Japan Outlook: Inflation Sustainably Above 2%?

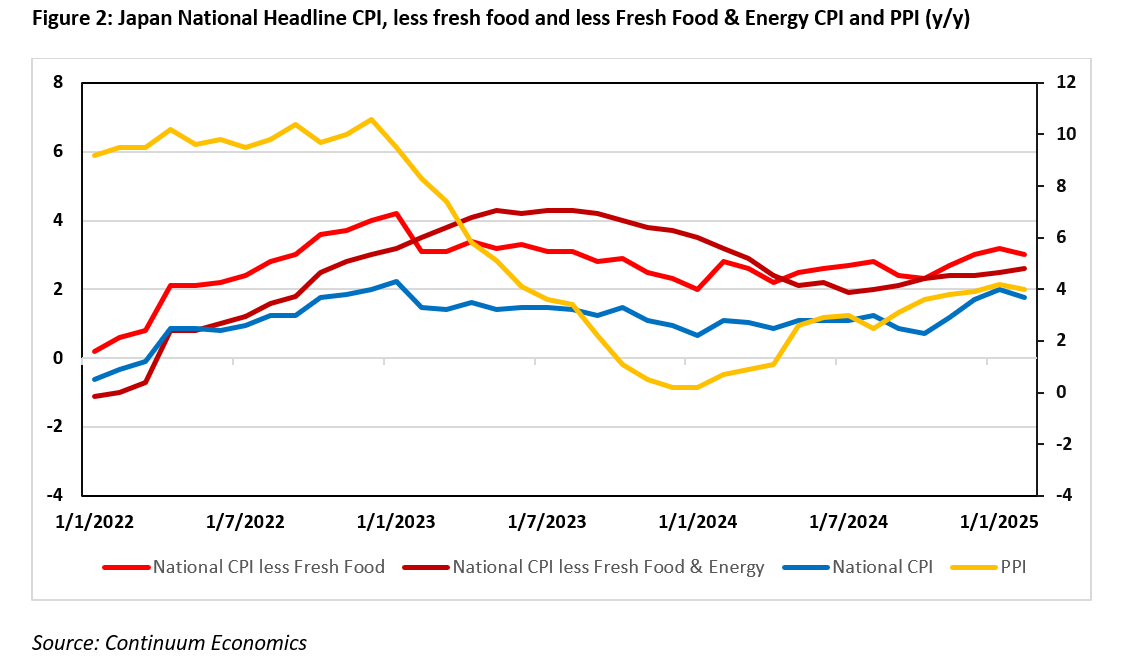

· Private consumption will have a modest growth in 2025 along the gradual change in business price/wage setting behavior before slowing to average in 2026. Wage hike in 2025 looks to be at least on par with 2024 after early result of the spring wage negotiation. SMEs are going to be pressured from matching wage growth of large enterprise as they tend to have a more traditional take towards price/wage dynamics. The trade balance in 2025/26 will rotate lower from 2024 level when JPY strengthens from BoJ’s rate changes and potential trade complication from Trump’s tariff - we forecast +1.1% GDP in 2025 and +1.2% in 2026. Government spending is expected to be steady in H1 2025 and slow from there onwards as budget cut takes effect.

· We are forecasting the BoJ to take the key policy rate to 0.75% in 2025, likely through a 25bps hike in May 2025. The year-end rate for 2025 could be potentially rise to 1% if the change in business price/wage setting behavior accelerates.

Forecast changes: 2025 CPI is revised higher to +2.5% from +1.5% in the December Outlook before moderating to 1.5% in 2026. We also revised 2025 GDP lower to 1.1% and sees 2026 GDP at 1.2% as real wages are squeezed d by higher CPI.

Macroeconomic and Policy Dynamics

The rebound in consumption remains restrained by real wage but are showing signs of life with two consecutive months of household spending growth. However, the recovery seems to be pointing towards relief of pent-up demand instead of consumers’ adaption of higher prices. It warrants caution on being too optimistic on wage/consumption dynamic in Japan.

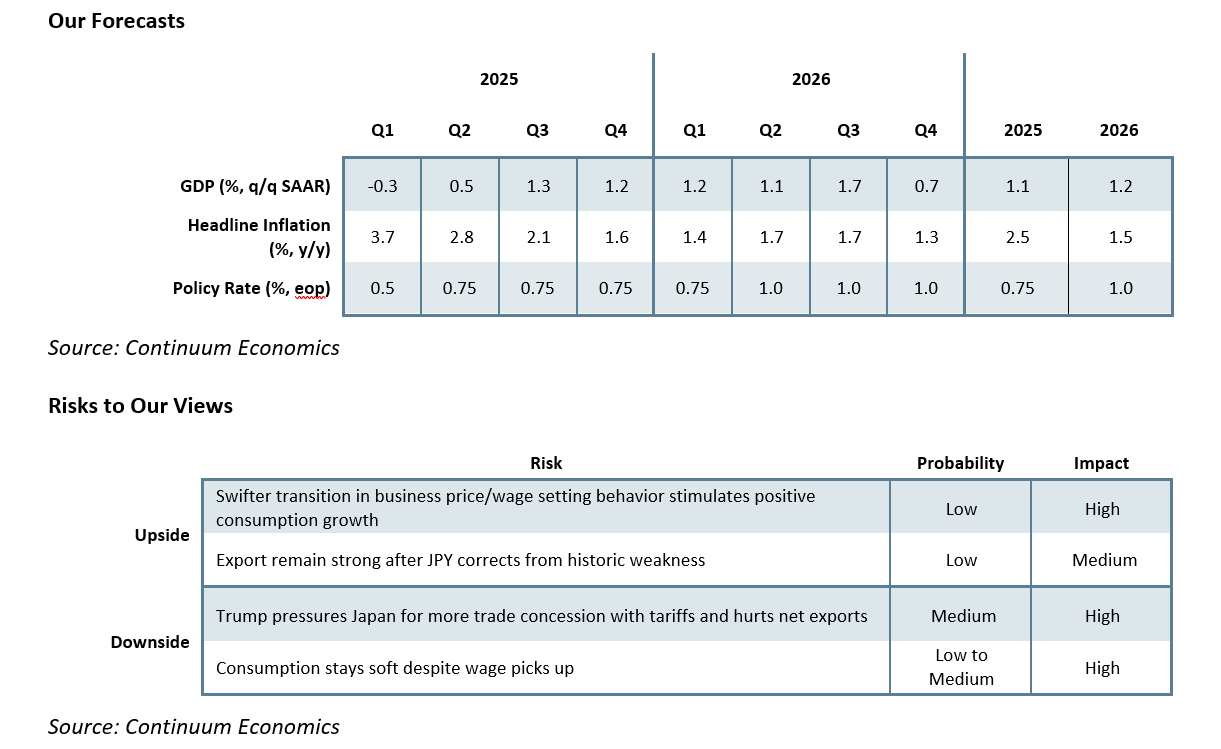

Our forecast for 2025 GDP is revised lower to +1.1% to reflect the modest recovery in private consumption. Economic growth will be normalized from more balanced wage/inflation dynamics and thus 2026 GDP’s forecast is revised to +1.2%. Private consumption is expected to grow at a modest pace, driven by higher real wage. Headline labor cash earning is solid (above 2% y/y) for the past quarters (Figure 1), contributing to desirable demand pushed by wage inflation in the BoJ’s eyes. Early rounds of spring wage negotiation are showing promising results for large corporation (above 5%) and major labor unions are asking for wage growth above 2024 level. Yet, SMEs will be challenged to keep up as their slower adoption to changes in price/wage setting dynamics will limit profit margins, as prices rise less than wage growth – some consumers remains resistant to higher prices and this is a headwind to consumption and profit margins as well. Therefore, though we have revised 2025 headline inflation to 2.5%, we see 2026 inflation to be at 1.5%.

Government spending will be steady in H1 2025 and likely see the budget cut takes effect from H2 2025 onwards. Meanwhile, the Japan trade balance will begin to rotate lower in 2025 from JPY’s corrective bounce higher from historical weakness and Trump’s tariff complication. Japan’s robust export have supported economic growth and there seems to be acts of stockpiling in Q4 2024 to avoid tariff complication, which likely contributes to lower exports in 2025. So far, we are seeing limited impact of the U.S. tariffs towards the broader Japan trade, but the U.S. is likely to impose further tariffs on Japan. Japanese exports to China is also a big growth factor in trade, closely followed by the U.S.. The Chinese government had released the ban on Japanese seafood import, signaling an openness to defrost bilateral relationship, though China overall import demand means that Japanese exports growth to China is currently limited . As the BoJ tilted towards more tightening, it looks like the JPY will inevitably strengthen significantly in a medium run and make Japanese goods less attractive and see a more neutral net export contribution in 2025/26.

BoJ had viewed 2% inflation a difficult target but as the change in price/wage setting behavior gains traction, they believe the target could be reached sustainably soon. Still, the BoJ seems to be too optimistic at the pace and magnitude of change in business price/wage setting behavior and looks likely to underestimate both the time it takes for Japanese consumer to accept higher inflation and traditional business (especially SMEs) to raise prices/wage.

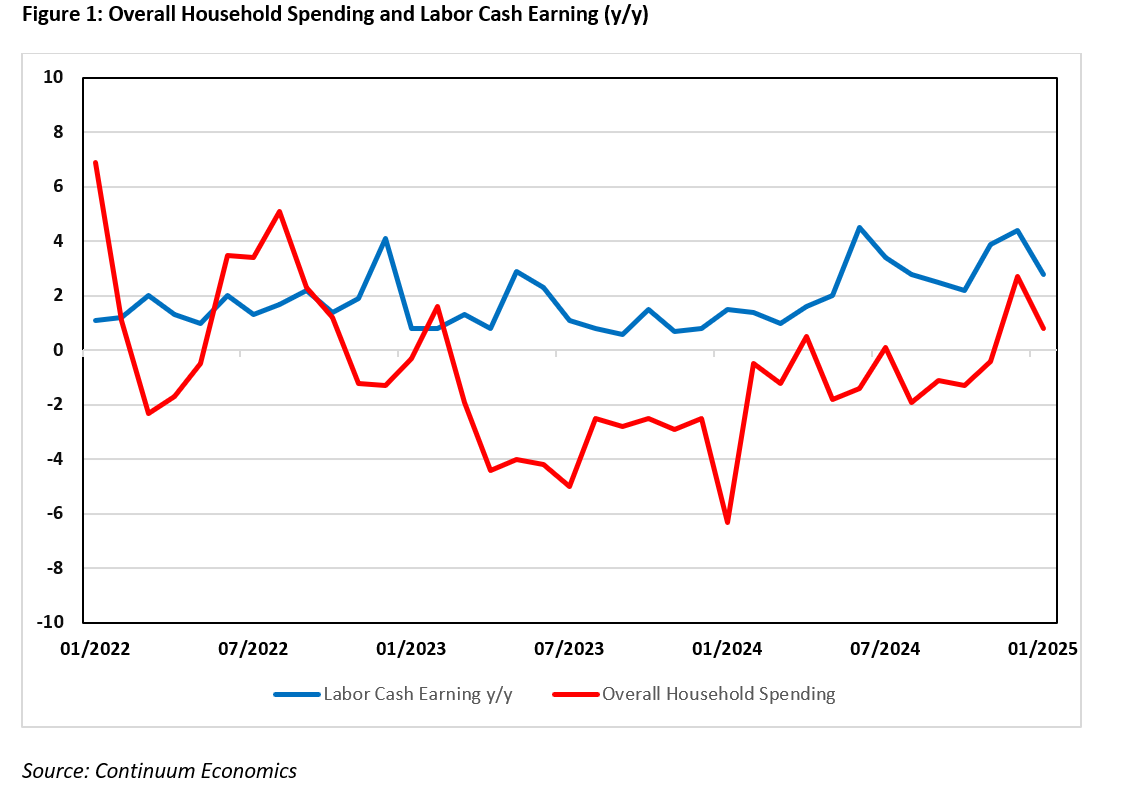

The National y/y CPI has risen significantly in the past months on higher energy & food price and a weak JPY. After a spike to 4% y/y in January 2025, headline CPI has shown some moderation to 3.7% y/y in February, while ex fresh food & energy steadily grind higher to 2.6% y/y. The hot CPI is not accompanied by strong household spending (Figure 1: 0.8% y/y January 2025), seems to suggest inflation may cool after transitory factors fade and JPY correct from historic weakness (Figure 2). Thus, we have revised 2025 headline CPI to be 2.5% y/y but 2026 is at 1.5%, with wage growth back to average as traditional business may see limited reason to raise prices. Overall, Japan is not quite ready for sustained wage growth and 2% inflation at the same time.

Policy Outlook

The BoJ has kept their medium-term hawkish rhetoric by suggesting more tightening if economic forecast align with a 2% sustained inflation trajectory. But their uncertainty of the short-term outlook clouds the prospect of an imminent hike at the May meeting. However, the latest remark from Ueda suggest he is comfortable with economics development and not worried about tariff impact. He is likely waiting for the result of spring wage negotiation to review the inflationary dynamic before giving any new forward guidance.

We remain cautious about the hawkishness of actual policy moves. While price & wage setting behavior is changing, it takes time to change traditional habits and we believe consumption growth would be more gradual than BoJ expect (overall household spending had not followed the boom in labor cash earning). After the relief of pent up demand, the reluctance to consume at a higher prices will squeeze corporate margin growth in 2025, meaning that companies (especially SMEs) would turn to less wage hikes in H2 2025 and 2026 lower the CPI inflation trajectory.

With early result of wage negotiation being positive and business price/wage setting behavior gains traction, we believe the BoJ will bring the policy rate to 0.75% in May 2025. We currently only see the BoJ to bring terminal rate to 1% in Q2 2026. If SMEs are able to shake off their tradition shackles to adopt a swift change to price/wage setting and Japanese consumers adapt to higher price faster, we could see CPI sustainably above 2% after year-end 2025, another 25bps hike from the BoJ to 1% by year-end 2025 cannot be ruled out.

Meanwhile, the BoJ would like the market to decide long term interest rates after removing Yield curve Control and does not seem to be worried about a gradual rise in JGB yields. Unless there is a spike in yields (2% in 10yr JGB), we are unlikely to see the BoJ to actually intervene in the JGB market, verbal intervention cannot be ruled out though.