Canada July retail sales weak but August seen stronger

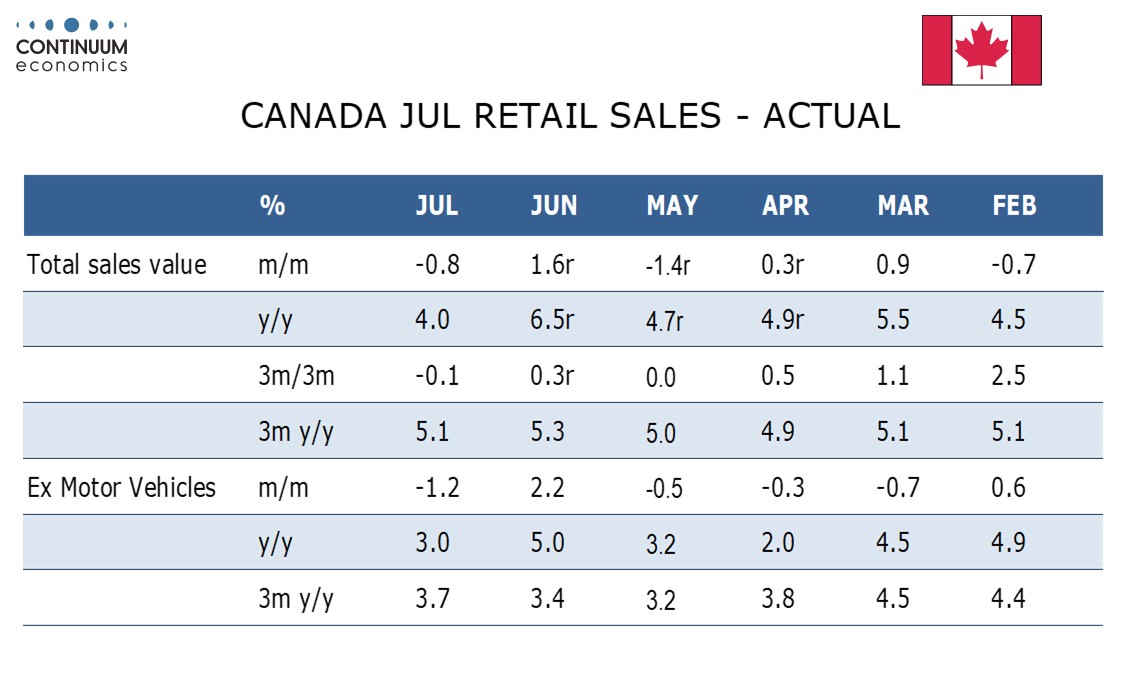

Canadian retail sales at -0.8% in July are spot on the preliminary estimate, something that is far from always being the case. The preliminary estimate for August is for a 1.0% increase, which suggests the Canadian economy is not falling sharply in Q3 after export-led slippage in GDP in Q2.

GDP saw three straight 0.1% monthly declines in Q2 but July is expected to see a modest increase despite weakness in retail. The preliminary August increase in retail sales argues against renewed GDP weakness in August, though weak employment data presents a different picture.

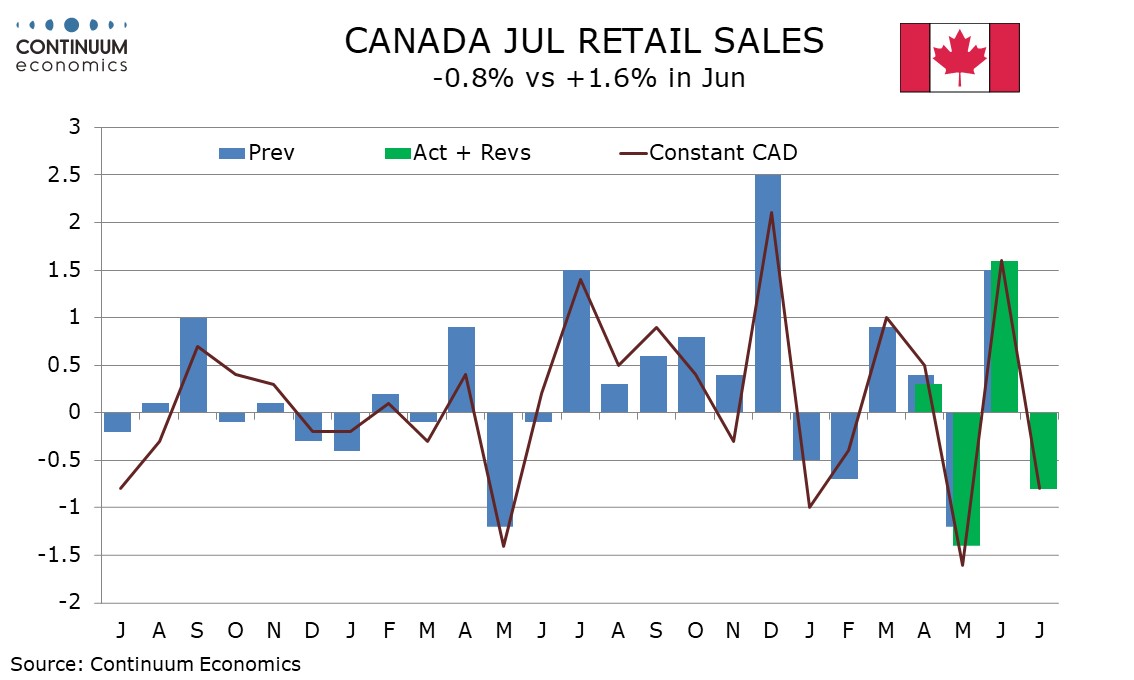

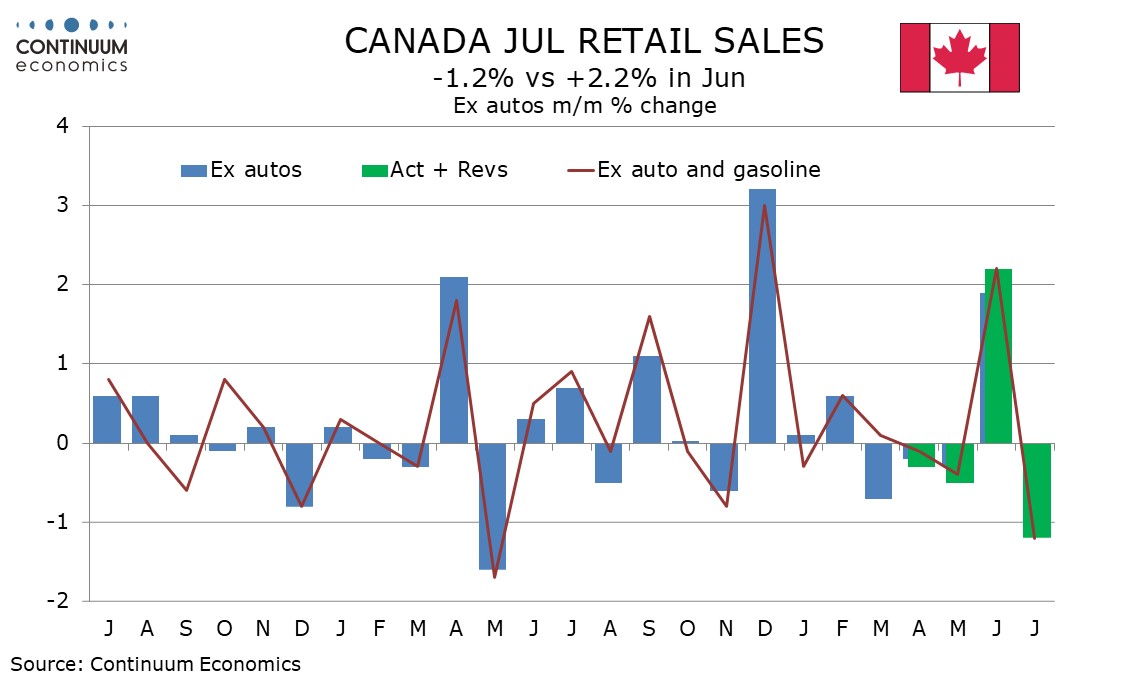

July’s details were clearly weak, with retail sales also down by 0.8% in real terms while ex auto data and ex auto and gasoline sales both fell by a steeper 1.2% in nominal terms. Building materials at -2.1%, food and beverage at -1.3% and clothing at -2.9% all saw significant July declines. There were no components showing any real strength.

July weakness does however need to be seen alongside a stronger June, which rebounded from a weak May. A 0.1% decline in 3m/3m sales suggests a subdued picture, though August will probably move back above neutral.