15-Month Consecutive Falling Streak Ends: Turkiye Inflation Surged to 33.3% in September

Bottom line: Turkish Statistical Institute (TUIK) announced on October 3 that the inflation slightly increased to 33.3% y/y in September from 32.9% y/y in August driven by higher education, housing and food prices, ending the 15-month consecutive falling streak. Increasing inflation, upside-tilted inflationary risks and adverse global developments will likely cause Central Bank of Turkiye (CBRT) to consider slowing the pace of its monetary easing cycle to address stubborn price pressures during the next MPC on October 23. We expect CBRT to reduce the easing size from 250 bps to 150-200 bps.

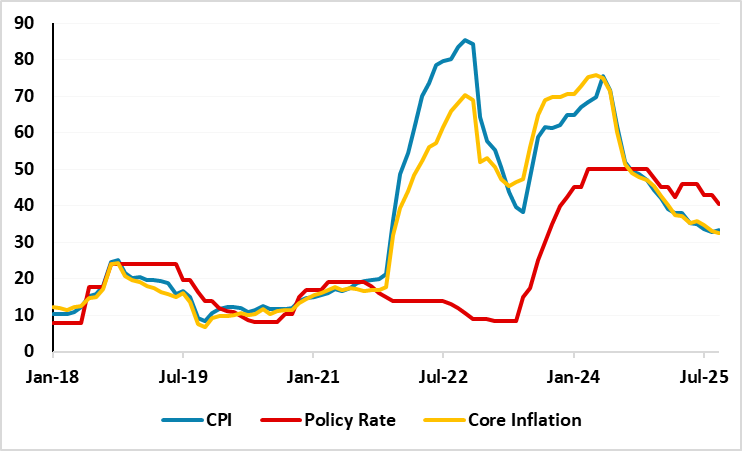

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – September 2025

Source: Continuum Economics

After softening for fifteen consecutive months and hitting the lowest rate in August since November 2021 with 32.9% y/y, CPI edged up to 33.3% y/y as education, housing and food prices lead the rise in the index. MoM inflation rose by 3.23% in September, up from 2.04% in August, also exceeding market expectations of 2.6% and infirming the success of the ongoing disinflationary program.

Education prices recorded the highest annual increase with 66.1% YoY followed by housing prices were up by 51.4% YoY. Prices rose at a slower pace across a number of categories, such as footwear and clothing, which came in at 9.8% YoY in September.

Core inflation surged by 3.2% MoM, bringing the annual rate to 32.5%. TUIK data showed that PPI rose 2.52% m/m in September for an annual rise of 26.59%.

Commenting on the figures, Treasury and Finance Minister Mehmet Simsek said on October 3 that “Food prices were a key driver of high monthly inflation in September which surged due to agricultural frost and drought. Taking into account that schools started in September, education and other related items also contributed significantly to monthly inflation.”

Taking into account that CBRT signalled slowing the pace of easing depending on inflation dynamics in the MPC report last month, we think increasing inflation, upside-tilted inflationary risks and adverse global developments will likely ignite CBRT to reduce the easing size from 250 bps to 150-200 bps during the next MPC on October 23.

Despite risks, we continue to think the slowdown in inflation will moderately continue in Q4 supported by the lagged impacts of previous monetary tightening and tighter fiscal measures while the extent of the decline will be determined by food inflation, energy prices, TRY volatility, and global developments.

Despite the CBRT predicts inflation will soften to 24% at the end of 2025, the road will be very bumpy due to risks. We envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly considering inflation becomes stickier requiring high interest to remain for some time.

I,Volkan Sezgin, the Senior EMEA Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.