Japan Outlook: Hot Inflation Partially Transitory

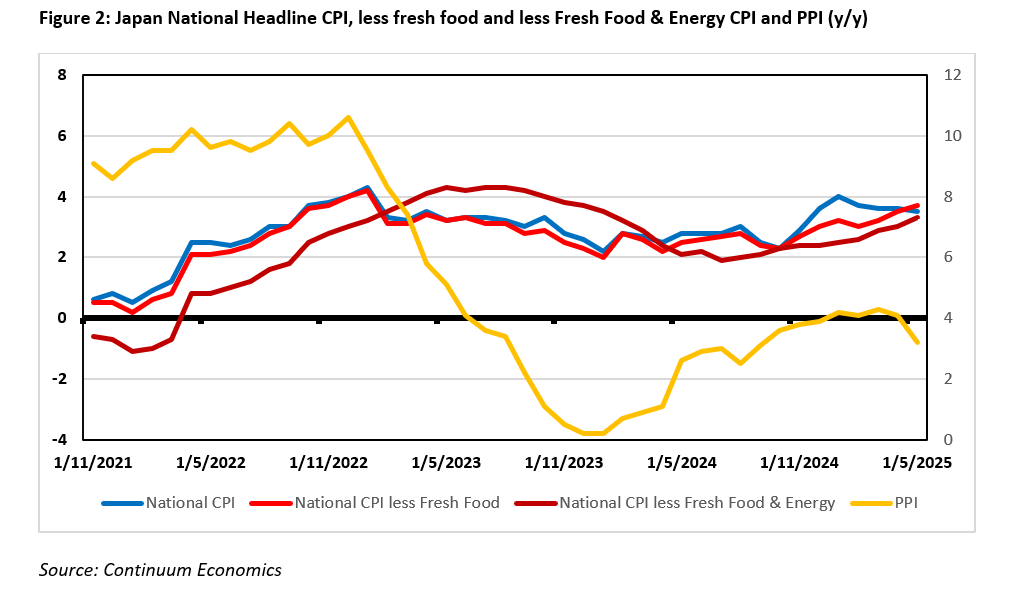

· Growth in private consumption remains sluggish in Q1 2025 on negative real wages. Wage hike in 2025 so far looks little affected by U.S. tariffs and should remain above 2% for the rest of 2025. The subtle change in business price/wage setting behavior will be supportive for consumption in 2025/26. Meanwhile, the trade balance in 2025/26 will rotate lower from ongoing U.S.-Japan trade conflict but will likely recover after a trade agreement. We forecast +0.9% GDP in 2025 and +1% in 2026.

· The BoJ have their hands tied by the uncertainty of U.S. tariffs. We are forecasting the BoJ to take the key policy rate to 0.75% in 2025 through a 25bps hike in the September meeting after U.S. and Japan reached a trade agreement. Our central forecast sees the BoJ to bring rates to 1% in Q1 2026 with current economic trajectory.

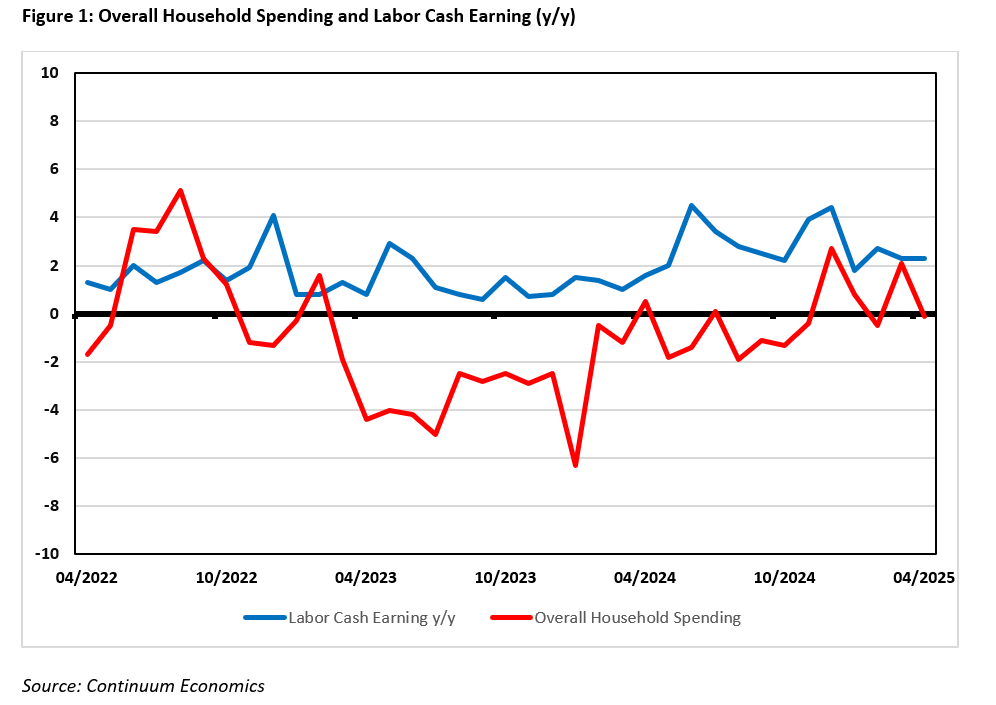

Forecast changes: 2025 CPI is revised higher to +3%, mostly from transitory factors, before moderating to 1.8% in 2026. We also revised 2025 GDP lower to +0.9% from +1.1%% and sees 2026 GDP at 1% as real wages are squeezed by higher CPI.

The trajectory of consumption remains choppy on negative real wages as we see household spending lacks momentum. Fortunately, Japan business has not pre-emptively transferred the burden of U.S. tariffs to weaker wage growth. Such price/wage setting dynamics are the cornerstone for Japan to reach 2% inflation sustainably.

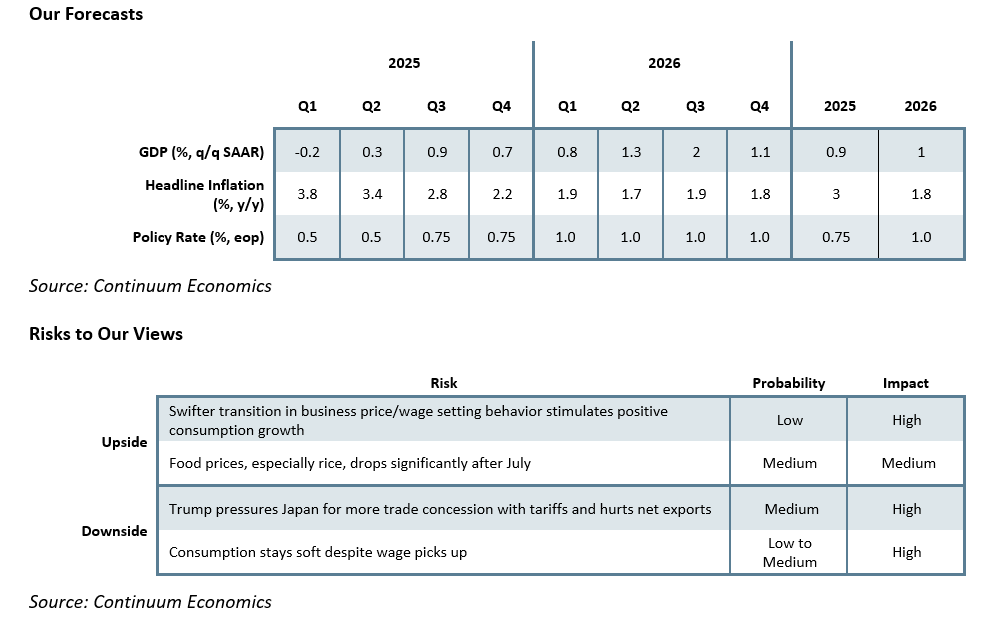

Our forecast for 2025 GDP is revised lower to +0.9% to reflect the sluggish growth in private consumption. Economic growth will be normalized from more balanced wage/inflation dynamics and thus 2026 GDP’s forecast is revised to +1%. Private consumption is expected to grow at a modest pace, driven by improving real wage in Q3/4 2025. Headline labor cash earning has remained solid (above 2% y/y) for the past quarters (Figure 1) despite the threat of U.S. tariffs and is contributing to BoJ’s favorite demand driven inflation. Despite promising results from early rounds of spring wage negotiation, it looks like major corporations will be conservative in wage hikes before the U.S.-Japan trade conflict settles. The combination of negative real wage and consumers’ resistance to high prices have been dragging the pace of recovery in private consumption in 2025 so far. Transitory factors, especially surging rice prices (poor harvest and residents stockpiling), have led us to a revision of 2025 headline inflation to +3%, we see 2026 inflation to be at 1.8%.

The effect of government budget cut will likely be shown from H2 2025 onwards. The opposition party has proposed to reduces consumption tax, which was rejected by the current ruling party LDP, but could be revived if LDP loses the neck-to-neck July upper house election. Government spending could be further restrained if the consumption taxes are lower, though consumption could be boosted on a temporary basis. Moreover, the Japan trade balance continues to rotate lower from stockpiling in Q4 2024 and policy uncertainty from Trump’s tariff. Our central forecast sees the U.S. and Japan reaching an agreement around July. It should see Japanese exports resume traction after Q3 2025. However, it is unlikely to see Japanese exports to be tariff free into the U.S. and could see a negative impact towards the overall trade balance in 2026/27 before Japan is able to redirect the supply to Europe and Asia. The JPY will inevitably strengthen significantly in a medium run from the BoJ’s tilt towards more tightening and could further reduce the attractiveness of Japanese exports.

With the change in price/wage setting behavior gaining traction, the BoJ believe the 2% inflation target could be sustainably reached in their two-year outlook. Still, the BoJ seems to be too optimistic at the pace and magnitude of change in business price/wage setting behavior and looks likely to underestimate both the time it takes for Japanese consumers to accept higher inflation and traditional business (especially SMEs) to raise prices/wage. The National y/y CPI has remained elevated in the past months (3.6% y/y in March and April 2025) on higher food price. Rice price almost doubled within a year due to poor harvest and stockpiling but could see a significant reversal after the release from Japan’s emergency reserve. The peak to trough in May once exceeded 50% of rice prices, will likely reflected in the coming CPI data. Apart from the headline CPI, ex fresh food & energy CPI also reached 3% in April 2025, suggesting underlying momentum is gaining strength. The hot CPI has so far not accompanied by strong household spending (Figure 1: -0.1% y/y April 2025), seems to suggest inflation may cool after transitory factors fade Thus, we have revised 2025 headline CPI to be +3% y/y and 2026 is at +1.8%, with inflation mostly driven by the gradual change in price/wage setting behavior. Overall, Japan is not quite ready for sustained wage growth and 2% inflation at the same time.

Policy Outlook

The BoJ has kept their medium-term hawkish rhetoric by suggesting more tightening if economic forecast align with a 2% sustained inflation trajectory. But their uncertainty of the short-term outlook, especially the result of U.S.-Japan trade negotiation, suggests a hike in the July meeting a stretch. The latest remark from Japanese PM Ishiba cools expectation of an imminent trade deal but both sides will unlikely to drag out the negotiation for too long. The U.S. and Japan will likely compromise for a framework in July and could untie BoJ’s hands in the September meeting.While we remain cautious about the hawkishness of actual policy moves, price & wage setting behavior is changing and building more inflationary pressure. Our central forecast sees the BoJ to hike by 25bps in the September 2025 meeting and a subsequent 25bps in Q1 2026, to bring the policy rate to 1%. For the BoJ to move further from 1%, we will need to see a faster adaption of higher price/wage from both Japanese consumers and SMEs owners and we feel that this will be slower than the BOJ needs to hike beyond 1% in 2026. Meanwhile, the BoJ is well aware of the bond market’s yield curve steepening as they announced their two-year plans of bond purchase tapering. They will be reducing their pace of extra purchase by JPY200 billion after April 2026. Moreover, MOF are also drafting plans to cut sales in long dated JGBs while increasing sales in short dated JGB, to calm market participant’s concern on supply/demand. The BoJ will mostly allow yields to gradually go up along the curve yet verbal and actual intervention cannot be ruled out if we see a jump in yields. However, monthly BOJ bond purchases are set to scale down to Yen2.1trn by Q1 2027 and means heavy QT with maturing bonds (here), which we see pushing 10yr to 2% in 2026. This could cause the BOJ to slow the QT ramp up still further and also be cautious about BOJ policy rate hikes in H2 2026.