China Outlook: Construction and Trade Headwinds v Policy Stimulus

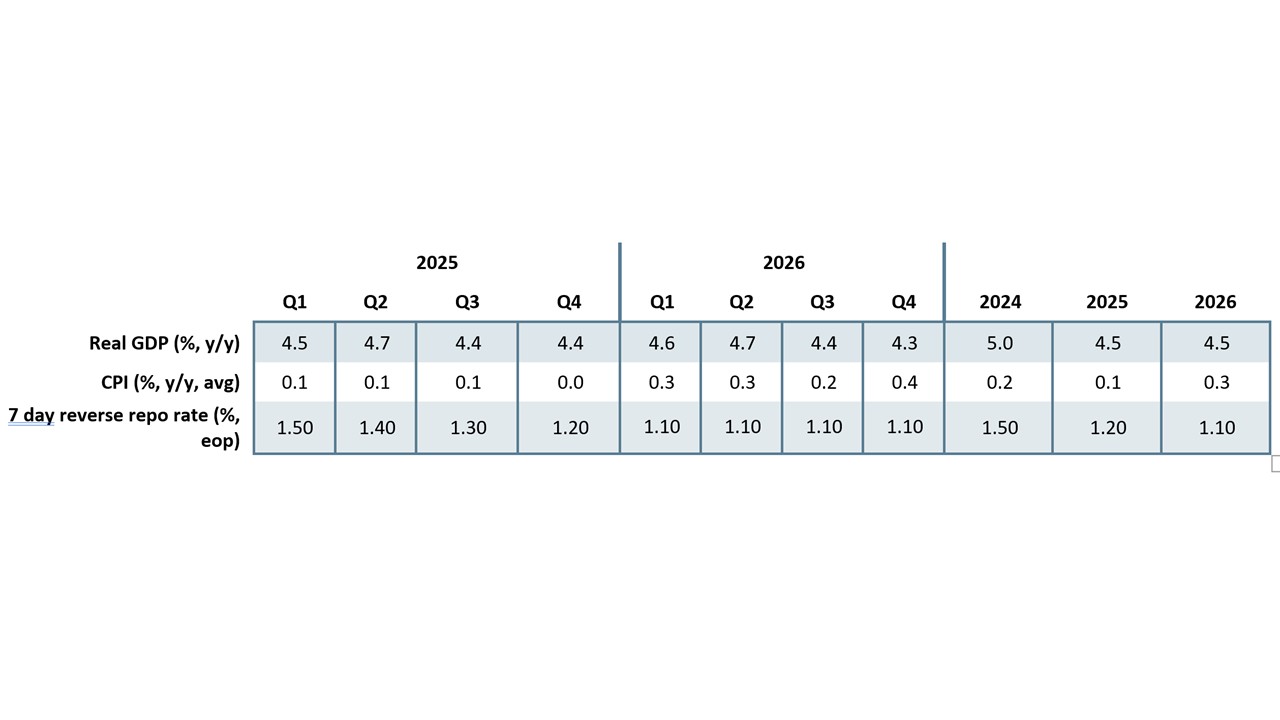

We look for 4.5% GDP growth in 2025. Though residential property investment will subtract less from GDP growth, net exports will also be a drag on the economy in 2025 due to the trade war with the U.S. Further fiscal stimulus beyond March’s NPC measures will be required to achieve a 5% GDP target. Some of this will likely be delivered, but we are unsure whether sufficient stimulus will be seen.

· We have further reduced down CPI inflation forecasts as an excess of production over domestic demand causes more disinflation. We forecast 0.1% for 2025 CPI inflation and 0.3% for 2026. However, we do not yet see signs that real sector purchases are being delayed by low/weak CPI inflation and this is not deflation.

· Thus, the authorities’ action in boosting CPI inflation will likely remain modest. We look for 10bps each quarter for the 7 days reverse repo rate in Q 2026 down to 1.1%. We then see the PBOC going on hold due to concerns over banks’ interest rate margins and a desire to avoid a super weak Yuan.

· Risks to the Outlook. The trade war with the U.S. could be bigger or longer than we expect causing more adverse effects on China GDP. Alternatively, the residential investment sector shrinkage could worsen rather than getting slightly smaller in 2025.

Forecasts

Risks to Our Views

| Risk | Probability | Impact | ||

| Upside | China’s authorities undertake aggressive and proactive fiscal and monetary policy stimulation to boost real GDP growth. | Medium | Medium | |

| Downside | U.S. imposes more significant across the board tariffs on China and China retaliates (though by less) and hurt China net exports and employment | Medium | High | |

| Residential property market sees renewed slowdown impact property prices/wealth and consumption as well as hurting residential property investment. | Low to Medium | High |

Source: Continuum Economics

Though more policy support is emerging from China authorities, net exports will likely join residential property investment as an outright drag on China growth for 2025. Key points to note

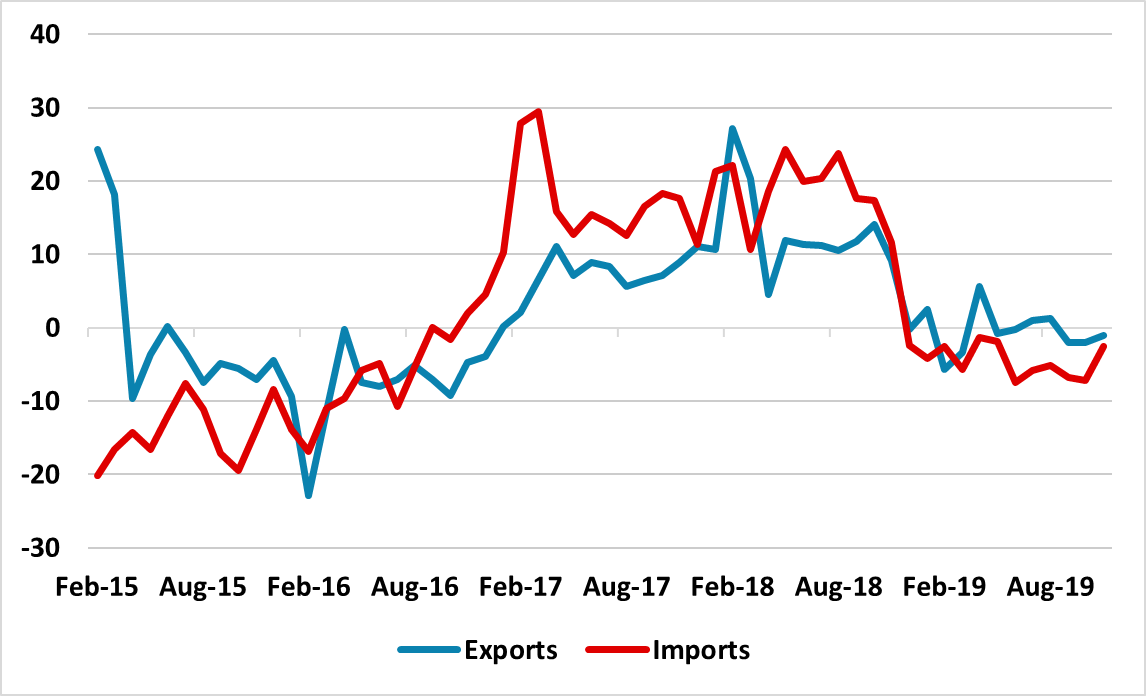

· Net exports. The U.S. clearly wants to pressure China to an enhanced trade deal, with 20% cumulative increase in tariffs already on the pretext of fentanyl. China authorities want to avoid the 18-month period it took to reach agreement in 2018-19 and quickly revise the phase 1 trade deal. However, the U.S. will play tough and demand a phase 2 deal that includes penalties if import targets from the U.S. are not meet (here). This will initially be a red line for China and we do not see a trade deal until Q4 2025 at the earliest. China exports to the U.S. will thus be hit directly by tariffs, just like 2018-19 (Figure 1). China companies will also find it difficult to full switch exports to other countries. The EU is watchful of dumping of exports, while some countries are already threatening to separately raise tariffs on China goods (e.g., Mexico and Vietnam). With import growth likely to slow less, we see net exports being a drag on growth in 2025 and then less in 2026 (when a trade deal is done).

Figure 1: Export and Imports Values USD (12mth % Change 2MMA)

Source: Datastream/Continuum Economics

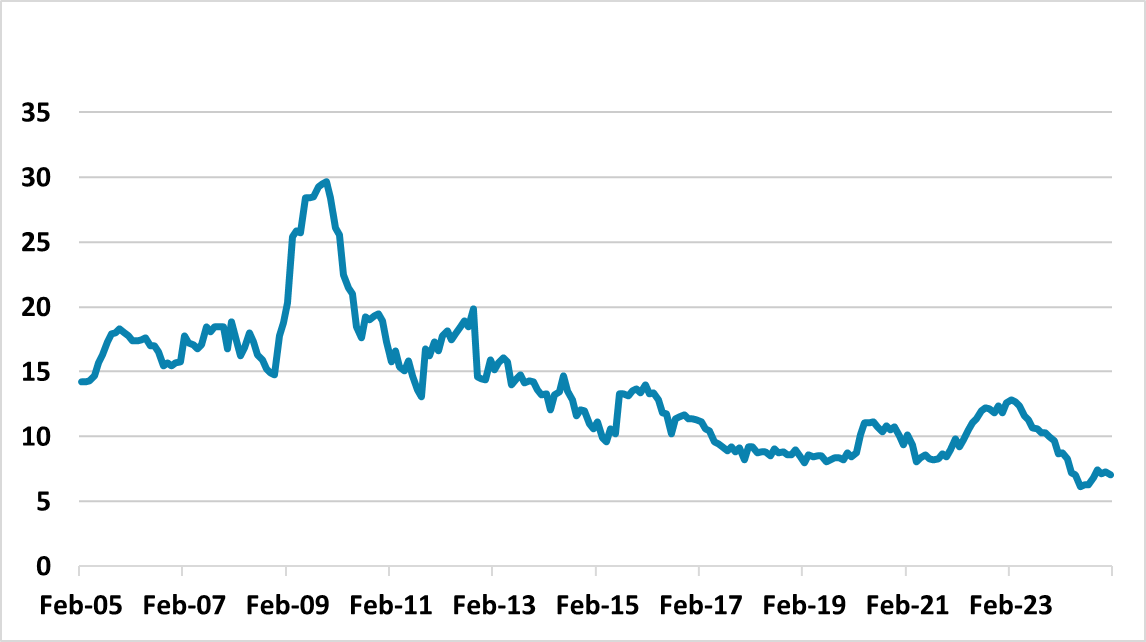

· False bottom in residential property. China authorities’ recapitalisation of the biggest banks is designed to raise credit supply, while the authorities are also stepping up efforts to buy completed housing for affordable homes. Combined with a slowing in the decline in house prices, this has prompted some optimism that a bottom could be seen in residential property. We remain negative for three reasons. Firstly, though new home sales are coming more in line with new lower levels of construction, a large overhang remains of completed and uncompleted homes. More aggressive action from the authorities is required, otherwise it will take years to run down the inventory and this will weigh on house prices and construction activity. Secondly, house price to income ratios remains high in tier 1 and 2 cities and sections of tier 3 cities. Households will not rush to buy houses with still elevated prices and any near-term bottom in the house market will likely prove a false dawn. It is true that residential property investment will likely be less negative than 2024, but we could still see it subtracting 1% from 2025 GDP and 0.5-1% from 2026 GDP. Thirdly, credit demand remains awful and is the main reason behind low M2 growth by China standards (Figure 2). Increased credit supply may not be enough in itself to lift M2 growth back above 10% that is needed to sustain 5% GDP growth.

Figure 2: M2 Growth (Yr/Yr)

Source: Datastream/Continuum Economics

· Consumer headwinds. Consumer sentiment remains poor, both due to the slump in the housing market but also weak employment and income growth. Though the authorities are trying to show a more business friendly attitude, improvement in hiring and income will likely be slow for private businesses as we are not seeing a return to the high growth years of 1990-2019. Additionally, though the authorities are promising more fiscal support for households, this is likely to remain targeted (here) rather than substantive improvements to safety nets (pensions, unemployment and health) or large-scale cash handouts. Some households are also showing signs of a balance sheet recession (here). We see consumption remaining sluggish overall, with resilience in areas where trade-in programs are extended.

· High tech production/Infrastructure spending. March NPC provided comfort of extra central government infrastructure spending, which is needed as a positive support for the economy. Additionally, the ongoing clean-up of local government and LGFV balance sheets will likely mean that local infrastructure becomes less negative and swings to a positive contribution to GDP growth. Finally, the authorities push in high tech manufacturing will continue to provide positive economic momentum to production/employment and income in certain sectors.

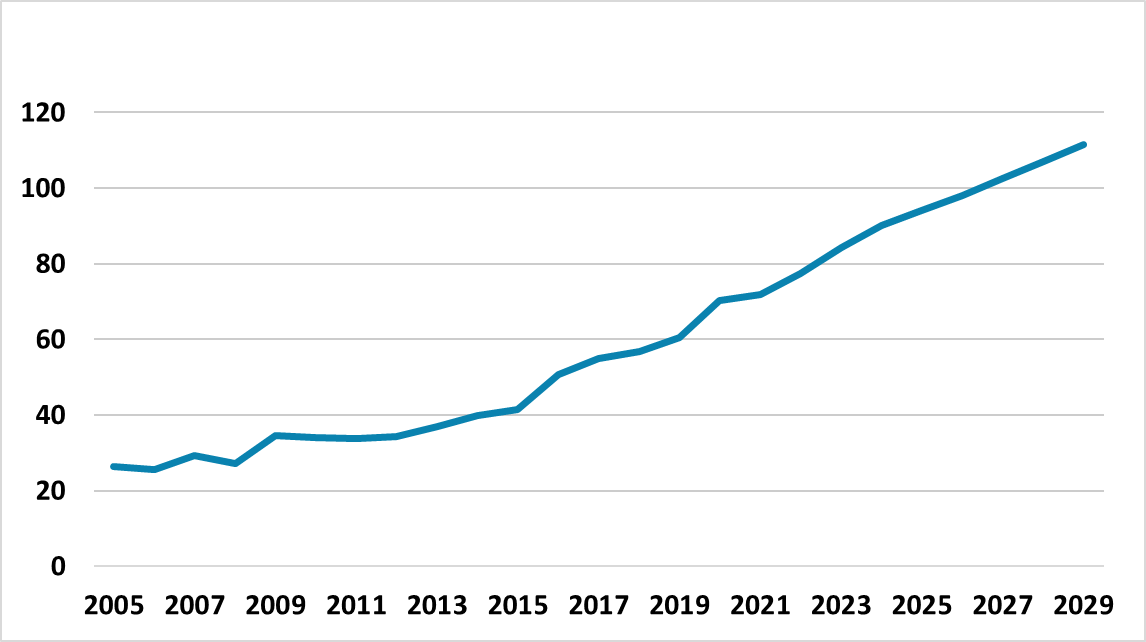

Overall, we look for 4.5% GDP growth in 2025. Though residential property investment will subtract less from GDP growth, net exports will also be a drag on the economy in 2025 due to the trade war with the U.S. Further fiscal stimulus beyond March’s NPC measures will be required to achieve a 5% GDP target. Some of this will likely be delivered, but we are unsure whether this will be sufficient. Firstly, the authorities are not in a hurry to actually deliver fiscal stimulation, both as growth is around 5% rather than well below and they want to keep a fiscal reserve in case growth sees more of a deterioration. Secondly, they remain concerned that the total government/corporate and household debt/GDP remains very high by EM standards and above the U.S./EZ though below Japan. Though official numbers show a controlled central government, the IMF shows a large budget deficit for the wider general government and also a sharp uptrend in government debt (Figure 3).

Figure 3: China Government Debt/GDP (%)

Source: IMF/Continuum Economics (IMF central measure article IV Aug 2024)

In terms of monetary policy, the authorities appear reluctant to match Yuan depreciation with new tariffs from the U.S., compared to the tactics in 2018. This is partially to avoid triggering an extra tariff response under Trump 2.0, but also to avoid domestic capital outflows if a quick Yuan decline is seen. We still expect some Yuan decline by mid-year to 7.45 but now not 7.65-7.70 (here). The PBOC will likely be slower in cutting the 7-day reserve repo rate and we now project a quarterly pace of 10bps reduction through to Q1 2026 to 1.1%. We also expect a quarterly pace of 25bp cut in the RRR Q2-Q4 2025.

After Q1 2026 we see no further easing from the PBOC. We do not feel that the PBOC is willing to move to ultra-low interest rates, as the adverse effects from squeezing banks’ interest margins could be too great. Additionally, internal opposition to QE remains significant, as seen with the struggle to stop government bond yields going lower over the last 12 months. Finally, China faces aggressive disinflation rather than outright deflation. We forecast 0.1% for 2025 CPI inflation and 0.3% for 2026, which reflects the excess of production over consumption. However, we do not yet see signs that real sector purchases are being delayed by low/weak CPI inflation. Thus, the authorities’ action in boosting CPI inflation will likely remain less than the new symmetric 2% inflation objective.