Canada August Employment - With Q3 looking weak, we now expect the BoC to ease in September

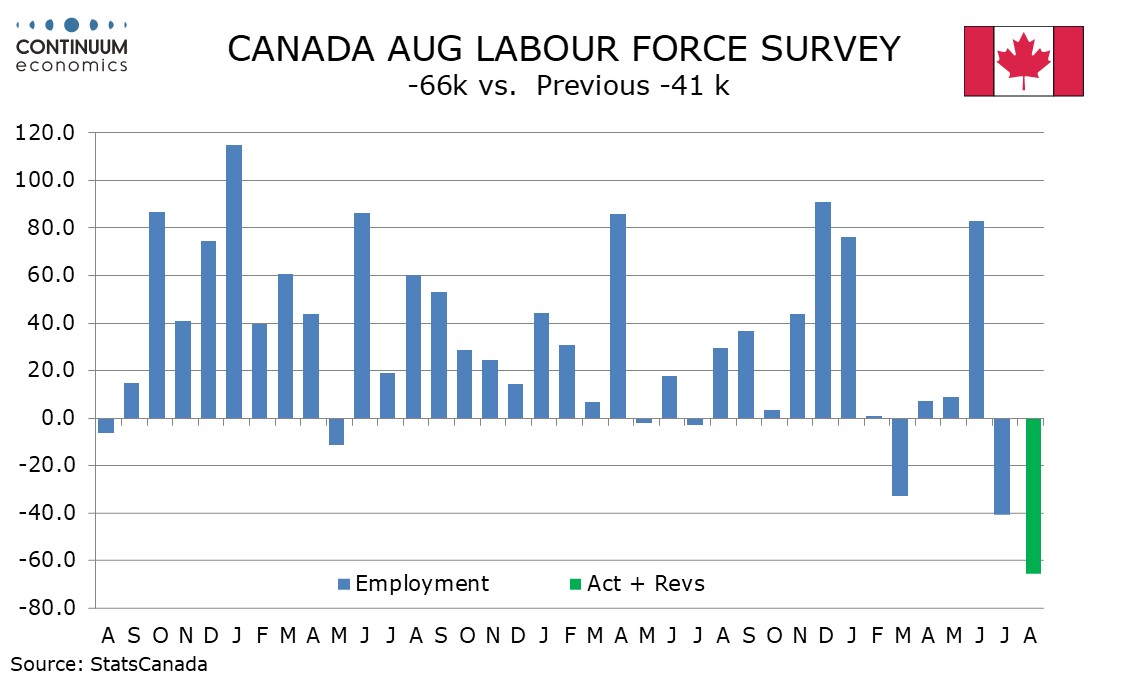

Canada’s August employment report with a 65.5k decline with unemployment up to 7.1% from 6.9% is much weaker than expected. While the detail is a little less weak than the headlines suggest, and the data has been volatile recently, we are revising our Bank of Canada call, and now expect a 25bps easing in September rather than a hold.

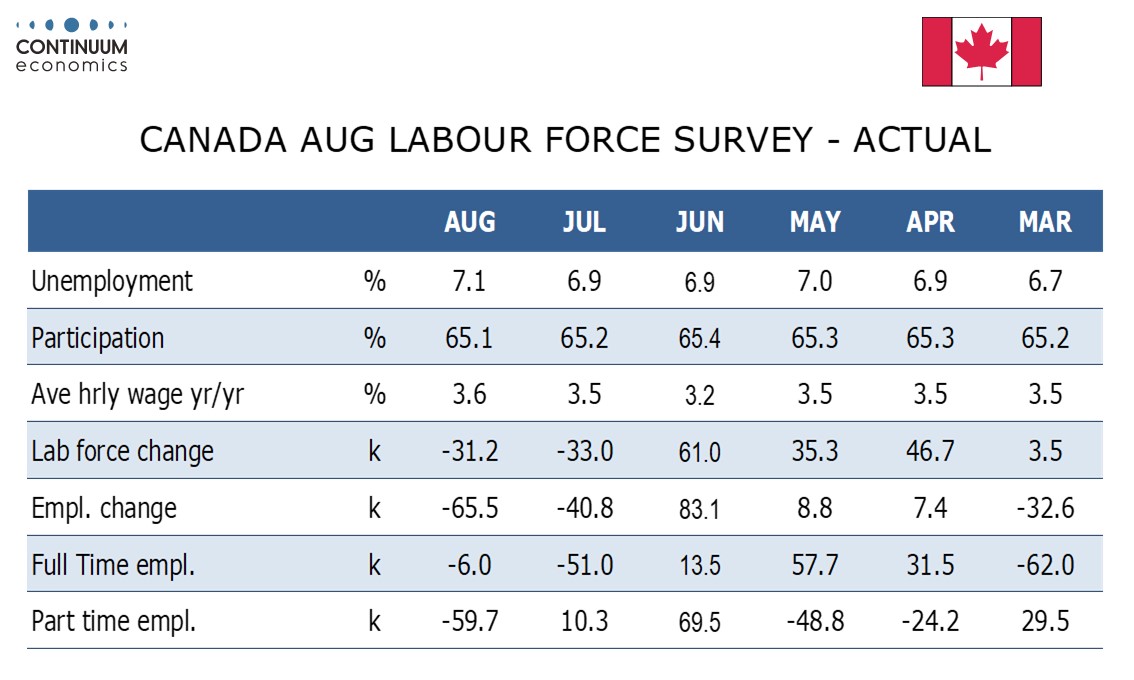

The data has been volatile, but a surge of 83.1k in June employment has now been fully reversed, with August’s decline following a fall of 40.8k in July. August’s detail showed most of the decline coming from a 59.7k fall in part time employment, with full time down by only 6k, though over the last three months full time employment has underperformed part time.

August’s fall was unusually led by self-employment, down by 42.6k, with the public sector down by 15.5k and the private sector falling by a modest 7.5k, though in July it was private sector employment with a 39k fall that led the drop. In August goods producing employment rose by 1.7k with manufacturing down by 19.2k but construction up by 17.1k. Service producing employment fell by 67.2k. There were three main negatives, transportation and warehousing at -22.7k, professional scientific and technical at -26.1k, and education at -18.4k.

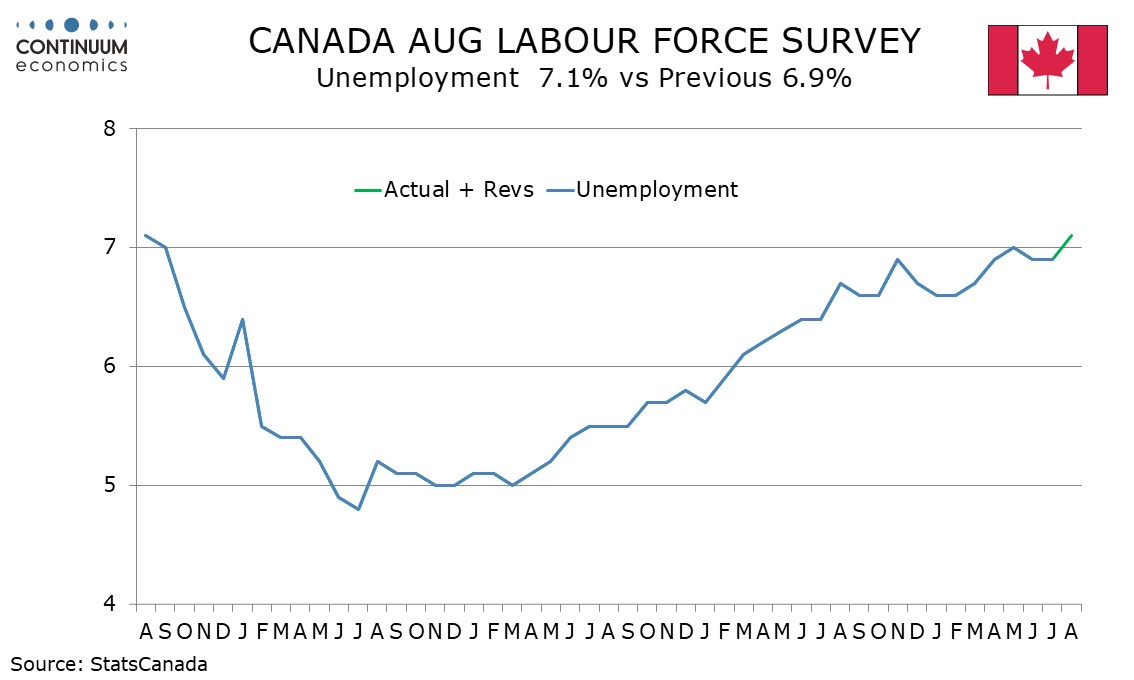

Despite a 31.2k fall in the labor force unemployment rose to 7.1% from 6.9%, reaching its highest since August 2021. Wages however are resilient, hourly wages for permanent employees up 3.6% yr/yr, up from 3.5% in July and the highest since February.

A weak Q2 GDP of -1.6% annualized strengthened the case for a BoC easing in September but was not conclusive given solid domestic demand and the number being in line with the BoC’s own forecast. However, with two straight months of weak employment data suggesting the economy is not regaining momentum in Q3, we now expect the Bank of Canada to deliver a 25bps easing in September. August CPI is still to be seen, but will be following a mostly comforting July release.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.