DM FX Outlook: USD under pressure as Trump policies disappoint

· Bottom Line: The market had expected the Trump presidency to see further fiscal expansion and consequent tight Fed policy and high US yields. But the combination of less tax cuts than previously expected and more aggressive tariff increases have led to reduced expectations for US growth and lower US yields. At the same time, plans for increased European fiscal spending on defence and infrastructure has raised EUR growth expectations and yields. The consequence is a generally weaker USD and a generally stronger EUR than previously expected. But there remains a lot of policy uncertainty, and while we expect a weaker USD than previously, the losses still look likely to be greatest against the JPY.

· Forecast changes: We have raised our EUR/USD forecast to 1.15 for end 2025 from 1.10, and cut our USD/JPY forecast to 135 from 145.

· Risks to our views: Much will depend on how equity markets perform, with significant general JPY strength only likely if equity risk premia rise. The risks to the US equity market still look to be on the downside due to US slowdown and high valuations, but more reasonable valuations elsewhere and the better growth prospects for Europe provide a competing positive story. Outcomes could depend on the extent to which tariff increases are imposed and sustained, and any progress towards a peace deal in Ukraine. Our forecasts assume that Trump’s tariff threats will generally be carried out, and that a peace deal is unlikely to be arrived at quickly. This suggests a risk negative and JPY positive picture. But if Trump relents on tariffs and/or a peace deal is reached more quickly we are likely to see a more risk positive picture emerge with the commodity currencies and higher yielders in general performing well. But the USD looks likely to weaken under most scenarios unless we see an unexpectedly large US fiscal boost.

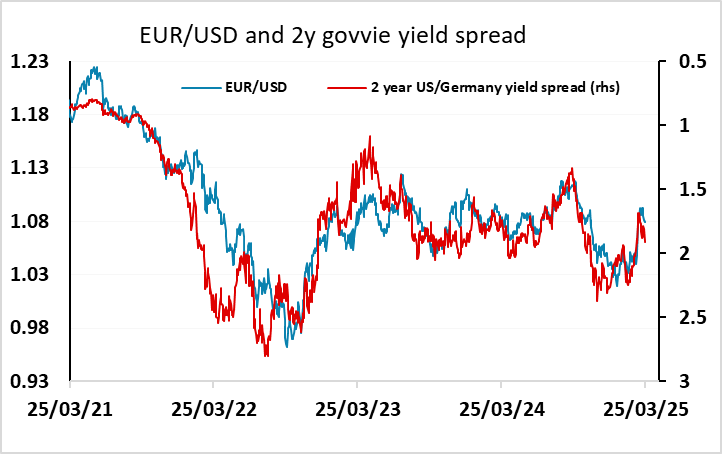

Figure 1: EUR/USD and the 2 year US/Germany yield spread

Source: Datastream, CE

EUR/USD has stuck close to the 2 year yield spread since the pandemic

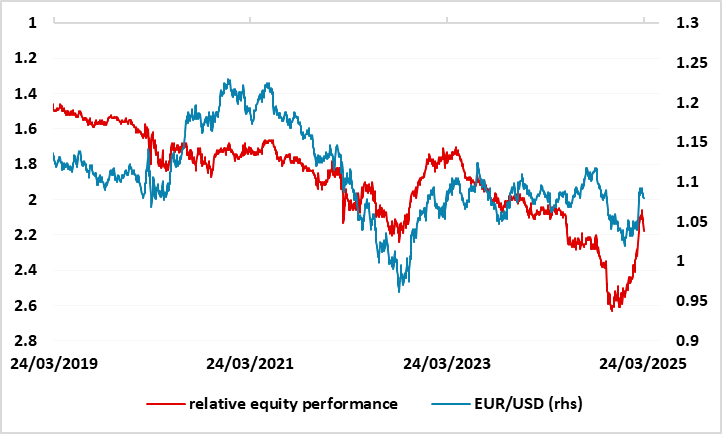

While there has sometimes been some impact from equity market correlations, EUR/USD has generally correlated very strongly with movements in the 2 year US/Germany yield spread in recent years. Currently, the spread is suggesting that EUR/USD has overshot a little on the upside, but the currency is getting some benefit from the outperformance of European equity markets since the beginning of the year. This may well continue in the coming months, given the less stretched valuations in Europe, the expected increases in European defence spending and the negative impact of tariffs on the US economy, so some outperformance of the yield spread correlation seems likely to continue.

Figure 2: EUR/USD and relative equity performance

Source: Datastream, CE

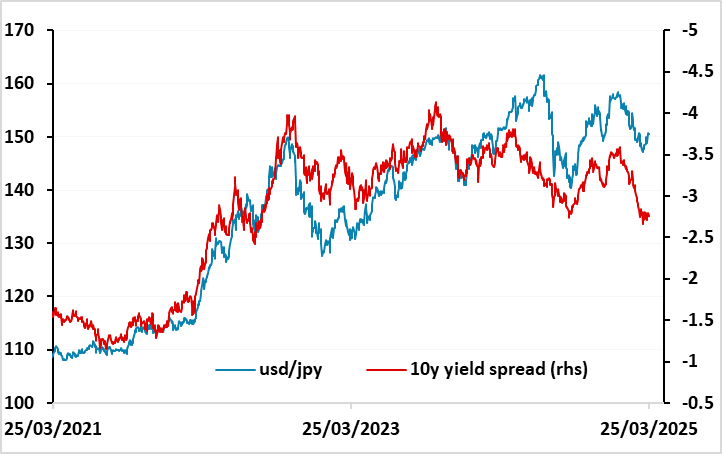

JPY still has the most potential for gains

There were some significant JPY gains through Q1 as the US/Japan yield spread contracted, with both declining US yields and rising Japanese yields contributing. However, although the JPY made some significant gains, the JPY rally ran out of steam in the last week or two, in part because the strength of the EUR led to some JPY losses on the crosses. While yield spreads continue to point to a much lower USD/JPY over the year, the JPY continues to struggle to make gains unless equities are on the back foot. In periods of positive risk appetite, the riskier currencies will continue to be preferred.

Figure 3: USD/JPY and yield spreads

Source: Datastream, CE

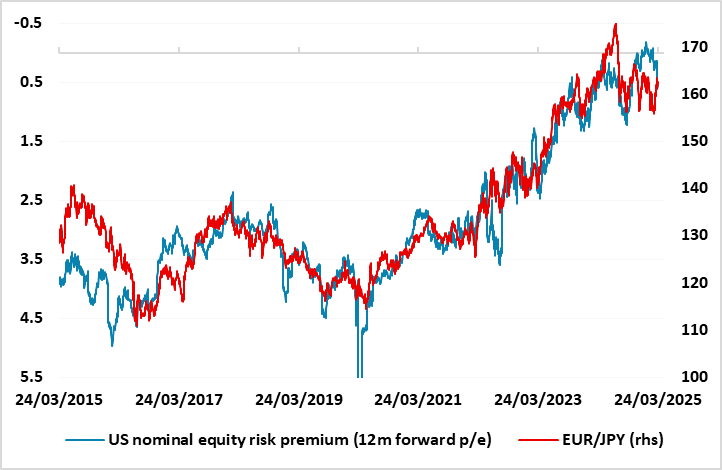

For EUR/JPY, JPY strength early in Q1 saw a break in the strong correlation between the US equity risk premium and EUR/JPY that had persisted for the last 8 years. But by the back end of March, the EUR had recovered and EUR/JPY had moved back in line with the level suggested by the correlation with equity risk premium. The fundamental case for this correlation persisting isn’t very strong. Narrowing yield spreads between the EUR and JPY make it harder to see the JPY as the primary funding currency, and the relatively low Japanese inflation rate in recent years also means that some JPY appreciation should be seen due to the real depreciation the lower inflation rate implies. Nevertheless, the US equity risk premium serves as a short term guide to the EUR/JPY trend. We would anticipate some further rise in this risk premium over the year from the still very low current levels as US yields fall and equities dip, suggesting there is scope for EUR/JPY to move into the 150s.

Figure 4: EUR/JPY and US equity risk premium

Source: Datastream, CE

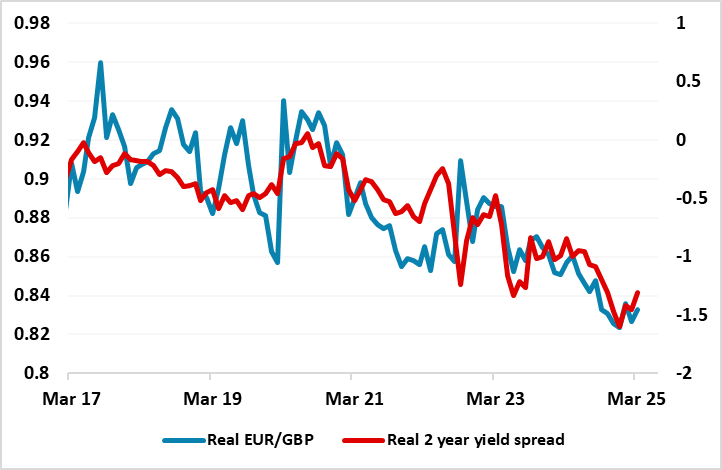

GBP starting to edge lower

GBP strength through 2024 took it to its highest level against the EUR in real terms since before the Brexit referendum in 2015. Much of this strength looks to have been justified by the relatively high level of UK yields. Some spiky activity around the pandemic aside, EUR/GBP has moved fairly closely with the nominal UK/Germany 10 year yield spread since the Brexit referendum. However, there are a few factors that suggest the pound is now on the way down.

First of all, although EUR/GBP in nominal terms has moved quite closely with nominal yield spreads, GBP is stronger in real terms than it looks in nominal terms, as UK inflation has been higher than Eurozone inflation in recent years. This also means that real yields in the UK aren’t quite as high as they look. Inflation expectations in the UK are somewhat higher than in the Eurozone, so that the real yield spread is likely closer to 1% rather than the 2% nominal 2 year spread. Real EUR/GBP already looks somewhat too low relative to the real yield spread.

Figure 5: EUR/GBP and real 2 year yield spreads

Source: Datastream, CE

Secondly, the market continues to price in a very cautious BoE easing path. UK rates are currently only priced to fall a further 50bps this year, only marginally more than the Eurozone despite the much higher starting level of UK rates. Unless we see much stronger relative UK growth, it is hard to justify the much higher level of UK real yields, especially if, as we expect, UK inflation comes down to target by year end. We would expect the BoE to cut by 25bps more than the ECB over the rest of the year, and this should allow significant narrowing of spreads along the curve.

Thirdly, while European countries in general look likely to increase defence spending, the German spending increase will also see more infrastructure spending and will be debt financed, while the UK spending will be offset by cuts elsewhere, negating any the positive growth impact. This may also undermine GBP sentiment relative to the EUR.

All this suggests to us that there is scope for EUR/GBP to move significantly higher this year, moving into the high 0.80s, with scope up to 0.90 by end 2026.

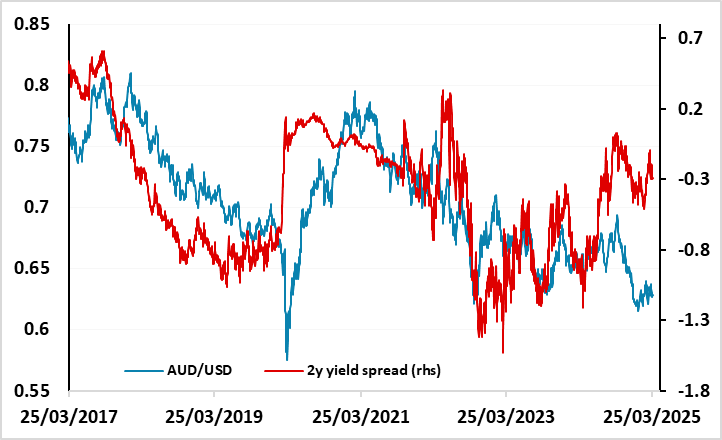

Commodity currencies have potential to outperform, but will be challenged if equities weaken

Figure 6: AUD/USD looking cheap relative to yield spreads

Source: Datastream, CE

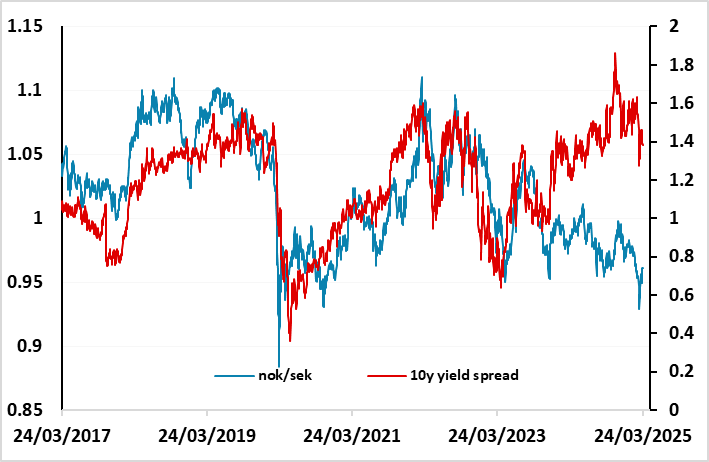

There have been some recent signs of a better performance from commodity currencies in recent weeks. AUD/USD tested its highs of the year near 0.64, and EUR/NOK has fallen to its lowest since July. Even the CAD is slightly stronger than it was at the beginning of the year, despite the US partial imposition of tariffs. Both the AUD and the NOK underperformed their usual relationships with yield spreads through 2024, and have potential to recover significantly. But both tend to require a reasonably positive risk backdrop to make gains. It was once the case that the NOK moved closely with the oil price, but this relationship broke down after the pandemic, and both the NOK and AUD had moved closely with yield spreads in recent years, until 2024. The AUD suffered through 2024 in part because of its correlation with Asian equity markets which were soft on concerns around China slowdown, but even allowing for this, it looks too low at current levels. We look for both the AUD and NOK to appreciate significantly this year, but the risk is that equity markets weaken and weak risk appetite undermines demand for the higher yields. We do see equities weakening in H1, but by the end of the year we look for the US market to be broadly unchanged from current levels, and that should be enough to see AUD and NOK gains on the year. The upside for the CAD looks much more limited given the tariff picture, although there is potential for recovery if Trump changes his mind.

Figure 7: NOK/SEK looking set for recovery

Source: Datastream, CE