SNB Review: Staying at Zero – For Some Time?

Very much as expected, both in deed and word, the SNB kept the policy rate at zero this month having cut by 25 bp back in June in June. Indeed, markets priced out what was previously seen as a good chance of rates turning negative, even against a backdrop of the punitive tariff scheme the Swiss economy faces and which will damage the real economy and also add to already weak price pressures. Indeed, the SNB now sees 2026 GDP growth at the lower end of the 1%-1.5% range it offered three months ago. While still pointing to possible FX intervention and a continued willingness to adjust policy accordingly, the statement was (probably deliberately) vague about both taking rates below zero and what the consequences would be. Regardless, we point to stable policy out through 2026 at least, with a possible return to zero rates, although the (unchanged) inflation outlook rules against that risk – at least at the current juncture.

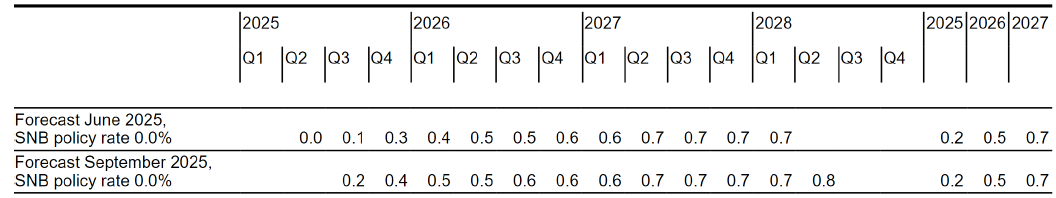

Figure 1: SNB Inflation Outlook Unchanged

Source: SNB - conditional CPI (% chg y/y) forecast based on policy remaining at zero

The swing back in market thinking has been a result of clear hints from the SNB Board itself suggesting that there is now a high bar for any return to negative borrowing costs because of the adverse impact on savers and pension funds. Indeed, SNB President Schlegel stressed in a recent interview adverse impact of negative rates on the likes of savers and pension funds, going on to warn that doing so may need stronger countermeasures later on, this possibly a result of the fresh pick-up in property prices now emerging. But while the bar may be high it is still there and this effectively does not rule out negative rates, but merely that something not yet considered would have to warrant it

As for the tariff impact, the SNB view largely chimes with ours; we feel at this juncture that our semi-consensus and below-trend GDP outlook of 1.2% growth this year and next (the 2026 outlook revised a notch lower but would have been more negative has it not been for a reassessment of sporting events which may boost headline GDP by over 0.3 ppt next year) – in other words sports adjusted GDP growth next year may be below 1% and some 0.5 ppt below potential.

But the irony is that while mortgage lending and house prices have started to rise afresh, banks seem reluctant to lend overall with private sector credit actually still slowing. However, the updated inflation forecast from the quarterly assessment confirms continued but not greater disinflationary price pressures. Moreover, the SNB target being a less explicit sub-2% offers policy makers more flexibility. Though the medium-term forecasts are hardly changed and they remain low with 2027 inflation at 0.7%, but where the SNB statement again noted that these are consistent with price stability!

The SNB will also hope that the any (vague) threat of negative rates implicit in its inflation projections (as well as the effective 'stealth' negative rate as sight deposits held at the SNB will be remunerated at the SNB policy rate only up to a certain threshold) may help restrain the CHF strength and perhaps also encourage banks to lend. But we still see rates staying at zero through to at least end-2026.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.