Sweden Review: Riksbank Still Flagging Final Rate Cut?

Although matching nearly all expectations, we are disappointed that the Riksbank did not deliver a further and probably final 25 bp rate cut this time around, especially given its repeated suggestion of prob a cut later this year. Now, there are three more policy verdicts before year-end and we think that the flagged rate cut may materialise by the time of the next meeting in September, taking the policy rate to new cycle low of 1.75%. And with both real activity and adjusted CPI data having delivered downside news and surprises, the rationale as well as scope is there for such a move as it all points to and reflects what may be marked spare capacity in the economy. Indeed, despite the July CPI pick-up, underlying inflation pressures, while volatile, still seem to have fallen at least to levels consistent with the 2% target (Figure 1). As a result, we do not see any looming policy reversal, as we see this likely rate cut to 1.75% next month staying in place into 2027!

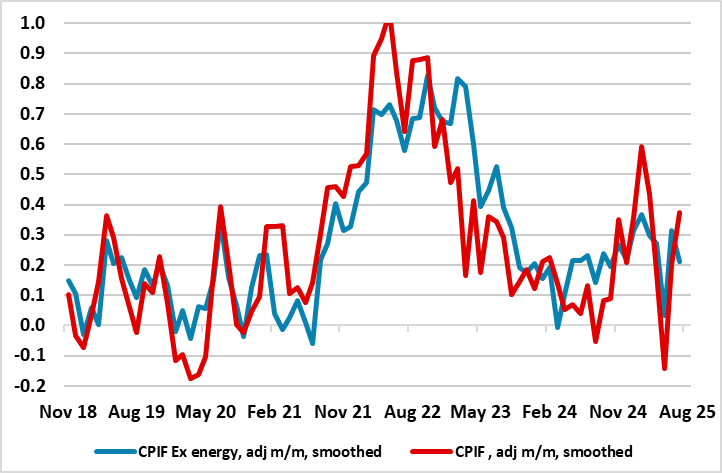

Figure 1: Adjusted Core Inflation Volatile but Consistent with Target

Source; Stats Sweden, CE

After the Riksbank cut its policy rate by a further 25 bp to a new cycle low of 2.0% in June, the Board then suggested that a further move is possible and did so again after this month’s decision. Implicitly, it seems that the flagged rate cut would have occurred this time around were it not for the CPI spike seen in the July data. Admittedly, and as the Board acknowledges, that spike is almost certainly a reflection of temporary factors, most notably energy price swings, alongside what may be a more sustained but far from demand-driven recent tripling in food inflation. To us, the underlying picture is reassuring as seen in the ex-energy CPIF measures (Figure 1) is still consistent with target and this is despite the impact on this measure of food inflation now running at over 5%. Indeed, the Board view this time around backed up such a picture, suggesting that ‘several indicators support the view that inflation will fall back to target going forward’. But the Riksbank’s infamous caution seemingly won the day this month with it purporting that ‘the unexpectedly high inflation calls for vigilance’.

This caution was evident in its forecasts (last updated in June). Given that even with what was a substantial paring back of its growth forecast back then and with an ensuing revision that now sees an output gap of almost 2% of GDP, we remain puzzled that there was no appreciable downgrade to the inflation outlook. Instead, while we see CPIF inflation falling below target by next year we think the economy will under-perform the 1.2% and 2.4% GDP projections for this year and next and that this will make the Riksbank have to react and deliver the half-hearted rate cut it has flagged.

This is made all the more likely by recent real economy data. The Q2 flash GDP estimate showed only a modest 0.1% q/q rise, much weaker that the Riksbank’s forecast (0.9%), something backed up by other weak hard data and falling business confidence indicators supports that economic activity remained subdued in Q2 and probably continued so into Q3 and weak sentiment can probably be linked to the uncertainty about the global economy in the wake of the new US trade policy and inflation concerns among households. Against this backdrop we are puzzled by the Riksbank’s suggestion that business confidence numbers are close to ‘normal’ as we think they more point to a below-consensus 2025 GDP outlook of 0.9% and only a moderate further pick-up to 1.8% next year.