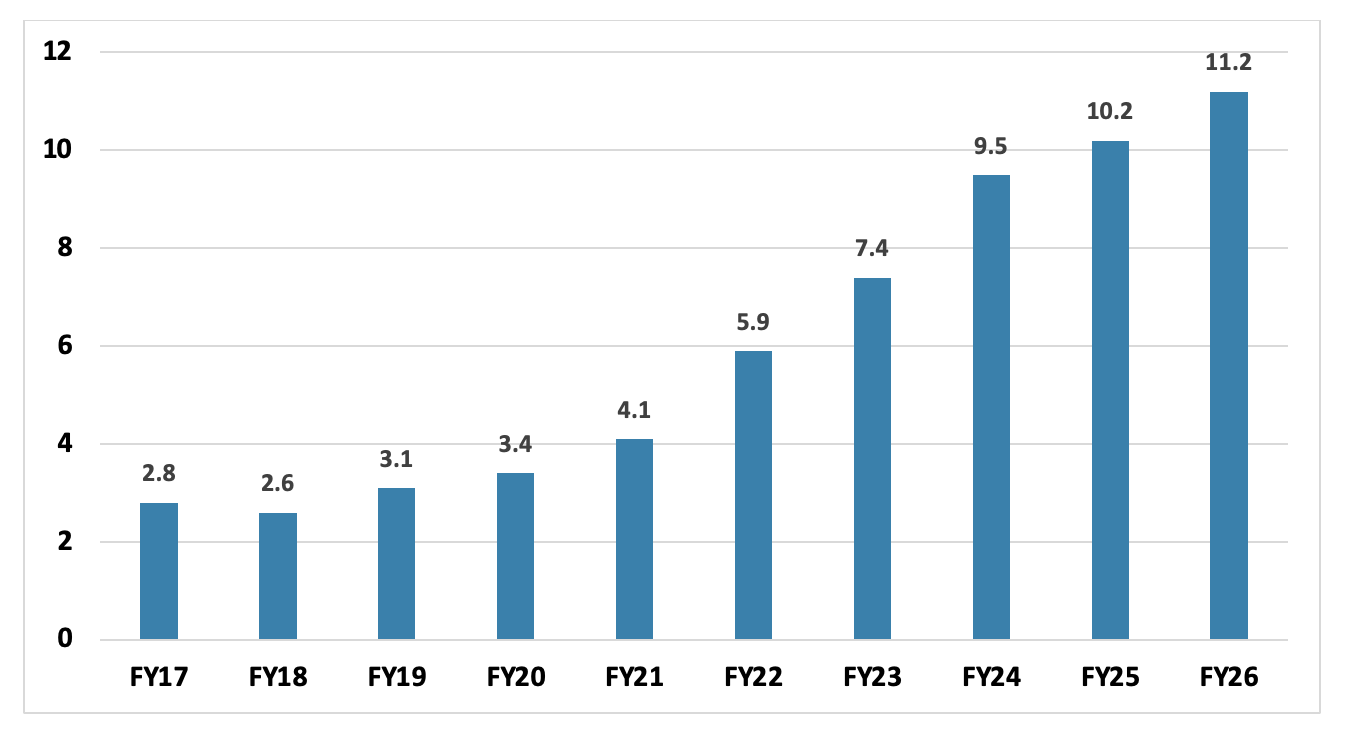

Figure 5: Government Capital Expenditure (INR tn)

Source: Ministry of Finance, Continuum Economics

Private consumption lost momentum through much of FY25, particularly in urban areas, as high interest rates, sluggish wage growth and rising costs of living curbed discretionary spending. The recent budget’s personal income tax relief—exempting individuals earning up to INR 1.2 million—represents a meaningful step toward restoring purchasing power. This, combined with lower inflation and monetary easing, should help revive urban consumption in 2025. Rural consumption, by contrast, has already begun to recover, aided by improved agricultural output following strong kharif and rabi crop seasons. Aided by favourable monsoon conditions over FY26 and FY27, and enhanced access to agricultural credit, farm incomes are expected to stabilise. Demand for consumer durables and two-wheelers—a useful rural barometer—has picked up, and this trend is expected to continue into 2026, albeit with regional variation. Importantly, wage growth remains uneven. In the industrial and agricultural sectors, surplus labour continues to cap wage gains. Only in high-end services and digital professions is upward pressure on pay visible. This creates a two-track consumption story: pockets of high-end demand remain resilient, but mass-market demand—particularly for mid-tier consumer goods—remains price-sensitive.

Figure 6: Private Consumption and Public Spending Growth (% yr/yr)

Source: Continuum Economics

The investment cycle in India is now gaining traction, supported by public capex and private participation in policy-favoured sectors. Infrastructure remains a key growth engine. With increased fiscal allocation to highways, airports, and logistics parks, and continued interest-free loans to states for capital expenditure, the multiplier effects on construction, cement, and metals are expected to become visible over 2025. Private investment is also rising in ancillary sectors such as power equipment and EV supply chains. Services will continue to drive GDP, accounting for nearly 60% of output. IT and IT-enabled services, financial services, travel, and healthcare remain growth pillars, particularly as global demand for digital transformation and outsourcing strengthens.

India’s trade outlook is moderately constructive but clouded by geopolitical headwinds. Front-loading of US-bound exports has continued amid uncertainty over potential US tariff changes, and India’s exposure to these risks is non-trivial. The lack of trade bloc membership and still-high average tariff levels hinder smooth market access for Indian goods.

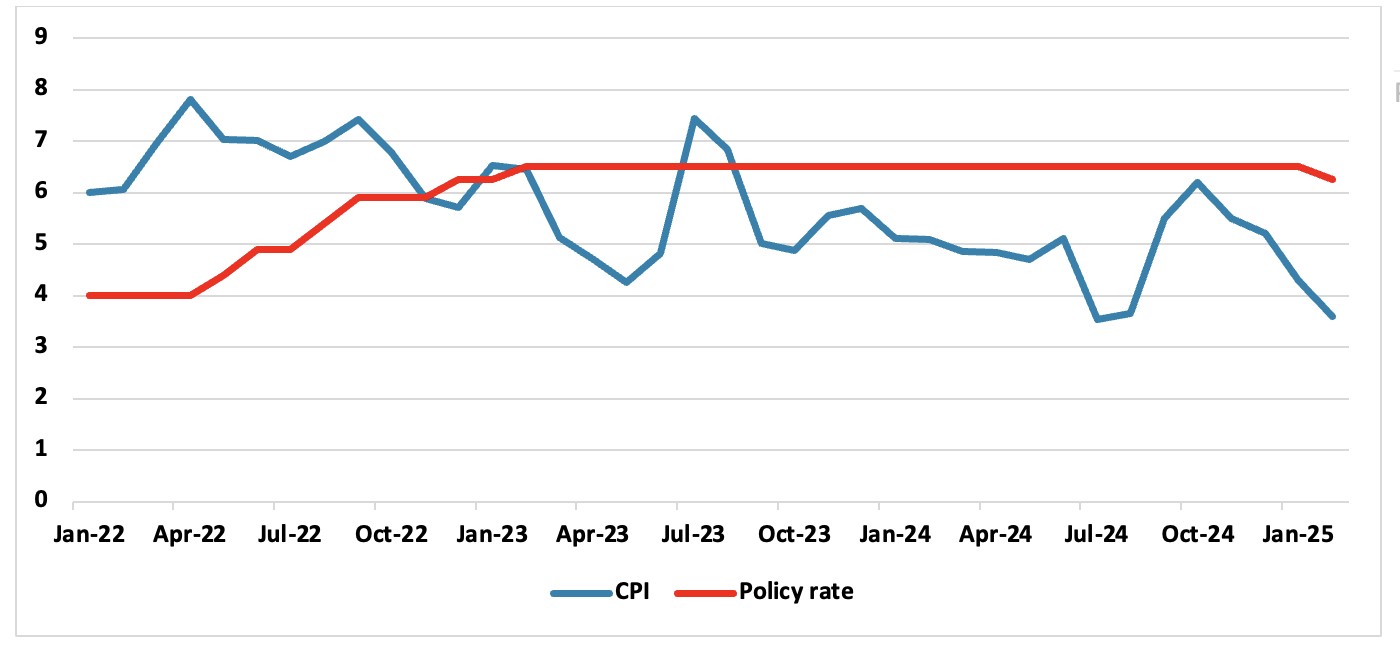

Figure 7: India Inflation and Policy Rate Trajectory (%)

Source: Continuum Economics

India’s inflation trajectory has turned decisively downward. Headline consumer inflation dropped to 4.3% in early 2025, aided by softening food prices, improved logistics, and a favourable base. The government’s continued intervention in food supply—such as limits on sugar exports and reduced wheat import duties—has helped ease price pressures. Fuel and commodity price moderation globally has also supported the disinflation trend. This is expected to persist over the course of 2025 and 2026, assuming favourable weather conditions. There continues to be a risk of heatwaves in April, which could spike food prices again. Overall, India’s inflation is expected to ease to 4.5% yr/yr in 2025 and 4.3% yr/yr in 2026.

Given this backdrop, the Reserve Bank of India (RBI) initiated its first rate cut in February 2025 and is expected to continue its cautious easing cycle. We forecast the benchmark repo rate to end 2025 at 5.75%, with a further mild reduction in 2026 to 5.5%. However, the pace of easing will be data-dependent, especially as INR volatility and imported inflation remain key risks. Any sustained depreciation of the currency could delay further cuts and feed into industrial input costs.

India’s economy is entering a phase of stable but uneven growth, with consumption recovery still lagging the investment surge. Fiscal and monetary tailwinds should begin to align more visibly in FY26, supporting a pickup in domestic demand. However, the resilience of rural incomes, pace of job creation and response of urban consumers to tax incentives will determine the growth trajectory. Overall, the macro environment remains supportive of medium-term investment, particularly in government-prioritised sectors.

Indonesia: Stable Sustained Growth Trajectory

Indonesia’s economy is set to deliver a steady but unspectacular performance over 2025 and 2026, with real GDP growth forecast at around 5% annually—broadly in line with recent historical averages. While this pace maintains Indonesia’s position as a regional outperformer within ASEAN, it falls short of President Prabowo Subianto’s ambitious target of 6.3% in 2025 and 8% by 2029. Domestic consumption will remain the primary engine of growth, buoyed by moderate inflation, a loosening monetary cycle and expansive government social programmes. However, fiscal constraints, weak global trade dynamics and creeping investor unease over governance and regulatory risks will cap the upside.

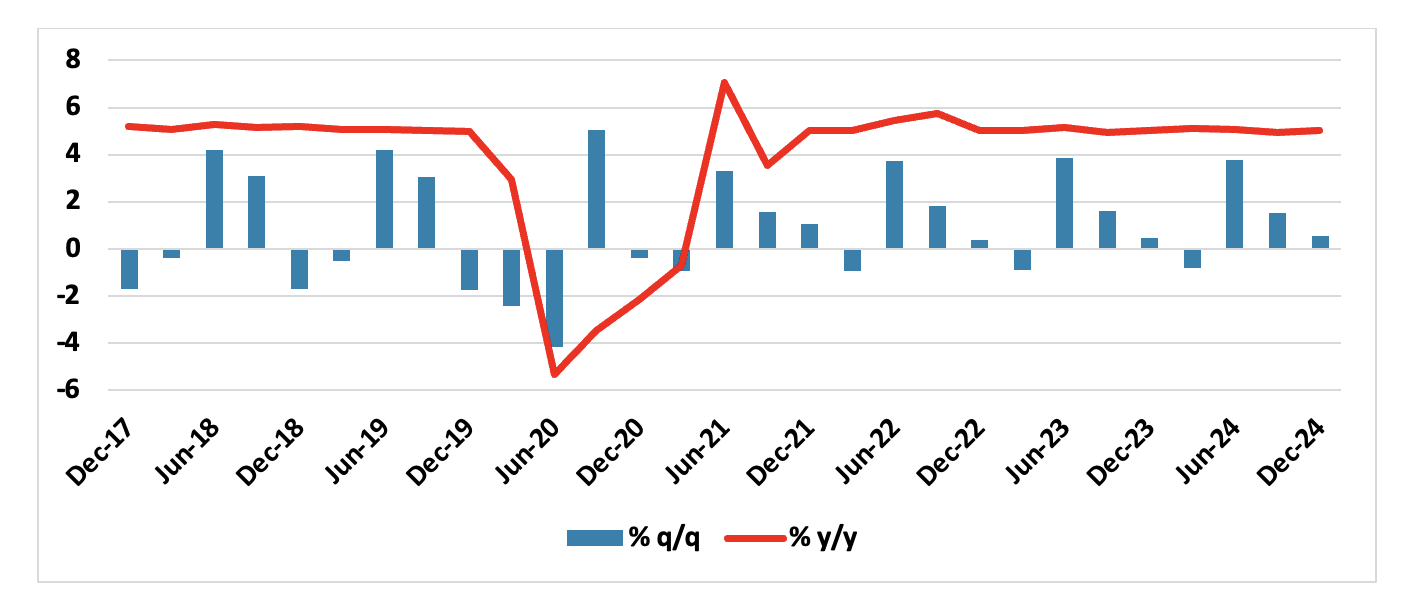

Figure 8: Indonesia Growth Trajectory (%)

Source: Continuum Economics

Private consumption will remain the linchpin of Indonesia’s economic resilience. Growth in household spending is expected to maintain momentum, supported by minimum wage increases, temporary food subsidies and benign inflation. Confidence indicators remain strong. However, structural concerns persist. Retail sales data show softening momentum in early 2025, with deceleration in food and fuel. The expansion of social aid, particularly the flagship free school meal programme, is providing short-term uplift, but its long-term impact is unclear amid rising concerns about fiscal sustainability.

Investment growth will remain modest. While lower interest rates support affordability, investor appetite is tempered by geopolitical volatility, the recent passage of the controversial mining law and uncertainty around the rollout of the Danantara sovereign wealth fund. Prabowo’s pivot toward economic nationalism and state-driven capital allocation is raising questions among institutional investors about the predictability of the policy environment. The Prabowo administration is pursuing an interventionist economic agenda, blending populist social programmes with state-led industrial policy and security sector influence in civilian governance. Recent legislation expanding military roles in public office and prioritising religious organisations in mining permits reinforces this trend. While these moves may consolidate political stability and rural support, they carry reputational risks. Foreign direct investors may be wary of opaque policymaking.

Telecoms, e-commerce and logistics continue to benefit from improved connectivity and a youthful, digital-savvy population. Government-led tourism promotion, combined with the "golden visa" scheme, is expected to gradually lift inbound visitor numbers, though the sector remains small relative to regional peers. Manufacturing is where Indonesia seeks to reimagine its economic trajectory. The government's aggressive downstream strategy—banning raw mineral exports and pushing for local value addition—has had mixed success. The nickel sector has attracted significant Chinese and Korean investment into battery production, with new EV plants expected to come online in 2025 and 2026. However, expansion into other segments like copper and bauxite faces challenges due to limited reserves and policy inconsistencies.

Indonesia’s external performance is holding up for now. A notable trade surplus in early 2025 was driven by robust non-oil exports, including palm oil, iron and steel, and consumer electronics. However, risks to the export outlook are material. Slowing demand from China and mounting US trade protectionism—especially tariffs affecting supply chains—could dent Indonesia’s export growth in the second half of 2025. The current account is expected to remain in modest surplus, but rupiah weakness may trigger renewed pressure.

Headline inflation fell to a two-decade low in early 2025, largely due to temporary electricity discounts and subdued global commodity prices. It is expected to average around 2.0% yr/yr in 2025, well within Bank Indonesia’s (BI) 1.5–3.5% target range. However, underlying price pressures are expected to firm in the second half of the year as subsidies expire, the rupiah remains under pressure, and imported inflation picks up—particularly for food and fuel. In 2026, inflation will edge up slightly to 2.8% yr/yr.

Figure 9: Indonesia Inflation, Core Inflation and Main Policy Rate (%)

Source: Continuum Economics

BI cut its policy rate to 5.75% in January 2025 and is likely to deliver two more 25-basis-point reductions later in the year. While inflation conditions allow space for easing, the central bank will remain cautious. The rupiah has already weakened by over 8% since late 2024, and further depreciation could risk imported price spikes and capital outflows. BI’s emphasis will remain on ensuring monetary credibility while providing selective support for growth. We expect the policy rate to be 5.25% in 2025 and 5% in 2026.

Indonesia’s 2025–26 outlook remains one of stability amid shifting headwinds. Growth will be solid but not spectacular. Consumption and public spending will support momentum, while policy easing provides a moderate tailwind. Inflation will stay contained, but the currency will remain a flashpoint. Strategic sector investment and the rollout of Danantara represent potential inflection points for productivity and capital formation.

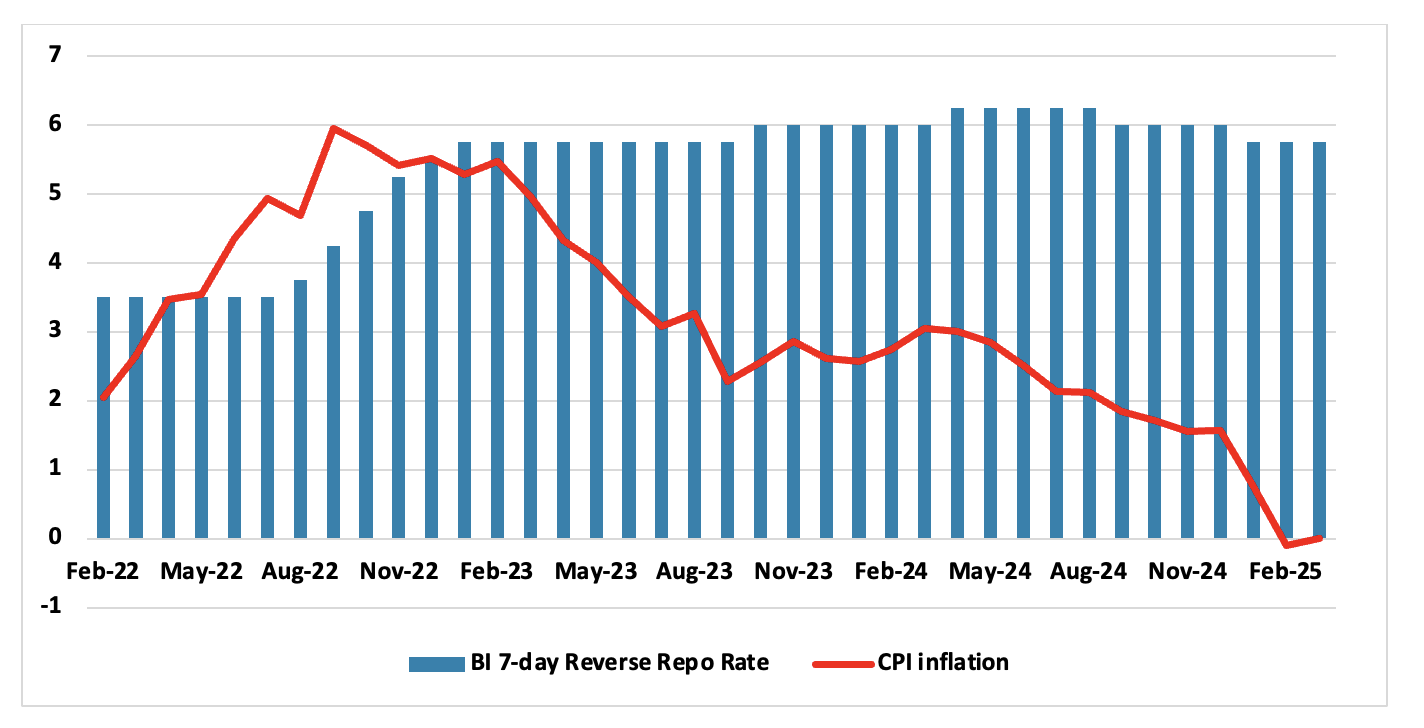

Australia: More Easing to Come, Slowly

As growth in Australia rebounded from its lowest point since COVID-19 to 0.6% in Q4 2024, the RBA has begun their easing cycle and cut interest rate by 25bps to 4.1% helped by inflation trends. Domestic demand continues to recover as headline inflation treads lower while real wage remains positive. Australian consumers seem to be tilted towards more saving with the household saving ratio rising to 3.8% (three consecutive quarter growth). Australia’s labour market has been surprisingly solid for the past year but seems to have a rough start in 2025. Nevertheless, the RBA is comfortable with the labor market because wage growth did not follow the red-hot jobs market. Wage price index y/y has rotated from the high of 4.2% to 3.2% and should be moderating in the coming quarters with the lagged effects of the GDP slowdown in 2025. Household balance sheets stays restrained by mortgage payment but supported by house prices recovery from the trough of a brief correction.

Real wages are forecast to be in positive territory throughout 2025/26 and should see support for private consumption in 2025/26. The recovery in household consumption is welcoming as it indicates Australian consumers begin to recover from the inflationary shock in 2024 but requires further confirmation whether it is just a relief of pent-up demand. Public investment revived after quarters of slowing, contributing to more balance economic growth. Australian export also rebounded after three quarters. There is a strong demand for energy products and minerals ore, with the latter being supported by Chinese economic stimulus for Chinese steel manufacturers. Export of service stays solid.

The RBA highlighted the uncertainty in the global economy and acknowledge quicker easing of inflationary pressure. Our central economic forecast is little changed and believe the Australian economic growth will remain modest in 2025 (2%) and pick up its pace in 2026 (2.4%). We forecast headline y/y CPI to tread lower for H1 2025 as household continue to replenish their savings before rebound in H2 2025 and we look for 2.4% for the year as a whole. The pace of CPI moderation has been faster than anticipated from the expansion of electricity rebates, as well as slower recovery in private consumption.

Despite the RBA begin their easing cycle, they seem to be concerned about the impact towards inflation if they are cutting too fast. In the February statement, it is stated that CPI below the midpoint of target range is favoured. We forecast gradual RBA cut in 2025 to 3.6% and bring the policy rate to 3% in 2026 – which we see as the terminal rate.

Malaysia: Steady growth, policy recalibration

Malaysia entered 2025 with a stable growth trajectory, supported by resilient domestic demand, rising foreign direct investment, and a reform-oriented fiscal framework. Real GDP growth is forecast to expand by 4.9% yr/yr in 2025 and 4.7% yr/yr in 2026, moderating slightly from the 5.1% yr/yr rebound in 2024. While the economy benefits from robust private consumption and targeted industrial policy, the global trade environment and subsidy rationalisation at home will test the durability of this momentum. The government’s Madani Economy framework and its accompanying policy pillars—namely the National Industrial Master Plan 2030 (NIMP2030), the National Energy Transition Roadmap (NETR), and the National Semiconductor Strategy—reflect a decisive shift toward industrial upgrading, digitalisation and fiscal discipline. However, external vulnerabilities and domestic political constraints will temper the pace of structural change.

Private consumption will remain the mainstay of Malaysia’s GDP expansion through 2026. Real wage growth, supported by civil service salary increases and a higher minimum wage, will bolster household spending despite gradual subsidy withdrawal. Stable inflation and low consumption taxes will further support purchasing power, although high household debt will limit upside potential. Public consumption and investment, by contrast, are expected to slow, reflecting tighter budget discipline. Government expenditure is being reoriented away from broad-based subsidies and toward infrastructure, healthcare, and digital initiatives. Construction will remain a bright spot, particularly in Johor, where the new Johor-Singapore Special Economic Zone is expected to accelerate commercial and residential development.

Gross fixed investment growth will remain positive, driven by data centre construction, EV-related supply chains, and semiconductor manufacturing capacity. Malaysia continues to benefit from China+1 dynamics and the global shift in supply chains, attracting sustained FDI inflows, especially from the US and regional peers. However, the geopolitical exposure to both the US and China presents a delicate balancing act, with rising US trade protectionism posing a clear downside risk to electronics exports.

The services sector will continue to grow led by digital infrastructure, wholesale and retail trade and tourism. International tourist arrivals are expected to exceed pre-pandemic levels by end-2025, underpinned by visa waivers and Chinese visitor flows. The long-term residency programme ("gold visa") is set to attract not only tourists but also students and digital entrepreneurs. Manufacturing will maintain a strong pace of expansion, particularly in semiconductors and advanced electronics. Malaysia is actively climbing up the value chain from its traditional strengths in chip testing and assembly to higher-end design and fabrication. The government’s partnership with Arm Holdings signals intent, though execution challenges—including talent shortages and funding gaps—will limit near-term breakthroughs. Agriculture and mining, while politically important, will lag behind in growth terms. Palm oil faces regulatory headwinds from the EU, and hydrocarbon exports will be weighed down by soft prices. Natural gas remains a transitional bright spot, but global competition will intensify post-2026 as Qatar’s LNG expansion hits the market.

Headline inflation is expected to average 2.3% yr/yr in 2025, up slightly from 1.8% in 2024, reflecting the phased removal of petrol subsidies, higher electricity tariffs, and modest wage-driven cost pressures. Inflation will rise further to 2.5% yr/yr in 2026. Inflation will stay within Bank Negara Malaysia’s comfort zone, aided by stable food prices and limited pass-through from subsidy rationalisation, given the targeting of higher-income groups.

Bank Negara is expected to hold the overnight policy rate steady at 3% through 2025 and into 2026. While the central bank labels its stance as “slightly accommodative,” the combination of inflation pressures and a volatile ringgit will keep it on a cautious footing. A widening interest rate differential with the US remains a key vulnerability for capital flows and exchange rate management if the Fed tilted to a tightening cycle.