Japan Outlook: Lukewarm Japan and BoJ

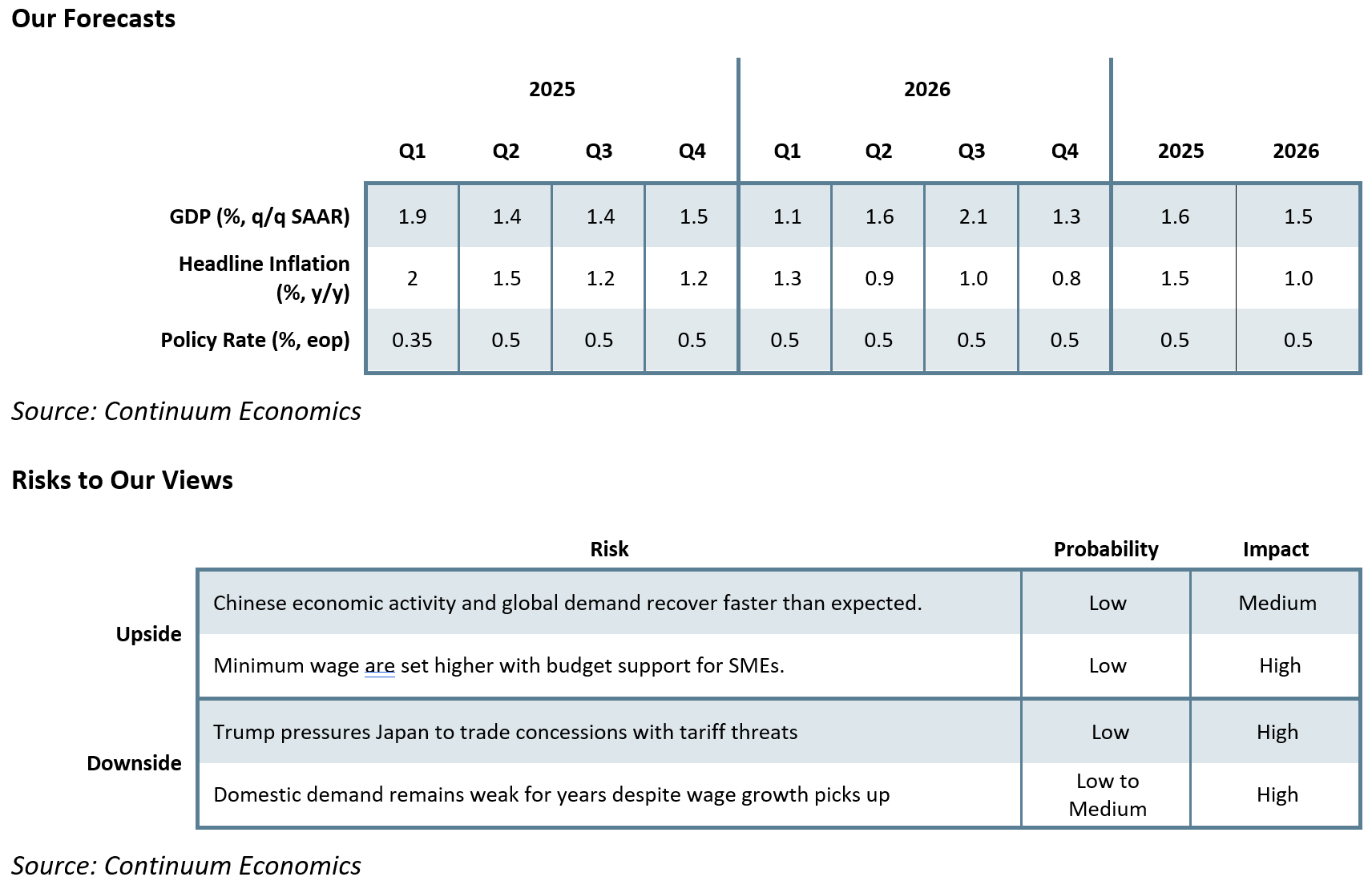

· Due to the slow recovery in consumption, 2024 GDP has been revised lower to -0.5%. Private consumption will continue to grow throughout 2025/26 gradually as business price/wage setting behavior gently shift and Japanese consumers adapting to higher inflation. Wage growth in 2025 will be above average but unlikely to repeat the pace in 2024 from profit margin restraint caused by consumers reluctant to fully accept higher prices. The trade balance in 2025/26 will likely rotate lower from 2024 level when JPY strengthens from BoJ’s rate changes - we forecast +1.6% GDP in 2025 and +1.5% in 2026. Government spending is expected to steady throughout 2025/26. While the Japanese government’s fiscal room is limited, they are unlikely to cut the budget deficit with their dedication to boost wage growth and seek political support from residents.

· We are forecasting the BoJ to take the key policy rate to 0.5% in 2025, likely through one 10bps and one 15bps hike in the first half of 2025. The BoJ has taken a hawkish tilt in their July meeting in sight of inflation picking up by raising the policy rate but seems to be taking it slow as the risk of inflation overshooting is low and they would not like to be perceived by market to be rushing to neutral policy rates. The upside risk lies in the Japanese government pushed wage growth higher by increasing minimum wage in 2025/26 and it could see terminal rate rising to 1%.

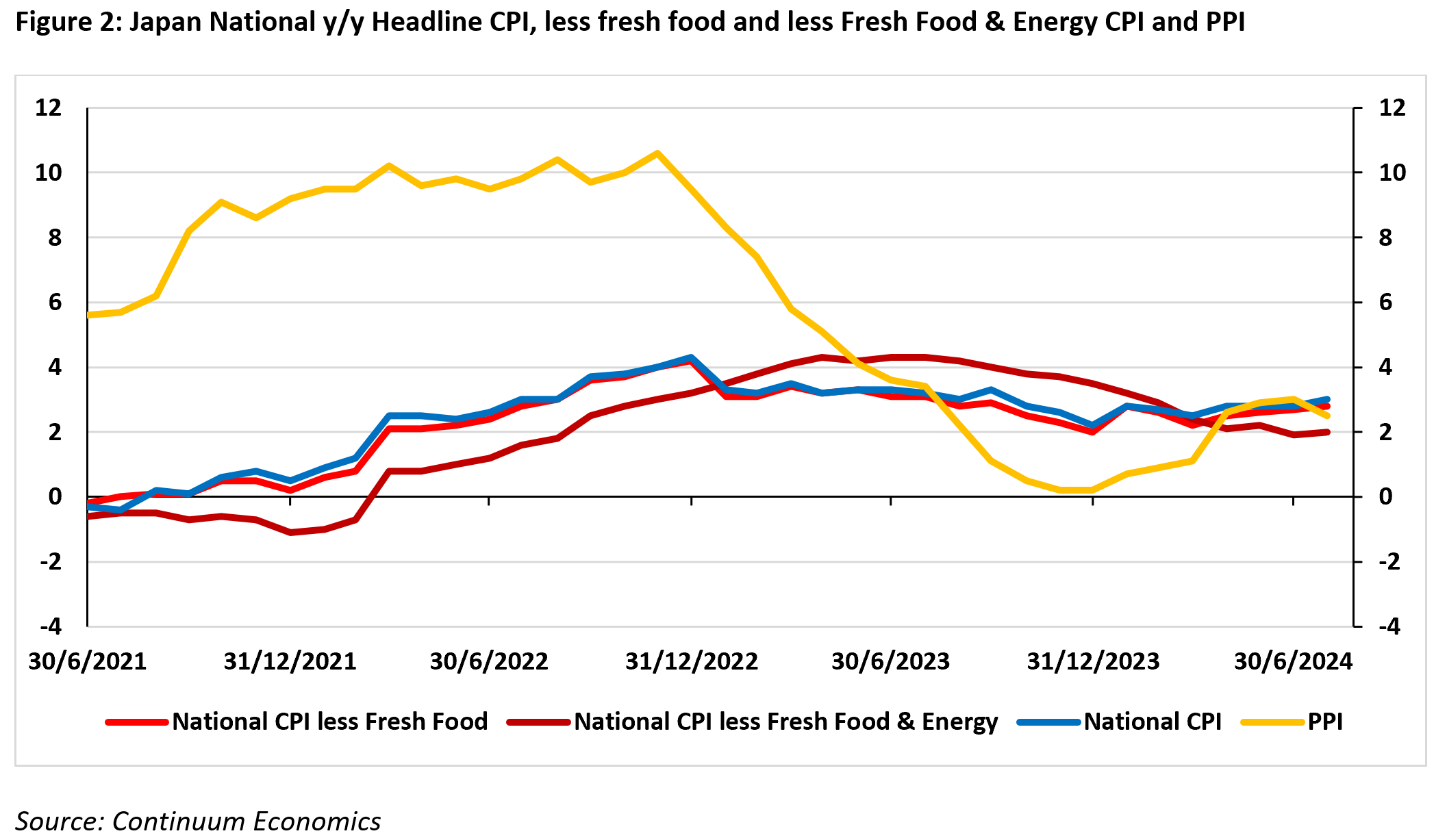

· However, if BoJ is too slow (waiting for result of spring wage negotiation before further tightening) they may miss the window when inflation flattens after H2 2025. Although Japanese business have begun to exert changes to price setting behavior, the low PPI and customers’ reluctance to fully accept higher inflation are slowing the pace of price increase.

Forecast changes: We revised 2024 GDP lower to -0.5% from +0.2% as private consumption recovery is much slower than forecast. 2025 GDP is unchanged at 1.6% and sees 2026 GDP at 1.5%. CPI is revised slightly higher to +2.6% from +2.5% in 2024, +1.5% from +1.1% in 2025 before moderating to 1% in 2026.

Macroeconomic and Policy Dynamics

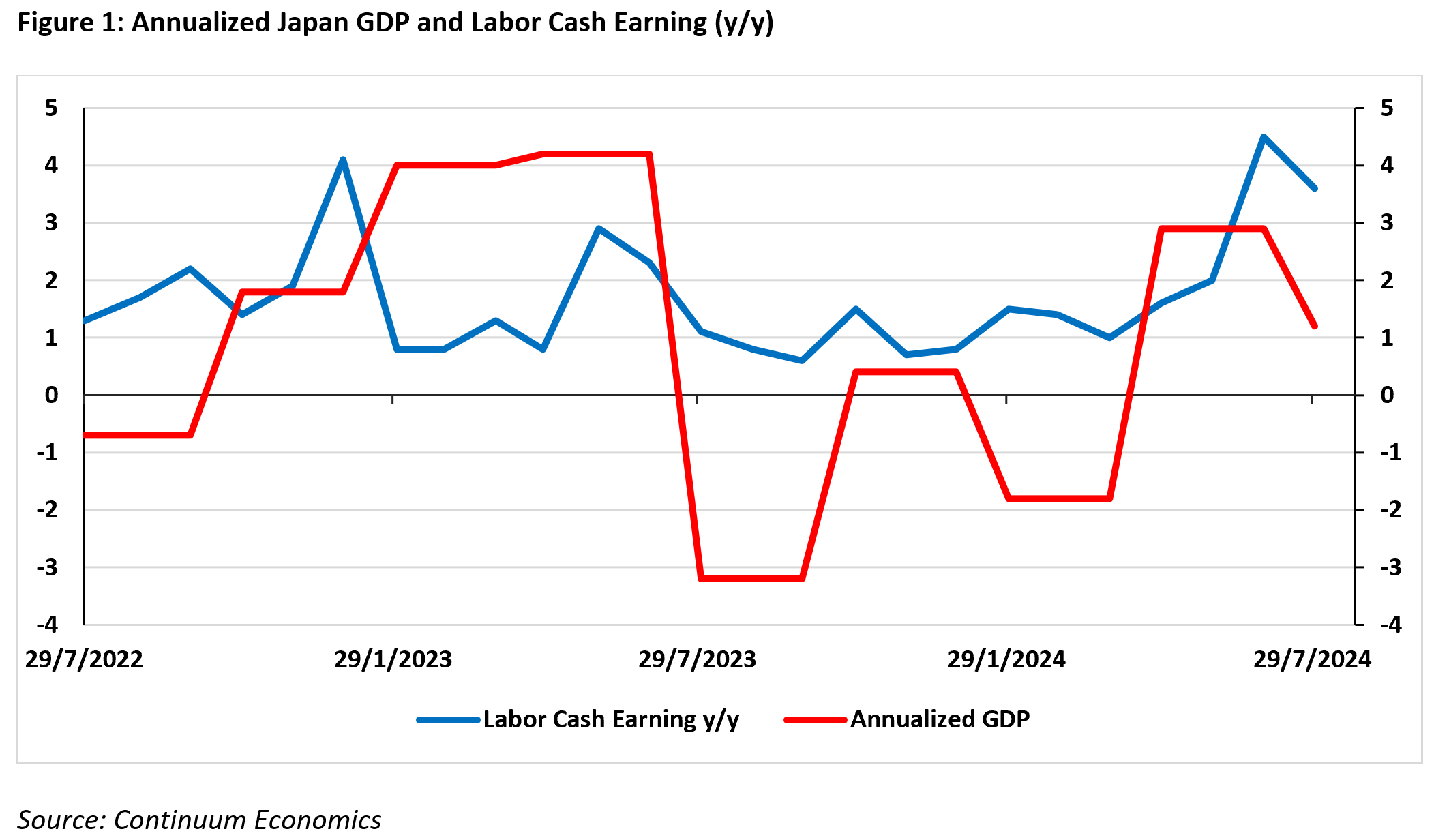

The BoJ has taken a hawkish policy stance in the July meeting by hiking interest rate to 0.25% and announced a bond purchase reduction plan (halving the pace by around 3 trillion JPY in two years) but have since taken things slow and does not sound like another rate hike is imminent . Labor cash earnings is steadily above 2% and potentially most part of 2025. Wage growth for small to medium firms will be lower than large firms but enough to bring real wages positive. BoJ believe such a trajectory would translate into higher trend inflation, along with the change of business price setting behavior. After the consumption contraction in Q1 2024, the economic rebound has been sluggish (overall household spending contracted three months in a row) because real wage was driven lower by the spike in CPI. The recovery in consumption seems to be a relief of pent up demand on rising wages, instead of a drastic change in spending behavior. Thus, our 2024 inflation forecast are revised only marginally higher to +2.6% from +2.5% to reflect such behavior brought by improving real wage in the face of a reluctant consumer.

Our forecast for 2024 GDP is revised lower to -0.5% to reflect the sluggish recovery in private consumption. Economic growth will be normalized from more balanced wage/inflation dynamics and thus 2025 GDP’s forecast is +1.6%, 2026 GDP at +1.5%. Private consumption is expected to continue gradually recovering from positive real wages with growth being modest in 2025/26 as Japanese will still be adapting to high prices. Headline labor cash earning has grown at a decent pace above 2% for the past quarters, contributing to stronger trend inflation in BoJ’s eyes. However, the strong gains in wage is unlikely to be repeated in 2025 as higher labor cost and modest consumption will further squeeze profit margin where small and medium business are already struggling. Still, 2025/26 wage hike will be above average with labor union already calling for the government to raise minimal salary and for another historic wage negotiation. Government spending will be steady given the limitation in fiscal space and we are not forecasting another round of stimulus. The Japanese government may try to seek approval from residents after the latest setback in the general election by modestly focusing the budget in supporting wage growth.The Japan trade balance will rotate lower from the beginning of 2025 if the BoJ’s policy change lead to a significant strength in the JPY as we project in 2025. Japanese Yr/Yr export & import continues to grow by 1.1% and 1.8% (in real terms) in Q3 2024 and is expected to be lend minor support to 2024 and most part of 2025. Japanese exports to China is the biggest growth factor in trade. The Chinese government has recently released the ban on Japanese seafood import, seems to open doors for improving trade relationship and may provide a minor benefit for Japanese trade figures. As the BoJ took a hawkish turn and the Fed begun its easing cycle, it looks like the JPY will inevitably strengthen significantly in a medium run and make Japanese goods less cheap and see a more neutral net export contribution in 2025/26.

Meanwhile, BoJ has revised their inflation forecast in October for y/y CPI less fresh food and energy from +1.9% to +2% for 2024 and revised 2025 GDP higher to +1.1% from 1%. BoJ had privately viewed the +2% inflation target a long shot but now sees trend inflation reaching such target because business in Japan are exerting a change in price/wage setting behavior in face of higher input prices in the past two years (Figure 2). Still, the BoJ seems to be too optimistic at the pace and magnitude of change in business price/wage setting behavior and looks likely to underestimate the time it takes for traditional Japanese consumer to accept higher inflation.

Fresh food and energy, once the biggest inflationary factor, has moderated further (energy prices +0.6% y/y and fresh food +1.2% in October 2024) and is not expected to resume their post COVID era inflationary impulse. The National y/y CPI has moved away from the 3% spike in August to 2.3% in October and is forecast to simmer in the coming quarter. In 2024, headline CPI is forecast to be +2.6%, driven by the strong wage hike that pushes prices higher in the short run yet limited by both consumption and price setting behavior. By 2025, we project headline inflation would revert to the traditional Japanese pace of +1.6% as the pace of wage growth cannot be sustained and BoJ cumulative tightening anchors inflation expectations before further slowing to 1% in 2026.

Policy Outlook

The BoJ tilted towards a hawkish stance and brought short term interest rate to +0.25% in July in face of higher than anticipated trend inflation from the change of Japanese business price & wage setting behavior. Bond purchase will be halved (around 3 trillion JPY) over the coming two years. The BoJ would like the market to decide long term interest rates and they are only favoring gradual changes in yields with commitment to intervene on any major spike or alternatively above 2% 10yr yields – unlikely with slow policy rate normalization.

Despite early signs of current price & wage setting behavior being inflationary, the BoJ would like to see more supportive data and a decent 2025 spring wage negotiation before taking the next step in policy change. The BoJ is taking it slow to avoid sending the wrong message to the market as they see little risk of an inflation overshoot. Given the current inflation dynamics, we see the BoJ to take interest rate to 0.5% in 2025, splitting into one 10bps in Q1 and one 15bps hike in Q2 2025.

We are cautious towards further policy rate hikes beyond 0.5% in H2 2025. While price & wage setting behavior is changing, it takes time to change traditional habits and we believe consumption growth would be more gradual than BoJ expect (overall household spending and retail trade had not followed the boom in labor cash earning). After the relief of pent up demand from wage boost in H2 2024, the reluctance to continuously consuming at a higher price is likely to squeeze corporate margin growth in 2025, meaning that companies would turn to less wage increases in 2025 and subsequently lower CPI. A hawkish policy take may drive trend inflation to be lower than BoJ’s target of 2% unless the Japanese government took the charge and drive minimum wage significantly stronger. The failed normalization attempts in 2000 and 2006 show that the BOJ can go too far and then end up reducing the policy rate.