Free Thematic

View:

October 03, 2025

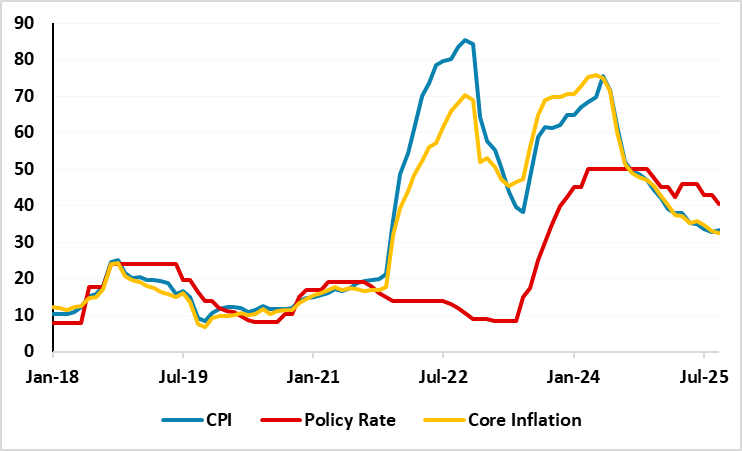

15-Month Consecutive Falling Streak Ends: Turkiye Inflation Surged to 33.3% in September

October 3, 2025 9:54 AM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on October 3 that the inflation slightly increased to 33.3% y/y in September from 32.9% y/y in August driven by higher education, housing and food prices, ending the 15-month consecutive falling streak. Increasing inflation, upside-tilted

October 02, 2025

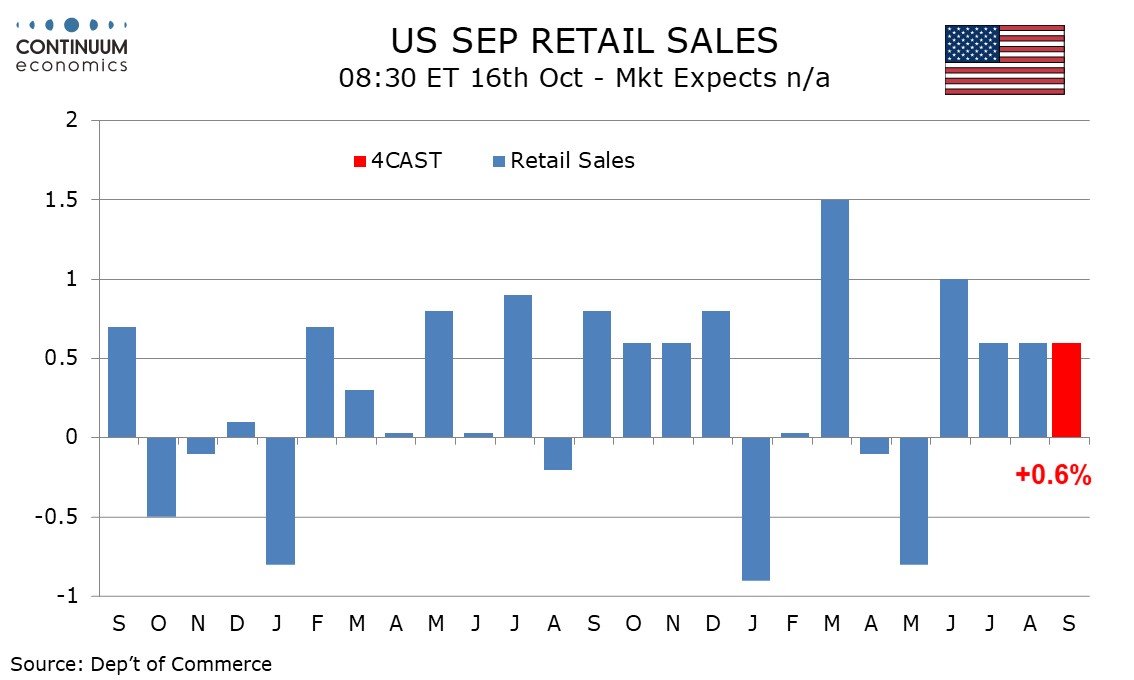

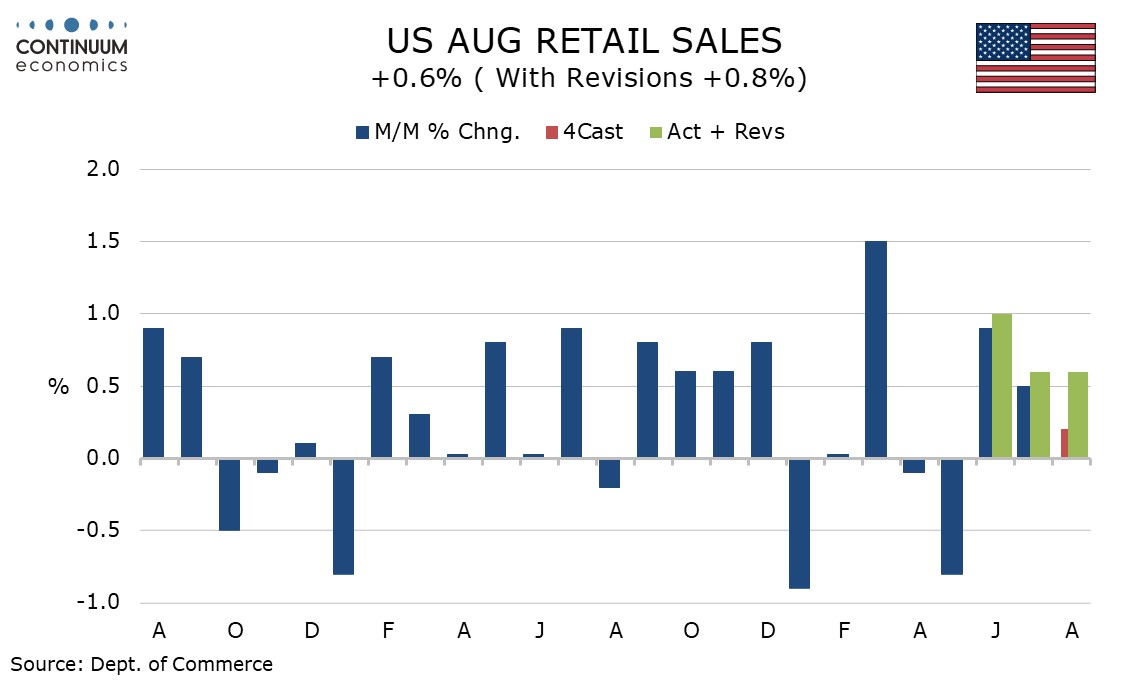

Preview: Due October 16 (dependent on shutdown ending) - U.S. September Retail Sales - Still growing, if more on prices than volumes

October 2, 2025 12:53 PM UTC

We expect a third straight 0.6% increase in retail sales in September, with slightly over half of the increase coming in prices, leaving only moderate growth in real terms. We also expect 0.6% increase ex autos but a slightly weaker 0.5% increase ex autos and gasoline.

October 01, 2025

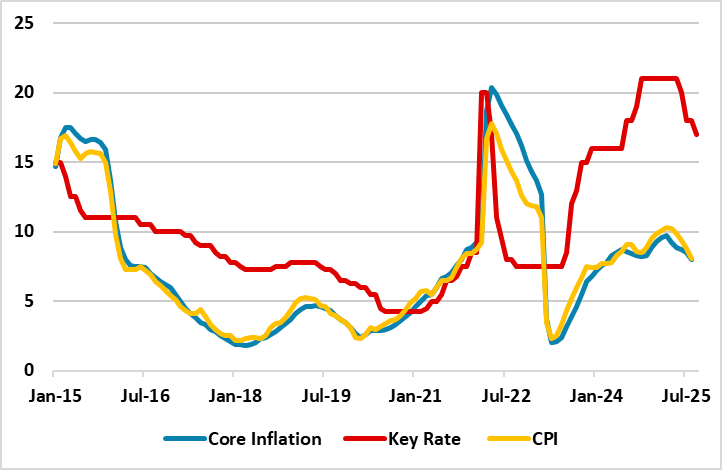

Russia’s Inflation is Expected to Continue to Soften in September

October 1, 2025 1:35 PM UTC

Bottom Line: We expect Russian inflation to continue its decreasing pattern in September, after hitting the softest rate since April of 2024 with 8.1% YoY in August, particularly thanks to lagged impacts of previous aggressive monetary tightening coupled with softening services and food prices. Sep

September 30, 2025

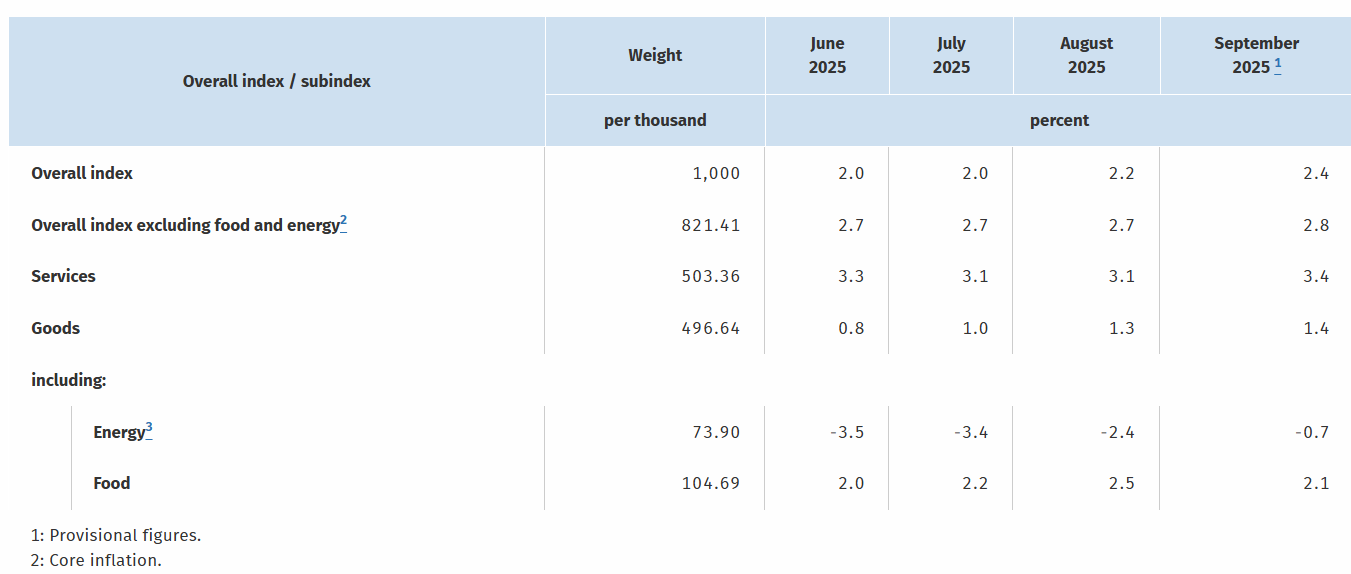

German HICP Review: Headline Higher And Core Rises Due to Fresh Services Push?

September 30, 2025 12:25 PM UTC

Germany’s disinflation process hit a further more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This (again) occurred largely due to energy base eff

September 29, 2025

RBI Likely to Hold Rates, Watchful of Tariffs and Festive Demand

September 29, 2025 6:57 AM UTC

The RBI is expected to keep the repo rate unchanged at 5.5% in its October review, pausing after three consecutive cuts earlier this year. With inflation undershooting and GST rationalisation set to push CPI lower, policymakers see little need for immediate action. The central bank will instead wait

September 26, 2025

Banxico Review: Slower Pace for 25bps Cuts

September 26, 2025 6:39 AM UTC

Banxico cut by 25bps to 7.5%. However, Banxico pushed up the near term inflation forecasts, which could mean that the November 6 meeting does not see a rate cut but rather Banxico waits until the December 18 meeting. This is our view and we look for 25bps to 7.25%. We then see two further 25bps

September 25, 2025

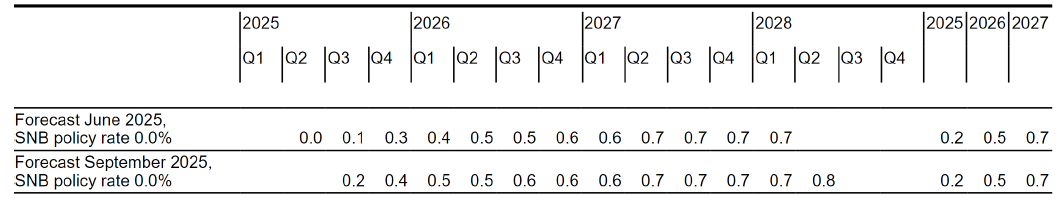

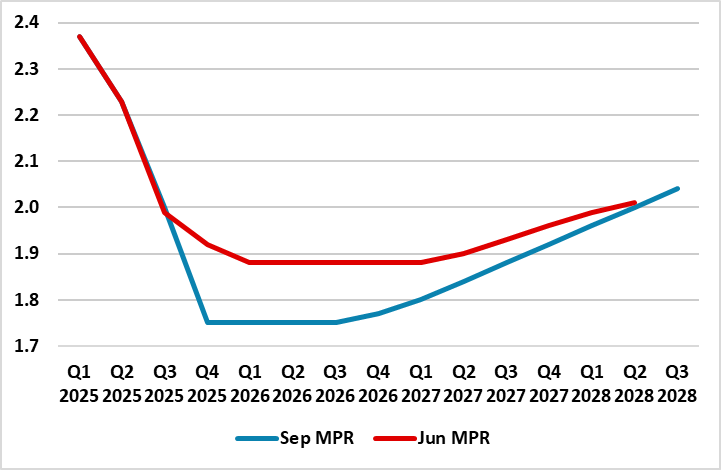

SNB Review: Staying at Zero – For Some Time?

September 25, 2025 8:03 AM UTC

Very much as expected, both in deed and word, the SNB kept the policy rate at zero this month having cut by 25 bp back in June in June. Indeed, markets priced out what was previously seen as a good chance of rates turning negative, even against a backdrop of the punitive tariff scheme the Swiss econ

September 24, 2025

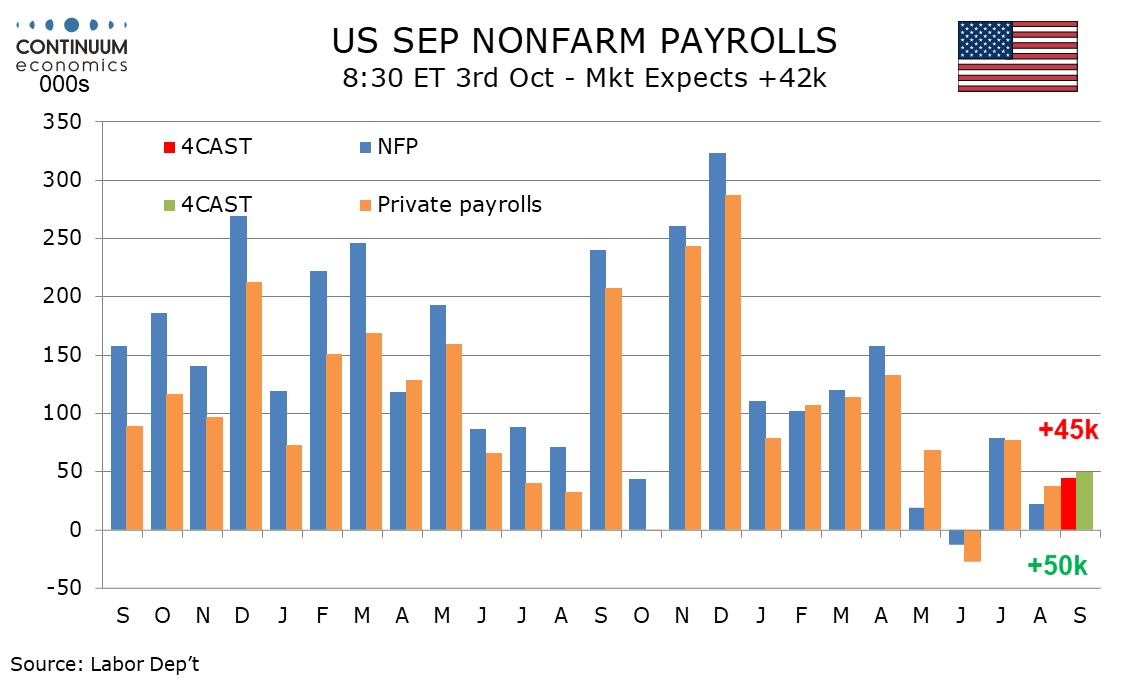

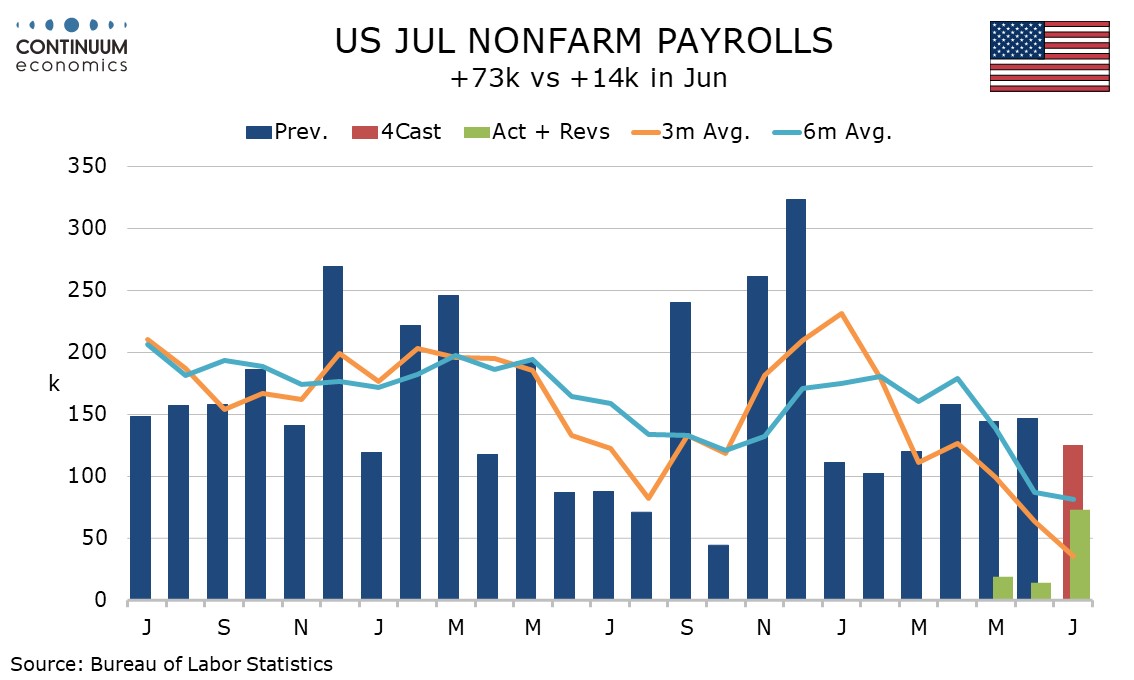

Preview: Due October 3 - U.S. September Employment (Non-Farm Payrolls) - Still subdued, but slightly stronger than in August

September 24, 2025 3:28 PM UTC

We expect September’s non-farm payroll to show another subdued rise, of 45k, with 50k in the private sector, but marginally stronger than July’s respective gains of 22k and 38k. We expect unemployment to slip to 4.2% from 4.3% on a fall in the labor force, while average hourly earnings maintai

September 23, 2025

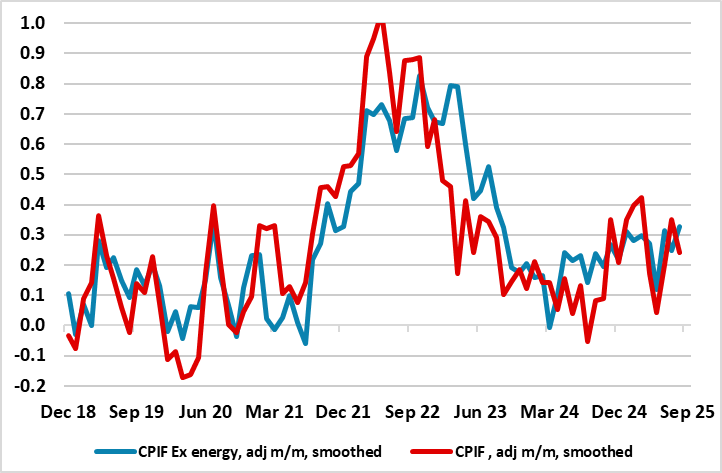

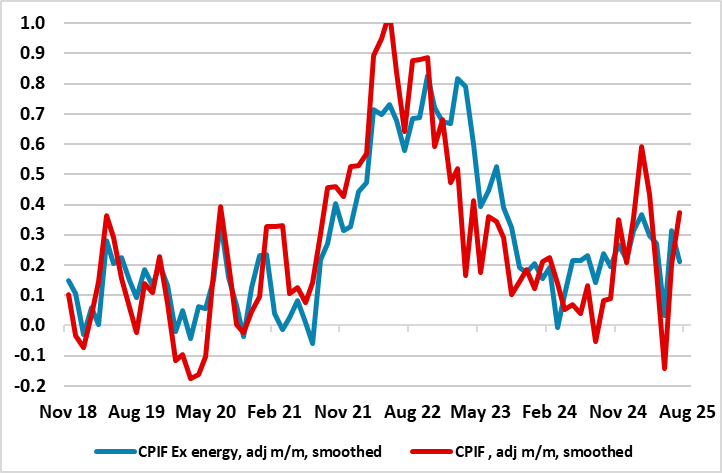

Sweden Riksbank Review: Riksbank Delivers Final Rate Cut?

September 23, 2025 8:16 AM UTC

Although aware of the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises as well as what now looks to be a clear fiscal loosening, the Riksbank delivered the 25 bp final rate cut we expected. The Board was very clear that no further easing

September 22, 2025

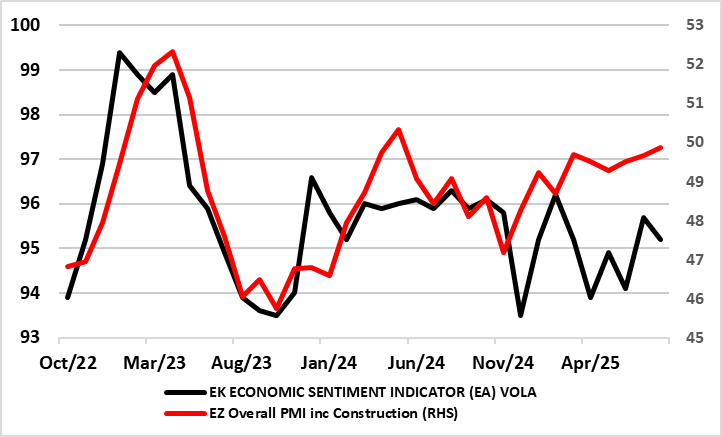

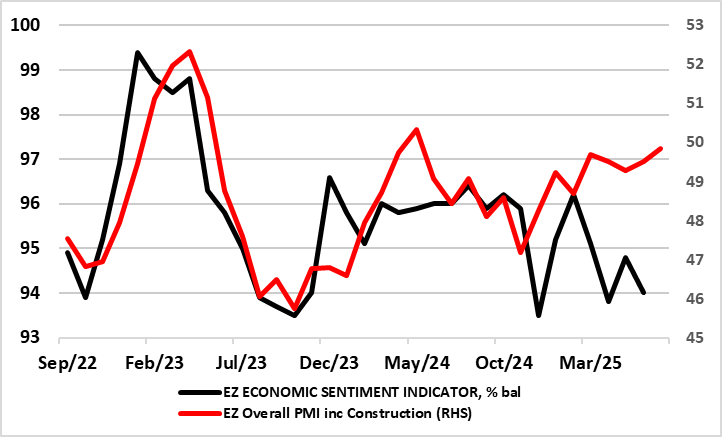

Eurozone Outlook: Resilience or Irrelevance?

September 22, 2025 9:49 AM UTC

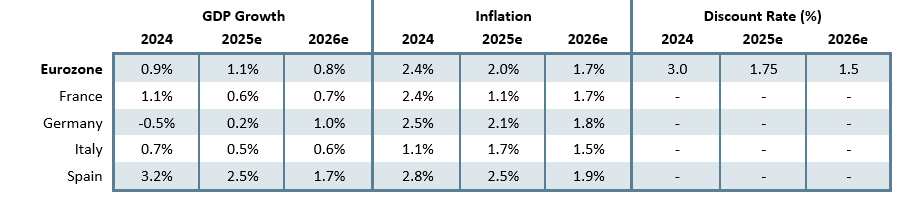

·· Yet again, and amid what may still be tightening financial conditions and likely protracted trade uncertainty, we have pared back the EZ activity forecast for 2026. However, the picture this year appears to be slightly better but this is largely a distortion and we think that the ec

September 19, 2025

Canada July retail sales weak but August seen stronger

September 19, 2025 12:48 PM UTC

Canadian retail sales at -0.8% in July are spot on the preliminary estimate, something that is far from always being the case. The preliminary estimate for August is for a 1.0% increase, which suggests the Canadian economy is not falling sharply in Q3 after export-led slippage in GDP in Q2.

September 17, 2025

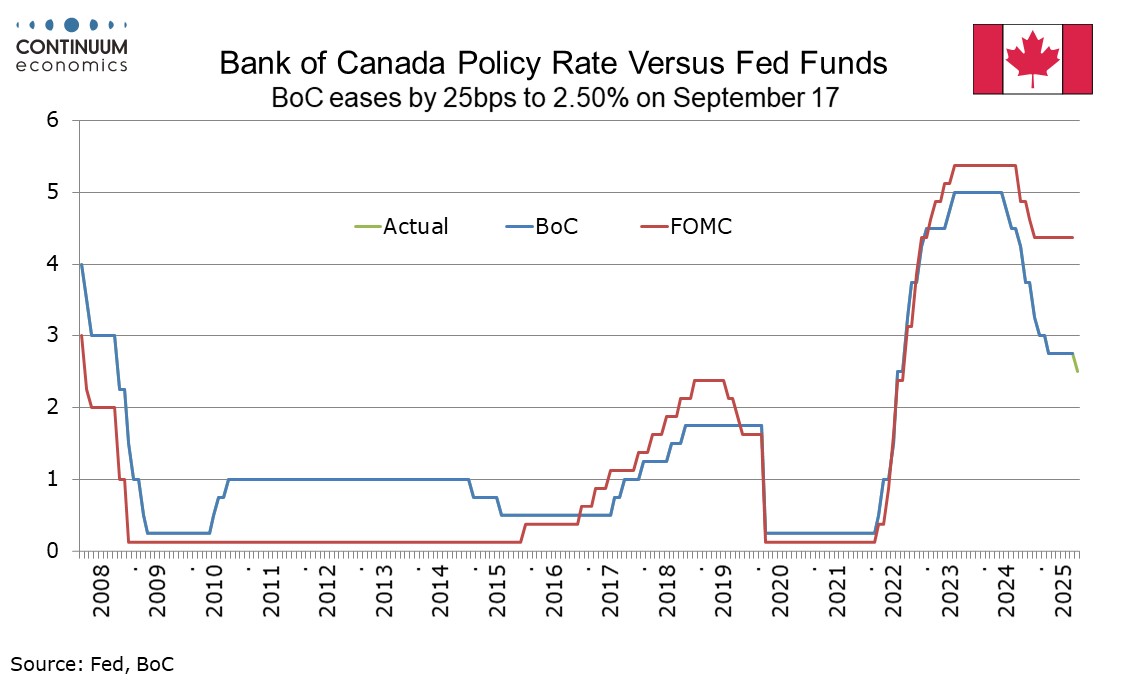

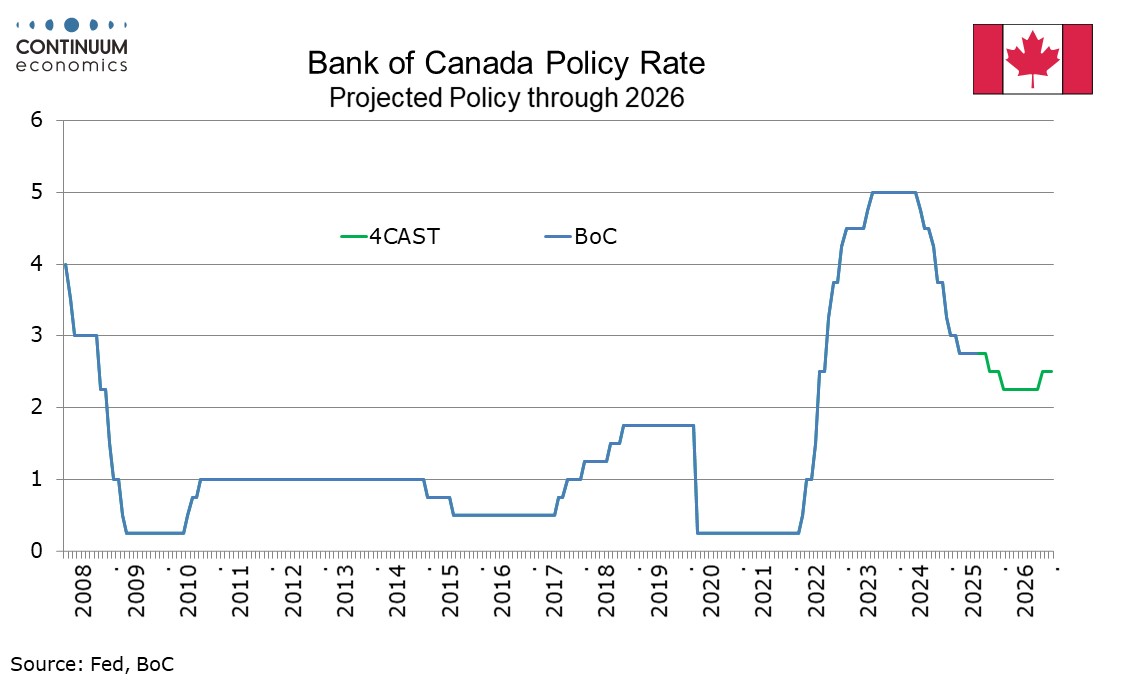

Bank of Canada - Clear consensus to ease, we expect two further 25bps moves

September 17, 2025 3:46 PM UTC

The Bank of Canada’s decision to ease today for the first time since March, by 25bps to 2.50% was as the market expected. We expect two further easings from the BoC, in Q4 of this year and Q1 of 2025, which would take the rate to 2.0%, which is likely to prove the floor.

September 16, 2025

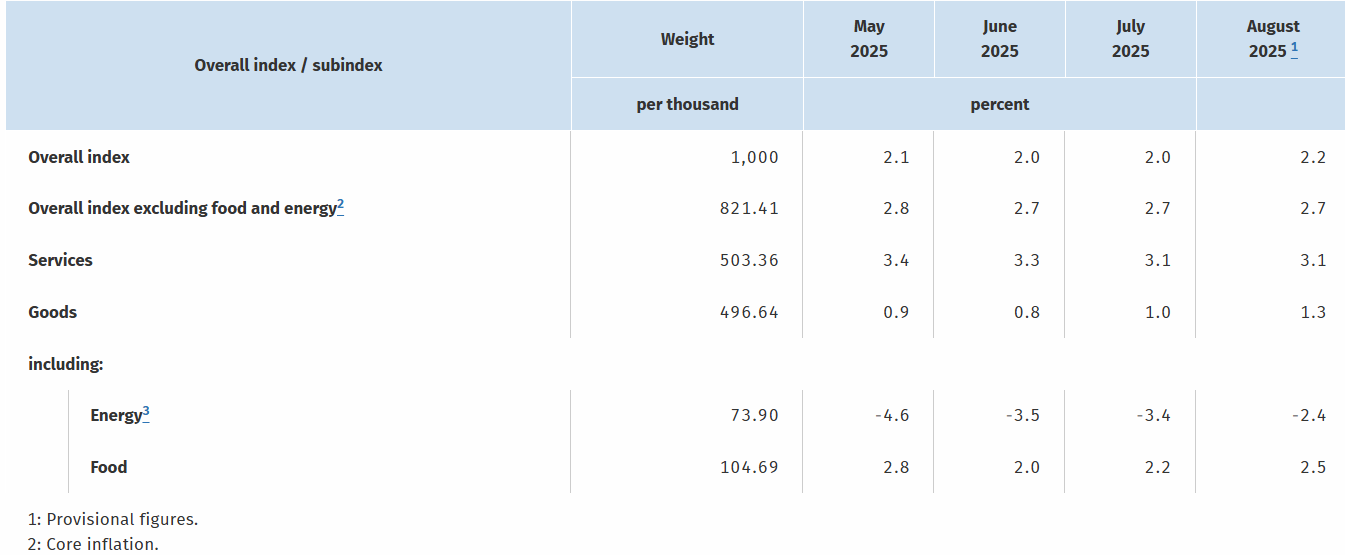

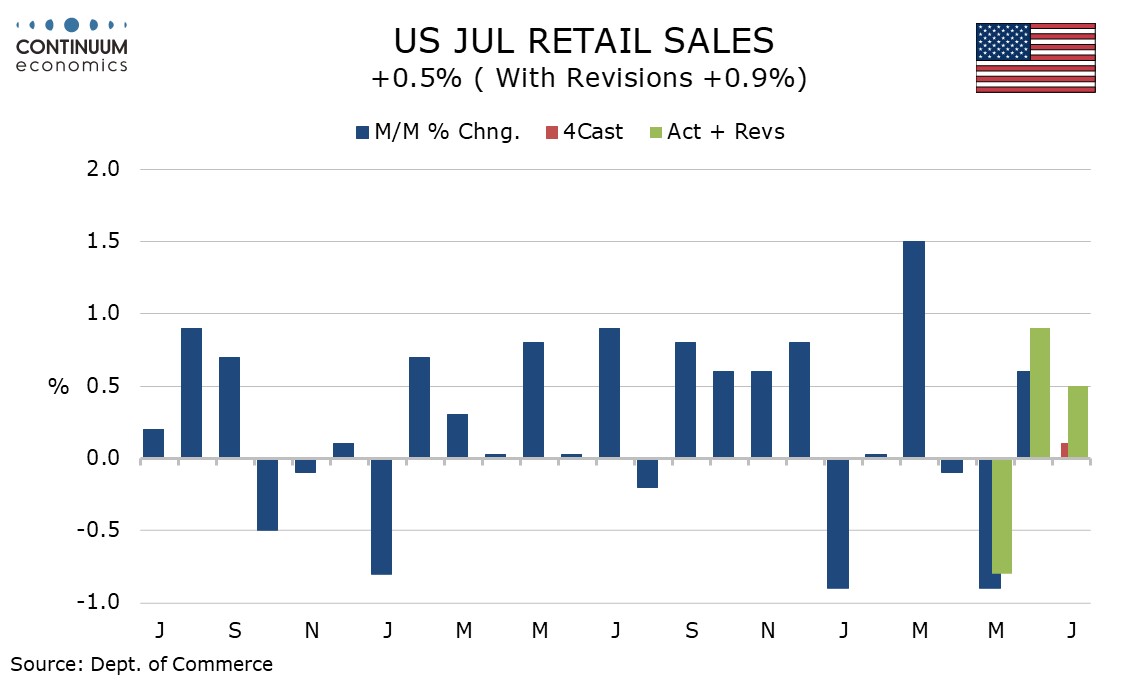

U.S. August Retail Sales - Still Resilient

September 16, 2025 12:48 PM UTC

August retail sales with a 0.6% increase, with the ex-auto and ex auto and gasoline gains both at 0.7%, are stronger than expected and suggest continued consumer resilience despite a slowing in employment growth. The rise modestly exceeds a 0.5% rise in CPI commodity prices in August.

September 15, 2025

Sweden Riksbank Preview (Sep 23): Riksbank To Deliver Final Rate Cut?

September 15, 2025 1:09 PM UTC

Although noting the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises, we adhere to our view that a further but final rate cut is looming and probably at the Sep 23 verdict. Indeed, we were disappointed that the Riksbank did not deliver a

September 12, 2025

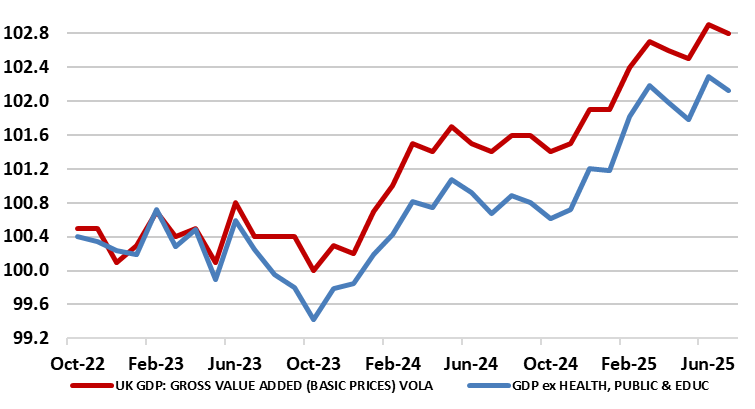

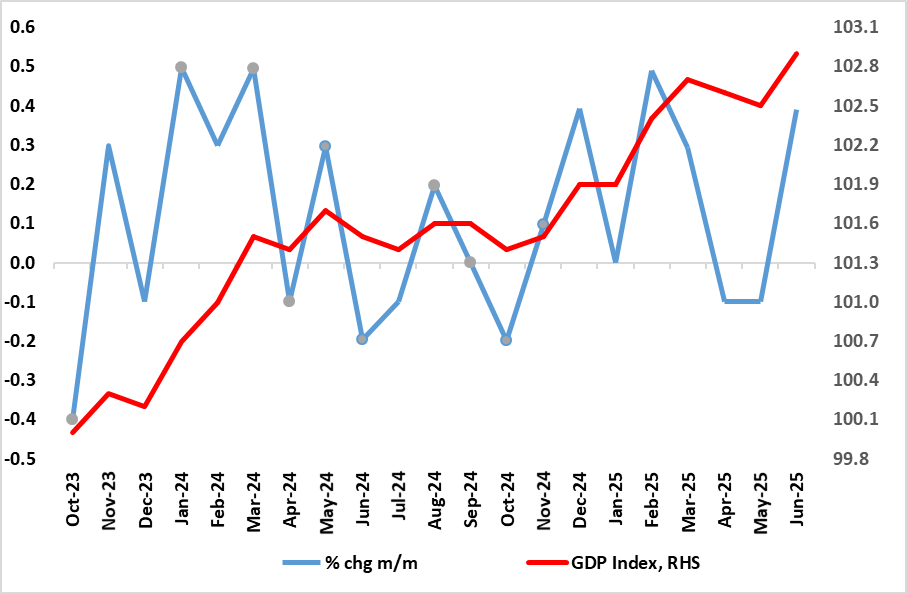

UK GDP Review: Conflicting Signs

September 12, 2025 6:52 AM UTC

Although we are pointed to a flat m/m GDP outcome for the July data, thereby matching the official outcome, the actual outcome was a small m/m fall (before rounding). The three-month rate slowed a notch to 0.2% but we think this overstates what is very feeble momentum, which may actually be nearer

September 11, 2025

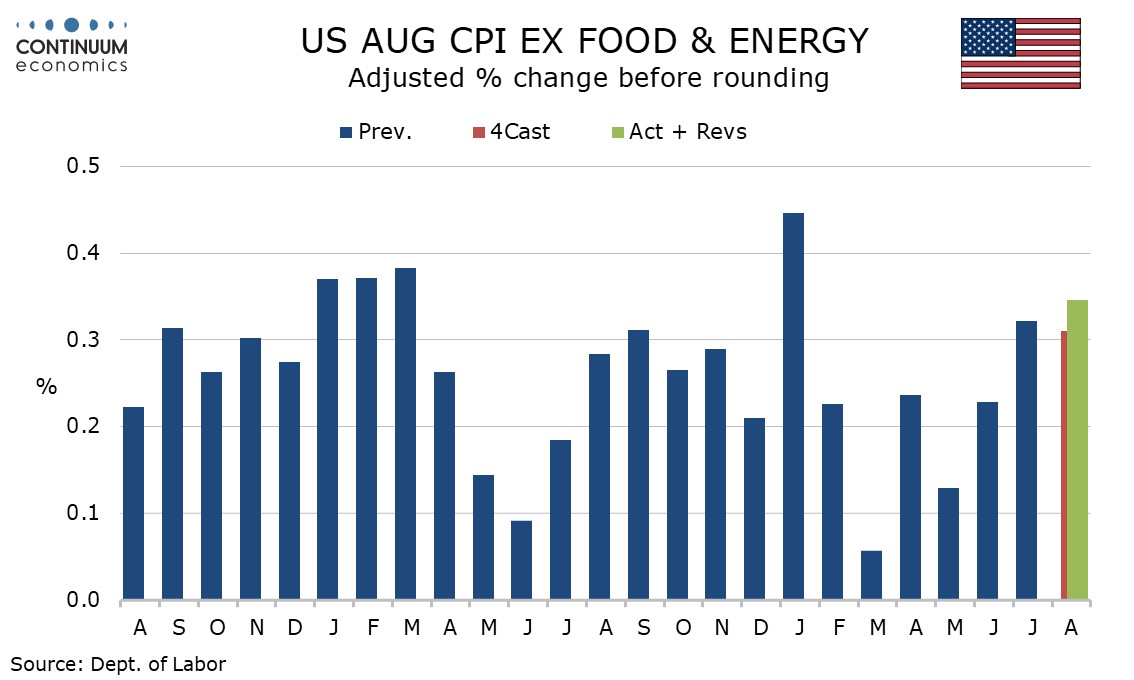

U.S. August CPI, Weekly Initial Claims - Risks on both sides of Fed mandate but possible seasonal adjustment issues for Claims

September 11, 2025 1:07 PM UTC

August CPI is firmer than expected overall at 0.4% and while the core rate was as expected at 0.3% its rise before rounding at 0.346% is uncomfortably high emphasizing the upside risks to the Fed’s inflation mandate. Initial claims at 263k from 236k however point to downside risks to the Fed emplo

September 10, 2025

September 09, 2025

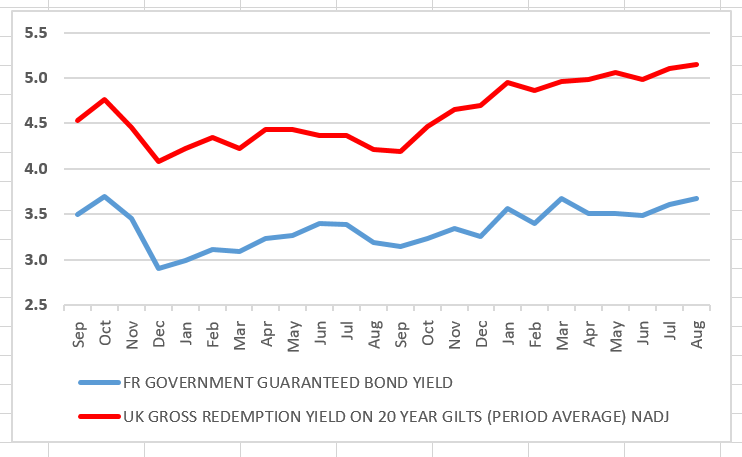

France: Kicking the Fiscal Can (Again)

September 9, 2025 8:41 AM UTC

That France has seen the departure of yet another prime minister is no surprise, hence why financial markets took the confidence vote in its stride. Admittedly, French sovereign spreads and yields have risen in the last month, but even so the actual level of bond yields remains well below that of

September 08, 2025

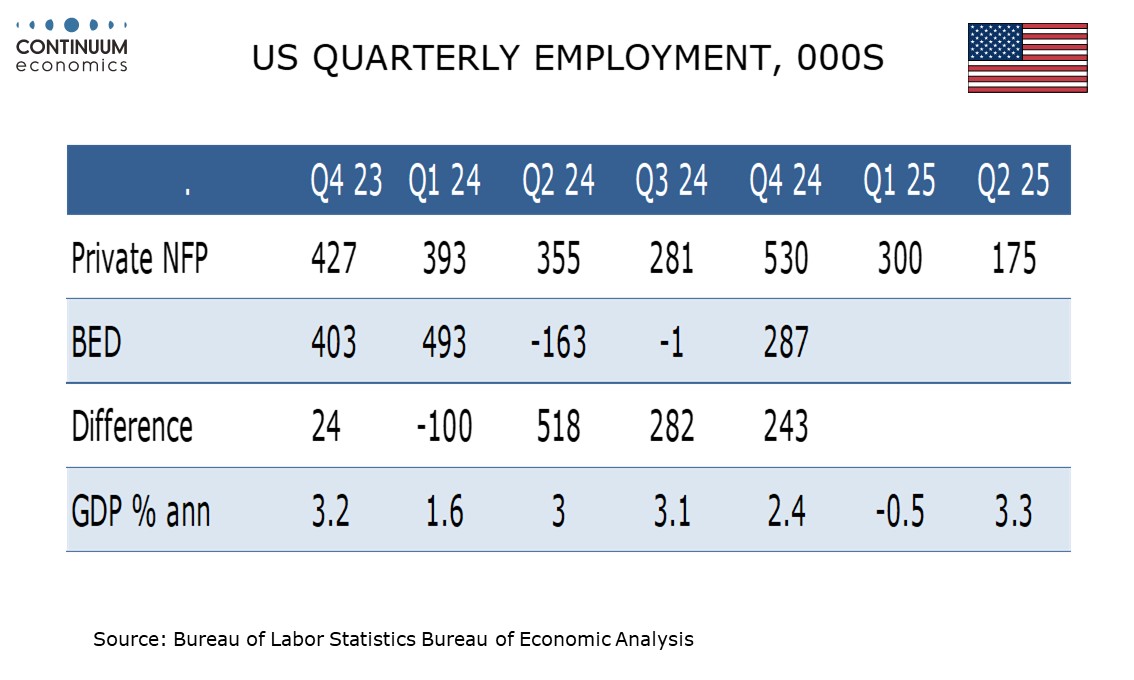

Expecting a Negative Non-Farm Payroll Benchmark Revision

September 8, 2025 3:25 PM UTC

Tuesday sees the release of the preliminary Labor Dep’t estimate for the March 2025 non-farm payroll benchmark, with expectations for a significant negative, possibly as large as the -818k preliminary estimate for the March 2024 benchmark delivered a year ago. The eventual revision to March 2024 p

September 05, 2025

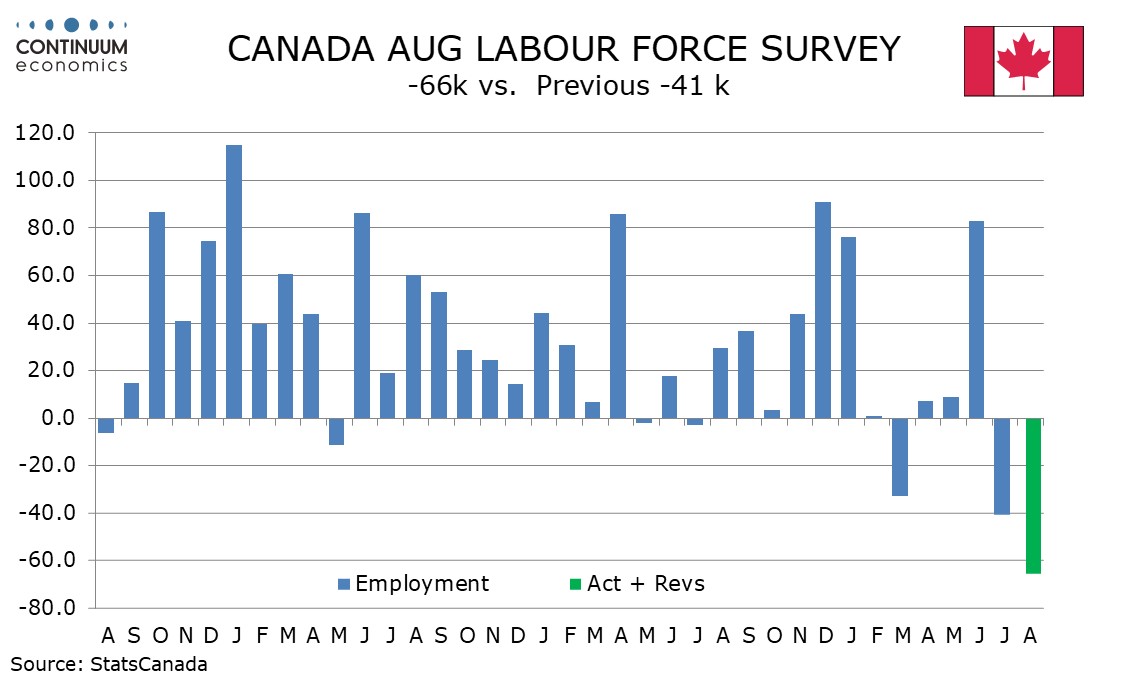

Canada August Employment - With Q3 looking weak, we now expect the BoC to ease in September

September 5, 2025 1:41 PM UTC

Canada’s August employment report with a 65.5k decline with unemployment up to 7.1% from 6.9% is much weaker than expected. While the detail is a little less weak than the headlines suggest, and the data has been volatile recently, we are revising our Bank of Canada call, and now expect a 25bps ea

September 04, 2025

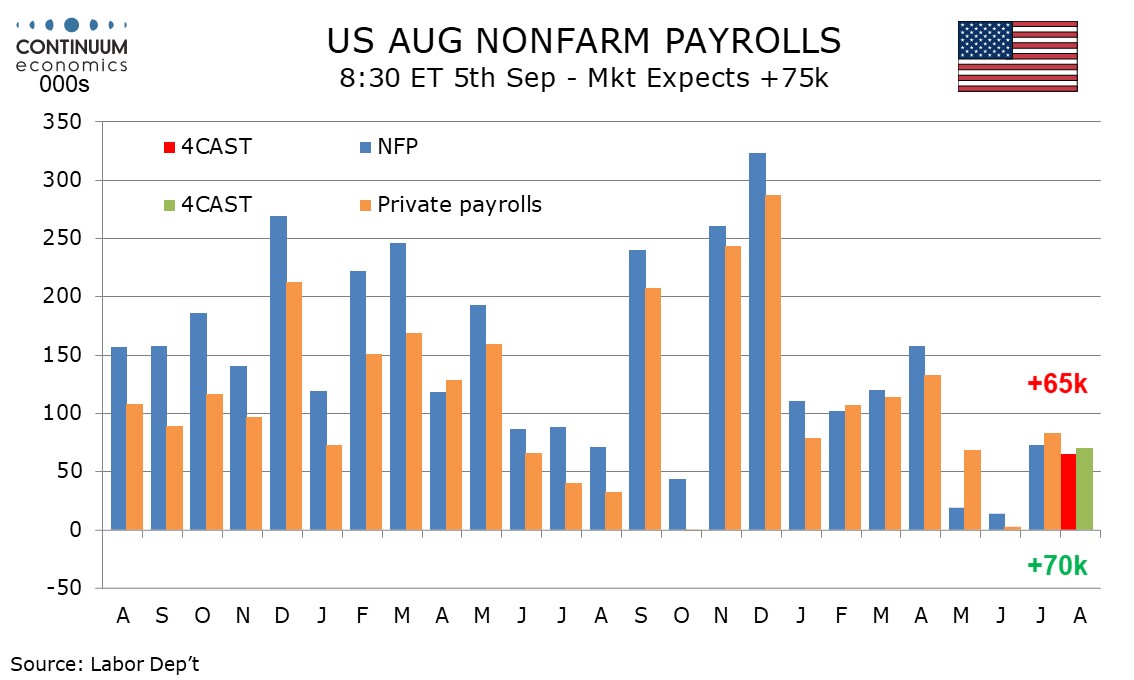

Preview: Due September 5 - U.S. August Employment (Non-Farm Payrolls) - Similar to July's, still not recessionary

September 4, 2025 2:45 PM UTC

We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second st

September 03, 2025

ECB Council Meeting Preview (Sep 11): No Change and Little Guidance

September 3, 2025 9:20 AM UTC

A second successive stable policy decision is very likely at next week’s ECB Council meeting resulting in the first consecutive pause in the current easing cycle, with the discount rate left at 2.0%. We see the ECB offering little in terms of policy guidance; after all, in July the Council sugge

September 02, 2025

India GDP Review: Public Spending and Services Lift India’s Growth to Five-Quarter High

September 2, 2025 6:45 AM UTC

India’s economy grew 7.8% y/y in Q1 FY25, beating expectations. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment remained subdued. However, sustaining momentum in FY26 will hinge on broad-based demand and improving global co

September 01, 2025

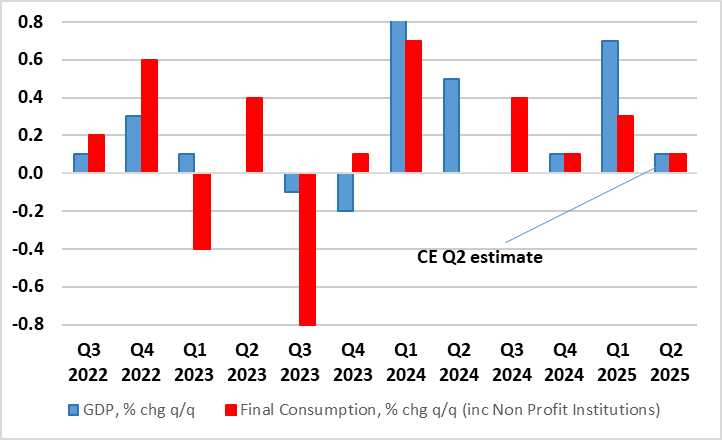

Hitting Beyond Expectations thanks to Construction Activities: Turkiye’s GDP Growth Rebounded Strong in Q2

September 1, 2025 10:55 AM UTC

Bottom Line: According to Turkish Statistical Institute’s (TUIK) announcement on September 1, Turkish economy increased by a strong 4.8% YoY despite political turbulence after arrest of Istanbul mayor and opposition’s presidential candidate Ekrem Imamoglu in Q2, prolonged monetary tightening eff

August 29, 2025

German HICP Review: Headline Back Higher But EZ Price Picture Still Reassuring?

August 29, 2025 12:12 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

August 28, 2025

ECB July Account: Policy ‘On Hold’ Leaves Easing Door Open But Less Widely So

August 28, 2025 12:37 PM UTC

The account of the July 23-24 ECB Council meeting saw some discussion about cutting at that juncture but with no immediate pressure to change policy rates what was then exceptional uncertainty added to arguments for keeping interest rates unchanged. In particular, it was seen that maintaining policy

August 27, 2025

South Africa GDP Growth Preview: Moderate Growth Will Resume in Q2

August 27, 2025 3:22 PM UTC

Bottom line: Department of Statistics of South Africa (Stats SA) will announce Q2 GDP growth on September 3, and we expect that South African economy will likely grow by around 1.0%-1.2% YoY in Q2 2025. We think that the growth momentum will continue to be supported by low inflation and interest rat

August 26, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 26, 2025 11:51 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

August 25, 2025

Tariffs and Tensions: India–US Trade Talks Stalled as Relations Sour

August 25, 2025 6:25 AM UTC

India–US relations have entered a tense phase after Washington doubled tariffs on Indian exports to 50%, the steepest duties applied to any US trading partner. The move, tied to India’s record Russian oil imports, has derailed trade talks scheduled for late August. With USD 87bn in exports at ri

August 22, 2025

Fed Powell: Signals September Cut

August 22, 2025 2:35 PM UTC

Fed Chair Powell spent the first 10 minutes at Jackson hole reviewing current data and discussing the policy stance. Powell clearly signaled a September cut, given downside risks to employment after the July employment report revisions. However, Powell did not signal whether the move will be 25b

August 21, 2025

Bank Indonesia Delivers Surprise Second Rate Cut to Shield Growth

August 21, 2025 5:10 AM UTC

BI is opting for early stimulus while macro buffers remain strong—stable rupiah, low inflation, and manageable deficits. However, this window may close quickly if external risks materialise. Business leaders should expect a monetary pause in Q3, but prepare for moderate volatility if inflation or

August 20, 2025

Sweden Review: Riksbank Still Flagging Final Rate Cut?

August 20, 2025 8:37 AM UTC

Although matching nearly all expectations, we are disappointed that the Riksbank did not deliver a further and probably final 25 bp rate cut this time around, especially given its repeated suggestion of prob a cut later this year. Now, there are three more policy verdicts before year-end and we thin

August 19, 2025

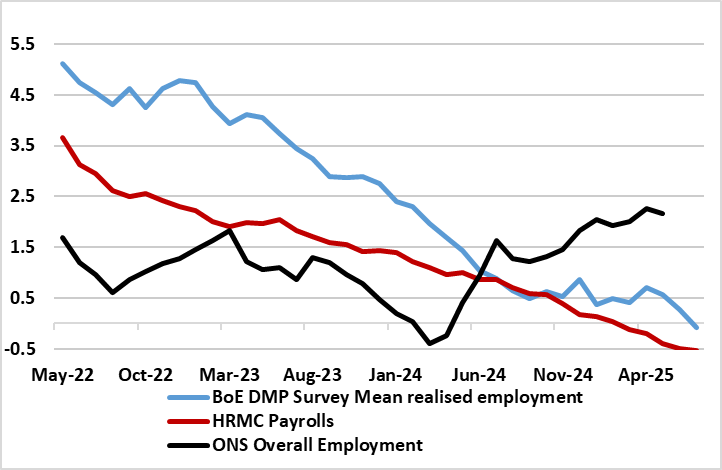

UK Labor Market: Is the BoE too Complacent?

August 19, 2025 10:10 AM UTC

Unlike the Fed, which has dual mandate of curbing inflation and promoting employment, the BoE remit is purely the former. But it is clear that labour market considerations weigh heavily on the dovish contingent of the MPC and possibly increasingly so. However, we feel that the BOE is not fully e

August 18, 2025

Trump-Putin Summit: No Ceasefire Agreement, Possible Concessions Discussed

August 18, 2025 12:29 PM UTC

Bottom Line: U.S. President Trump and Russian President Putin met in Alaska on August 15 to discuss the fate of war in Ukraine. The meeting lasted three hours, but did not yield an immediate ceasefire agreement as we expected. After the meeting, Trump and Putin both signaled what could happen next i

August 15, 2025

U.S. July Retail Sales - Resilient entering Q3

August 15, 2025 12:51 PM UTC

July retail sales with a 0.5% increase are in line with expectations, with net upward revisions totaling 0.4%. Ex auto sales rose by 0.3% also with 0.4% in upward revisions while ex auto and gasoline sales rose by 0.2%, here with revisions of only 0.2%. The data suggest consumer spending is holdin

August 14, 2025

UK GDP Review: Fresh Upside Growth Surprise But Partly Inventory Driven?

August 14, 2025 7:02 AM UTC

To what extent better in June GDP, not least it having been the warmest even such month in England, lay behind the fresh upside surprise that saw the economy grow 0.4%, twice generally expected and with the falls of the two previous months pared back so that a clearer uptrend has emerged (Figure 1).

August 13, 2025

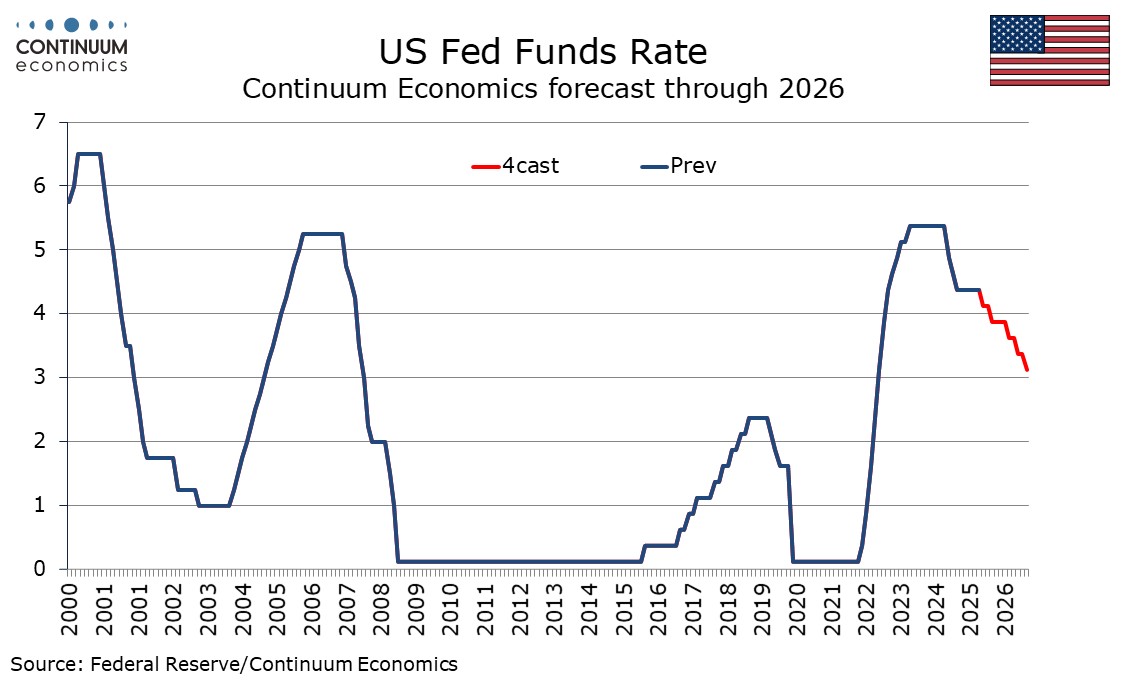

September Fed ease now more likely than not, but far from assured

August 13, 2025 3:29 PM UTC

A September FOMC easing now looks more likely than not, but remains far from a done deal. We are however revising our call to two 25bps FOMC easings this year, in September and December, from just one, in December. 2026 is harder still to call given threats to Fed independence, but we continue to ex

August 12, 2025

August 11, 2025

August 08, 2025

Mexico: Further 25bps Cuts Ahead

August 8, 2025 6:44 AM UTC

Banxico forward guidance, plus trade policy risks with the U.S. now see us forecasting an end 2025 policy rate at 7.25% with two 25bps cuts in September and December. We now feel that the risks to 2026 growth will encourage Banxico to move the policy rate down to 6.5% by spring 2026 by two 25bps rat

August 07, 2025

BoE Review: The (Fiscal) Elephant in the Room as the BoE Splits

August 7, 2025 12:48 PM UTC

The widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relativel

August 06, 2025

UK GDP Preview (Aug 14): Small GDP Rises Hardly Worth Shouting About?

August 6, 2025 2:48 PM UTC

There are some better signs as far as June GDP is concerned, not least it having been the warmest even such month in England. But we see only a 0.1% m/m rise (Figure 1), even with slightly better property and retail signals for the month. However, such an outcome, while a contrast to the two suc

August 05, 2025

Indonesia Q2 GDP Beats Expectations

August 5, 2025 9:45 AM UTC

Q2’s outperformance gives Indonesia’s economic planners breathing space. Investment recovery is a strong positive signal, but sustaining growth in H2 will depend on policy agility, export resilience, and keeping domestic consumption robust.

August 04, 2025

Tariffs and Tensions: India Holds Its Ground Amid US Pressure

August 4, 2025 5:17 AM UTC

India has responded firmly to US tariff escalation, defending its strategic autonomy on Russian oil and domestic market protections. The economic hit is manageable, but the geopolitical signal is clear: India won’t yield under pressure. Talks will continue, but New Delhi won’t trade core interes

August 01, 2025

U.S. July Employment - Revisions to May and June mean trend has slowed significantly

August 1, 2025 1:06 PM UTC

July’s non-farm payroll is weaker than expected not only with the 73k headline and 83k rise in the private sector, but also with large downward revisions totaling 258k for May and June. Unemployment remains low but edged up to 4.2% from 4.1% while average hourly earnings were on consensus at 0.3%,

July 31, 2025

July 30, 2025

Bank of Canada - Consensus to hold, but cautious bias towards easing

July 30, 2025 3:34 PM UTC

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now

July 29, 2025

EZ Real Economy – Diverging Sentiment Indictors Complicate Outlook

July 29, 2025 9:26 AM UTC

The ECB contends that the EZ economy has shown resilience of late. Maybe so, albeit where GDP data (likely to average a satisfactory 0.3% q/q performance so far this year) are probably offering a misleading picture of underlying trends in real activity. Indeed, recent GDP data gains have been pr

July 28, 2025

Indonesia’s 2026 Blueprint: Growth Goals Amid a Shaky Global Backdrop

July 28, 2025 5:54 AM UTC

Indonesia’s newly approved 2026 macroeconomic framework targets robust growth, fiscal discipline, and poverty eradication. However, external headwinds—including unresolved US tariff risks—and tepid domestic consumption pose serious execution risks. Without sharper prioritisation and institutio