India GDP Review: Public Spending and Services Lift India’s Growth to Five-Quarter High

India’s economy grew 7.8% y/y in Q1 FY25, beating expectations. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment remained subdued. However, sustaining momentum in FY26 will hinge on broad-based demand and improving global conditions.

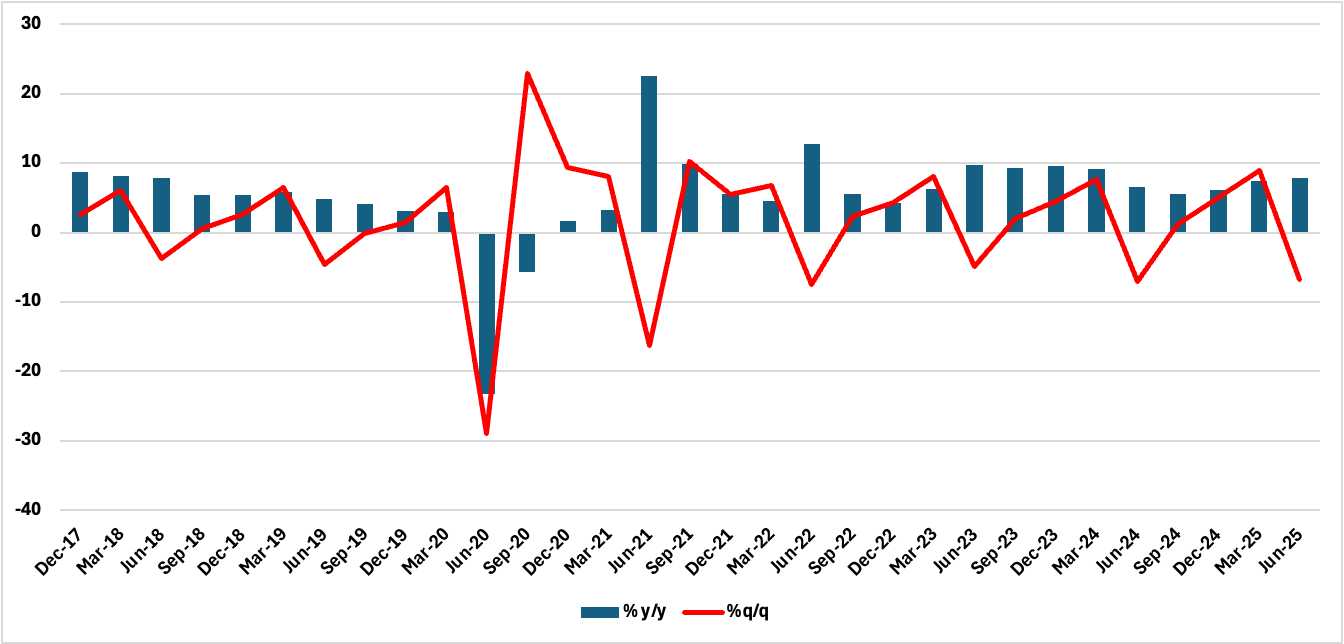

India’s economy posted a stronger-than-expected expansion of 7.8% yr/yr in Q1 FY26 (April–June 2025), its fastest pace in five quarters, according to data released by the Ministry of Statistics and Programme Implementation (MoSPI). The print handily outperformed the RBI’s forecast of 6.5% and our forecast of 6.6%, reinforcing India’s position as the world’s fastest-growing major economy. Nominal GDP rose 8.8% to INR 86.1tn, while real Gross Value Added (GVA) advanced 7.6% to INR 44.6tn.

Figure 1: India GDP Growth (%)

Source: MOSPI, Continuum Economics

Public Spending Anchors Growth

Government expenditure remained a critical propellant, with public consumption up 7.5% yr/yr. While slightly below the 9.4% pace of the previous quarter, it underscores the extent to which fiscal outlays continue to anchor growth. Infrastructure-linked activity, supported by higher central capital expenditure, also fed into a 7.8% rise in Gross Fixed Capital Formation, reflecting strong investment demand.

Private consumption, which accounts for more than half of GDP, also grew a solid 7%, but slowed from 8.3% a year earlier, pointing to still-cautious household sentiment amid uneven income growth. In effect, the robust headline number is heavily skewed towards state-led demand, while private spending dynamics are showing signs of fatigue.

Sectoral Performance: Services Dominate, Mining Contracts

Services once again led the expansion, surging 9.3%, buoyed by transport, financial, and digital services. Manufacturing and construction grew 7.7% and 7.6%, respectively, both supported by strong public capex and easing input costs. Agriculture surprised to the upside with 3.7% growth, recovering from just 1.5% a year earlier, aided by favourable weather and higher sowing.

By contrast, mining contracted 3.1%, continuing its structural weakness, while utilities output edged up just 0.5%, highlighting uneven performance in core industrial segments.

Deflator Effect and Price Dynamics

The upside surprise also reflects the role of the GDP deflator, which was unusually soft in Q1. Nominal GDP growth slowed to an eight-month low of 8.8%, but because the deflator (a measure of inflation across the economy) eased sharply, real GDP was pushed higher. With wholesale and consumer price inflation muted, the gap between nominal and real growth narrowed, producing a stronger real growth figure.

This has dual implications: while real GDP underscores India’s resilience, lower nominal growth may constrain fiscal revenues at a time when the government is cutting levies on everyday goods and small cars. For FY26, the government projects nominal GDP growth at 10.1%, leaving little fiscal room if revenue buoyancy weakens.

Outlook

The Q1 data highlight India’s resilience in the face of global headwinds and tariff shocks, with domestic demand—especially government-led spending—doing the heavy lifting. Services, manufacturing, and agriculture all delivered robust performance, offsetting the drag from mining and utilities.

However, the composition of growth raises important questions. With private consumption slowing and private investment still subdued, the economy’s momentum remains disproportionately dependent on fiscal stimulus. Without a revival in household demand and corporate capex, sustaining growth near 7% through FY26 could prove challenging. For now, the Q1 upside surprise will prompt an upgrade to our growth forecast for FY26 in the upcoming outlook. Yet the test for India’s recovery is no longer just whether it can grow fast, but whether it can grow on a more balanced foundation.