DM FX Outlook: USD to edge lower despite high yields

· Bottom Line: Recent strong US data has bolstered the USD, with the Trump election victory also supportive due to expectations of tax cuts and tariffs which are seen leading to less Fed easing than previously expected. While we still see the USD weakening through 2025 as Fed easing reduces the USD’s yield advantage, the decline is likely to be less than previously anticipated.

· Forecast changes: We have cut our EUR/USD forecast for end 2025 to 1.10 from 1.20, and raised our USD/JPY forecast to 145 from 125. While there are still likely to be significant USD declines over the long run, we are not expecting this in 2026 as we see the Fed re-tightening in response to the impact of Trump’s fiscal policies.

· Risks to our views: Equity markets remain a big uncertainty. We currently anticipate a gradual decline in US equities through 2025 and 2026 as valuations are very extended and higher US yields in 2026 in particular will prove challenging. However, there is a risk of a much sharper decline and a return to more normal equity valuations, especially if earnings growth disappoints. If so, the JPY would likely be the biggest beneficiary, with still huge scope for JPY gains longer term given very low JPY valuation. There are also a lot of uncertainties over Trump’s policies. We anticipate that most of the tariff threats will be negotiated away, but if we see higher than expected tariffs imposed it could be initially USD positive but could also easily backfire on the USD due to negative equity market impact. We would also point out that in Trump’s first term we saw significant USD weakness in 2017-18 defying normal paradigms, so normal reasoning may not apply. Finally, it is possible that the EUR sees some positive premium from a ceasefire to the Russia/Ukraine war, even if the solution isn’t seen as ideal.

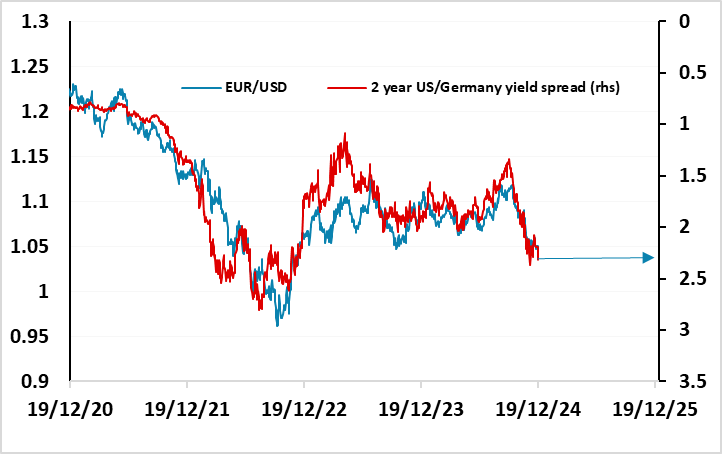

Figure 1: EUR/USD and the 2 year US/Germany yield spread

Source: Datastream, CE

EUR/USD has stuck close to the 2 year yield spread since the pandemic…

While there has sometimes been some impact from equity market correlations, EUR/USD has generally correlated very strongly with movements in the 2 year US/Germany yield spread in recent years. We expect this to remain broadly stable over the coming year, suggesting there is also likely to be little movement in EUR/USD. Nevertheless, we slightly favour the EUR upside because of its initial low valuation and the fact that the market is pricing aggressive ECB easing and much less aggressive Fed easing. There is a risk of some convergence in these views.

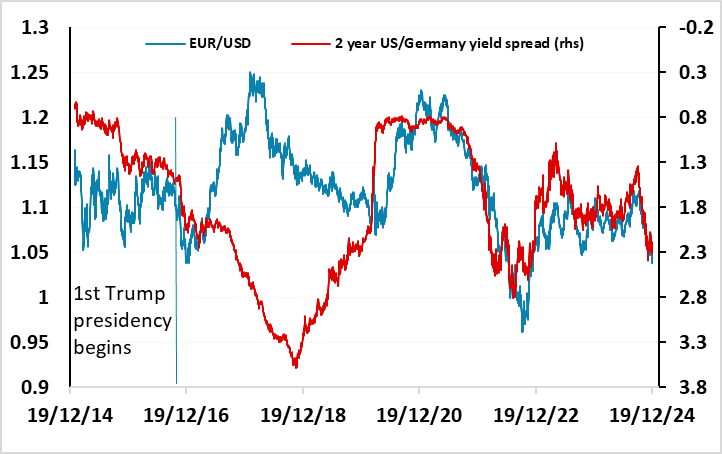

…but the USD was less predictable during the first Trump presidency

Of course, we may see the market break away from the yield spread correlation. After the first Trump election win in 2016, we saw a period of USD strength related to expectations of easier fiscal policy, but the USD declined though much of 2017 and 2018 even though yield spreads moved strongly in the USD’s favour from mid-2017. Part of this reflected concern that Trump was not able to deliver on his pro-growth policies due to opposition in Congress, while more straightforwardly Trump’s preference for a weaker USD also contributed to USD weakness. However, it turned out that the USD weakness was temporary, and the rise in US yields seen through 2017 and 18 eventually helped the USD to recover through the second half of Trump’s presidency.

Figure 2: 1 Trump presidency saw a break from the usual yield spread relationship

Source: Datastream, CE

This time around, it would not be surprising if the USD once again showed a less tight relationship with yield spreads. The impact of tariffs and tariff negotiations, both on the US and foreign economies and on Fed policy, could deliver an unpredictable impact on the USD, especially If Trump once again expresses a desire for a weaker USD and highlights big current account surpluses in the Eurozone and China. From a value perspective, the USD is starting at very strong levels historically, which suggests upside is now more limited. So our USD forecasts do err slightly on the low side of where recent yield spread correlations would suggest. We would emphasise that there is greater uncertainty than usual. Even if we were certain of all of Trump’s policies, the USD implications are less clear than they have been in recent years.

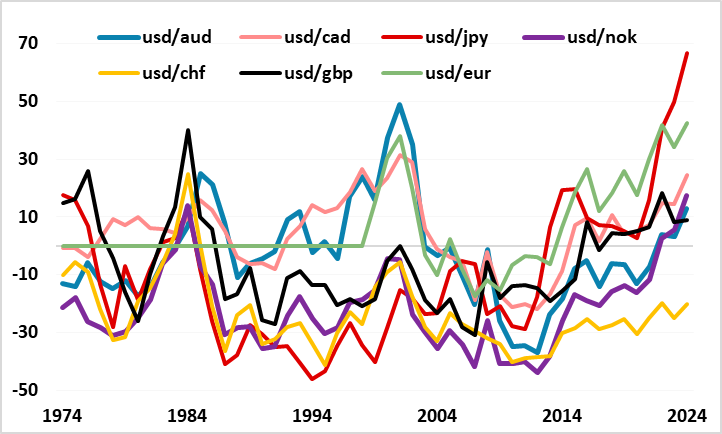

JPY weakness remains extreme

We continue to look for substantial JPY gains in the next couple of years, both against the USD and on the crosses, primarily because of value considerations. As we have noted in the last couple of quarterly outlooks, the JPY is not just the weakest it has ever been in the floating era, it is the weakest any of the G10 currencies have ever been. USD/JPY is trading 65% above Purchasing Power Parity (PPP), and with the BoJ set to tighten policy over the next year while the rest of the G10 are likely to ease, there should be scope for substantial JPY gains.

Figure 3: % Differences from PPP

Source: Datastream, CE, OECD

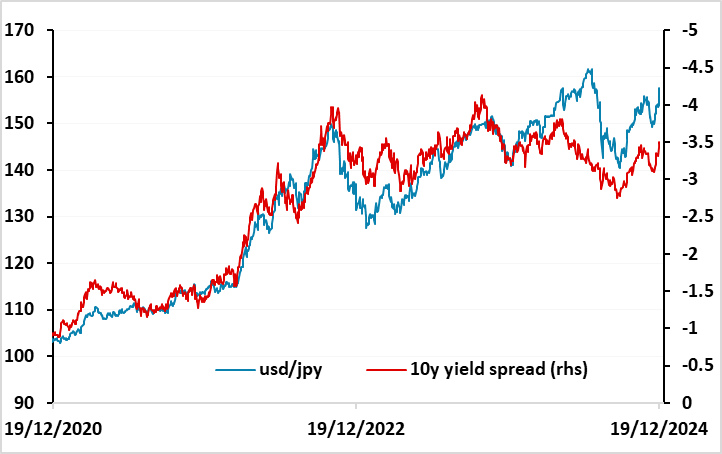

However, USD/JPY movements in the short run have tended to move closely with the (nominal) 10 year US/Japan yield spread, and with the more hawkish tone of the last FOMC, we no longer look for much change in the US/Japan 10 year spread over 2025. But as with the EUR, we may see a paradigm shift in the Trump presidency. While there is some fundamental support for the yield spread driven performance of USD/JPY, the relationship over recent years has suffered from money illusion, in that it has taken no account of relatively low Japanese inflation either in terms of the impact on the real value of the JPY or the level of real yields. Real USD/JPY is much higher than nominal USD/JPY, and real yield spreads in favour of the USD are somewhat lower than nominal yield spreads. Theoretically, it should be real yields and the real value of the currency that are correlated. Practically, we tend to see the nominal currency move with nominal yield spreads, but at some point there needs to be a correction for the real decline in the JPY.

Figure 4: USD/JPY and nominal yield spreads

Source: Datastream, CE

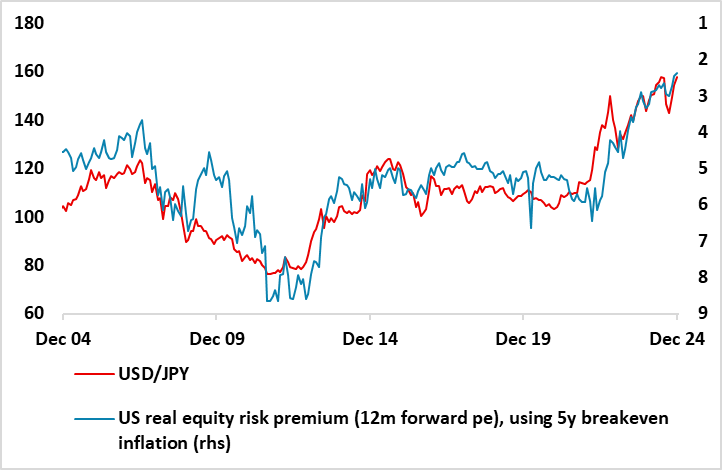

The most likely trigger for a paradigm shift is a turn in the equity market (mainly U.S.). While there is a strong short-term correlation between USD/JPY and nominal yield spreads, there is also a longer term correlation between the JPY and US equity risk premia, both against the USD and on the crosses. US equity risk premia are approaching the lows seen before the dotcom crash of 2000, and there is a significant risk of a sharp equity correction lower, particularly if the AI revolution proves unable to produce the hoped for revenues. If this occurs, USD/JPY can be expected to move sharply lower. Even so, we see this as a risk rather than a baseline at this stage, with our central view of the US economy and US equity market suggesting USD/JPY will only fall modestly from current levels.

Figure 5: USD/JPY and real US equity risk premium

Source: Datastream, CE, FRED

GBP strength supported by higher yields

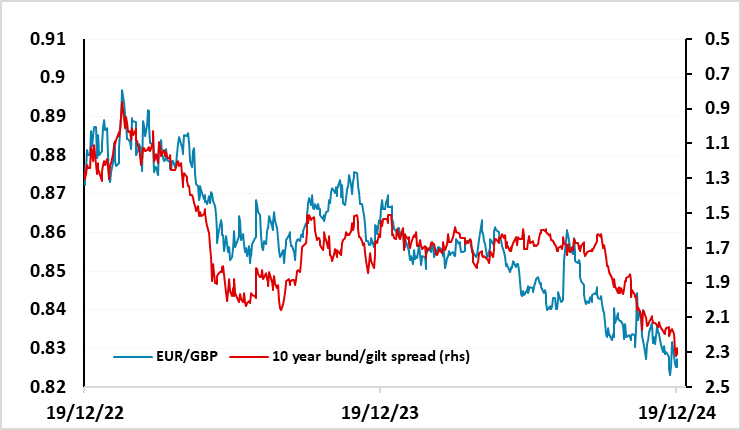

GBP strength has been one of the notable developments this year, with the pound benefiting from the stronger than expected H1 growth performance and a slower pace of easing from the BoE relative to the other major central banks. This has supported an improvement in sentiment that has justified some reduction in the risk premium that had built up in GBP during the latter years of the previous UK government. But the rise in GBP against the EUR has been primarily due to yield spreads. UK inflation, particularly wage inflation, has been relatively stubborn, and UK yields have also been boosted by the first Budget from the new government. While this initially triggered a reaction that was similar to that seen after the Truss budget in 2022, albeit a lot less violent, the initial GBP weakness faded and the pound has since benefited from the improved yield spread in its favour.

Figure 6: GBP benefited from rising yield spreads

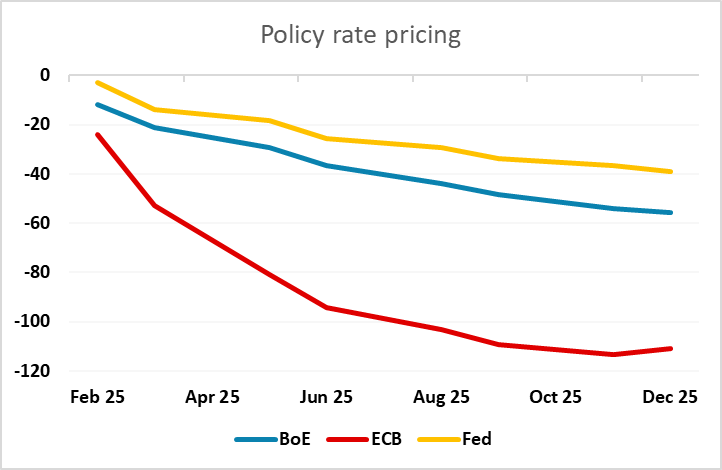

Downside risks for GBP as favourable yield picture unlikely to persist

While the Bank of England still looks likely to take a cautious approach to easing, it is unlikely to be as cautious as the market is currently pricing in. The market is currently pricing in 110bps of easing from the ECB in 2025, against 55bps from the BoE, with the ECB already having cut rates 100bps from the peak against 50bps from the BoE. It looks hard to justify this degree of difference in policy when the UK and Eurozone economies have performed similarly and UK CPI inflation is only modestly higher than the Eurozone. BoE policy expectations look more aligned with the Fed, and that doesn’t look consistent with the relative economic performances. We would anticipate some convergence between BoE and ECB policy expectations over the course of 2025 as the BOE cuts more than expected, and that should allow GBP to slip lower, with a EUR/GBP move up to 0.85 consistent with our yield forecasts. However, as with the EUR and JPY, there is a health warning because current paradigms may not be robust, and GBP is at high levels historically, with real EUR/GBP at its lowest since before the Brexit referendum in 2016. Risks are therefore on the high side of 0.85.

Figure 7: Market prices in very different BoE and ECB easing paths

Source: Refintiv

Commodity currencies have potential to outperform

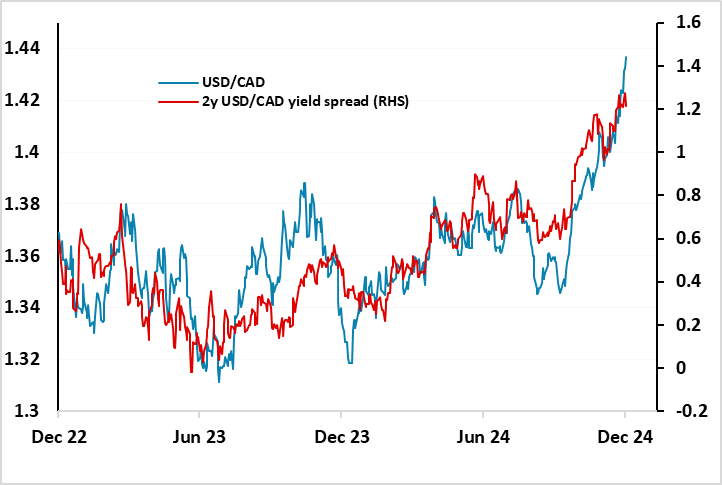

Despite the generally risk positive environment of the last year, commodity currencies have not performed particularly well. The CAD’s weakness is explainable by the widening of yield spreads in the USD’s favour over the year, but this doesn’t really explain the weakness of the NOK and AUD. Norges Bank has maintained relatively tight policy, and while there is some correlation between rising US yields and the rise in USD/NOK, the NOK has underperformed spreads and it’s noticeable that CAD/NOK has been little changed. AUD has also struggled in spite of relatively tight RBA policy and has hit new lows for the year in December. The AUD has been held back to some extent by the weakness of the Chinese economy and particularly the Chinese equity market, but hasn’t managed to recover in spite of a better Chinese equity performance in the last few months.

Figure 7: USD/CAD driven by yield spreads

Source: Continuum Economics/Datastream

The high level of USD/CAD continues to be justified by the high level of US yields. We see little scope for a decline in US yields over the coming year, suggesting it will be hard for USD/CAD to move back below 1.40. However, there may be more scope for gains in the AUD and NOK. For the AUD, this may depend on the performance of the Chinese economy and the extent of US tariffs and their impact on world trade. NOK weakness is more mysterious, puzzling even Norges Bank, but the stability of CAD/NOK suggests we may not see much movement.