Sweden Riksbank Preview (Sep 23): Riksbank To Deliver Final Rate Cut?

Although noting the possible impact of recent both real activity and adjusted CPI data having delivered upside news and surprises, we adhere to our view that a further but final rate cut is looming and probably at the Sep 23 verdict. Indeed, we were disappointed that the Riksbank did not deliver at its last (August) meeting, especially given its repeated suggestion of probability of a cut later this year. Now there are three more policy verdicts before year end but as suggested above we think that the flagged rate cut may materialise at the first such decision, taking the policy rate to new cycle low of 1.75%. And with, the rationale as well as scope is there for such a move as it all points to and reflects what may be marked spare capacity in the economy. Indeed, despite the July CPI pick-up, underlying inflation pressures, while volatile, still seem to have fallen at least to levels consistent with the 2% target (Figure 1). As a result, we do not see any looming policy reversal, as we see this projected rate cut to 1.75% staying in place into 2027.

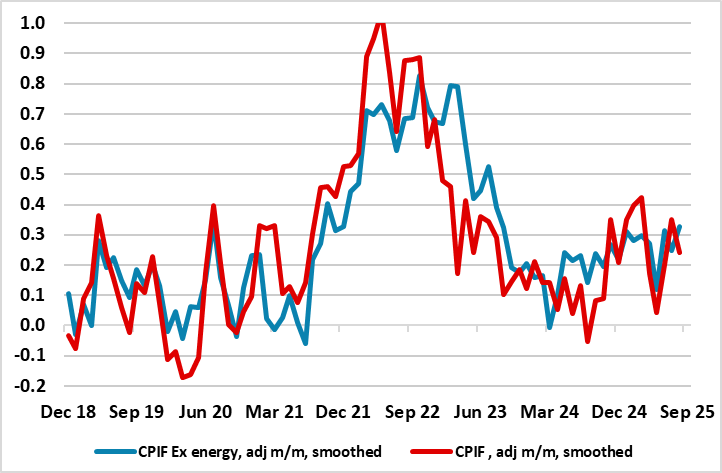

Figure 1: Adjusted Core Inflation Volatile but Consistent with Target

Source; Stats Sweden, CE (NB both measures still include food and smoothed equates to 3-mth mov avg)

After the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0% in June, the Board then suggested that a further move is possible and did so again after last month’s decision. Implicitly, it seems that the flagged rate cut would have occurred last time around were it not for the CPI spike seen in the July data that partly persisted into August. Admittedly, and as the Board acknowledges, that spike is almost certainly a reflection of temporary factors, most notably energy price swings, alongside what may be a more sustained but far from demand-driven recent tripling in food inflation. To us, the underlying picture is reassuring as seen in the ex-energy CPIF measures (Figure 1) is still consistent with target and this is despite the impact on this measure of food inflation now running at over 5% (something more supply driven and alsos likely to weigh on spending power). Indeed, the Board view still suggests that ‘several indicators support the view that inflation will fall back to target going forward’. But the Riksbank’s infamous caution seemingly won the day with it purporting that ‘the unexpectedly high inflation calls for vigilance’.

Admittedly in the new forecast that will come with the scheduled updated Monetary Policy Report, the Riksbank will need to revise up its short-term inflation forecast, but not by much at least for the targeted CPIF measure. However, the Riksbank's CPIFXE forecast has undershot its expectations and into 2026 a downgrade will be needed due to the scheduled VAT cut in April 2026, which should have an immediate impact in slashing over 0.5 ppt off all main inflation measures. An offsetting

But Riksbank caution was evident in its forecasts (last updated in June). Given that even with what was a substantial paring back of its growth forecast back then and with an ensuing revision that now sees an output gap of almost 2% of GDP, we remain puzzled that there was no appreciable downgrade to the inflation outlook. Instead, while we see CPIF inflation falling below target by next year we think the economy will under-perform the 1.4% and 2.2% (calendar adjusted) GDP projections for this year and next and that this will make the Riksbank have to react and deliver the half-hearted rate cut it has flagged. Even the improved Q2 GDP estimate was much weaker than the Riksbank’s forecast, something backed up by other weak hard data and falling business confidence indicators supports that economic activity remained subdued in Q2 and probably continued so into Q3 and weak sentiment can probably be linked to the uncertainty about the global economy in the wake of the new US trade policy and inflation concerns among households.

Against this backdrop we are puzzled by the Riksbank’s suggestion that business confidence numbers are close to ‘normal’ as we think they more point to a below-consensus 2025 GDP outlook of 1.0% and only a moderate further pick-up to 1.8% next year. All of which supports not only the rate cut arriving soon, but with the risk if further reductions into 2026 rather than any early policy reversal.

,

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.